Land

Meritage Boosts Nashville Presence With 2,500-Lot Deal

A land acquisition from Willow Branch Homes strengthens Meritage’s strategy in a market where demand outpaces supply.

One of Warren Buffett's most-quoted investor nuggets of wisdom applies to homebuilding's land game in a moment of flux.

Be fearful when others are greedy; be greedy when others are fearful."

What he didn't say is important: In either case, you also have to be disciplined and very smart.

Meritage Homes executives – briefing Wall Street analysts on Q1 2025 results last week – outlined a major land transaction that underscores a broader strategic theme: To feed a machine that depends on inventory velocity, operational efficiency, and a keen match between affordability and buyer demand.

In its newly disclosed deal with Middle Tennessee-based Willow Branch Homes, Meritage acquired roughly 2,500 lots concentrated in the Nashville metropolitan area — a market the company says boasts the highest absorption pace in its portfolio. It’s another step in a pattern that Meritage has made clear through earlier acquisitions, including its purchase of Mississippi Gulf Coast builder Elliott Homes last fall.

This time, with Vestra Advisors serving as financial advisor to Willow Branch, Meritage has solidified its Tennessee presence without assuming control of Willow Branch’s homebuilding operations, which will continue separately. Instead, Meritage locked down a large pipeline of ready and future lots in one of the nation’s fastest-growing markets — at a time when access to buildable land, particularly for quick-turning spec homes, has become more critical.

The company's leadership made it clear that lot control and operational cadence — not mere market entry for its own sake — drove the decision.

We’re excited about the acquisition of approximately 2,500 lots from Willow Branch Homes, which significantly expands our footprint in Nashville,” said Phillippe Lord, CEO of Meritage. “This market remains firm for us, and we continue to see very good absorption and opportunity for growth.”

Lord described Nashville’s performance in sharper terms:

Our absorption pace in Nashville was 5.3 per month during the first quarter — the highest in the Company.” He added, “Nashville has been our best-performing division since we entered that market.”

The Willow Branch acquisition deepens Meritage’s operational base in Tennessee, a state it first entered in 2013 by acquiring Nashville-based Phillips Builders. Now, in a post-pandemic, migration-fueled economy, Meritage’s move signals a double-down on markets where strong inbound population growth and affordability dynamics continue to outperform.

According to the latest U.S. Census Bureau migration data, the Nashville-Davidson-Murfreesboro-Franklin metropolitan area ranked among the top ten fastest-growing large metros for net domestic migration between 2020 and 2023. Over that period, Nashville gained approximately 123,000 new residents, driven largely by inflows from California, Illinois, and New York, as well as from more expensive Southeastern markets like Atlanta and Miami. Nashville’s population is projected to surpass 2.2 million by 2030, fueled by a diversified economy spanning healthcare, technology, entertainment, and manufacturing.

This growth feeds directly into Meritage’s operating thesis: Offer attainable, move-in-ready homes in migration destinations where household formations outpace supply. Lord noted,

Our focus is on delivering affordable homes to meet strong demand, particularly in markets where demographics and job growth remain favorable.”

Land-Light, Inventory-Heavy: A Strategic Continuation

The Willow Branch deal mirrors themes evident in Meritage’s Elliott Homes acquisition six months ago: the preference for buying land pipelines over companies, the prioritization of operational simplicity, and the ability to feed a high-velocity build-to-spec model without stretching balance sheet exposure.

