Land

Lennar, Rausch Coleman Combo: An Affordably-Priced Growth Driver

Learn how Lennar’s acquisition of Rausch Coleman Homes reshapes affordably-priced new home growth, M&A dynamics, and the future of homebuilding in tertiary markets.

Only eight or so weeks ago, John Rausch and his team at Rausch Coleman Homes were about to announce an ambitious expansion into Florida. This would mark a bold entry for their family-run company into one of the nation’s fastest-growing housing markets.

After two catastrophic hurricanes reshaped the Florida housing landscape, plans took a sharp turn. Today, the Arkansas-based builder finds itself not as a new player in Florida but as the latest member of Lennar Corporation, the nation’s second-largest homebuilder.

This strategic acquisition highlights Lennar’s aggressive moves to drive affordably priced profitability, which is a leading wedge into its future. It underscores the increasingly consolidation-driven dynamics shaping the U.S. homebuilding industry as 2024 comes to a close.

The Deal at a Glance

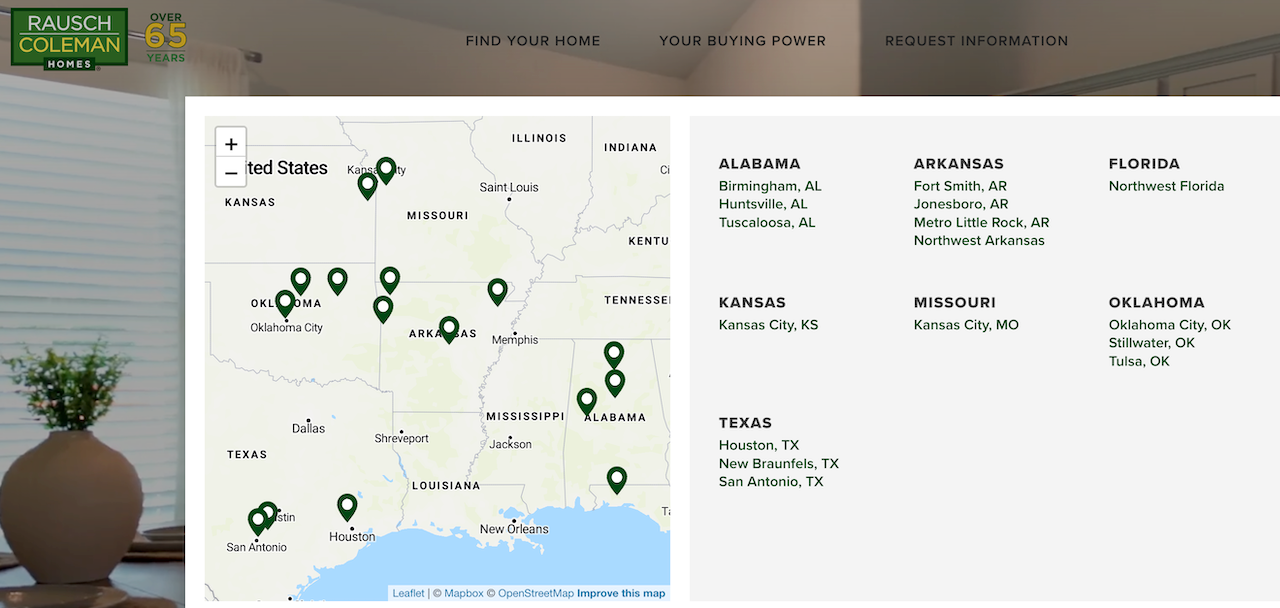

Lennar Corporation announced today its definitive agreement to acquire Rausch Coleman Homes, a top 25-ranked U.S. homebuilder headquartered in Fayetteville, Arkansas. With this acquisition, Lennar secures Rausch Coleman’s operations, which expect to deliver approximately 5,000 homes in 2024 at an average sales price of $230,000 – i.e. new home sales revenues of $1.15 billion. The acquisition extends Lennar’s footprint into tertiary markets — Arkansas, Oklahoma, Alabama, Kansas, and Missouri — and strengthens its existing presence in Texas and Florida.

The transaction reflects Lennar’s ongoing commitment to its “land light” strategy, with all of Rausch Coleman’s land assets slated for purchase and option agreements with a third party. This approach is a hallmark of Lennar’s pivot toward leaner operations, which the company highlighted in its recent Q3 2024 earnings call.

Vestra Advisors – which advised M.D.C. Holdings on its sale to Sekisui House, Landsea Homes on its acquisition of Antares Homes, and Smith Douglas on its IPO – served as advisors to Rausch Coleman in its sale to Lennar.

