Technology

Little Big Deal: What Synergos' Purchase Of Florida-Based ODC Means

The combination of Synergos’ hands-on, tech-enabled, locally-trusted contractor services and Asahi Kasei’s long-term operational roadmap points to a transformative potential for U.S. homebuilders seeking to streamline operations in a cost-sensitive environment.

Grand bargain 2024 presidential campaign promises notwithstanding, homebuilders know in their hearts and guts that no matter what candidates claim as antidotes to America's housing affordability crisis, operational efficiency remains a lock and key to any enduring solution.

In that light, last week's announced acquisition of ODC Construction by Synergos marks a pivotal moment in Synergos' journey, expanding its operational footprint into Florida and the Carolinas.

And although it's a relatively below-the-radar deal in the context of homebuilding mergers and acquisitions, directionally the combination has a national sweep in its implications for how U.S. operators might finally realize that more than 20% in operational efficiency they've found to be so elusive over the decades.

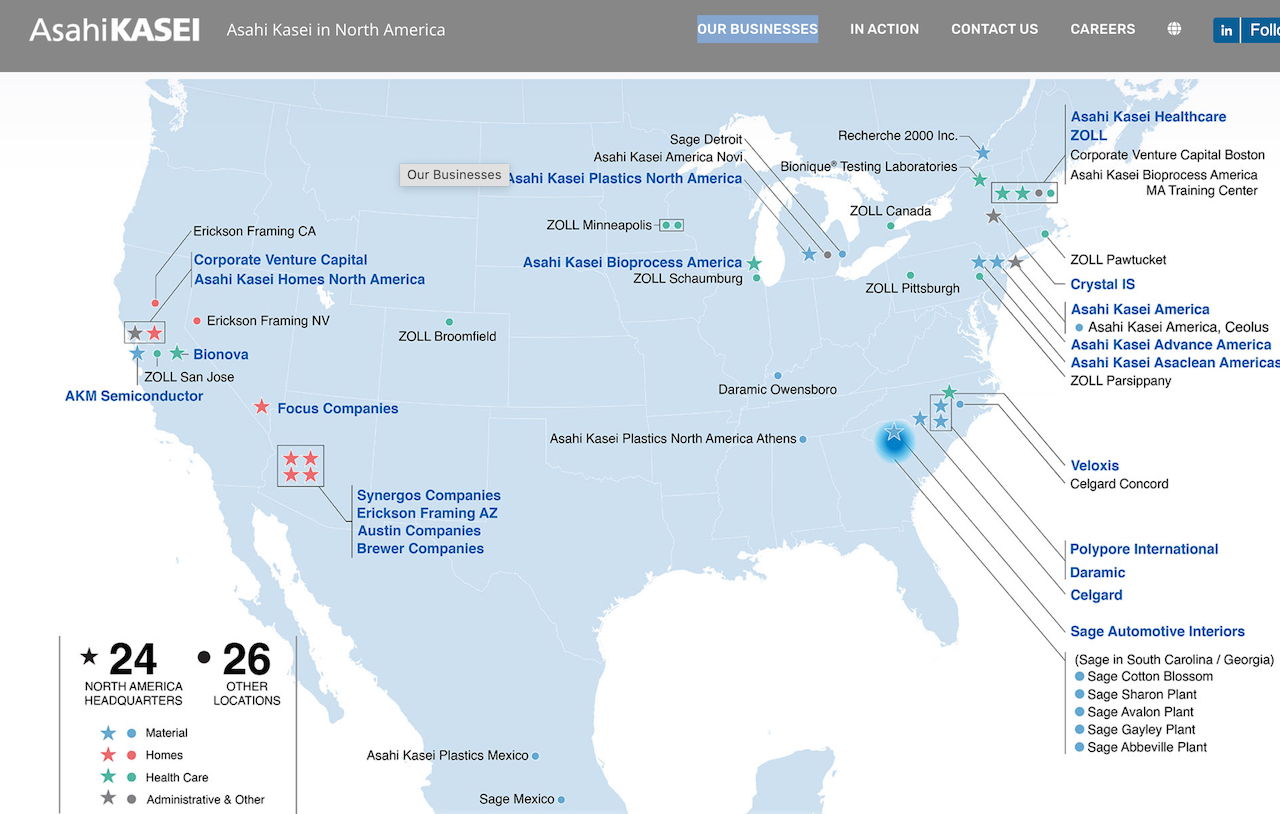

This Synergos move highlights the company's ambition to capitalize on the Southeast’s robust housing market, with Florida being the nation's leader in new home construction. For Synergos – led by former Pulte executive Rich Gallager, president and CEO – this deal signals a strategic eastward push, leveraging its Japan-based parent company's capital clout and operational rigor with ODC’s established reputation in shell construction and positioning itself to bring its integrated, technology-driven contractor services to new regions.

