Land

Lennar Adds Alabama To Its Footprint, With Breland Purchase

Although Lennar's staying quiet about the acquisition 'late last year,' the Breland Homes deal spotlights another 'rinse-and-repeat' for Alabama-area serial success story Louis Breland.

Lennar's "Find a home you'll love" dropdown menu for home searchers lists 24 states, cascading alphabetically from Arizona to Wisconsin. In the past two years, as pandemic-effect migration, mobility, workplace, and economic shifts began to shape a new normal of new homebuilding market activity, Idaho and Wisconsin communities cropped up under Lennar's flags.

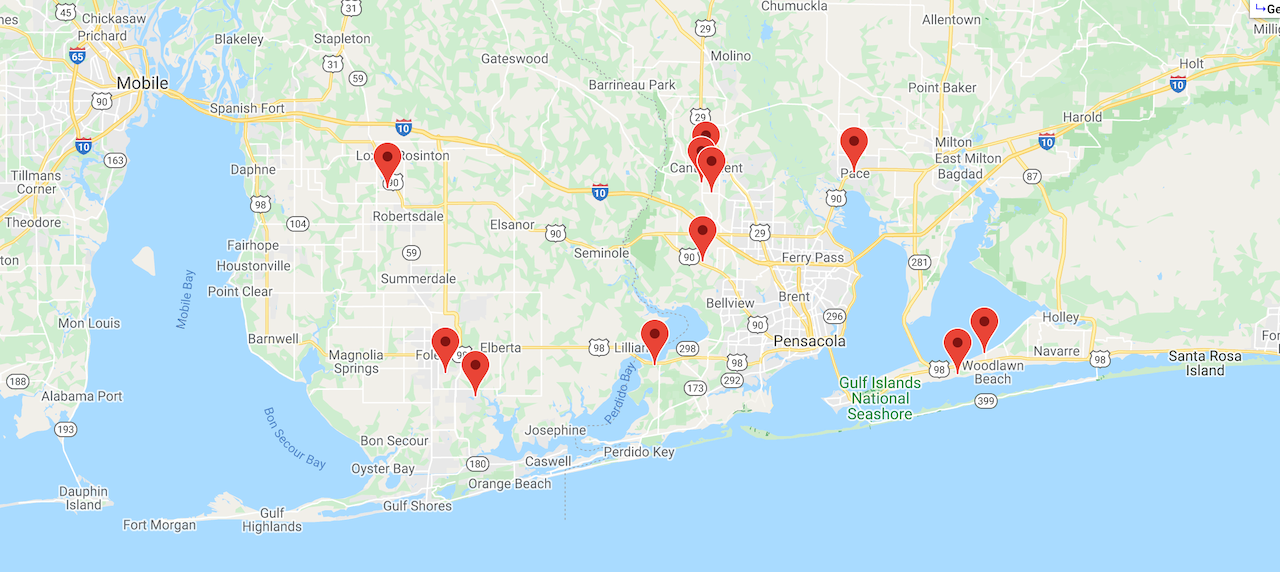

Now, if you dial the Gulf Coast phone number listed on Huntsville, AL-based Breland Homes' website, listing 13 communities that stretch from just east of Mobile over and into the Florida panhandle east of Pensacola, the greetings you'll get is "Lennar Homes, can I help you?"

The News

A report yesterday from Huntsville-based WHNT/News 19-TV correspondent Madison Neal reveals that Lennar – "late last year" – purchased the homebuilding Breland Homes assets of Huntsville-based residential and commercial developer Breland Companies. Neal reported the deal, and spoke on the record with Breland Companies president Joey Ceci, who confirmed the sale of the homebuilding operation:

Breland Homes was purchased late last year by Lennar, which is really one of the best home building companies in the world, named by Fortune magazine as one of the most admired builders,” Ceci explained.

At a high level, the sale pairs a multi-regional 33-plus-market enterprise striking at an opportunity for fast-growing current, near-future, and long-haul volume, area operational capability, and deeper clustered-market scale in across Georgia, Florida, and now Alabama with a multi-time "rinse-and-repeat" homebuilding mini-empire builder with operational and land strategy chops that prove to span good parts of the housing cycle and not-so-good.

We reached out to both Ceci and Breland Homes' four-decade-plus namesake founder-developer-homebuilder Louis Breland for comment, but our calls were not returned at the time we published. Also, we checked in with Lennar media relations, and were told by a Lennar media relations executive that Lennar has not made its acquisition of Breland public and would not comment further.

We do note that Breland Homes sold in 2012 to D.R. Horton, which – on background – may have secured a five-year non-compete in the market with Louis Breland. Such a non-compete arrangement with D.R. Horton could have expired in about 2017, at which time Breland reignited a homebuilding entity to go along, once again, with an active residential and commercial land purchase and development machine.

What It Means to Lennar and Breland

Lennar's move into Alabama runs consistent with a game plan that reflects opportunism and a tried-and-tested market expansion model that's proven to be a success since COVID-19 began in Spring 2020 to alter migration trends, hybrid workplace requirements, second home demand, generational housing preferences, and an overall embrace of healthier, safer, more durable new homes.

With the Breland Homes acquisition, Lennar instantly adds incremental profitable volume in the North Alabama and Gulf Coast markets – previously considered secondary and tertiary markets whose permit counts might not support full divisional focus – that have experienced outsized, pandemic-resilient growth.

Here's what's going on in Huntsville for growth:

Just shy of Birmingham, the U.S. Census Bureau estimates show Huntsville may take the lead for the most populated Alabama city in 2021. A big jump from being the smallest of the four major cities just 10 years ago.

According to AL.com, Vintage Population Estimates from the Census show Huntsville added around 23,000 people between 2010 and 2020."

In the Gulf Coast alone – where Breland division leads Todd McCrory and Jeannie Brown head up operations – seven counties from Mobile and Baldwin in Alabama to Escambia, Santa Rosa, Okaloosa, Bay, and Gulf, now produce upwards of 10,000 new-home permits annually, and have been growing a reported 17% a year.

That market stands as one of 50 or so markets once considered to be secondary or tertiary markets that are new housing hives of the new normal," an homebuilding executive with experience in the geographic arena tells us.

In Breland, Lennar has acquired both an cycle-proven operational skill-set and an asset-light land and development source in the Breland Companies, which plans to continue to purchase land and develop lots for area builders even as it serves in a favored-nation capacity to develop for Lennar.

Breland's homebuilding pedigree goes back to the mid-1970s, when Louis and his brother started building homes in Mississippi, while Louis was still in high-school and kicked the first iteration of Breland Homes into gear when he turned 18.

Through economic and housings best and worst years – both nationally and in an Alabama market that's now on fire as a quality and value alternative to far more expensive Sun Belt retirement, second home, and new-normal migration destinations – Breland's relationship-driven land access and strong operational and sales programs have repeatedly struck lightning in a bottle.

Recent M&A transactions, including the Orosz family's sale of Orlando-based Hanover Family Builders to Landsea, have shown that some entrepreneurial private homebuilding founder principals are drawn multiple times into a calling to start a new venture from the ground up when non-competes or other terms run their course.

Breland's track record of "rinse and repeat" for this start-up, build-up, sell, and revert to land buying and development suggests that canny privately-capitalized players sense that the valuation of their homebuilding entities is peaking, and that now – in a time of still healthy buyer momentum and a vaunted squadron of strategic and financial and international acquirer groups trolling for capability and volume -- may be the moment to get the most value for what they've built.

So, sooner or later, that Lennar website drop-down menu will get a refresh that puts Alabama right at the top of the list of geographical alternatives to "find a home you'll love."

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.