Capital

Pool Of Priced-Out Households Spreads In Inflation's, Rates' Grip

Market by market, a relatively healthy universe of households capable of new-home payment power shrinks as price and interest rate increases take hold. Now, that's accelerating.

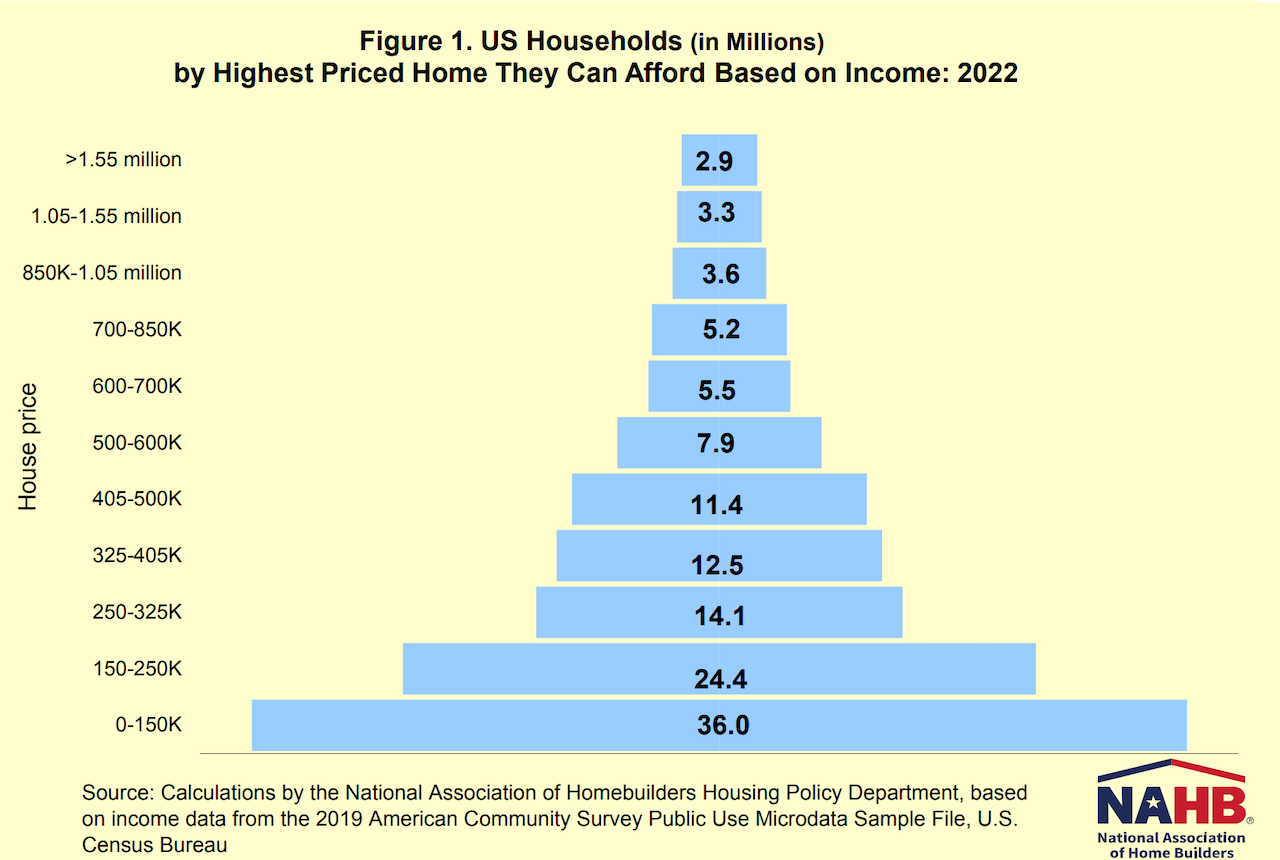

Priced out. Data doesn't lie. Some 39 million households – slightly less than three of every 10 Amerian households – have payment power enough for a new home at today's extraordinary median price of $412,506.

The rest don't. They're priced out.

The next 12 months will tell as to the impact of shifting hundreds of thousands of households across the Rubicon – from having payment power, to priced out -- and what that means for a new home construction sector whose fortunes ride on selling a new home to 3% of those with the wherewithal today.

- The baseline of folks priced out of new-homeownership today reaches nearly 90 million households, seven of every 10 U.S. households.

