Leadership

Lennar-Rausch Coleman: A Homebuilding Model Rewritten

The story of Lennar’s acquisition of Rausch Coleman — and the parallel rise of Millrose Properties — marks a turning point. This inside look at the deal reveals why it happened, what it means, and what’s next for the industry.

The merger of Rausch Coleman Homes with Lennar — one of the most significant homebuilding acquisitions in recent years — wasn't a long-planned exit. It was a decisive pivot sparked by an unexpected phone call, a meeting with Lennar executives, and a realization that the future of homebuilding was shifting rapidly toward an asset-light, land-light model.

Now, with Millrose Properties as a publicly traded land banking entity, the deal’s implications stretch far beyond just Lennar and Rausch Coleman — this is a blueprint for where the industry is headed.

A Broker’s Call and a Strategic Shift

John Rausch, chairman of Rausch Coleman Homes, recalls the moment that set the deal in motion.

It was last February or March. A local broker we knew in Northwest Arkansas called and left a message. I almost didn’t take the call — because, you know, once rumors get out, things start flying. But something told me to take it. And that’s when we got connected to the Lennar team.”

What began as an informal conversation with Lennar executives Fred Rothman (Chief Operating Officer) and Diane Bessette (Chief Financial Officer) quickly turned into something much bigger. Rausch Coleman, one of the nation’s leading private homebuilders, had been planning an expansion into Florida. But through discussions with Lennar, a different path emerged: one that aligned with the evolution of homebuilding’s financial and operational structure.

Millrose Properties Inc., a homesite purchase platform for residential homebuilders, acquired about 24,000 homesites from Fayetteville-based Rausch Coleman Homes on Monday (Feb. 10) for $900 million in cash." – TB&P

Why Lennar? Why Now?

The decision to sell was not about necessity but opportunity. Rausch Coleman wasn’t struggling — it was thriving. Yet, Rausch saw in Lennar an opening that made long-term strategic sense.

“We had never built Rausch Coleman to sell. We built it for long-term growth. But when we met Lennar’s team, their culture, and their vision, it just made sense.”

Lennar’s ability to bridge its eastern and western footprints with a deep presence in Oklahoma, Arkansas, and Texas made Rausch Coleman a perfect fit. But the game-changer was Millrose Properties, the newly spun-off land banking REIT.

“The timing was key. Lennar was rolling out Millrose, and this gave them instant entry into our markets—without the years of ramp-up they would have needed otherwise.”