‘Super-Sub’ Model Allure

At the core of Synergos’ offering is its “super-sub” model—an integrated, multi-stack construction services contractor. This approach allows homebuilders to outsource key operational areas in which inefficiencies arise from managing numerous subcontractors, trades, and schedules. The acquisition of ODC brings this model to the East Coast, promising to alleviate some of the industry’s most pressing pain points, such as a shrinking skilled labor pool and the need to enhance construction cycle velocity and cost-efficiency.

Gallagher’s leadership at Synergos underscores the value of transparency, performance excellence, and alignment between builders and trade crews—factors that resonate strongly in the U.S. construction environment, where high-volume builders are under pressure to deliver homes at lower cost while maintaining quality. As noted in our 2021 coverage of the Brewer Companies acquisition, this model builds trust by aligning subcontractors under a single ownership structure, leading to smoother operations and greater accountability across trades.

As we wrote in The Builder's Daily after an earlier Synergos acquisition in November 2021:

What's been working for Synergos – which evolved out of Asahi Kasai's 2018 purchase of the Erickson Companies' framing & truss platform, and integrating leadership under former Pulte regional executive Rich Gallagher – is this:

"The stresses we face as companies, whether it's in a time of peak activity or at the bottom, are essentially the same," says Gallagher. "Those stresses separate builders and their trades – emotionally, in focus, and self-interests. What we've zeroed in on at Synergos is working to rebuild bridges of trust, based on performance excellence, transparency, alignment, and visibility."

Hallmarks of the absolutely vital performance requirements of a multiple-scoped array of contractor services, materials, installation, etc. would be greater velocity in inventory turns, less friction, and smoothed access to the 18,000 separate bill-of-materials piece-level parts that go into an average new home. – The Builder's Daily

Asahi Kasei’s Influence and U.S. Growth

As the parent company of Synergos, Asahi Kasei exemplifies the increasing role Japan-based firms are playing in the U.S. homebuilding sector. Like other major players from Japan such as Sekisui House, Daiwa House, Sumitomo Forestry, and Misawa, Asahi Kasei is investing in the U.S. market to sustain growth as domestic demand in Japan stagnates.

Asahi Kasei’s strategy centers on importing its lean-production methodologies and systemization know-how, which have long been a hallmark of Japanese industrial practices. This is not just about capital investment; it’s about bringing operational rigor, data-driven technologies, and manufacturing efficiencies to an industry in the U.S. that has historically lagged in these areas. The combination of Synergos’ hands-on, tech-enabled, locally-trusted contractor services and Asahi Kasei’s long-term operational roadmap points to a transformative potential for U.S. homebuilders seeking to streamline operations in a cost-sensitive environment.

A Playbook for Lean, High-Velocity Construction

ODC’s strong foundation in shell construction complements Synergos’ established operations in the West, creating synergies that are expected to improve construction timelines and lower costs across projects in Florida and the Carolinas. The acquisition also addresses the labor cliff facing the U.S. construction industry, where skilled labor is in short supply, and younger workers are not entering the trades in sufficient numbers.

Synergos' value proposition, as articulated in our 2022 The Builder's Daily article on the Focus Companies acquisition, revolves around its ability to integrate technological solutions like digital twin technology to compress construction timelines significantly—from as long as 80 days to as short as 32 days in certain markets. A few passages from that TBD story remain relevant in looking at the sweeping implications of the Synergos-ODC combo in a supply-constrained, price-challenged, higher-for-longer borrowing cost operating environment over the next six to 18 months. We wrote:

As we telescope to the North American homebuilding, residential real estate, and distribution landscape, the "pros" of multi-scoped under-one-roof contractor solutions platforms – whether or not a new residential construction downturn becomes severe and extended include:

- A builder's gotta build: homebuilders mostly don't do that – i.e. build. Rather they secure land, secure house designs, hire contractors, and market and sell completed vertical homes at a premium. Right now – think supply chain shock, labor constraint, and lot supply limits – builders need "capability" where they can get it, and super-subs, on paper, represent gate-keeper access to that capability. A "core-competency" pivot is underway.

