Capital

Many Homebuilders Look At Build-To-Rent As A Safety Valve ... Is It?

Given a last-resort chance to keep the lights on, pay the banks, and eke out a livelihood – versus the alternative – most builders would do what they need to do to remain a going concern ... Of course, there are ifs.

Will build-to-rent – specifically its capital investment channel and development pipeline – work out as the 2023 safety-valve homebuilders have in mind?

This makes for a pressing question for new single-family for-sale homebuilders readying themselves for a Spring Selling price-to-market sweepstakes.

They're working right now, mostly on two bucket areas of opportunity to bend back asking prices on new homes sufficiently far to rekindle a steady pace. One bucket they're digging into is their 2022 profit margins, starting at downright exuberant and testing the tolerance levels of viability. The other, a trickier calculus, means extracting price concessions on materials, labor, products, land, and other present and future expenses – including their own overheads and team member salaries.

The belief – raised often enough to consider prevailing -- is that, if worse comes to worse, and efforts to ring a price strike gong that can reignite market-rate sales to owner-occupiers, build-to-rent would be the fall-back. In a worst-case survival scenario, a homebuilding firm might be willing and able to give up a few grudging margin points beyond the norm in exchange for the opportunity to scale production, secure predictability, and capture additional cost gains from the steady source of business.

Given a last-resort chance to keep the lights on, pay the banks, and eke out a livelihood – versus the alternative – most builders would do what they need to do to remain a going concern.

Of course, there are ifs.

One of them – the impact of which is still coming clear – is the current and near-term appetite of the build-to-rent channel. It had been an incalculably voracious juggernaut.

Now, it's a far more fussy, picky, discriminating demand base, in no small part because of an enormous involuntary contraction in global equity.

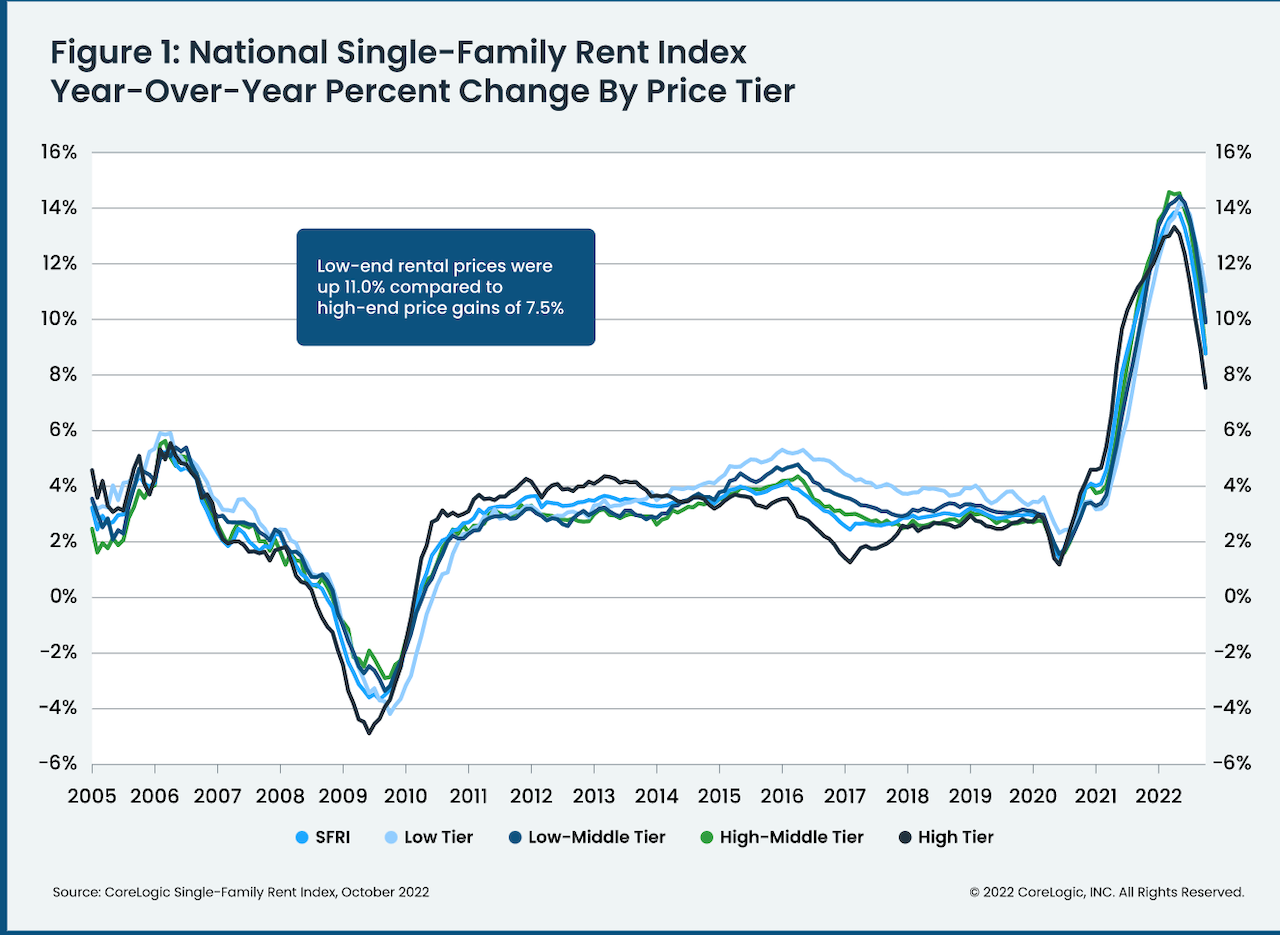

Landlords' rent power and interest rates each reversed course in a big way in the last twelve months. Rates have now doubled the cost of most of us mortals' borrowed money. Rent power – stickier – is now sliding fast in the face of softening demand, creeping vacancies, and a record-breaking under-construction inventory due to come online in the next several months to a year.

That's done a number on the numbers build-to-rent developers and investors populated their late-2021 early '22 vintage pitch decks and pro formas. Many of them don't work now, and underwriting of new rental communities – save for exceptions – has done an about-face.

Another 'if' is that homebuilders – the site-built, single-family detached and attached variety of mavens who've long dominated the for-sale owner-occupier market – are not the only comers in the BTR landscape.

Typical vertical-community multifamily players, hospitality players, building-as-a-solution modular platforms, and other real estate developers have also upped their stakes in newly developed single-family-rental construction and development arena.

Should a builder begin to look at build-to-rent as a line of last resort if new community openings, new pricing, and new barrages of incentives and inducements fall short of the mark, that builder will not be alone.

The smell test for most homebuilding operators who want to keep that option open – and what residential real estate professional ever says 'no' to optionality? – will likely be in determining how well-suited their particular product set, the floorplans, the construction cycles, the square footages, the densities, etc. are to either the value-oriented renter or, instead, the premium level renter household.

Selling in bulk – especially with a prospective customer segment in the rent-by-necessity cohort many younger households find themselves in – is a skillset not very many homebuilders can pull off and navigate to safety.

Serving premium-level renters, at least a fair share of home are renting by choice, or at least renting by choice as a tactic to wait out a home price pivot downard and eventual stabilizing of prices, may be a better fit for most operators.

Resiliency, after all, often requires a well of tolerance and survivability at a subsistence level. Getting through the turbulence – especially should it go longer than the six to eight months many people we're hearing from expect the tough-going will stretch out – will stress-test each firm's sense of who they are and what they do best, and how that works when an unplanned, unimagined eventuality like now occurs.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.