Leadership

Omicron — In An Era Of Ongoing Challenge — Means More Testing

Housing leaders — already battling a daunting array of business, operational, and logistical challenges — need to up their game on ensuring workplace, jobsite, customer, and partner safety as variants emerge.

Omicron, today's headline risk in a hyped-up, volatility-racked roller-coaster Wall Street marketplace, is both yesterday's news and tomorrow's unfurling challenge for housing business, investment, construction, and development community leaders.

The residential real estate and construction sector's present – predicated on prescience, plenty of capital, and shrewd commitments now that generate margin-sensitive returns in the future – contains moving-parts enough to fill most strategists' fully-prioritized day, and then some.

Namely:

- Supply chain impacts, and the day-to-day pursuit of workarounds

- Direct cost inflation, as every vendor seizes now to pass through price hikes

- Land-cost inflation, as sellers leverage scarcity vs. a proliferation of buyers

- Zoning and entitlement risks, as localities squeeze more and give less on demands from residential neighborhood developers

- Quits, as inter-company, and pan-industry competitors target talent

- Consumers, and the question of how long Animal Spirits of behavioral demand sustain themselves

- Workplace, job-site, and customer interaction health and safety

These are present-day table-stakes – users of ready cash in hand as operating resources, both planned and unforeseen – and they challenge the technical and tactical problem-solving nature and character of managers on the front lines and senior level leaders in housing's regional, divisional, and community command centers. This applies particularly in housing's 50- to 75-most-active new home construction geographies, where nine out of 10 newly built homes are in process.

Now, homebuilding operators and the multilayered daisychain of stakeholder partners that feed into and out of their current capability come face-to-face with less cash on hand to carry on day to day because of stalled completions, higher input prices, and dimmed certainty as to when the flow if outlays and income regain equal footing.

So, while Covid's Omicron strain has created a white-knuckle limbo between the variant's first emergence last week and the time its full array of characteristics and potential for harm come to light, here's where strategic leaders – continuing to dead-reckon in a pandemic era for which there's no helpful playbook designed to help navigate this specific blend of challenges – might focus with agency and efficacy to secure both the present and near-future of their enterprises.

First, what public health leaders say they know about Omicron adds up to so far, according to Carlos Del Rio, president-elect of the Infectious Diseases Society of America, in a note to physician members of IDSA:

The News

... I spoke with Dr. Ian Sanne, an infectious diseases specialist who works in Johannesburg and member of South Africa's Ministerial Advisory Council on COVID-19. Dr. Sanne said that thus far they have seen a significant increase in cases (from about 300 per day to about 4,000 per day in the country) but not yet an increase in hospitalizations. He is not yet sure what the clinical picture of this virus is or if it is more severe, but some breakthrough infections are occurring among vaccinated individuals. Among the young, the symptoms have been mostly mild.

What it means to housing's leaders

The take-away from the emergence, taken apart from the financial market gyrations that speak to bets, risks, rewards, and threats to huge sums of capital pursuing yield, safe haven, and sustainable returns amidst a broad calculus of obscured visibility and ongoing disruptions, includes this.

The impact and implications of Omicron – and any of the potential Covid variants certain to surface in a global context of only partial herd immunity and the presence of many many potential hosts with no antibody defenses -- fork into two streams, one actual and one perceived, anticipated, or feared.

Without succumbing to panic, nor adding further risks to livelihoods with near-term lockdowns, Dr. Del Rio's recommendation is to amp up tools that can improve each of our environments – among team members, with business and trade partners, and with customers and other stakeholders – locally.

Del Rio notes:

In light of all of this, what can we do and should Omicron modify our plans? I think we should remain vigilant and hopefully use this as an opportunity to increase vaccination rates. I am more concerned about low vaccination rates across the country than I am about Omicron at this point. The second thing I would recommend is doing more testing. Our testing rates in the U.S. are decreasing, and testing is critically important. If you are traveling, incorporate testing into your travel plans. If you are getting together with friends and family, use rapid testing to prevent having an asymptomatic person join the party. Rapid testing works well to identify Omicron. Vaccination and testing are key components of a layered prevention strategy that should also include masking in indoor spaces, gathering outdoors or in well ventilated spaces, and staying home when sick.