Notably, the Rausch Coleman acquisition alone is projected to account for half of Lennar’s stated 10% growth target for 2025.

Strategic Rationale: The Why Behind the Deal

The Rausch Coleman acquisition positions Lennar as a stronger competitor in a sector leaning heavily into affordability-driven growth and profitability. With an average home price of $230,000, Rausch Coleman fills a critical niche in markets where affordability remains a decisive factor for buyers. These tertiary markets — often overlooked by larger builders until the post-pandemic era — represent a burgeoning opportunity to scale housing production in areas where wages and housing costs align more closely.

Tony Avila, CEO of Builder Advisor Group, emphasized the strategic foresight in Lennar’s move:

“John Rausch has built an incredible team and company with tremendous growth. Lennar is quite prescient in making this acquisition, especially at a time when private builders are facing capital constraints, and public builders like Lennar can leverage lower-cost debt to drive scale.”

This acquisition also follows Lennar’s August purchase of WCH Homes, which allowed Lennar to leapfrog its competition in Georgia. With these back-to-back deals, Lennar demonstrates a clear strategy to expand its footprint into high-growth areas while securing reliable local partners.

This is an excellent environment for M&A," Avila says. "Some private builders are capital constrained. Banks are reducing their construction lending exposure as deposits have decreased. Banks are asking for more deposits from their borrowing customers which is challenging for a private builder. Public builders need to grow to meet projected earnings targets and achieve economies of scale in targeted geographies."

Millrose and the Land-Light Lens

Lennar’s land-light strategy, underscored by its Millrose spin-off announced during the Q3 earnings call, is a key factor in how the company plans to integrate Rausch Coleman’s assets. By leveraging third-party partnerships for land ownership, Lennar mitigates financial risk while maintaining flexibility. This approach has been pioneered by efficiency leaders like NVR and emulated by newer public homebuilders like Dream Finders and United Home Group.

Incorporating Rausch Coleman into this framework allows Lennar to scale quickly without overburdening its balance sheet — a critical move as public builders vie for market share in a consolidating industry.

What It Means for Homebuilding

A Hyper-Consolidated Industry

The Lennar-Rausch Coleman deal adds fuel to the ongoing wave of mergers and acquisitions sweeping the U.S. homebuilding industry. Public builders, armed with better access to capital, are aggressively targeting private operators to bolster growth. Lennar’s acquisition comes amid predictions from Builder Advisor Group’s Avila of several additional M&A deals before year-end.

Tertiary Markets Take Center Stage

This acquisition signals a growing focus on tertiary markets, where affordability concerns are less pronounced, and operational costs are lower. These markets offer an attractive proposition for builders aiming to balance rising costs with profitability.

Affordability as a Competitive Advantage

Rausch Coleman’s $230,000 price point aligns with a rising demand for affordable housing. This acquisition positions Lennar to deliver homes that meet the needs of cost-conscious buyers while addressing shareholders' demands for strong returns.

A Changing Playing Field for Private Builders

Private builders, even those with Rausch Coleman’s scale, are finding the future tilted in favor of larger public enterprises. By joining Lennar, Rausch Coleman's team transitions from a family-owned legacy firm to a major player within a publicly traded powerhouse, ensuring access to resources, capital, and scalability.

Why It Matters in 2024’s Economic Context

The Lennar-Rausch Coleman acquisition is more than a business deal; it reflects broader trends in housing affordability, demand, and consolidation. With mixed signals in interest rates, inflation, and employment, public builders are positioning themselves to navigate uncertainty with aggressive growth strategies.

We expect, with a Trump presidency, additional M&A in the homebuilding sector," Avila adds. "We anticipate a new Fed Chairman appointed by Trump (after 2026) will be more dovish than Powell, which should lower mortgage rates. We anticipate that the use of tariffs will be less inflationary than expected and that the threat of tariffs will be used to negotiate better trading terms with global partners, which will help the American economy. We also anticipate less stringent regulation, which will reduce inflationary friction."

A New Era for Lennar and Rausch Coleman

This acquisition represents the next chapter in a 65-year legacy for John Rausch. For Lennar, it’s another decisive move in its race to unseat D.R. Horton as the nation’s top homebuilder. By prioritizing affordability, expanding into tertiary markets, and leveraging its land-light strategy, Lennar positions itself for growth in a rapidly changing housing landscape.

As the industry approaches 2025, this acquisition exemplifies the strategic realignments that will continue to define the future of homebuilding — where consolidation, affordability, and operational efficiency reign supreme.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.