Land

New Home Advances Its Quest To Rank As Top-15 Homebuilder

In a one-to-one conversation with The Builder's Daily, New Home Company president and CEO Matthew Zaist discusses the deal to acquire Katy, TX-based Hamilton Thomas Homes, and the roadmap beyond.

[Illustration: (from left) John Bohnen, Jennifer Keller, and Matthew Zaist, President & CEO of New Home Company]

Texas reigns among three or four essential launching pads – Florida, the Southeast, Salt Lake City, as well – for 2020s and 2030s residential development and construction's accelerated growth runway for any homebuilding organization with a claim to a national Manifest Destiny.

The latest example of a dynamically evolving new geography of domestic in- and out-migration and market economic development comes this week, with New Home Company's announcement it has purchased Katy, TX-based Hamilton Thomas Homes, its first mergers and acquisition deal since its mid-July 2021 sale to Apollo Global Management.

New Home's Texas foray comes as the nation's homebuilding business community loudly hums with M&A activity, on pace to equal or eclipse the deal flow and market concentration of any 36 months in recent memory.

The confluence of three forces drives M&A's motivations and pick-up in momentum:

(1) Large strategics – publics, large privates, non-U.S.-based strategic portfolio owners, and Clayton Homes – race for market share, exposure to key customer segments, and penetration in emerging faster-growth local economies;

(2) smaller, mostly bank-lending financed private operators are feeling the pinch of more and more expensive and hard-to-access private capital, and

(3) a post-pandemic acceleration of America's new geography of retirement, work-life balance, and cost-of-living management.

New Home Company – which Apollo took private with its 2021 acquisition – started up and went public in 2013 with a big, bold national footprint ambition to rank one-day as a top-15 ranked national builder, operating in 20 or more of the United States' most-active new-home real estate markets.

That strategy remains in place, and New Home Co. may now have its Apollo stakeholders' green light and financial war chest to play more aggressively for that growth. Smaller private operators have begun to feel hints of duress, and others – while they're not in do-or-die mode – feel "capital-constrained" from carrying forward their potential growth in their markets. Having expanded organically in the past 12 months to Oregon and Washington state, New Home Co. – with Apollo's war chest backing it – may likely be looking for M&A expansion into the Southeast, and Florida and other markets with strong organic and in-migration fueled economies.