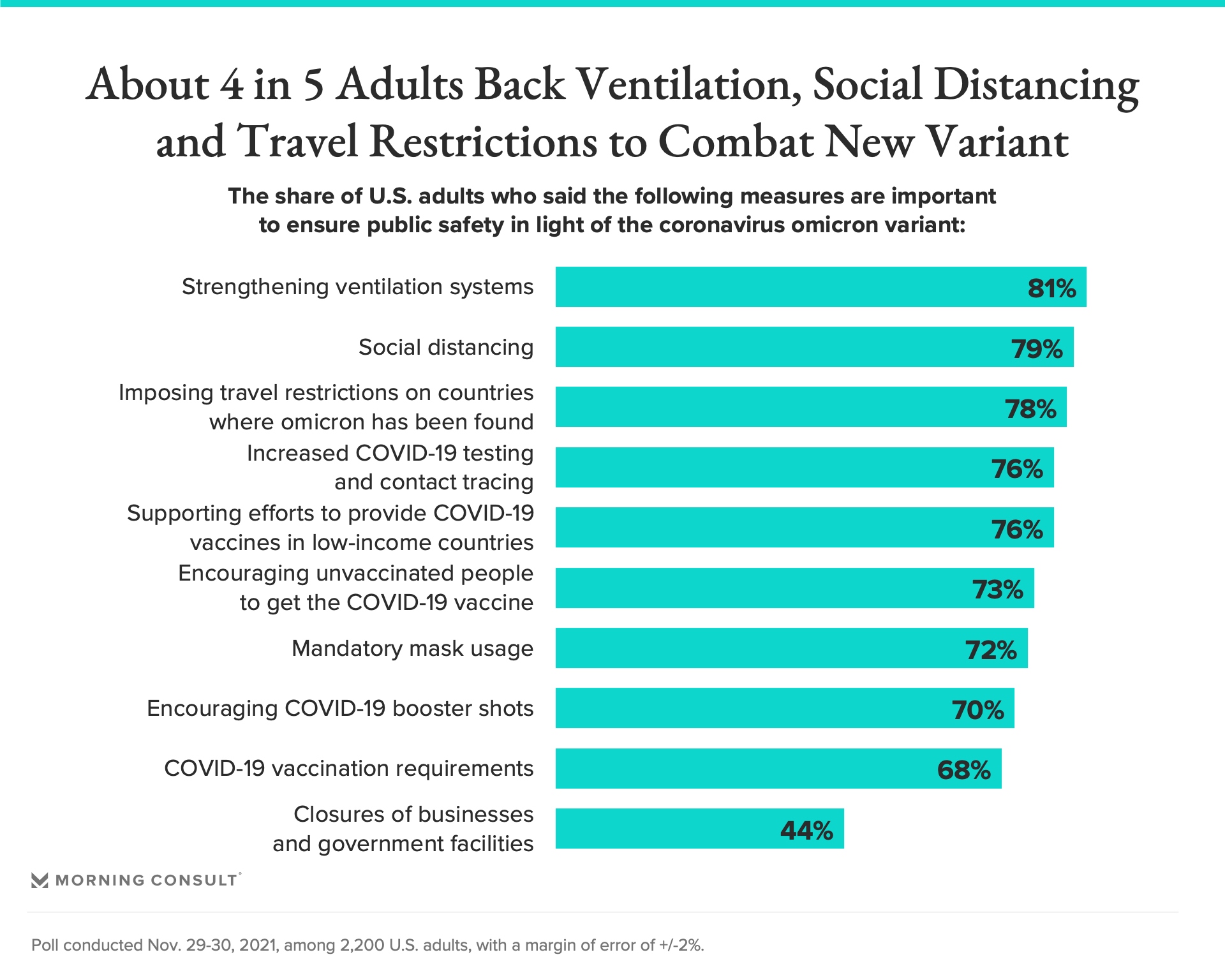

Three out of four respondents to a Morning Consult poll concur that testing belongs as an important tool in an array of measures Americans should take to safeguard against the Omicron variant.

Morning Consult findings include:

Public health measures to combat the spread of the new omicron variant are popular across the board, with the exception of business and government closures. Most adults favor mostly voluntary measures like strengthening ventilation systems, social distancing and shoring up COVID-19 testing over requiring vaccinations.

Here's a link to the National Association of Home Builders resources regarding testing and vaccination for job sites and workplaces.

Why it matters

As housing's strategic leaders quickly recognized and nimbly jumped into action to secure beginning in Spring 2020, both the short and the long game for their businesses involves the health and safety of customers, partners, and team members above all. In some respects, the new Covid variant may wind up amounting to either greater or lesser destructive potential than the current Delta variant, which has mounted its own seasonal surge – increasing both hospitalizations and mortality rates in many geographical areas as the weather gets colder.

What matters most now for organizations whose business and investment models straddle past-years investments, present day monetization of those investments, and a healthy, sustaining pipeline of future investments with as much of a de-risked return profile as possible comes down to a simple, always applicable, working credo: do the next right thing.

Today, that means neither over- nor underplaying the potential of a new Covid variant capable of spreading fast and evading its hosts' defenses.

Instead, do what's there to do to keep people safe, productive, and focused on capability at a moment when challenges to that stack as high as any pile of containers in our port cities.

Homebuilding and its ecosystem have a richly defined infrastructure of distribution and value-add in its highly local model. Let's turn the infrastructure into an already build channel to test each human participant in every workplace setting to ensure their safety, and that of their teammates, customers, partners, and family members at home.

It's the next right thing – Omicron or not.

Join the conversation

MORE IN Leadership

Eastwood Homes, Napolitano Unite In Culture-First M&A Deal

In a rare private-to-private M&A deal, Eastwood Homes acquires Virginia’s Napolitano Homes—uniting two family-founded builders in a move that blends culture, strategic market expansion, product synergy, and generational transition.

Fire-Ready Future Forward: KB Home Builds Hardened Homes At Scale

Escondido, CA-area’s Dixon Trail becomes the nation’s first IBHS-certified Wildfire Prepared Neighborhood—fusing resilience, affordability, and innovation into a new model for community design.

KB Home Guidance Cut Bodes Sharper Sector Challenges Ahead

In a reflection of broader market tensions, KB Home — following on an earlier lowered guidance from Lennar — drastically revises its 2025 outlook downward amid weakening consumer confidence and escalating costs.