Land

Locals Got Hammered In '20 to '22 Housing Boom ... How About Now?

Hometowners often got priced-out as transplant refugees anted up ever higher prices for active for-sale inventory during the rush. Maybe some of that standing spec inventory can now price-in people who helped make those hot markets hot.

A standard-issue personal financial advice column holds out a promise:

Want to buy a house but can’t afford it right now? A financial expert offers advice to Gen Zers and Millennials

Typical of such pieces, three nuggets – improve your credit score, set a savings goal, and know where to save your money – circle back to a thumbs-up recommendation of a couple of high-yield savings vehicles as a tactic Millennial and GenZ prospects should consider to get themselves financially prepared.

The piece might also have added a fourth gem of wisdom:

One word: Move.

A dark underbelly of all of the "fastest growing markets" stories we've been seeing since COVID-19 and dirt-cheap mortgages started feeding rocket fuel into migration and mobility patterns from late Spring 2020 to late Spring 2022, has been one of real estate's unwritten rules.

Locals lose.

The narrative stands as a real estate value, migration, and mobility pillar for all time in one way or other. People always have and always will follow opportunity where it leads, and those already there – where opportunity beckons -- invariably feel the brunt of negative impact of newcomers.

It's the way recent times amplify, intensify, and accelerate such patterns that makes this latest variation on the theme noteworthy, both as a challenge to new home and community developers, and an opportunity.

Newcomers – often refugees from hyper expensive markets, and now empowered with work-from-anywhere livelihoods – could outbid hometowners in many of the most-active residential real estate markets of the past couple of years.

The pandemic era iteration of this phenomenon compounds and ongoing and growing predicament for homebuilders and developers whose longstanding multiplier-effect positive impact on local, regional, and national economics – not to mention their cultural impact on making a bulwark of the American Dream, homeownership, attainable – requires that they produce and sell new market-rate homes affordably.