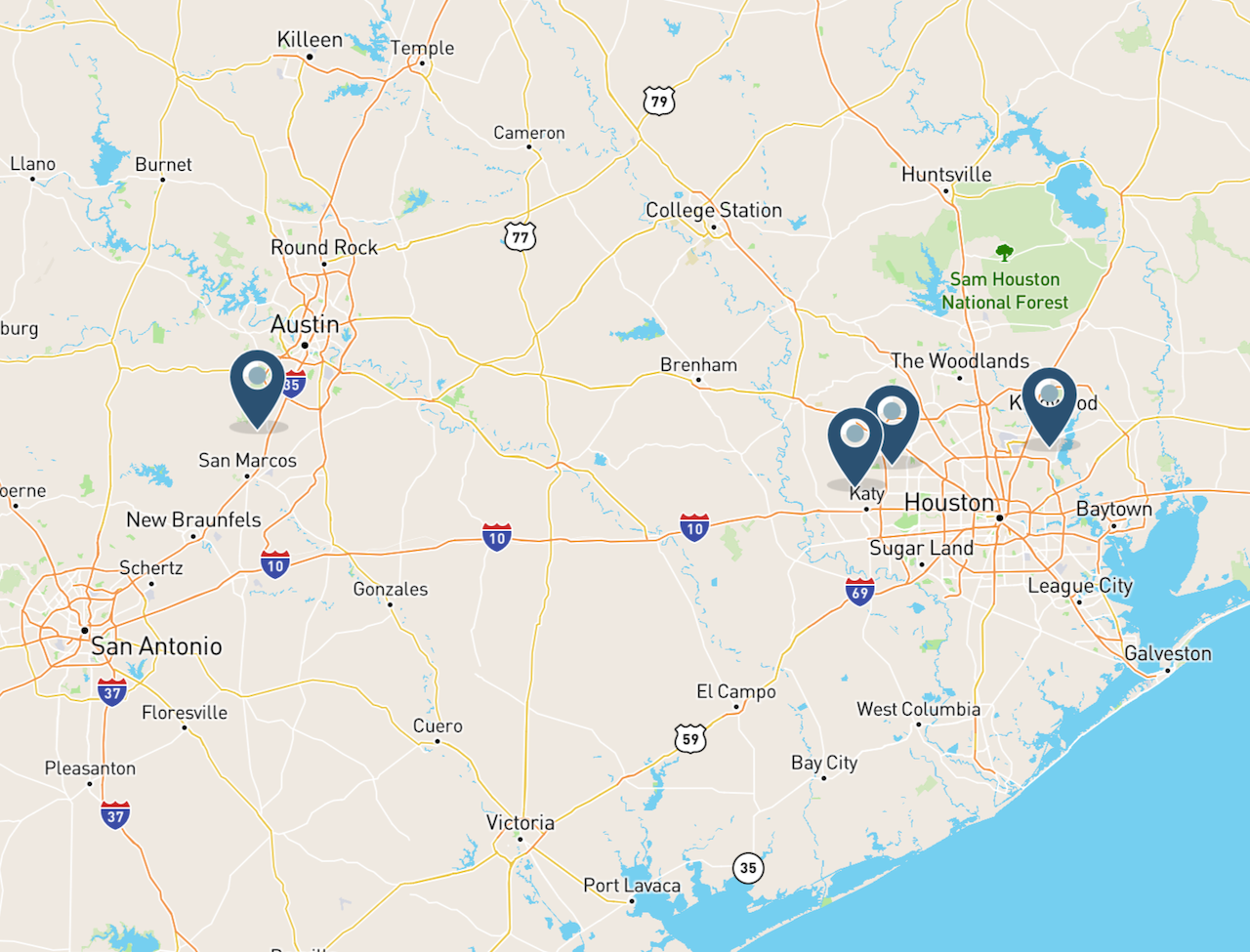

In Hamilton Thomas Homes, currently operating three actively selling communities in the Houston area and immediate-future plans to start selling in two Austin neighborhoods, New Home Co. has matched with both assets and capability that suggest that New Home and Apollo strategists believe they're investing into strong near- and mid-term growth and scale-up opportunity in two or more of the nation's top-five fastest growing markets.

- Strong customer and product-mix fit in leaning toward move-up, second-time move-up homes aimed at buyers whose discretionary means may better shield them from higher-for-longer interest rate sensitivity, as well as from list-price sensitivity as economic volatility works its way through the economy.

- Deep land pipeline: Per the announcement, "New Home Co. has assumed a portfolio of approximately 2,000 lots owned and controlled by Hamilton Thomas representing an estimated 12 new home communities." This pipeline offers visible local scale in Houston and Austin and allows New Home's Texas operators to build out land positions and product alternatives to serve a full array of price points and neighborhood offerings.

- Cultural alignment: The New Home Co.-Hamilton Thomas combination in Texas re-unites New Home CEO Matthew Zaist with two of his former William Lyon Homes colleagues, John Bohnen and Jennifer Keller, who were both division presidents at William Lyon during Zaist's senior strategic role there. What's more, Bohnen and Keller both have built relationships capital in both the Houston and Austin markets to achieve decisive growth opportunity given the added resources they'll get to tap into.

We talked today with New Home Co. President and CEO Matthew Zaist on the company's first M&A deal, and where it fits into a roadmap slightly altered from a timing standpoint due to the turbulence of the post-pandemic period, but essentially what it's been all along: Building a top-15 national homebuilding enterprise with a sustainable investment model that generates value to homebuyers and profit to its owner-stakeholders.

One day, perhaps not for the next three to five years, we may see New Home Company back on deck to go public, a move that many would regard as logical for an operating company owned by a large private equity player. Until then, however, New Home gets to operate as a more entrepreneurial entity and build itself into a national powerhouse without some of the encumbrances of public company reporting and quarter-to-quarter challenges.

Here are some of the key highlights of our conversation in curated segments:

The Roadmap

Matt Zaist, President and CEO, New Home Company

When Apollo and I worked on the acquisition of New Home Company a little more than two years ago, our goal was to grow into a top 15 national homebuilding platform over the coming years. That involves scaling the existing operations that New Home had when we bought it, but also expanding both organically and in-organically through potential acquisition opportunities. We've been incredibly fortunate, even before this acquisition. Over the last two years, we've grown a geographic platform from California, Arizona, and Colorado when we acquired the company and we've organically expanded into Portland and Washington over the last year. Within that footprint, before this acquisition, we had also increased our lot pipeline by about 4-times over the last two years.

Apollo has been an incredibly great partner. When we bought New Home Company, one of the things we saw was a platform that was under-capitalized. Part of the benefit of having a partner like Apollo --with their kind of flexibility in and around helping to capitalize the company for growth – is they consistently invested in us over the last couple of years to support that growth."

Why Texas? Why Hamilton Thomas Homes?

