Land

McStain Sells A Majority Interest To KC-Based Platform Ventures

Colorado front-range stalwart, a market-leader in energy-, water-, and health-focused applied building technology in its home and community designs, proves value remains a catalyst in Q4 2022 homebuilder mergers and acquisitions.

Left to right: Ryan Anderson, Co-Founder and Co-President of Platform Ventures, Terry Anderson, Co-Founder and Co-President of Platform Ventures, David Ware, President and CEO of McStain Neighborhoods

The News

Kansas City-based Platform Ventures, an entrepreneurial, 14-year-old real estate investment firm with sector focus on middle market housing, logistics, hospitality, and office assets and entities, closed last week on the acquisition of a majority interest in 56-year-old, Denver-based, Colorado front-range private homebuilder McStain Neighborhoods.

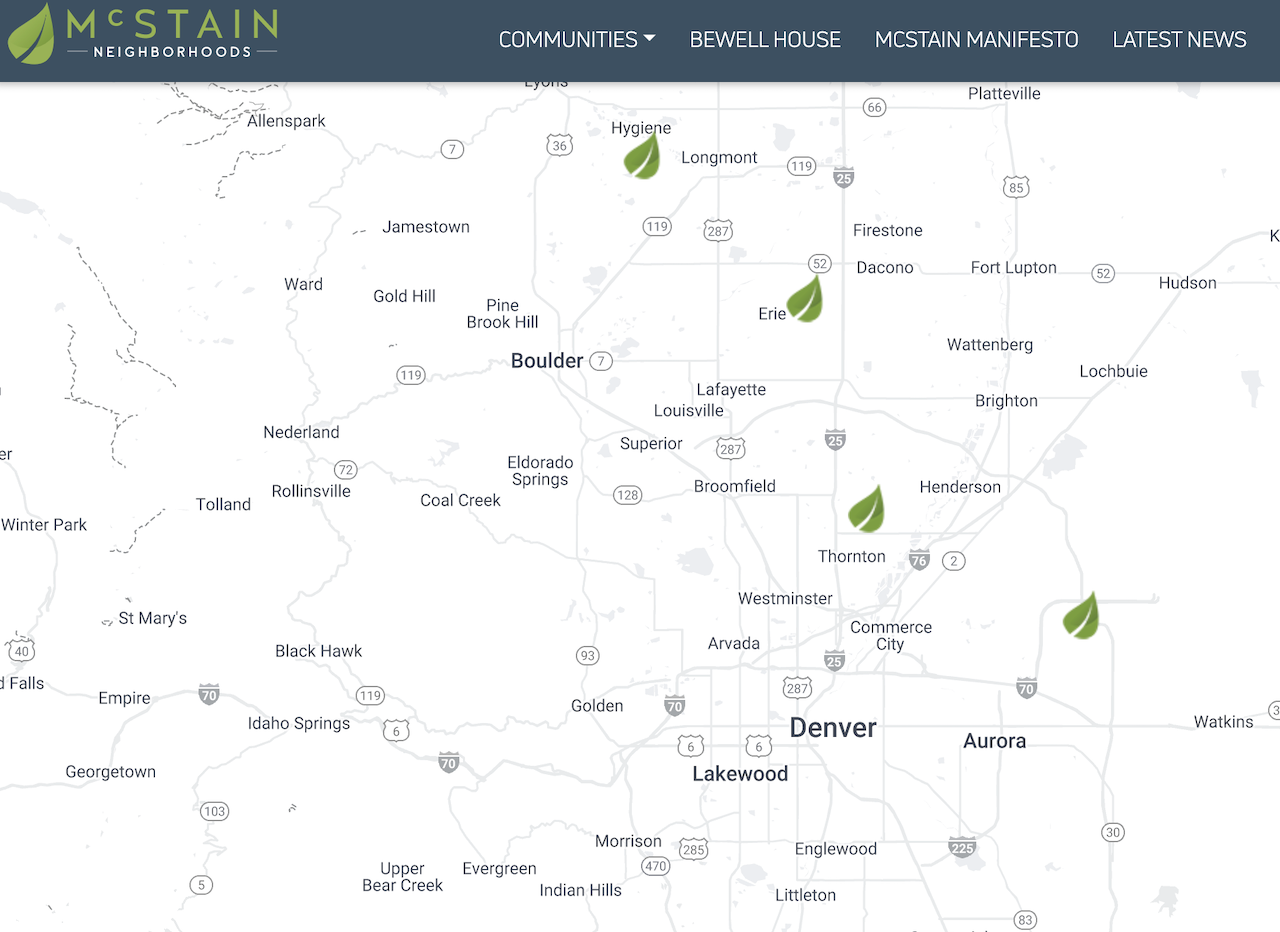

An award-winning, early-adopter pioneer in energy- and water-efficient healthy homes with a strong, high-quality brand, McStain currently operates in five actively-selling communities, with an opportunity to double in size thanks to the Platform Ventures capital infusion. Now, McStain joins Austin-based Scott Felder Homes and Kansas City suburban rings builder Inspired Homes in a Platform Ventures portfolio that flanks residential land and development holdings as part of a budding residential real estate and construction operations regional empire.

The combination, kicking off Q4 2022's late-cycle homebuilder mergers and acquisition phase, spotlights the more precision-targeted tenor of strategic M&A match-ups, featuring intensified de-risking motivations, more discriminating price and valuation terms, focus on potential to ignite scalable growth, and the capacity for buyer and seller to weather turbulence and come through to the other side intact. Whelan Advisory Capital Markets served as sell-side advisor for McStain Neighborhoods.

Top-line Take-aways

- The deal reflects the depth and capital structure diversity of homebuilding's current cohort of acquirers – strategic, financial, and hybrids.

