Brief

Price Tag For Regulation Costs On New Home Construction: $94K

A 24% slice of the new-home selling price pie goes now to "regulatory burden," the weight of land-use permitting, impact fees, cost-of-time charges, etc. in the pre-construction stages, and the added expense of start-to-completion construction cycle code and regulation.

For more than seven-and-a-half of the 30 years the average new homebuyer will spend making monthly payments on principal and interest toward full ownership, that household will be footing what could be called a "new home tax" on her or his piece of The American Dream.

A walloping 24% slice of the new-home selling price pie goes now to what builder-developer-investor community leaders refer to as "regulatory burden," the weight of land-use permitting, impact fees, cost-of-time charges, etc. in the pre-construction stages, and the added expense of local inspections, neighborhood design guidelines, utilities hook-up charges, etc. in the start-to-completion construction cycle.

National Association of Home Builders vp for Survey and Housing Policy Research Paul Emrath writes:

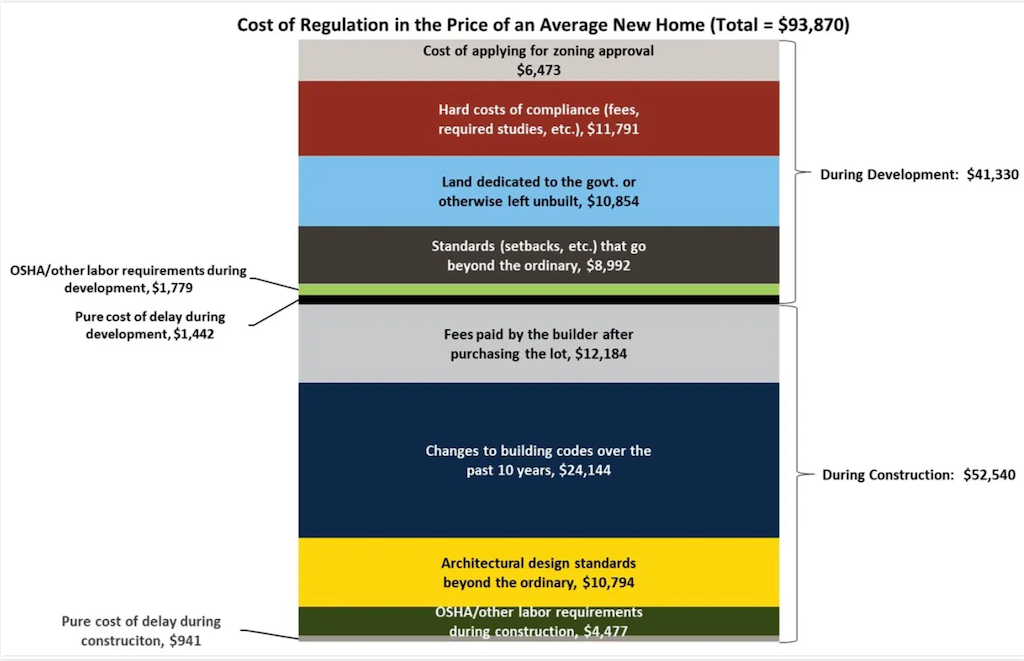

On a dollar basis, applied to the current average price ($394,300) of a new home, regulation accounts for $93,870 of the final house price. Of this, $41,330 is attributable to regulation during development, $52,540 due to regulation during construction. In dollar terms, the NAHB studies show the cost of regulation continuing to rise between 2016 and 2021, although not as much as it did between 2011 and 2016.

The ironies – lost on no one – include:

- Uncle Sam dominoes: The same lever that gives monthly payment power to homebuyers – dirt cheap mortgage interest rates – allows every node of the building ecosystem, from municipalities, to Federal agencies, to financial institutions, to building materials suppliers, to builders to pack those price increases into those monthly mortgage payments.

- K Is The Shape Of The Future: The K-rebound from pandemic financial, social, and health shocks is quickly morphing into a broader economic model for housing attainability. Those priced-in to a homeownership track become the households in the top portion of the K, while those – growing – populations who are priced-out occupy the bottom portion.

That prospect is troubling in light of the American economic experiment in merit-based mobility – which, although hidden under the weight of arguments that builders need to pay, and pass along, too high a price in regulatory charges on new homes, is there.

The prized American Dream, predicated on working hard to achieve a level of quality of life for oneself and one's closest loved ones, is weathering a rough ride through the early part of this Century.