Marketing & Sales

'Not A Good Time To Buy' For Most Is The Exact Moment For Others

Disruptive forces can impact the size of the prospective universe of would-be buyers. Getting specific on your particular buyer with your particular home value proposition means answering these two questions.

It's never a bad time to remember a timelessly valuable, two-part quotation from homebuilding's latter-day 'Will Rogers' of company mission, purpose, strategy and culture Larry Webb.

It's a chameleon quote – it goes with any turf at any moment. It works when housing's booming and it seems like nothing can go wrong, or when things get tricky, or when they're so horrible that it seems like nothing will ever go right again.

It's an especially good time to remember it now. Because now, well, there's so much that can't be explained, or clarified, or roadmapped one way or another, and when you can't put reason, a definitive beginning-middle-and-end plotline, or a quantifiable measure of intensity or depth, then is when wisdom of the heart matters and means the most.

It's in the form of two questions.

Who are you?

Who do you want to be?" – Larry Webb

The "you" – Larry made it ever so clear – was no abstraction.

It was no fuzzy reference to a company, a brand, an operation. It was people, particular ones who woke up that morning and came to work that day and did what they did, either well, or well-enough, or not. He wanted each and every one of the people on the teams and in the ranks and across the enterprise he led not only to reflect on the meaning of the questions, and their response to them, but to feel their impact viscerally.

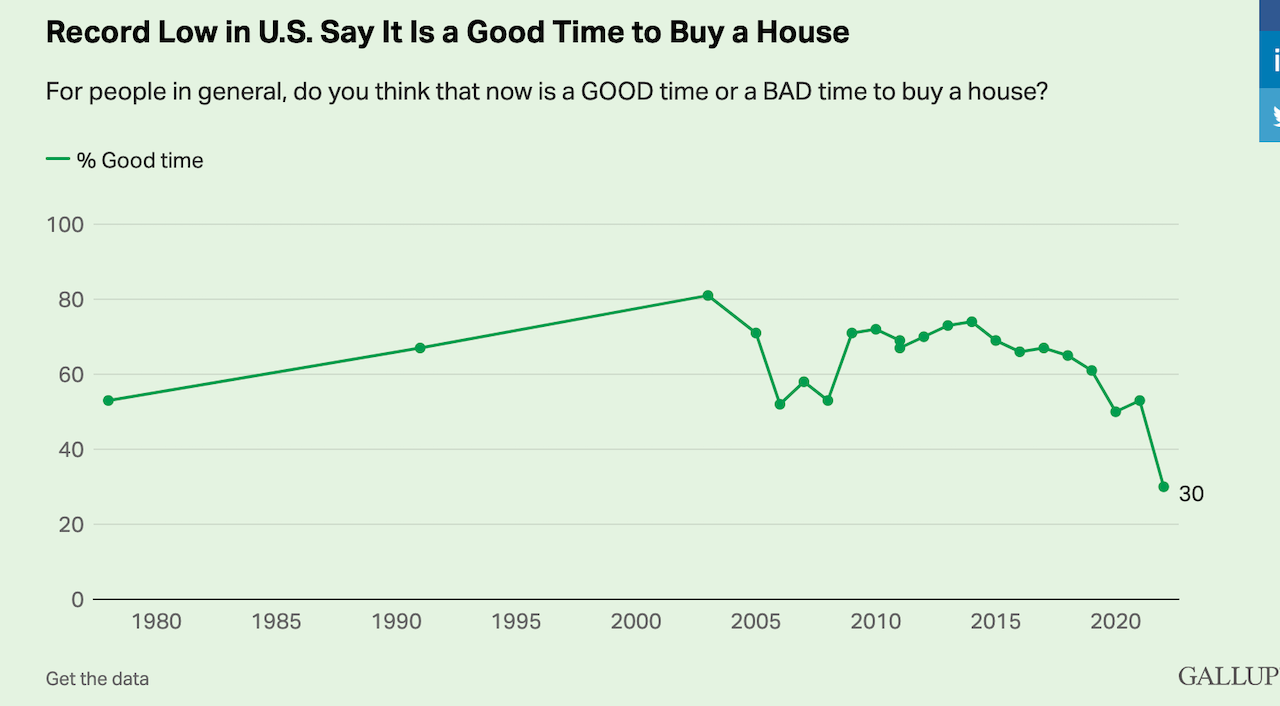

The context this morning is the framework of consumer sentiment and confidence and their role in your business performance. The complexion of that context got a wake up call last week with a print from the Gallup Organization:

- Record Low in U.S. Say It Is a Good Time to Buy a House: what may have sent shivers through the firmament among homebuilding operators and their partner vendors, suppliers, lenders, and advisors was not just the "record low" reading. Rather the tabulations among demographic – income – groups that show respondents with incomes exceeding $100,000 fell from more than half feeling it was a "good time" to buy a house in 2021, to barely over one-in-four feeling now's a good time.

And that one-in-four may or may not decline even further as the spinning plates of mortgage costs, ASPs, and signs of a wobbly near-term economy factor into households' decision-making.

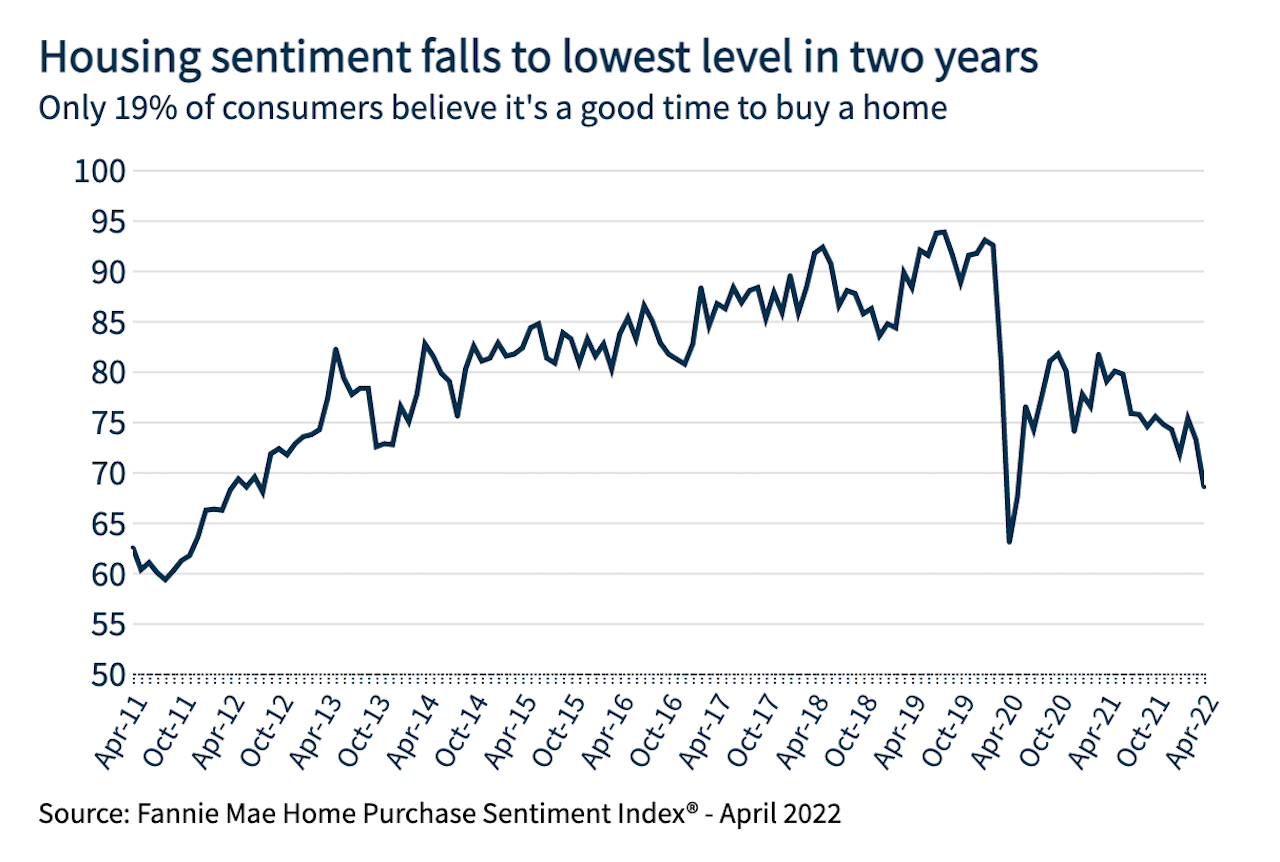

This week brought another salvo on the consumer sentiment front, this one from Fannie Mae whose monthly Home Purchase Sentiment Index clocked in with another eye-opening steep downward trajectory.

