Land

Poised To Pounce: If Credit Tightens, Get Ready For A Run

Here's the way 10 public homebuilding firms' strategists coyly position themselves to jump on new market share and earnings opportunities through the end of 2023 and into 2024, by drawing on troves of 'dry powder.'

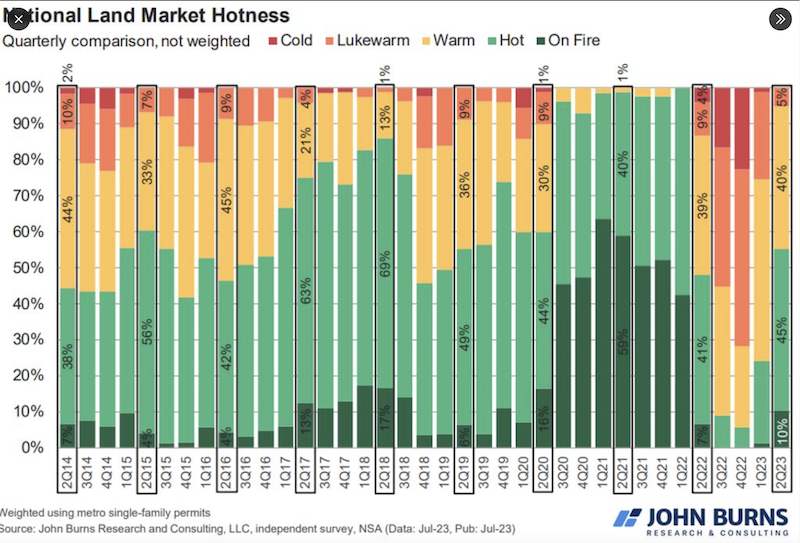

This week, John Burns Research & Consulting founder and CEO John Burns posted:

The land market is on fire again, per 55% of the 78 land brokers we just surveyed. This is the hottest the market has been in 15 months, & comparable to the market strength from 2018 through early 2020, as shown below." – X

It's no surprise, given the talk-track from top public homebuilding enterprise strategists reporting and commenting on their calendar Q2 [fiscal Q2 or Q3] business and financial performance in the current earnings cycle.

The simple answer as to why is a four-letter word: Pace.

A year-ago, the outlook for pace – often measured by the rate of new sales absorptions per community per month, and of course, a corresponding rate of deliveries and settlements – was a crapshoot. There was fear pace could go net negative, i.e. cancellations plus little-to-no action on the new sales front. That didn't happen.

Then, there were tactics to kickstart pace with discounts and incentives. There was worry, too, that unsold speculative inventory of new homes would languish. That didn't happen – as it turned out, spec homes emerged as the ready-for-primetime stand-in for resale inventory that simply did not materialize.

Then what happened happened, which is that pace – with some help on the mortgage buy-down front and some nudging on the incentives and discounts front – pronounced itself.

Homebuyer FOMO snapped-to. Climbing interest rates – rather than playing the show stopper – fed the FOMO.

Unexpected pace in early- and now-mid-2023 meant appetites and requirements for replenishing land and lot positions arrived ahead of schedule – well before a once-expected reset on land prices and terms ever had a chance of occurring.

So why are land brokers telling the analysts at John Burns Research & Consulting the "land market is on fire?"

Pace. Plus a whole-lot of pent-up capital – cash – builders need to put in place to keep their asset-lighter machines in constant pull-and-push motion.

On Monday, we canvassed 10 public homebuilding companies' earnings commentary, pulling out each of their declaration of the "dry powder" each as stored up as they monetize their inventory turns against a dramatically lower outlay on new land acquisition costs.

Today we'll take a high-level look at each of those organizations' strategic "tell" with respect to how aggressive their next steps will be to add to their lot pipelines, especially in a dynamic heat-map of geographies continuing to enjoy economic exuberance and in-migration.