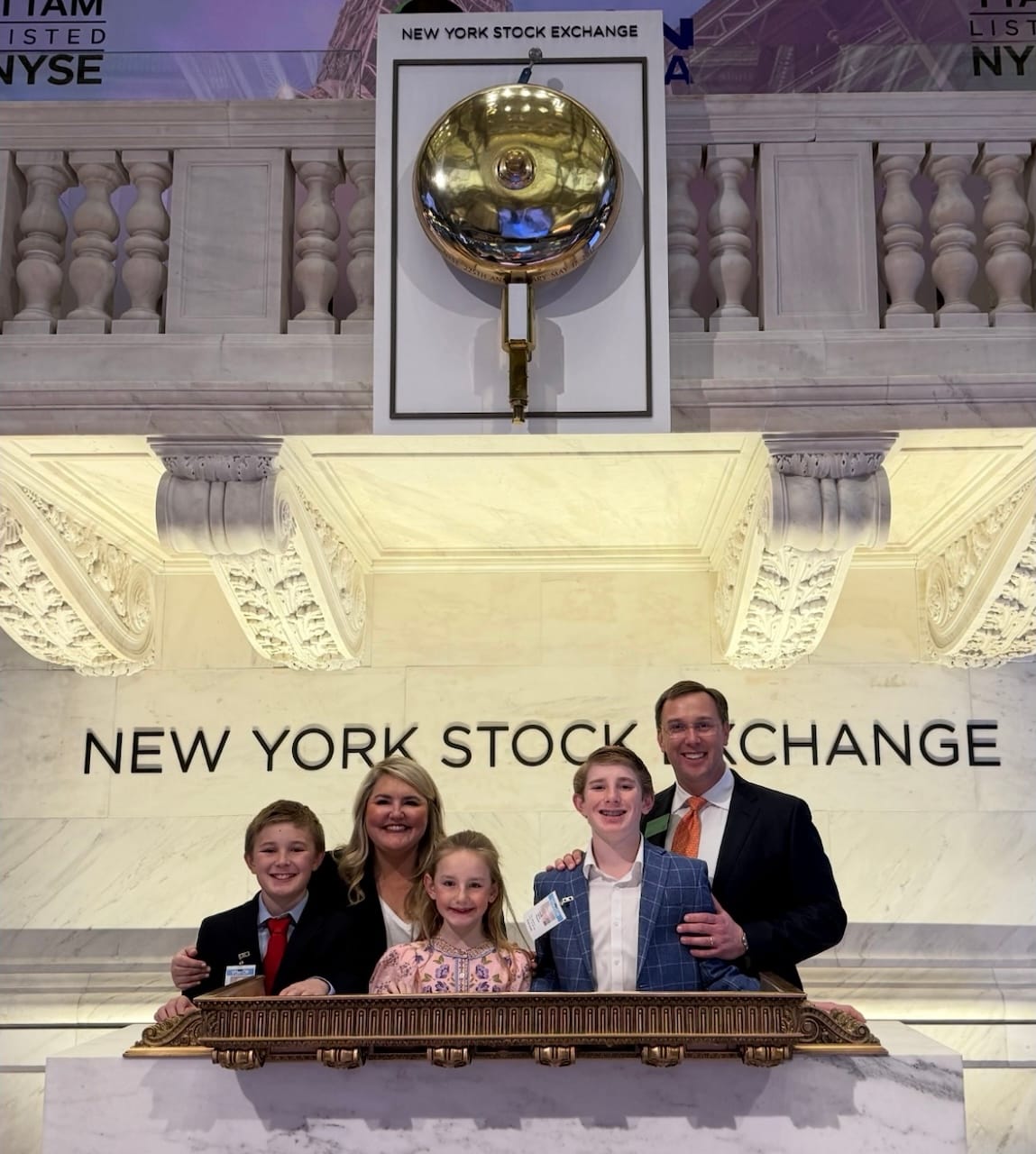

A Moment of Celebration at the NYSE

As the deal closed and Millrose began trading on the New York Stock Exchange, John Rausch experienced a moment that underscored the magnitude of this transition—not just for his company, but for his family legacy.

“One of the most meaningful moments for me was getting to take my grandfather and my kids to the NYSE opening bell ceremony. It was a full-circle moment—seeing where we started, celebrating where we are, and recognizing where we’re going. That’s something I’ll never forget.”

The experience was both symbolic and personal—a rare opportunity to reflect on decades of work while stepping into the future of homebuilding’s evolving landscape.

Deal Structure: A New Homebuilding Model Takes Shape

In September 2024, Lennar finalized the acquisition, absorbing Rausch Coleman’s operations while allowing its land development team to operate as a separate entity — The Calara Group. Calara is now positioned to source land for Millrose, reinforcing the asset-light, capital-efficient model Lennar is pushing forward.

“What Lennar saw in us was more than just homebuilding. It was a ready-built land and development platform that could fuel their growth while keeping them land-light.”

Under the agreement, nearly all Rausch Coleman team members transitioned to Lennar or Calara, preserving continuity and expertise while enabling Lennar to take an instant market-leading position in the regions where Rausch Coleman was strongest.

What This Means for Homebuilding

The deal is a milestone in homebuilding’s shift toward a new business model—one that prioritizes capital efficiency over land ownership. Historically, large builders have controlled land in-house, managing extensive land holdings for future development. But the financial reality of homebuilding has changed. Rising land costs, fluctuating interest rates, and capital constraints have made the traditional model more burdensome.

Millrose is designed to change that. As a REIT, it provides homebuilders—including Lennar—with a more flexible way to access land without taking on the financial risk of direct ownership.

“This institutionalizes what was historically a private market process. It provides a durable, scalable land banking solution, reducing costs and increasing flexibility.” —Tony Avila, Builder Advisor Group

The Millrose model allows homebuilders to focus purely on constructing and selling homes, treating land as an input—just like lumber, drywall, or labor. For private builders, this presents both a challenge and an opportunity. The challenge: competing against public builders who can now access land more efficiently. The opportunity: leveraging Millrose itself as a potential land source.

The Role of Calara Group

While Rausch Coleman Homes is now part of Lennar, its land development expertise lives on through The Calara Group. The new entity retains most of Rausch Coleman’s original land team, now focused on large-scale development projects for Millrose and potentially other builders.

“With Calara, we get to stay in the game—focusing on what we’ve always done best: developing land, creating great neighborhoods, and supporting the next generation of homebuyers.”

Calara will focus on sourcing and developing land for master-planned communities, balancing affordability with quality, and collaborating with builders beyond just Lennar. It’s also expanding into single-family rental and multifamily projects through partnerships like American Residential Group.

Lessons for Private Builders

For private builders watching this deal unfold, the key takeaway is clear: the industry is shifting, and adaptation is essential. Land ownership — once the defining factor of a builder’s strength — is becoming less critical than access to capital and operational efficiency.

“You’ve got to find ways around obstacles — land scarcity, capital constraints, market cycles. This deal made sense because it let us do that while staying true to our mission.”

For those considering their own futures, the Lennar-Rausch Coleman transaction highlights a range of strategic options:

- Scale through partnerships: Collaborate with larger builders or financial entities to maintain a competitive edge.

- Leverage land banking models: Instead of tying up capital in owned land, look to institutional land sources.

- Preserve expertise through spinoffs: If an acquisition is on the table, consider structuring it to maintain core competencies in a separate entity, as Rausch did with Calara.

What Happens Next?

With the acquisition complete and Millrose now a publicly traded entity, the pieces are in place for Lennar’s next phase of growth. Rausch Coleman’s markets in Oklahoma, Arkansas, Texas, and the Florida Panhandle now integrate seamlessly into Lennar’s national footprint.

We always knew Florida was a big opportunity for us. When Lennar asked why we hadn’t entered the Panhandle yet, we knew we were thinking along the same lines.”

For John Rausch, the deal marks both an end and a beginning. He remains deeply engaged in homebuilding through Calara, continuing his legacy while positioning for the future.

“It’s been a grueling year getting this done. But looking back, I wouldn’t change a thing.”

Take-Away

The Lennar-Rausch Coleman merger is more than just another acquisition—it’s a signal of where homebuilding is headed. As the industry grapples with shifting economic forces, rising land costs, and changing buyer dynamics, the companies that adapt fastest will come out ahead.

For Lennar, Rausch Coleman, and Millrose, the future is now. And for the broader industry, this deal serves as a wake-up call: the rules of homebuilding are changing, and those who embrace the new model will shape the next era of growth.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.