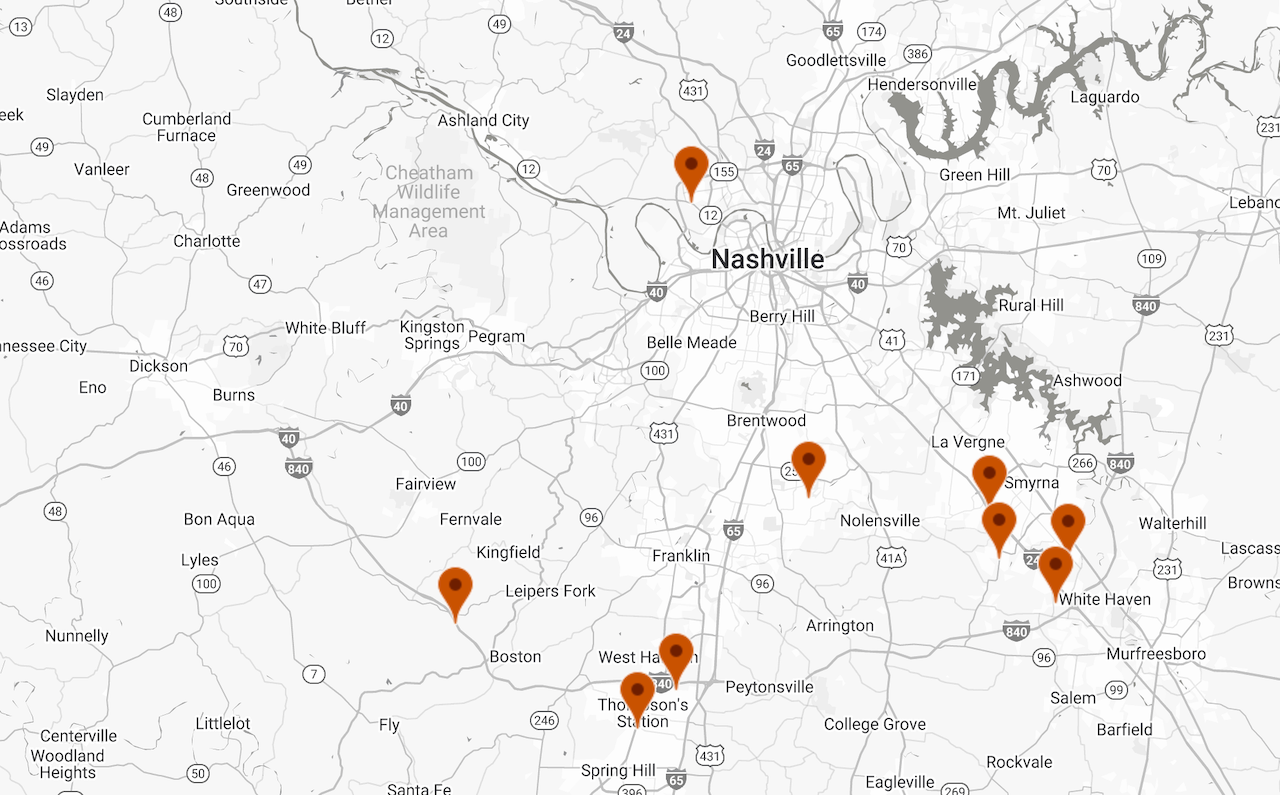

The lots we acquired are in prime submarkets — Smyrna, Spring Hill, Columbia, Thompson Station, Murfreesboro, and other areas in and around Nashville,” said Lord. “Importantly, these are high-absorption submarkets where we can continue to execute our quick-turn strategy effectively.”

Meritage's strategy emphasizes owning or controlling lots that are close to shovel-ready, reducing the cycle time from acquisition to sale. It is a model that relies less on long-term land banking and more on high inventory turnover — an approach that has distinguished Meritage in its peer group.

As we’ve said before, it’s important that our land positions allow us to be nimble and efficient, especially given the volatility we continue to see in mortgage rates and buyer sentiment,” said Lord.

Strong Absorption Despite Economic Crosswinds

Meritage’s choice to expand in Nashville comes at a moment when national housing market indicators show rising inventory levels and slower order activity across many regions. However, the company pointed out that its Nashville division has bucked that trend.

We continue to believe Nashville represents a strong opportunity for us,” Lord said. “Household formation trends, job creation, and migration patterns are all working in our favor there. It's the right time to solidify and expand our lot pipeline.”

CFO Hilla Sferruzza emphasized that absorption strength — rather than merely unit count or land bank size — shaped the Willow Branch opportunity.

This was a targeted acquisition,” said Sferruzza. “We are very disciplined about the markets we choose to grow in, and Nashville’s performance, particularly the sales pace, supports continued investment.”

Meritage reported that it ended the first quarter with 6.2 months of supply nationally, a figure in line with internal expectations. Lord addressed the delicate balance between inventory build and pricing discipline:

We are not pushing speculative inventory onto the market for its own sake. Our goal is to match supply to realistic, local buyer demand — and Nashville is one of the places where that equation is most favorable.”

Why the Willow Branch Deal Matters Now

The Nashville acquisition must be understood not just in isolation, but against a backdrop of tightening capital, lingering economic uncertainty, and a notable increase in finished-but-unsold spec inventory across the broader homebuilding landscape.

Public builders, enjoying still-strong balance sheets, are moving quickly to secure land opportunities that match their operational models. Private builders, meanwhile, face growing challenges: higher borrowing costs, tighter capital availability, and competition from better-capitalized rivals.

This pattern was evident in Meritage’s Elliott Homes acquisition last year, as well as in recent Nashville-area deals by Century Communities, Dream Finders Homes, and CastleRock Communities. Each transaction underscores the race to secure entitled lots and deepen local market scale.

In each case, strategic growth is being redefined not by geographic expansion for its own sake, but by the pursuit of operational density, land pipeline security, and alignment with demand trends — a trend Meritage’s leadership repeatedly emphasized.

Sferruzza noted,

Our approach is measured. We’re not chasing every opportunity. We’re focused on opportunities that allow us to enhance margins, support absorption, and maintain our return-on-invested-capital discipline.”

Staying Disciplined Amid Opportunity

As the Nashville housing market continues to absorb migration-driven demand — while grappling with affordability pressures and potential interest rate volatility — Meritage's move positions it advantageously.

Lord summed up the company's mindset:

Our Nashville division has proven that when you have the right product in the right submarkets, buyers respond — even in a more cautious economic environment. This acquisition gives us the inventory to keep meeting that demand efficiently.”

For now, as many builders tread cautiously into the second half of 2025, Meritage’s disciplined expansion through selective land acquisition stands as a case study in how to balance growth with operational rigor — particularly when the margin for error is narrowing.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.