Marketing & Sales

Mood Craters: Torrid Turning To Cool? Is That A Good Thing?

As price trends price-out more buyers, the role of customer care and learning around the buyer's journey meaningfully changes. It's a risk or an opportunity.

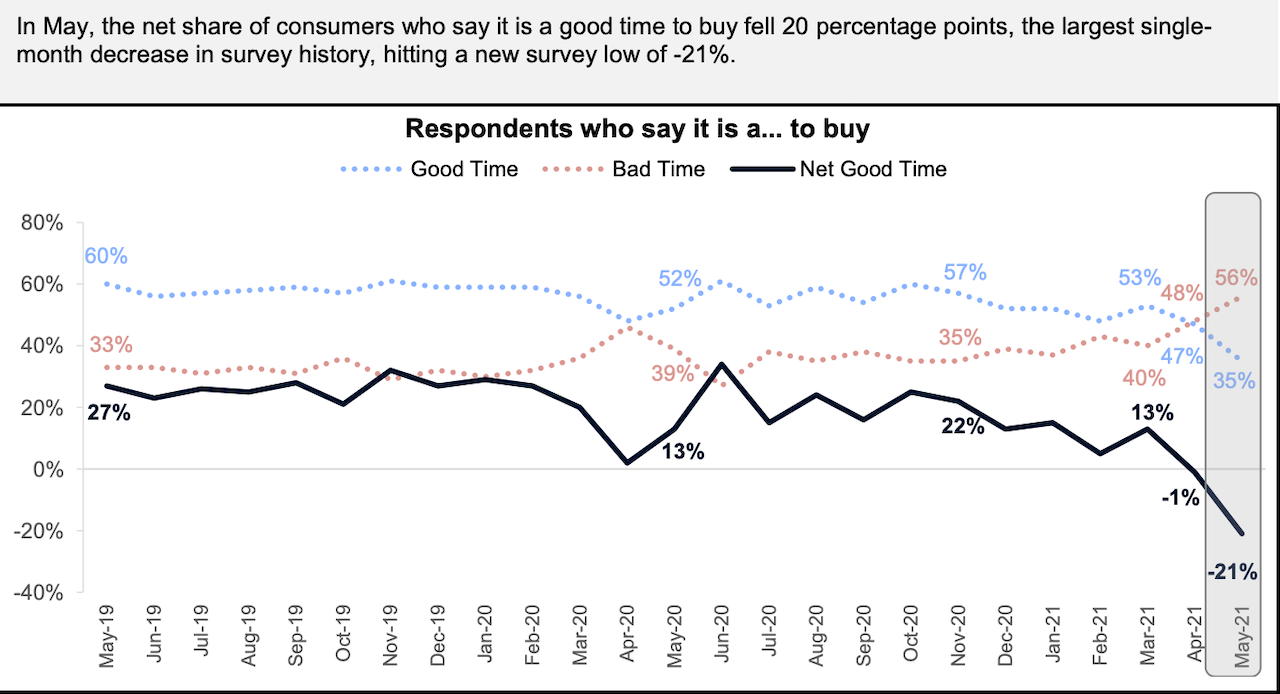

Fannie Mae's monthly sensitivity indicator on market sentiment this month flashes a signal those selling homes – new or used – have to take seriously.

For the second consecutive month, consumers also reported a significantly more pessimistic view of homebuying conditions; on net, that component fell to an all-time survey low, with only 35% of respondents believing it’s a good time to buy a home, down from 53% in March.

A blip? A sign that both prices and the overall anxiety buyers are encountering as they engage in the fray of trying to land their home within their budget range has started to reach the limit of market elasticity? A little of each?

Redfin's network of real estate pros report a similar change in tenor and temperature among buyers.

The housing market’s temperature may be starting to drop by a degree or two. Both pending sales and asking prices began to decline or flatten in the four weeks ending May 30. It’s too soon to tell if these are early seasonal changes or the start of the post-pandemic cooldown we predicted earlier this year. The period in question includes the beginning of Memorial Day weekend, which this year marked a return to “normal” life. It may also have marked the beginning of a return to a more “normal” housing market. We should know more as we continue to track the latest data over the next few weeks.

“The housing market was going 100 miles per hour and now it’s down to 80,” said Redfin Chief Economist Daryl Fairweather. “This is not the bursting of a bubble. Rather, it’s a sign that consumers might rather spend their time and money on other things besides housing now that travel, dining and entertainment are resuming in full force.”

The opportunity for new residential construction leaders now is in doubling-down on listening and learning from frustrated, angered, anxious, and determined people whose dreams of homeownership are being thwarted by forces beyond their control.

In that light, customer care and clarity around homebuyers' journey mean something more and different than when the playing field tilted so profoundly in builders' favor a year ago.