- The timing – coming as it does in shifting, volatile, and uncertain market trends – signals that transactions that blend realistic seller valuation, long-term value and growth potential, and opportunism will likely characterize the deals that close between now and the end of 2022.

- Culture plus strategy: the highly entrepreneurial Ryan and Terry Anderson – co-founders (in 2008) and co-presidents of Platform Ventures – gravitate to firms, leadership, and teams that tend to stand out as energized market-leaders in sustainable, health-and-well-being innovation, quality, and reputational trust, as competitive advantages against larger, publicly-traded national enterprises.

- Crucially, patient capital figures large in what stands to be a time-released investment return and growth opportunity, given that demand challenges – possibly getting tougher before they ease up – lie ahead.

Our mantra going back to the beginning has been, 'stay opportunistic all the time,'" says Platform Ventures co-president Terry Anderson, who notes that the firm has $2.7 billion of assets under management across its four key sectors. "We're going to move our simple, nimble plan to bring more firms into the family. We've got a 40-person team doing the research and leading the charge on acquisitions, and $100s of millions to work with. There are a lot of really well-run family-owned businesses in this sector, with the capability of standing out, running profitably, and growing fast once the market turns more favorable in the next year or two. We love this space."

We'll delve deeper into the what-you-need-to-know, what-it-means, and why-the-deal-matters elements in a moment. But first: Context.

Context

Among the really smart, time-tested gems of homebuilding business and operations guidance we've heard came early on in the "lessons learned" aftermath of what traffics, tersely, as the GFC. A little over a decade ago, a friend, Clark Ellis, who helped build a consultancy company since then, and now serves as one of The Builder's Daily Dream Team of advisors, counseled:

Get up each morning and run your company with the rigor and ruthlessness you'd bring to it if you were a majority share investor," Ellis said, circa 2010 or so at that year's builders' show.

What makes Clark's words almost maddeningly memorable is that they mean as much today as they did then, or more.

