Land

Meritage's Elliott Deal Signals New Stakes In Mid-2020s Land Rush

Meritage Homes' Gulf Coast expansion highlights the elevated pressure among public builders to secure land for higher-velocity, affordable growth.

Typically, in homebuilding, a rapid growth or high-risk outlook would self-cancel. In what appears to be evolving as a new normal, with strong hints of some new rules of engagement, every business leader we speak to is trying to fathom a "both-and" scenario.

As U.S. public homebuilders jostle like giants for access to high-potential land in a shifting market, Meritage’s just-announced acquisition of Elliott Homes shows how these enterprises are pivoting to secure a foothold for the next wave of growth. The deal marks a key move in Meritage's strategic aim to boost volume in its entry-level housing business as the company eyes 17,000 completions annually.

In the fast-evolving housing market, Meritage Homes' purchase of Gulf Coast-based Elliott Homes offers a peek into the new playbook for major public homebuilders: find untapped markets with a steady pipeline of lots, a local foothold, and affordable home prices — all crucial in a period when the broader economy and mortgage rates are projected to find more stability.

For Meritage, this acquisition isn’t just about growth; it’s a strategic answer to the widespread scarcity of buildable land.

This was very much a strategic fit for us,” Meritage CEO Phillippe Lord tells analysts on the company’s Q3 earnings call, emphasizing Elliott’s solid track record in Mississippi, Alabama, and the Florida Panhandle. “These areas are benefiting from a lack of affordability in neighboring states, and they’re seeing steady economic growth.”

Meritage’s focus on affordability aligns with broader industry trends as homebuilders increasingly prioritize entry-level communities, where demand remains resilient. Unlike high-end markets where buyers are sensitive to rate hikes, entry-level and first-time homebuyers still drive demand even with financing challenges, which is part of Meritage’s core strategy.

Securing Lots in a Tight Land Market

In the last few years, homebuilders have doubled down on land acquisitions and M&A to keep up with demand, especially as land shortages have driven up prices and limited options for large-scale development. For many builders, finished lots are the crown jewels — a resource so rare that they’re often scooped up through acquisition rather than self-development, which takes considerably longer. In fact, Lord noted that over 90% of Meritage’s land portfolio is self-developed, with finished lot purchases only occurring through strategic buys like the Elliott deal.

It’s not often we come across a builder with lots already in place,” Lord says, stressing the importance of acquiring an inventory that offers immediate growth potential.

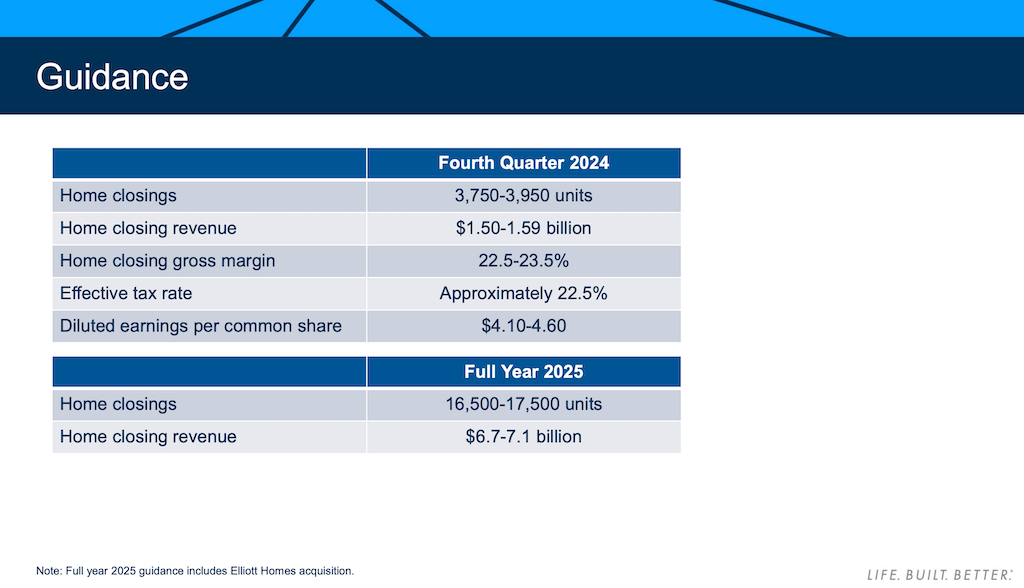

Elliott Homes’ land pipeline of 5,500 lots will bolster Meritage’s goal of reaching 17,000 completions in 2025, even as some of these lots stretch beyond immediate use, positioning the company for growth beyond the next few years.

