Leadership

'There're Buyers Out There' ... This Time May Be Different, For Some

As challenging as conditions have become, almost one-in-five consumers surveyed by Fannie Mae considers now a good time to buy a home. Job No. 1 is to reel them in.

A U.S. Federal Reserve that requires widespread and complete capitulation among key forces fueling economic demand-versus-supply imbalance has to deal with two bulls by the horns – a robust crisis-fatigued consumer cohort and a homebuilding business community not about to surrender without more of a fight.

So, two wild cards in housing's black box economy – one a tricky, temperamental rascal of a headwind and the other an up-to-now hellbent tailwind – bedevil business forecasting right now at a moment business forecasting, i.e. not the predictions business, is crucial.

- One, of course, is generational consumer and business inflation, the kind that takes a greater amount of money coming in and morphs that into a lesser amount of money to put to use.

- The other is generational demand vs. a bluntly gaping difference in new building activity to match it and meet it.

They appear to the naked eye to be on course to meet head-to-head at some point, sooner than later. That's subject to speculation.

A truckload of economists with Nobel Prize awards, former and present Treasury secretaries and Fed chairs, investment banking chieftains, hedge fund wizards, etc. to a person, can't honestly claim they know exactly how offsetting forces will play out in the next six to 18 months.

As Housing Wire's Logan Mohtashami writes in "Sixth recession red flag raised, despite strong jobs report," an exceptionally clearly framed consideration of a holistic set of countervailing housing economy trends, right up through and including this past Friday's bumper-crop jobs report:

I’ll take each data point one day at a time and try to make sense of it. Remember, economics done right should be very boring, and always, be the detective, not the troll.

Rather than clarity looking forward, let's imagine it from a future point looking back. At some time, 24 months, or three years, or five years from now, economists, housing experts, commentators, etc. – all the people homebuilding operators on the front may have little or no patience left for right now – will look with the greatest amount of focus on the behaviors of consumer households that fall into a single catch-all classification.

They consider now the moment to buy a new home.

This is a group – the size and geographical distribution of which are tough to know right now – whose manifold individual parts have the will, the wherewithal, and the clinching judgment of greater-value-versus-lesser-cost that goes with sayings like "date the [interest] rate; marry the house."

Are they tens of thousands, hundreds of thousands, are they deterrable or are they determined? Right now, a lens of economics – because, perhaps, it is a "dismal science," -- may be less instructive on a peer company to peer company basis than the eyes, hearts, souls, physical, and mental efforts of people zeroing in, one-by-one-by-one, on those households that can come up with the wherewithal, qualify for the loan, and consider now the "it" moment to spring.