Today, in a spreading majority of U.S. housing's most active new-home markets, homebuilding's non-publicly-held operators of many sizes and types face a present-, short-term and medium-term future gantlet. Those privately-held operators will have to endure stress and shock if they plan to be around for a next shot at prosperity promised over the longer haul through 2030 and beyond. Part of enduring, of course, will require their staying current and compliant with secured lending covenants. That could mean principals and owners may dig deeper into their own pockets to fund their enterprises' near-term outlook – literally becoming bigger investors.

Or it could mean taking on an investor for greater access to the kind of capital firms tend to need to weather the stress-test of the next two years or so, specifically by doing more of what they should and could be doing and less of the things they're currently doing that they should probably wind down, at least while things are rough out there.

Either way, the need to operate a homebuilding enterprise with 100% of the professional discipline, the portfolio and financial management rigor, and a present and near-term game plan rid of business sacred cows and any dead-weight initiatives – as if the operator is the capital investor -- is non-negotiable rule No. 1 for most private builders right now.

A ride-along with this rule, of course, is capital itself that detects and prices-in value even as it pursues classic buy-low-sell-high opportunity. The win-win key to mergers and acquisition value comes through a committed relationship rather than a one-off transaction.

Wikipedia has a page for "patient capital" and in it, the explanation wraps up this way, citing an article from journal Politics & Society:

The success of the platform company business model is in large part due to patient capital, as investors are prepared to accept long periods without profit in the hopes that the platform company obtains a dominant market position."

What the Platform Ventures-McStain Deal Means

Platform Ventures gets to add a proven, strong-reputation brand, operational competency, and differentiable consumer value proposition – sustainable, healthy, high-quality performance product spec – to a growing roll-up of regional operators.

They've got a great brand, a good team, they're forward-thinking on the environmentally thoughtful design and development, and now they've got the ability to be really thoughtful about how they focus priorities with a good capital runway that will take them through the next 24 months or so to better times," says Terry Anderson.

That runway may now allow McStain to explore more strategic engagement in single-family build-to-rent with more resources to compete with big players in the market for land positions suited for those near-term opportunities.

Platform Ventures is an entrepreneurial real estate company, really well aligned with our team's deeply embedded culture of innovation and they've got the smartest strategic players in the business when it comes to land opportunity," says David Ware, president and CEO of McStain Neighborhoods. "Now, we've got a nice balance sheet to work with, and we're well-capitalized to compete in markets 90% controlled by national public builders and still find our optimal position here."

Ware says that while McStain's sweet-spot of Colorado's Front Range single-family for-sale markets will remain a priority focus, the partnership now puts build-to-rent community building as an operational option into the firm's capability set.

Given the depth of their strategic interests, we can even explore a big 400-acre masterplan acquisition, where McStain might serve strategically as the placemaker developer, selling back lots to other builders, rather than the merchant builder we've been to date," Ware says. "There's a lot of potential in this partnership."

What the Deal Means

Merger and acquisition combinations occurring in the post-easy-money days will vet through far more scrutiny, especially with respect to land and lot asset valuations, given the moving-targets questions around home prices and sales pace in the current environment.

In some cases – where absorption pace momentum has held up reasonably well and defining patterns of sales indicate a deep pool of future demand – homebuilding operator sellers may bring more negotiating leverage to the table, especially with so many cash-rich potential buyers continuing to troll. Strategic acquirers among the national publics will likely continue to pounce on opportunities to add volume to incrementally complement run-rates.

Too, more patient capital will actively seek to match with builder sellers whose capability may be muted or latent right now, but stand to leverage operational and brand strengths for a fast lift-off, coming out of the trough in the cycle in the months ahead.

While there is a lot of uncertainty in the market these days, buyer appetite for acquisitions remains strong. Sellers that are organized, reasonable, and ready to move forward purposefully are being rewarded with successful closings; crystallizing value in the short term with access to greater growth and capital for the future,” says Margaret Whelan, Founder & CEO, Whelan Advisory Capital Markets, which served as sell-side advisor for McStain Neighborhoods.

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.