We'll start back with the June 15th Lennar earnings call and progress chronologically from there up through the calls last week. (We'll visit this week's earnings calls for a separate analysis in the next couple of days),

Putting Cash to Work Opportunistically (On Land)

Stuart Miller, Executive Chairman, Lennar (June 15)

The capital accumulation that we have in cash on our books is a strategic opportunity for us to participate and make sure there is even flow by some of the participants, either through partnership or other structures. In terms of some of the homebuilders, I think that there is still capital available for those that are operating in the production world. Whether that changes over time, we certainly have a front seat at the table in terms of being able to act where the right opportunities fit. We've done it before. We're not afraid to go forward. ... We've spent an awful lot of time and are spending a lot of time on creating systemic solutions for what I think of as kind of an opco-propco type configuration. There is no question that the structures that we have worked on can be constructive relative to some of the dysfunction that is in the market right now, and we're working in those directions as well.... The best answer ... is a broad one, and that is all of the above, it's all on the table. We are uniquely positioned to be able to participate. And all of it will be focused on building production trajectory, production consistency in growing the core business, the manufacturing homebuilding business. As we go forward, we have the latitude of balance sheet to be able to do that in a lot of different ways."

Jeffrey Mezger, Chairman, President & CEO, KB Home (June 21)

In most of our markets, there's a lot of large, well-capitalized landowners and they were very patient through the softening in demand and pricing really didn't capitulate. And now as demand is improving and you can again underwrite to a pace in a submarket, numbers are tight, but you can figure out ways to make them work. We have been successful with some of the smaller sellers that aren't as well capitalized where we may have abandonment and they just sat on it for a while and now we're back engaged with them and we're getting better pricing or better terms and they now have certainty of close again.

So, our teams never stopped looking. We weren't as aggressive in our work in Q3 and Q4 [2022] as we would be today in pursuing land activity. And I think it's pretty balanced out there. We're not the only builder out chasing land, so it's competitive."

David Auld, CEO, D.R. Horton (July 20)

Our target is market by market, flag by flag, how do we consolidate these markets and increase our market share. And just by the nature of doing that, we're going to get bigger and bigger and bigger."

... It is really hard to put a lot on the ground. It is really hard to build houses. And these private guys, now, they've got to struggle with capital from either private or banks increasing in cost. So, do we have the opportunity to talk to a lot of these guys? Yes, we do."

Ryan Marshall, President & CEO, Pulte Group (July 25)

We actually did increase our projected land spend number about a quarter ago. So when we went into the year, I think we were right around $3.2 billion to $3.3 billion. We've moved that up with the high end and as high as $4 billion, certainly down from last year, and that was intentional.

...O ur plan is to stick with that to continue, to stay very balanced and disciplined and running a good business and being really laser focused on picking our spots with where we're investing more capital... I don't think we need to do anything along the lines of put the pedal to the metal. I think we're going to continue to be foot on the gas, but we're going to continue to focus on monetizing the 214,000 lots that we have, which we'll see what the market holds, but I think that will give us an opportunity to continue to run a very nice business that will grow in the market."

Dale Francescon, Chairman, Co-CEO, Century Communities (July 26)

We still like the ratio of a 50/50 optioned versus owned. And we are getting back closer to that now. We ticked up above that when we dropped so many lots at the end of the last two quarters of last year. But we are starting to rebuild that now.

We are up sequentially quarter-over-quarter. We are at roughly the 58,000, as we said in our prepared remarks, we'll see our controlled lots continue to grow throughout the year. And so that will get us closer to that 50/50 ratio."

Sheryl Palmer, Chairman, CEO & President, Taylor Morrison (July 26)

We are very focused as an organization on maximizing the scale of each of our markets. ...And what does that look like? It's a little different, market by market. But certainly, I think, a top 5 position in some markets to top 3. But we all know the benefits of scale when it comes to kind of land acquisition, people, construction, cadence.

