Leadership

Not Ones To Capitulate Without A Fight, Builders Go Full Day-To-Day

The verdict on the degree of risk – to prices, land valuations, lending agreements, vendor relationships, key team member talent retention, not to mention critical new R&D investment – is still out.

For some of us, lyrics and life run constantly in concurrent streams. Instants where a lyric floats to mind and etches its way into real life almost as though it had to have been composed specifically for you, then, and there, fuse with everyday living's magic.

Some of them – both the lyric and the in-real-life moment – cross over more often than others. This one, for instance, as it applies to the housing cycle and its nested ecosystem of homebuilders and their partners:

You don't need a weatherman to know which way the wind blows." – Bob Dylan, Subterranean Homesick Blues

The lyric, said to be cited by lawyers and judges for its metaphoric meaning more than any other quotation from any other songwriter, crosses over into real life so seamlessly and often that many people doubt that Bob Dylan actually originated the phrase.

Never mind. The phrase fits this morning's unveiling by the Census Bureau of July 2022 housing starts and permits activity.

National Association of Home Builders chief economist Robert Dietz carefully curates the data points to highlight what they mean and why they matter for those who're focused on homebuilding and new residential development. Dietz writes:

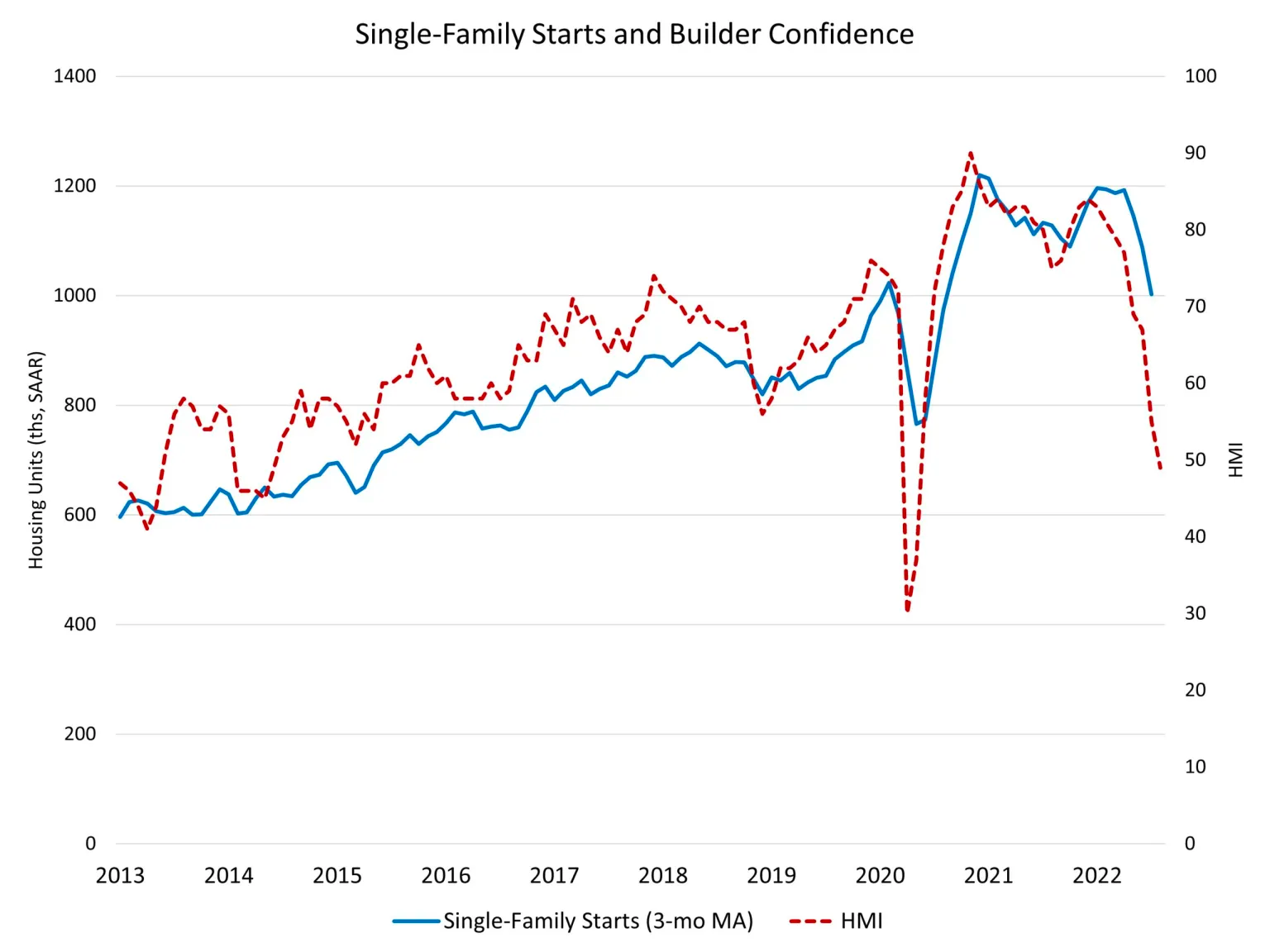

Single-family starts decreased 10.1% to a 916,000 seasonally adjusted annual rate and are down 2.1% on a year-to-date basis. This is the lowest reading for single-family home building since June 2020. More declines lie ahead, as single-family permits decreased 4.3% to a 928,000 unit rate and are down 5.9% on a year-to-date basis. NAHB is forecasting 2022 to be the first year since 2011 to record an annual decline in single-family home building.

The Census' starts and permits release – a lagging indicator – lags another lagging indicator, the NAHB/Wells Fargo Housing Market Index, a monthly builder sentiment reading that usually offers a sneak preview to what to expect from the starts/permits release. Yesterday's NAHB/Wells Fargo HMI was no exception.

Rob Dietz raises the lens of focus to grasp a bigger picture perspective on the one-two punch of HMI and housing starts here:

A housing recession is underway with builder sentiment falling for eight consecutive months, while the pace of single-family home building has declined for the last five months. The decline in single-family starts is reflected in the HMI measure of builder sentiment, as housing demand continues to weaken on higher interest rates while on the supply side builders continue to grapple with higher construction costs. Builders are reporting weakening traffic as housing affordability declines.

Nevermind that more than a year ago, we'd waved yellow flags relative to the sustainability of buyer, supply, demand, pricing, production, and valuation trends, and that by more than nine months ago the yellow flag turned decidedly red with stories like this one.

Data Says It: A New Homebuyer Pivot Has Happened

Our thought then was that the pandemic-triggered economic electroshock therapy had delayed, but not permanently prevented, an asset-bubble correction that was in the making prior to COVID-19. Raising Fed Funds rates in 2017 had proved earlier how susceptible to shocks and risk the housing recovery trend was even then.

By five months ago, bull and bear camps had staked out their turf, although bulls' new position called for a "normalization" versus more of a pronounced and challenging downturn. Worst-case scenarios that place a market correction's floor at 10% to 15% or even 20% – comfortably north, or just barely on the line defining a bear market – the question, "what possible factor are we neglecting to consider?" starts to nag. Why? Well, flashback to the days of "subprime risk is contained." No, household and business balance sheets are not leveraged as they were back then. Does that mean every possible risk to a major market-rate housing correction is clearly out there on the table?

We've heard circa 2019 is where "normal" finds a floor among those who believe an unsustainably frenetic market was normalizing. Well, here we are at 2019 in terms of housing starts, but now there are fewer folks who'd say things won't deteriorate further.

The verdict on the extent of exposure to business risk – to prices, land valuations, lending agreements, vendor relationships, key team member talent retention, not to mention critical new research and development investment to further understand consumers and new technology-enabled materials and designs to add value – is still out.