- That "priced out" baseline expands – eroding the U.S. households capable of paying for a newly built home at today's median price of $412,506 – by 118,000 homes for every price increase of $1,000.

- In fact, 11.4 million households in the beltline margins of those capable of paying the median price, but not capable of paying $500,000 for a new home, are at risk of both interest rates and inflation impacts.

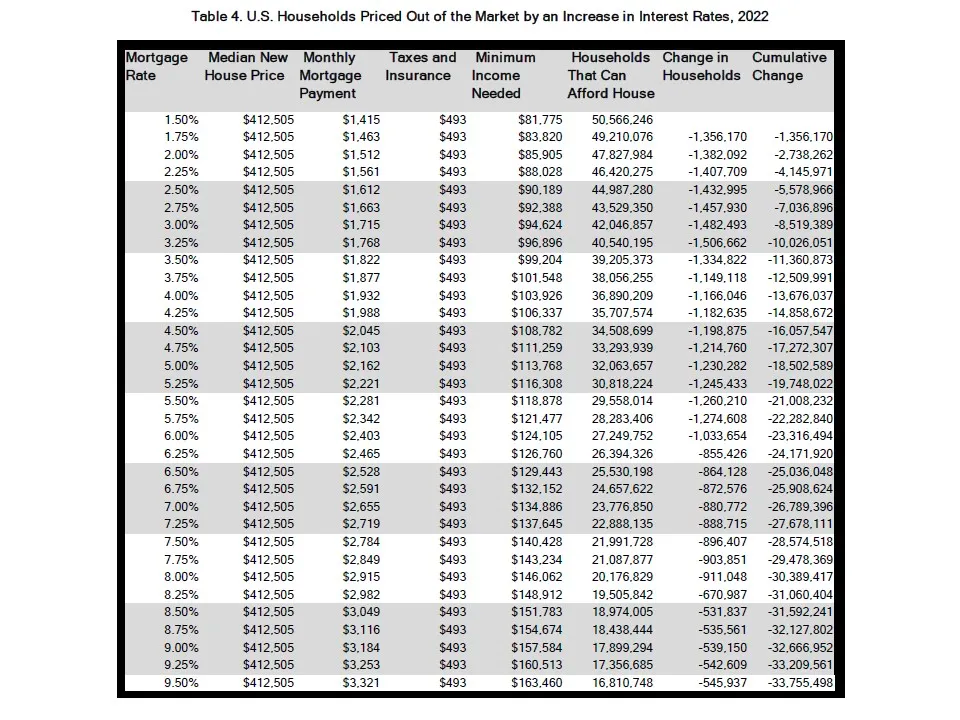

- When interest rates bumped up recently from 3.5% to 3.75% and beyond, more than 1.1 million households – a large share of them in the income-level margins for whom builders target entry-level homes – found themselves on the wrong side of the payment power dividing line.

- And that's not even accounting for a barrage of spiking costs builders now need to pass along in asking price increases from homebuyers.

Here's how – according to this week's analysis from National Association of Home Builders senior economist Na Zhao – the picture sharpens as current consumer and producer price trends, employment and household spending data, etc. weigh into Federal Reserve monetary policy moves to cool down overheated inflation.

Zhao writes:

For a new home with an estimated median price of $412,506 in 2022 and the recent 30-year fixed-rate mortgage rate of 3.5%, a quarter percentage point increase in the interest rate would price out approximately 1.1 million households. The monthly mortgage payments will increase as a result of rising mortgage interest rates, and therefore higher household income thresholds would be needed to qualify for a mortgage loan.

Meanwhile, running right into the late-February 2022 shock-and-awe Russian invasion of Ukraine, builders on the ground in many markets reported an "if-we-can-build-it-they-will-come" market demand that – to-date – was shrugging off price-increase after price-increase with little to no resistance.

Will those reports out of sales centers hold in March and April, when an array of brand new real and meaningful inflationary bursts mix with what happens to interest rates?