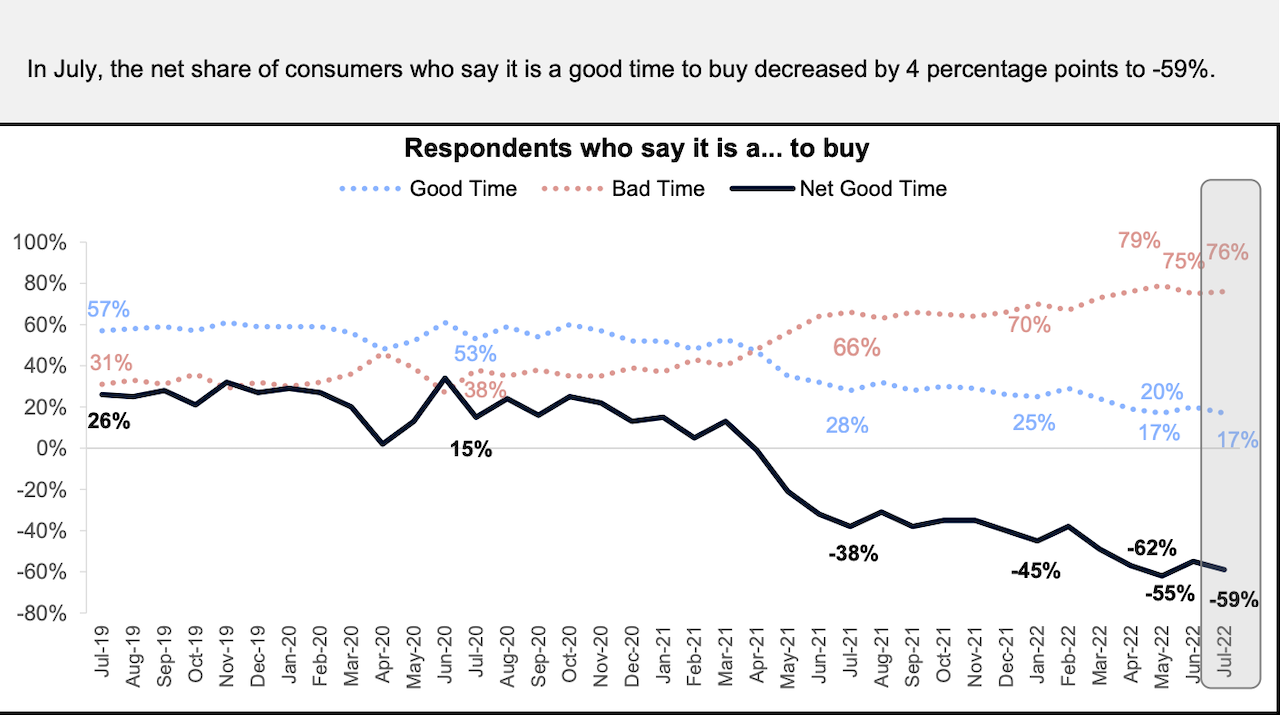

A report from Fannie Mae harvested from consumer survey respondents during the month of July and released this morning raises concern:

Surveyed consumers continue to express pessimism about homebuying conditions, with only 17% of respondents reporting it’s a good time to buy a home.

Mind you, this is a stream of folks who are both already in a backlog, with their deposits already sitting in escrow, or still apt to enter into one, given their myriad arrays of discretionary and non-discretionary lifestage and lifestyle motivators.

Al Trellis, a strategic advisor to principals, founders, and major shareholders of scores of privately-capitalized homebuilding firms with the team at Home Builders Network writes about that buyer we'll one-day categorize as the one who susses out the pros and cons and decides for the reason he, she, or they will decide it's the time to buy ... now:

I’ve said repeatedly that the economic landscape is difficult to interpret, and that the length and depth of a recession are very unclear. [This] article link highlights two points I have made, i.e. low unemployment and huge corporate cash holdings are mitigating factors which are extremely difficult to measure. Additionally, a factor that is relevant to the homebuilding sector is what I believe to be an approximate 2-2.5 million shortage in the national supply of housing. Adding this to the number of homes taken for rental use in the past three years, leads me to conclude that for-sale housing in the right markets and at the right prices will not be as strongly affected as some have prognosticated. My advice for the moment is simple: build out your backlog, start an appropriate number of specs, release those specs earlier than you would have 3-6 months ago, watch your market for the next 60-120 days to see what develops, and give buyers a chance to accept higher prices and higher interest rates. None of us can know for certain what will happen - but it is definitely too early to panic. Hopefully we will all have better clarity over the next several months.

Now, for the Fed to get positive feedback that it has tamed the beast of inflation, capitulation – or at least some sense that there are hedges and options ahead as far as a run-up in prices and costs – stands as a virtual non-negotiable.

Still, who'll surrender if they don't have to? With due respect to HousingWire economics correspondent Logan Mohtashami's urging "always [to] be the detective, not the troll," we'd look for early signs of evidence as to how that capitulation first starts showing up in consumer household housing formations and behaviors.

Truman Patterson, a senior vp at Wolfe Research, writes:

We will be watching the 3Q HH Formation metric closely for signs of individuals potentially doubling-up on housing arrangements given recent affordability challenges."

Meanwhile, in the trenches, many players – large, medium, and small – don't betray a willingness, just yet, not to keep fighting the fight, with puts and takes, concessions and workarounds, for every possible buyer who believes that it's the right time to buy.

Said one homebuilding founder/principal this morning,

It's definitely time to make sure the lifeboats are ready to go if it comes to that – even if it's not quite time to jump in and lower them into the seas."

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.