- The labor cliff: People who "know-how" to build are an endangered species, and getting rarer, as a trickle of newcomers can't offset a stream of experienced, skilled skilled workers aging out. Super-subs – as it turns out – are magnets for reliable access to crews with track records of competence and quality. Alternatives for builders range from bleak to grim to existential.

- Follow the money: Wall Street and global investors continue – albeit cautiously -- to seek "safe haven" yield in residential real estate, and as build-to-rent new construction remains an active channel, integrated contractor solutions can add a dashboard of predictability/reliability and pricing leverage due to deep local scale and buying clout.

Capability and core competency tend to shadow each other in homebuilding, but now may have entered an inflection point where operators better choose what they're best at and draw on capability as a service for those activities they're less proficient and efficient at. Of course, when market conditions shift suddenly from highly accelerated to rapidly decelerating, the risks of an undiversified, unhedged symbiotic dependency on the new-construction housing cycle, and the staying power opportunity of diversification become evident, as we've noted here:

The question of whether this time's different forks into three correlated challenges around the burgeoning growth prospects for the super-subs.

- Fit to thrive, come what may – In the past, these multiple scoped subcontractors did well on the upswing in volumes, but coming off the peak into the downturns "they got eaten up by their overheads." They need more elastic, more bi-directional scalability, to work as sustainable, resilient pan-cycle businesses.

- Beyond the big builder – A related issue, for a future-proof business and operating model, super-subs need customer diversity, not just in new residential construction, but in commercial, i.e. multifamily, and possibly "after-market" opportunity, in which case they'd need to evolve customer support, customer care and service capabilities not currently in their wheelhouse.

- The endgame: people and tech – A design-thinking business model would elevate the architecture, engineering, construction, modular, prefabrication, componentization, industrialization, and transportation platform in such a way as to attract the highest level talent as well as the investment in both research and capital spending in rationalization of the building lifecycle.

ODC’s expertise in foundational elements like block masonry and framing, combined with Synergos’ capabilities, provides builders with an operational edge at a time when efficiency is paramount.

Japan-Based M&A Deals Are Becoming the Norm

Historically, Japan-based companies were outliers in the U.S. homebuilding and real estate sector. However, this is no longer the case. Asahi Kasei’s acquisition of ODC is part of a growing trend of Japanese firms expanding aggressively into North America, leveraging their expertise in lean production, technological innovation, and access to less costly capital. This trend is reshaping the competitive landscape, forcing U.S.-based homebuilders to re-evaluate their operational models to compete with the efficiencies introduced by these new entrants.

For U.S. homebuilders, this deal serves as a clear indicator that Japan’s influence in the sector is not a passing trend, but a structural shift. Companies like Synergos — backed by Japan-based capital and operational know-how — are poised to become major players in the construction lifecycle, helping builders navigate the twin challenges of affordability and skilled labor shortages.

What Homebuilding Leaders Should Take Away

- Operational Efficiency Is Now a Competitive Necessity: The "super-sub" model, as seen with Synergos and ODC, provides builders with a streamlined, cost-efficient construction process, addressing both labor shortages and the demand for faster construction cycles.

- Lean Production and Technology Will Drive the Future of U.S. Homebuilding: Japan’s systemization know-how, particularly around lean production and building technology, is reshaping how U.S. homes are built. Builders need to adopt similar methodologies to remain competitive.

- M&A Activity Signals a New Era of Globalization in U.S. Homebuilding: The influx of Japan-based companies into the U.S. market, through acquisitions like Synergos’ purchase of ODC, reflects the growing globalization of the homebuilding industry. This trend will likely accelerate as demographic pressures in Japan push companies to seek growth abroad.

MORE IN Technology

Lennar Taps Into Geothermal To Power New Colorado Homes

A major homebuilder's bet on geothermal heating and cooling for over 1,500 new Colorado homes could pave the way for mainstream adoption as buyers increasingly seek sustainable, energy-saving features.

AI Crushes Missing-Middle Time And Cost Curves Toward Affordability

Developing multifamily rental and for-sale properties takes time — sometimes years -- depending on a labyrinth of zoning rules and the whims of local jurisdictions.

Brandon Elliott’s Next Big Thing: An Uber-Style Building Trades Platform

After selling Elliott Homes to Meritage, the Gulfport, Miss.-based entrepreneur sets his sights on transforming trades with a logistics-tech startup that aims to make construction faster, smarter, and more affordable—starting with siding.