Land

Mobility: What It Was, What It Is And What It May Never Be Again

Our market-rate housing business community is too enamored of trend flavor-of-the-month prognostications, self-assurances, and full-steam-ahead wagers, based largely on seat-of-the-pants reckoning and pure guesswork.

What moves people to move, where, and when is at the heart of real estate's perpetual challenge and opportunity.

And it is at the soul of value.

And value is construction and real estate's No. 1 challenge, because value always and forever means someone sells and someone buys. This is not a one-and-done issue for The Builder's Daily. It's a run-of-schedule, 24/7, 365-day a year matter.

Our market-rate housing business community is too enamored of trend flavor-of-the-month prognostications, self-assurances, and full-steam-ahead wagers, based largely on seat-of-the-pants reckoning and pure guesswork.

Rigor can be boring; it can also save your business.

Let's look at an analysis Brookings Institution fellow – one of the nation's most accomplished domestic migration experts and demographers – William Frey has to say about American mobility and migration in the wake of COVID-19's force of nature impact on real estate and households. Frey's point of reference, in this case, is recently released, 2020 Census data that he knows how to look at better than most.

Frey's take-away punchline is deadpan, understated, but massively instructive to those whose bets on what makes people move, where, and when run in the billions of dollars:

The results show that each of these demographic components continued and often exacerbated trends that were already evident before the pandemic. Many large coastal and midwestern metropolitan areas and their urban core counties registered their lowest population gains (or greatest declines) in a decade due to this combination of demographic components: accelerated domestic out-migration, lower immigration from abroad, and a decline in the excess of births over deaths. Because each of these components have different pandemic and non-pandemic related explanations, predicting post-pandemic population shifts is not a straightforward exercise.

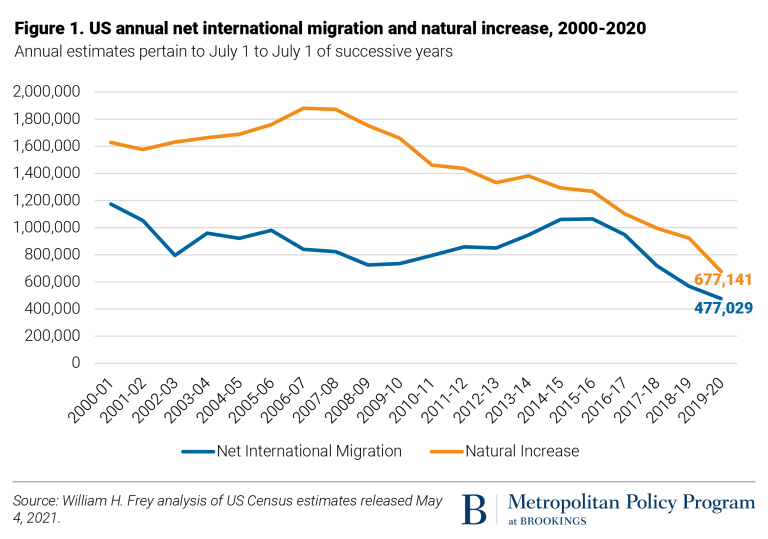

Numbers and a picture of them speak volumes:

First, the backdrop.

Once, demographics was considered destiny. Under social science constructs that emerged in the 1970s, as Baby Boom generation Americans resculpted the multiverse of the U.S. economy, more finite, countable patterns could be argued to have cause-and-effect impacts on markets, as household street addresses together serve as engine of one-third of that economy.

That center largely held as an organizing economic, business, and societal principle until the turn of the 21st Century – when married-with-children households no longer dominated as the defining pattern-maker, and instead, other characteristics, like educational attainment drove economic mobility and trends.

Then, the pandemic.

In COVID-19's aftermath, amateur hour in deciphering, reckoning with, and banking on where Americans are moving and why, and whether those directions and motivations are enduring or fleeting, is a materially consequential business issue. Frey's eye for the key gem of insight from all the noise around 2020-to-2030 migration and mobility patterns has a stark baseline:

Together, low immigration, more deaths and fewer births led to a national 2019-21 growth rate of 0.35%—the lowest in at least 120 years. This sets the context for growth patterns in most regions and metropolitan areas throughout the U.S., leaving domestic migration—movement within the U.S.—as the factor which can either exacerbate or reduce these areas’ further population downturns.

In most metro areas Frey looks at, he sees two forces at work shaping motivations to move and those movers' impact – plus or minus – on metro area populations. One force, of course is the vaunted reflexive "flight" impulse, which Frey fully acknowledges as a thing. The other, not fully appreciated force of impact on metro area migration and population, is the combination of lower birth rates, higher death rates, and lower immigration rates – a pandemic consequence that may or may not be temporary.

A disciplined analysis of what's gone on and what to expect sounds like this:

It is difficult to predict how urban populations will fare in the post-pandemic era, say two to five years down the road. It is most likely that natural increase levels will pick up as pandemic-related deaths subside, and couples will resume something closer to pre-pandemic childbearing patterns. It is also possible—and quite likely—that the recent restrictive immigration policies will be reversed, as there becomes a greater awareness of the important role that immigration plays in bolstering the nation’s overall growth, especially among its younger labor force population.

As to domestic migration, there are real questions about how much the mid-2010s dispersal to suburbs and smaller areas will continue, and whether the selective “flight from density” in the past year will become a way of life after cities become safer, and more jobs become available there. There is some likelihood that the latter “flight” could be short lived or even reversed since much of it may have been temporary in nature. This could change as new generations of young people—a traditional source of big city growth—will once again find places like Manhattan and San Francisco attractive. These are questions that cannot yet be answered. But it is important that for analysts and policymakers to recognize that last year’s “flight”, however well publicized, is only one of several elements contributing to recent pandemic-related population changes in the nation’s major metropolitan areas.

This may or may not align with the trillions of dollars surging into bets that work-from-anywhere, Millennial-lifestage-family-formation fever, and urban out-migration will comprise a fundamentals-driven juggernaut that will carry market-rate housing and community development, and their global investor stakeholders, safely through the 2020s.

But what demographics begins to map, new structural patterns – ones more intimately and profoundly related to how home and community creates, sustains, and regenerates equity value – now play a critical role in what makes movers move, where, and when.

Builders and their investor, developer, manufacturer, and distributor partners need to draw on true insight rather than trendspotter instinct to martial resources toward that kind of value creation.