Products

LP Readies Entekra Closure As A Footnote, Hewing To Core Skills

Entekra will not be the last of casualties among building technology ground-breakers scrambling now for a nearer horizon of profitability versus a bluer sky of promise to impact transformation, affordability, sustainability, and resiliency and the like.

In November 2021, LP chief strategists shouted from the rooftops their excitement and high hopes over Entekra, an adjacent 2018 business investment in offsite wall-and-floor panel and roof truss systems that had proven to add velocity to building envelope design, engineering and assembly ... and, had shown early glimpses it could make money too.

Yesterday, 17 months later, in its first quarter 2023 earnings call with investment analysts and researchers, the Entekra venture – due to be shut down and dissolved within 60 days -- added up to a financial and accounting footnote.

During executive commentary on LP's quarterly financial and operational performance, chief financial officer Alan Haughie noted:

We also made the difficult decision to close Entekra. We're disappointed that the deteriorating housing environment in Northern California necessitated this action, and we regret the impact that the closure will have on the Entekra team. But ultimately, we determined that LP's capital is better invested in our core businesses. As a result, in the second quarter, we expect to the corporate cost a non-cash write-down of remaining Entekra assets of roughly $25 million as we wind down the business over the course of the quarter.

What happened?

The answer is "it's complicated."

In what now needs to be recognized as a sharply different and bygone economic, capital investment, and Northern California regional housing market backdrop, entrepreneur Gerry McCaughey stood the company up in 2016. He drew largely on friends, family, and his own financing, and bank lending to tool the first plant, assemble software development and production teams in both the U.S. and Ireland, tell the operational story, and build a book of business – public builders, private regional and local single-family, multi-family and commercial developers – on the back of a minimum value proposition that delivered on time- and materials-efficiency gains as well as precision-manufacturing quality ... and McCaughey's persuasive powers and credibility.

A decision in 2018 to venture with LP as a big $45 million investor and eventually as a majority owner in Entekra had both known and unknown risks that came along with more evident rewards. Yes, the capital infusion would power Entekra's rapid scalability push with a new, supercharged Modesto, CA, facility. Further, the long-term strategic fit checked boxes on both sides. For Entekra, it opened a door to a multiregional hub-and-spoke operational footprint.

For LP, an organization hell-bent on breaking out of its lumber products and OSB commodity-anchored competitive and investment position into a building technology solutions valuation, Entekra seemed like central casting as an innovative, integrated siding and OSB delivery mechanism to the new residential construction sector.

All good. However, it would have been naive for Entekra's original strategic principals to believe – even in the best of times – that LP would either leave the operation to its own devices or choose not to fuse the operation into its own leadership stable and strategic, portfolio management, and resource investment systems.

Capital resource dollars are never a steady-state factor. Rather, they're in constant flux, ever subject to strategic portfolio investment allocation and reallocation. When market conditions – particularly in Entekra's Northern California operating footprint – took a turn for the worse starting in early Spring 2022, both the known and unknown risks of the LP-Entekra venture popped, fully-formed, into view.

We expect that Entekra will not be the last of casualties among building technology ground-breakers scrambling now for a nearer horizon of profitability versus a bluer sky of promise to impact transformation, affordability, sustainability, and resiliency and the like. Credit, debt, equity – they're all on a different footing now than they were even a year ago.