So do I think there's room to run? Actually quite a bit. I would say some markets we're at scale, but I would say good scale today. But when I look across the portfolio, I think there's a couple of significant opportunities. One is additional scale in a number of our markets. I think there's only 1 or 2 that I would call subscale, but I think there's many others that have just a lot of room to run if we're in the top 6 or 7.

And then I think there's complementary markets. We have to look at those opportunities as they present ourselves. There's going to have to be a good strategic fit. They're going to have to be accretive to the portfolio. So we'll see if those opportunities -- but I think, certainly, we're most focused on organic growth. But we'll continue to look at the opportunities that I think will present themselves in the coming year given the stress of the private building community is feeling."

Robert Schottenstein, CEO, M/I Homes (July 26)

Job one for us is to continue to grow our business. We think we have gained market share in nearly all of our markets over the last number of years, and we expect to continue to growing market share. So job one for us. Job one for us would be to invest in our divisions. And that's how we'll likely be deploying most of the cash."

Allan Merrill, CEO, Beazer Homes (July 27)

We had a pretty significant growth in the land position over the last three or four years, which is what’s really fueling the growth in community count that you’re seeing. We were in the 18,000-lot range and now we’re obviously in the 22,000 lots. So it’s taken some time to go throughout on those lots, especially during COVID, given some of the disruptions we’ve had. But it’s really that increase that you’ve seen that’s really driving the community count growth that we’re going to see in 2024.

"We have good visibility into community count growth for the next 18 months, and as we go forward quarter-to-quarter, we’ll continue to update what we see from a community count perspective. But we have our eye set on getting over 200 by the end of 2026. That’s the guidance and we’re finding land deals, frankly, that pencil well for us to go out and grow the community count."

Bob Martin - CFO, M.D.C. Holdings (July 27)

This latest quarter, we were at about 17% of our total lot supply was options so a fairly small percentage. Just one thing to note is there is -- or there was 4,500 additional lots that we are actively doing due diligence on that sometimes is reflected in other builders' numbers. We don't reflect it in our option number until it's actually approved by our asset management committee. But that is a pretty big number relative to what we have officially under option in our numbers so just one point there.

And then as far as finished versus developed I think on a relatively small number of approvals, we were 60-40 finished versus developed in this most recent quarter.

Typically what happens as the land market heats up it's harder to get the finished lot contracts more of less become development project. So, we'll continue to look for the finished lots. But it wouldn't surprise me if you see it flip to more lots that we have to develop versus lots that we buy finished. Naturally, there is a possibility something you know very well about land banking. That is a mechanism that's been used to get to finished lots. But it's not something that we've done before. And in this kind of interest rate environment I can only imagine that's going to get even more expensive to get those types of transactions done. So, we're focused on getting finished lots where we can. But I can't tell you that it's going to be the majority of what we do in the future."

Doug Bauer, CEO, Tri Pointe Homes, (July 27)

We're seeing some strategic opportunities for growth. At the same time, I would say that our primary focus is looking at organic in a couple of markets that we're currently in the process of establishing. So more to come on that. Obviously, the organic model is something we know very well. That's how Tri Pointe started. So, I would say that's A, and let's call M&A B -- as I look at the credit markets and talking to the bankers. It's going to take a little bit longer for more opportunities to kind of flush out of the system. There are definitely capital constraints. As you know, all the banks, big money center banks and others are under a lot of pressure, raising capital. The credit markets are very tight for the less-capitalized builders and land developers. That's another area that we're looking at too. But there's a little bit of a longer process as you go through and see where the opportunities could land. I think it will be towards the end of the year going into next year as the credit markets continue to probably slow -- continue to slow down their credit opportunities for the small to medium-sized builders and land developers."

The back-of-the-envelope "dry powder" cash generation these 10 builders have tallied runs into the $15 billion or more ball-park for the first six months of 2023. Depending on, as Doug Bauer notes, just how tight lending and credit markets become for those less-well capitalized operators, the land rush could get mighty active going into year-end.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.