Matt Zaist

Texas has always been critical to our plans for two reasons. The overall size and scale of the four major metro markets in Texas are unquestionable in terms of what they can do for growth. There's no doubt that the state of Texas is just an incredible business climate and it's going to continue to attract and generate jobs at a rate that far surpasses the national average.

But, also, given the Western Regional footprint that New Home has, Texas becomes the long-term key to creating real growth opportunities, which ultimately also means unlocking the Southeast.

When you're trying to look at acquisition opportunities, you start with financial analysis. But ultimately at the end of the day, it’s finding local entrepreneurial leadership that has an alignment with our strategy for growth and positioning in the market.

"That’s critical and the Hamilton Thomas opportunity here is unique. I've had an opportunity to work with both John and Jennifer and they're two of the best homebuilding executives that I've ever met. So, we knew we had great operators and owners of that company. In this one we found great markets, we found great leadership, we had great cultural alignment and the deal came together relatively quickly.

"One of the unique things about Texas that probably isn't appreciated is the land markets and the entitlement process and development process in Texas have gotten more complex over the last few years. It used to be a relatively straightforward market to do business. Austin, in particular, has probably the most restrictive entitlement process of any of the major Texas markets.

"Having a guy like John [Bohnen] who has operated successfully for years in that market, just gave us a lot of confidence and we've got a guy who can grow and scale you know, that market for us and in Jennifer [Keller's] history with Land Tejas with a KB before that in with Lyon also told us, ‘Hey, we've got a local leader in Houston who understands the land acquisition entitlement development game.'"

"That said we need to scale in every market we're in. We’ve done a good job over the last few years expanding our land pipeline in our footprint. Now, with the 2000 lots that we acquired through this transaction and that local team's leadership, we're in a position over the next few years to achieve significant growth that will help us get well on our way to achieving our long-term goals."

Product Alignment

Matt Zaist

Hamilton Thomas designs great houses, and they're currently in a segment of the market that's probably a bit less interest rate-sensitive than others. However, our goals and John and Jennifer's goals are to offer opportunities for people at a variety of different price points, similar to New Home's operating strategy which is more of a Main Street and Main approach to where we want to play within each MSA that we operate in. Even when we're trying to appeal to a first-time homebuyer, it's not going to be about the lowest-cost housing solution. It's finding really good land opportunities that are close to employment, close to good schools and services and amenities that we think matter to most homebuyers. With Hamilton Thomas, the real estate is well located. It's where people want to live. The fact that it's a bit more oriented to second-time move-up is where their current positioning is, but I certainly would say that within their lot pipeline, we've got opportunities to provide housing solutions for folks at a variety of different price points and without sacrificing the desirable location aspect of where we're going to put our New Home communities."

Acquisition Opportunities

Matt Zaist

Big publics are incredibly well capitalized, and a handful of national private builders – that we are aspiring to grow into – are well capitalized. One of the things that as an industry we're going to have to grapple with is the fact that the availability of capital to grow businesses is you know being bifurcated. We've got private builders that have historically relied upon local bank financing and owner-operators willing to personally guarantee debt to build their communities and grow their companies. As we've seen regional banks pull back on their willingness to finance this industry it is creating a playing field of haves and have-nots. By the nature of being private, of being more entrepreneurial, and having the backing of Apollo's flexible and scaled capital, it creates an opportunity for us to find opportunities in new markets where you can find that great entrepreneurial leadership team who wants to grow and has an opportunity to grow, but maybe the opportunity to capitalize their business for growth isn't there today. Hamilton Thomas and John and Jennifer was a great opportunity. Good people, and a shared vision of where the combined company could be at the end of the day.

We hope that this is the first of several acquisition opportunities for us in the coming years.

New New Home Locations?

Matt Zaist

The top 20 to 25 homebuilding markets in this country are all still really great solid markets. Mapping them and graphing them, the 'Smile States' are what makes the most sense to me long term. We like the West Coast. We like the Rockies. We like the Southwest. We like Texas. I'm a native Floridian you know, Florida and Georgia, the Carolinas you know, Nashville up into the Mid-Atlantic that, that that ring is based on migration, demographic trends, job growth. It's hard not to like all of those markets. They're going to be good in five and 10 and 15 years and certainly that's, that's what you need to do. This isn't a business that you can willy-nilly go in and out of the market. You've got to be committed to markets, and believe they'll be good for the foreseeable future. You're making an investment in real estate, but more importantly, you're making an investment in people and teams and you want to show commitment to a market that you know in good times as well as in challenging times. The reality is we are a cyclical industry and we're going to go through ebbs and flows. If you're going to go into a market and you want to feel confident, at least for a company like us, that you're gonna be there for the long stretch."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.