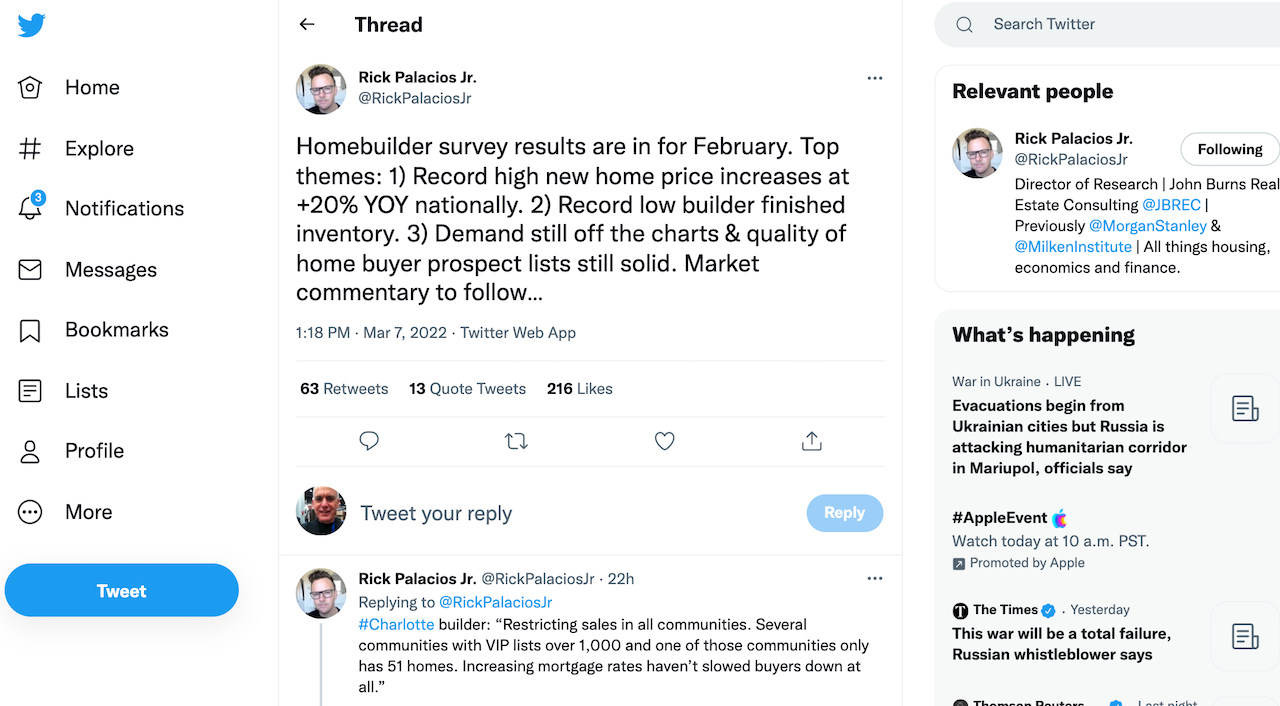

Bill McBride, at Calculated Risk, taps into monthly builder survey commentary from community sales outposts in the most active housing markets, and had this from Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting as a sum-up:

Homebuilder survey results are in for February. Top themes: 1) Record high new home price increases at +20% YOY nationally. 2) Record low builder finished inventory. 3) Demand still off the charts & quality of home buyer prospect lists still solid. Market commentary to follow…

The ground shifts beneath us, and jolts whose magnitude and duration we still don't know the extent of make one thing clear. A new or next normal most people expect at this juncture in the pandemic era's elongated period of limbo is not yet taking hold.

Instead, it's slippery slopes, re-forecasts, hockey sticks, and Hail Marys. Inflation – for all the ways it's dissected and defined – remains a wild card.

At the very least the gaps between the two inflation gauges could remain quite wide. This could especially matter later this year if inflation in goods prices, driven by pandemic disruptions and now Russia’s invasion of Ukraine, begins to subside. One can imagine a world in which the Fed thinks inflation has really started to come back down while others vehemently disagree.

One way or another, erosion in the pool of demand with each $1,000 increase to a new home's price tag will at some point carry a consequence, and those $1,000 increases are flying around like hotcakes. And when you look carefully at the anecdotal commentary JBRE's Palacios spotlights, builders' efforts to meter, cadence, hold back releases, etc. is a frantic effort to factor as many unpredictables as possible into the moment they fix a price agreement with a customer, while so many forces are in constant motion.

Household balance sheets, stiffer loan criteria, and loan to value ratios being what they are, property deflation – the bubble popping – doesn't crop up on the radar as a likely scenario.

What happens to a housing bubble that stops being a bubble, but doesn't pop?

We may be about to find out.

Join the conversation

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.