Fannie Mae chief economist Doug Duncan's explanation for the falling knife of consumer sentiment hits at a multifactorial series of causes:

The current lack of entry-level supply and the rapid uptick in mortgage rates appear to be adversely impacting potential first-time homebuyers in particular, evidenced by the larger share of younger respondents (aged 18- to 34) reporting that it’s a ‘bad time to buy a home.’ Additionally, consumer perception regarding the ease of getting a mortgage also decreased across nearly all surveyed segments this month, suggesting to us that the benefit of the recent past’s historically low mortgage rate environment appears to have diminished, and affordability is poised to become an even greater constraint going forward. This sentiment is consistent with our forecast of decelerating home sales through the rest of 2022 and into 2023.”

Events of the past six months or so have siphoned off two growing cohorts who last year at this time were soundly within the "would-be buyer" pool of those who both wanted to buy and had the means – payment power – to buy.

One cohort is made up of folks just-within or on the bubble of wherewithal, who are now priced-out due to the hit of either or both inflation or interest rate increases. As the National Association of Home Builders calculates, that number ballooned in the month of April, and continues to swell with every upward step of mortgage interest rates to a new plateau.

The other group of those opting or opted out of the new home front – including some of those with that $100k-plus income level mentioned in that Gallup News survey – may be the reverse side of the FOMO set. Those who up to a certain point in the past couple of months drove to make their home purchase for fear of missing out may feel that now the line is drawn – they've missed out.

While it is not insulated or isolated from what's going on in the economy, the stock market, or housing's macro cycle, the supply-and-demand sub-segment that impacts homebuilders' backlogs of contracted buyers and the ongoing stream of potential buyers is its own "set" of households – demographically, income- and financial-wherewithal, and lifestage.

Remember a single string of numbers is the root source of two widely different – and growing in their disparity – sets of implications about "typical" households, one the mean and the other the median.

The value of that ratio [between mean family income divided by median family income] is larger than one, indicating that average income is larger than typical income. Moreover, that ratio is increasing in value over time, suggesting one of the following is happening: (1) rich families are becoming relatively richer, (2) poor families are becoming relatively poorer, (3) both (1) and (2) are happening at the same time in different proportions.

So data points and polls and surveys that speak to typical American households with respect to their preferences, desires, and capability to purchase a new home, and the far-more-particular pool of people and households who're plunking down earnest money deposits on a home they want to buy not just for 2022 but for five to seven to 10 years of the place they want to live.

The match or mismatch between a typical American household and the attainability and preference scales with respect to a new home and the actual customer base of new homebuilders is a complex layering of local economics and home formation and income growth and lifestage.

Whether or not the national data points and trends and risks and exposures specifically apply to homebuilding operators serving that quarter-plus of American households who continue to feel right now is a good time to buy a home comes down to how each of those operators answer two questions every moment of every day they come to work.

Who are you?

Who do you want to be?"

If they have a relatively rigorous response to each of those two questions, they're going to do a lot of things right even if circumstances get more tricky, more iffy, and more bumpy in the weeks and months just ahead.

Join the conversation

MORE IN Marketing & Sales

11,000 Buyers Turn 65 Each Day, Here's How Homebuilders Win

Even in a hesitant market, 55+ buyers hold the keys to growth. Deborah Blake shows builders how to win their trust—and unlock their equity—with empathy, lifestyle, and design.

The AI Revolution is Here: The Implications For Homebuilders

Artificial intelligence and automation are changing the rules of competition. Builders that invest now—in systems, culture, and people—will gain a lasting advantage in efficiency, customer experience, and profitability.

How Homebuilding Sales Became A Strategic Center Of Gravity

Dave Rice and New Home Star help turn homebuilder sales associates into data-powered business strategists and a linchpin to critical customer feedback. Here’s why that matters now more than ever.