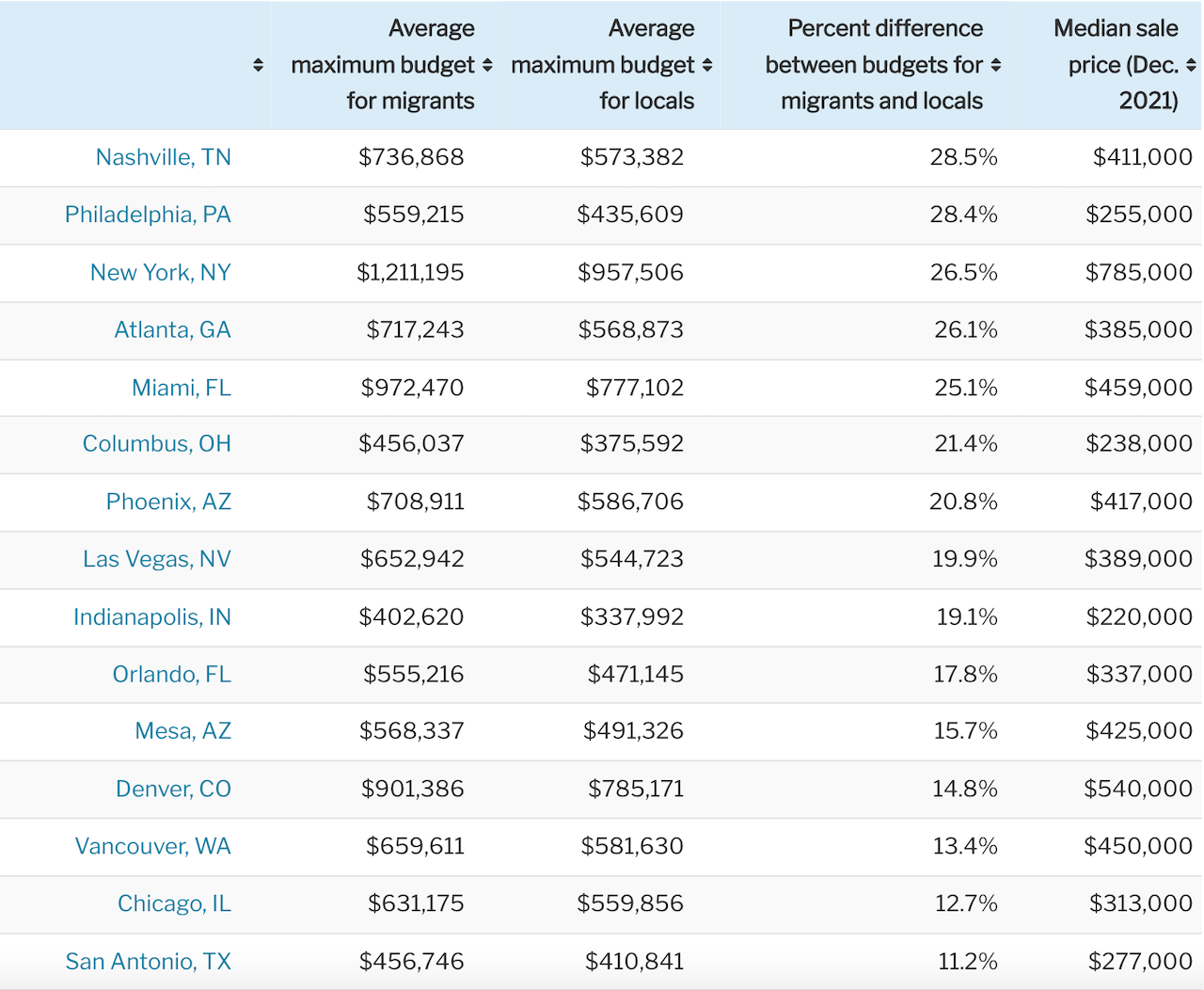

We see the issue clearly in a February 2022 data capture from Redfin, where below we look at the 15 markets where in-migrants could outspend hometown residents by the most as of Dec. 21:

The influx of out-of-towners with big budgets is contributing to the rise in home prices in popular migration destinations, pricing out many locals. Nashville home prices remain lower than many expensive coastal cities, but were up 22.6% in December from the year before. So while Nashville may be a good deal for someone coming from Los Angeles, many locals are stuck renting.

Money.com put an exclamation point on the transplants vs. locals data with its conclusion on the trend.

Transplants with higher salaries from places with higher costs of living, like California, have been able to expand their home searches to lower-cost areas if their employers allow them to work remotely from any location. Even if they pay over asking price in their new city, [local Nashville real estate agent] Geyer says, “in their eyes, they’re getting a deal.”

There's little reason to think that this imbalance will regain equilibrium anytime soon.

Tech- and business-enabled distributed- and remote work macro trends, age demographic household and family formation forces, and "the-rent's-too-damned-high" price levels in coastal urban cores – not to mention evolved omnichannel digital marketing initiatives by homebuilders and masterplanned communities – remain as crucial drivers homebuilders continue to count on to help clear both backlogs and spec starts under construction without giving up too much on pricing.

Hometowners – especially younger ones, as yesterday's release from the National Association of Home Builders of its Housing Opportunity Index illustrate, face bleak prospects if their aspirations are to buy locally.

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI), just 42.8% of new and existing homes sold between the beginning of April and end of June were affordable to families earning the U.S. median income of $90,000. This is a sharp drop from the 56.9% of homes sold in the first quarter that were affordable to median-income earners.

While builders, developers, and – by the way, build-to-rent construction, development, and investment players – get a tailwind benefit in the near-term from "pricing-in" transplants fleeing unreasonably high housing costs and a host of other less desirable factors of gateway city or coastal-market urban areas, they're also adding to the pool of "have-nots," priced-out of ground-up homeownership in their hometowns.

Given the tensions and cross-purposes builders and developers grapple with at the local community level homebuilders might consider effort to turn a negative narrative into a positive one for a longer-term opportunity, especially where they may have standing inventory to try to move.

Why not focus "pricing-in" promotions, incentives, and sales efforts on a narrowed local basis, with every intention to ensure that hometown residents get their best shot at ground-up construction in or near neighborhoods their friends and family members occupy?

If the only local option locals get in new market-rate residential real estate is a built-to-rent neighborhood, that may represent that immediate-term win for developers. But who ever feels all that happy with a "better-than-nothing" option?

The hard work builders and developers have ahead of them – whether it's now, or in the mid-term future, or over the long haul – is to "price-in" people who're part of making these "hottest market" destinations the reason they're so hot – walkable, pleasant, roomy, peaceful, culturally rich, food-friendly, and neighborly towns and cities – in the first place.

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.