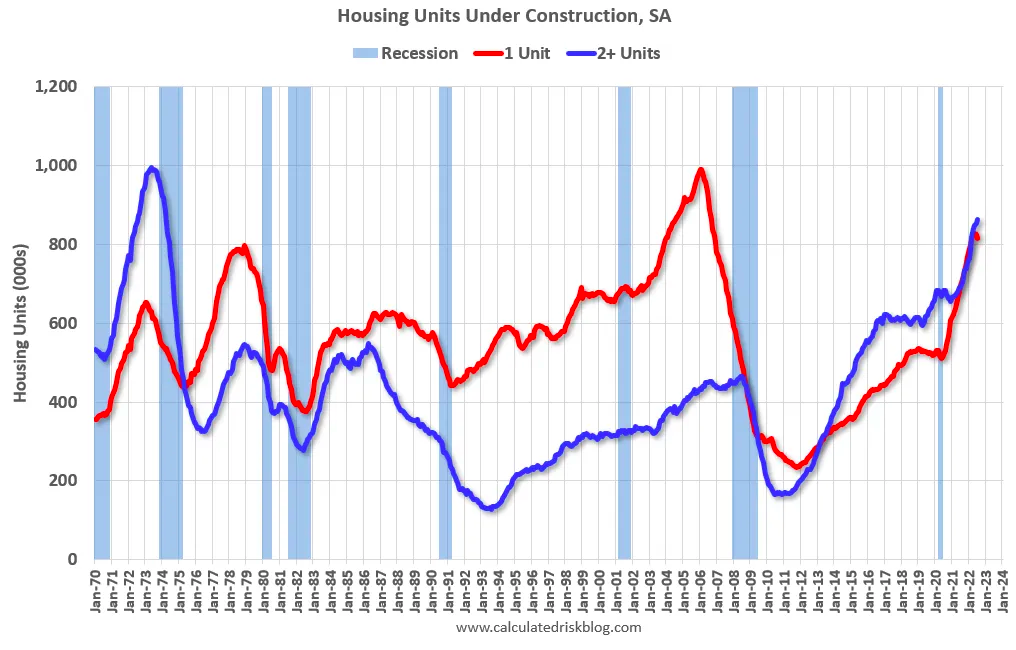

Importantly, challenges with both backlogs [i.e. cancellations] and forward-order absorption pace appear to grow steadily more severe each month. Calculated Risk's Bill McBride notes:

Homebuilders are reporting that demand is slowing, yet a large number of housing units will be delivered later this year (with all these units under construction).

Our own Dream Team thought and practice leader, Scott Cox puts this calculus into real-world terms as a brightline moment-of-truth playing out over the next 20 weeks.

We’re in the beginning of a downward adjustment in for sale housing. Time will tell if it’s a modest correction, or more severe. Much will depend on the next few months and whether we can sell out the specs in the python (to mix a metaphor) without very large discounts.

That depends on whether demand reduction is gradual, or we hit a buyer air pocket. Also, it ties to whether we greatly reduce spec starts, so that buyers who are in the market need to buy our already under-construction specs.

One way or another, the truth – modest or severe – will be showing up in the all the lagging indicators within the next 100 to 140 days.

In the 75 or fewer markets that serve as proxies to the national new home marketplace in the U.S., homebuilders' themselves live and work as the leading indicators – each day and night in trench rules-of-engagement-style daily forays, round-the-clock reconnaissance, flash war-room intelligence, tactical response, and ever-evolving strategy aimed at mitigating risk, maximizing profit, and securing a navigable pathway forward.

All this is to say that homebuilders' ears to the ground and their appreciation for what what going on with customers' pursestrings and mindsets, as well as with the puts and takes process of regaining control of their build-cycle schedules and costs, put them well out in front of these lagging indicators.

As long as they're talking to and listening to people sitting at their kitchen tables, the degree to which there's a menacing rumbling on the horizon, or, rather, signs of sunnier days ahead, they'll know long before housing starts, permits, and new home sales data come to light, the answer to the question, "modest or severe?"

Ask just after Thanksgiving.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.