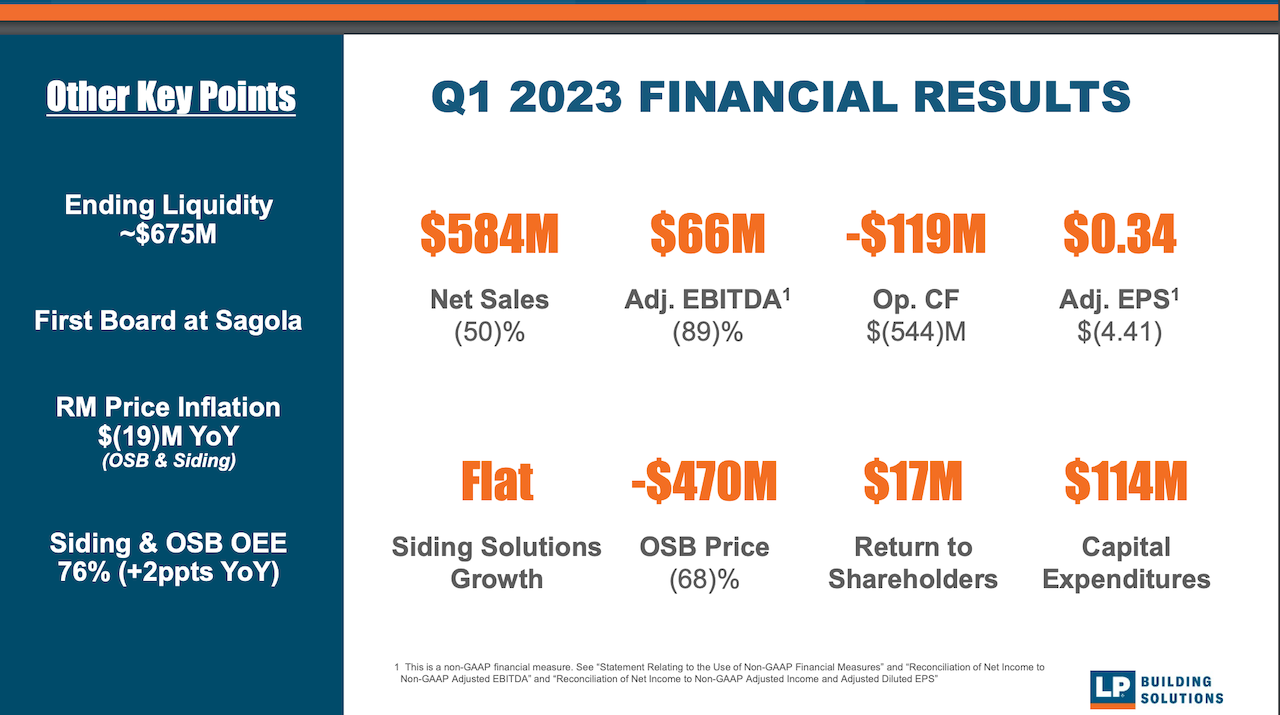

Big challenges to LP's core commodities business – pricing on OSB and stalled demand on the siding front – reflect themselves in the enterprise's 1st-quarter gut-it-out mixed-signals financial and operational performance:

To absorb the shock of fallen commodities prices, reduced demand volume, and continued investment in growing mill and distribution capability in the organization's core competency areas necessarily meant pain would come somewhere in an LP system, now required to make hard choices.

Many – especially stakeholders in a heretofore vibrant, focused, but now- financially-challenged vanguard of building-as-a-service factory-based panelization, prefabrication, and modular construction sector – see the Entekra failure as a strategic fumble by its majority owner.

Instead, it was a business – in and of itself – that, to scale up, needs more capital runway, cycle-proof financial resources, and fire-in-the-belly evangelism than the Entekra business arc had in front of it as an LP-adjacent operator. To support a huge, front-loaded capital expenditure with what is inevitably a long, slow time-released return on investment – i.e. the measure of commitment likely necessary to transform American residential construction capability – requires a kind of pan-cyclical capital only big residential developers seem to be able to tap into.

Fixed-versus-variable-cost driven businesses don't have that luxury of patience. They have to make at least enough money to pay the bills, keep the lights on, and revenue resource their way through a downturn to the next building boom. That's how so many firms – young, old, big, medium, and large – weather turbulence.

As for LP which has prided itself as an innovations and solutions seeker, it took a plunge with a big investment in 2018 that worked out until it didn't. It's ability to both innovate and develop solutions – in its own framework – stays intact.

Not one of the seven equity research and institutional investment analysts on LP's Q1 earnings call raised even a whiff of question or challenge regarding CFO Alan Haughie's tidings that Entekra would be shuttered.

They got it.

MORE IN Products

How Precision Can Shave Time From Homebuilders' Build Cycle

Sales may be priority No. 1 right now. And that needs to be bolstered by virtually flawless operations. Boise Cascade’s SawTek gives builders speed, savings, and first-time-right quality when it matters most.

In Uncertain Times, Capability Investment Is A Survival Tool

Boise Cascade’s $140M mill improvements reflect a long-game commitment to builders under pressure from volatility, costs, and customer hesitation.

Margins Tighten, Value-Add Matters In Construction Supply

Even as overall construction supply revenues inch upward, Webb Analytics’ deep dive into the $600B pro channel reveals a shifting reality: declining unit volume, cautious outlooks, and strategic bright spots in value-added manufacturing and service partnerships.