Operational Integration for Quick Growth

Meritage is tapping into Elliott’s established local presence to move rapidly in the Gulf Coast’s underserved entry-level market, where affordability is key. By retaining Elliott’s local operations team, Meritage gains a head start on the necessary infrastructure and connections in these communities, allowing them to execute on Elliott’s successful approach to affordable housing.

Elliott’s markets align perfectly with our focus on affordable homes for entry-level and first-move buyers," Lord notes, adding that the acquisition supports Meritage’s “move-in ready” model — a core part of their strategy that promises buyers homes within 60 days of purchase.

This efficiency is part of what has made Meritage one of the top-five builders in many of its markets, allowing it to reach buyers faster than competitors who rely more heavily on custom or delayed-build models.

Expanding in an Expectedly Resilient Market

The timing of the Elliott acquisition is no accident. Public homebuilders are recalibrating as they prepare for what experts predict will be a more stable financing environment. With the Federal Reserve recently adjusting rates and signaling a softer approach in 2025, many economists expect mortgage rates to stabilize, paving the way for a new phase of growth in housing demand. For builders like Meritage, that stability could be the green light they need to accelerate volume and buildout.

As demographic trends favor homeownership over the coming years, particularly among younger buyers in family formation stages, the demand for entry-level housing remains high. This backdrop is driving Meritage and its peers to scale up land reserves and secure favorable locations that cater to this steady buyer base. Meritage's CFO Hilla Sferruzza notes that Elliott’s lots will position the company well to meet demand.

These areas allow us to provide affordability without sacrificing margin — a key factor in today’s market.”

M&A and Land Strategy in 2025 and Beyond

With this acquisition, Meritage has a clear advantage as it competes with other top builders, like D.R. Horton and Lennar, who are also aggressively expanding their lot inventories. Homebuilders are angling for market share in a way that looks markedly different from a decade ago, with large-scale acquisitions now seen as a critical growth lever.

When asked about the potential for additional acquisitions, Lord hinted that Meritage remains open to more deals, though organic growth in current markets remains the priority.

Plan A is to grow where we are,” he explains, adding that Meritage is on track to increase its community count by double digits next year, with the Elliott lots contributing a steady stream of new homes.

Sferruzza also discussed Meritage’s off-balance sheet land financing strategy, which is set to launch in Q4, adding that it will enable Meritage to expand its land portfolio without straining the balance sheet.

This financing is supplemental, not replacement — it allows us to grow more aggressively in areas that are important for long-term demand."

Financial Incentives and the Rate Environment

The unpredictable mortgage rate environment remains a critical challenge, one that has spurred homebuilders to increase their use of financial incentives to offset buyer hesitation. Meritage has leaned on rate buydowns and other financing tools to keep up its sales pace, and this trend is expected to continue into 2025.

We’re heavily using incentives to maintain pace in this market,” says Lord, adding that Meritage’s commitment to affordable homes gives them an edge in navigating rate volatility.

Sferruzza provided reassurance, noting that if mortgage rates drop, the company would likely reduce incentives, leading to margin improvement.

We’re expecting margins to recover when rates stabilize,” she says. The current incentives, while costly, are a tactical move to compete in an environment where affordability remains top of mind for buyers.

Future Growth Outlook

Meritage’s acquisition of Elliott Homes reflects a broader trend of strategic expansion as homebuilders prepare for a stronger demand environment over the next several years. With demographic tailwinds and an anticipated easing in mortgage rates, the housing market is poised for a new growth phase that will likely push companies to pursue even more ambitious volume targets. Lord summarizes the company’s forward-looking stance:

We’re setting ourselves up to be a leader in affordable, entry-level homes—an area where demand is only going to grow.”

For Meritage, the Elliott acquisition isn’t just an addition to its portfolio; it’s a calculated move to position itself at the forefront of entry-level housing, a segment that will be increasingly essential to the homebuilding landscape as market conditions evolve.

MORE IN Land

Understanding Homebuilding's New Capital Partner: Land Banking

Scott Cox explores the return and surging business traction of land banking. Here's a thorough unpacking of structures, risks, and reasons public builders are doubling down—even as rate compression tests its limits.

Signorelli Builds Boldly Where Others Shy Away From Risk

From Valley Ranch to Austin Point, the Signorelli Company CEO turns constraints into catalysts, shaping the next era of Texas community development.

Why Smart Homebuilders Bet On Texas Single-Family Futures

The Builder's Daily contributor and land sage Scott Finfer makes the bullish case for Texas in 2025 — where fundamentals, patience, and long-term discipline still matter, and the housing market is hitting reset, not collapse.