Leadership

Late-Spring Selling Softens: Speed-Bump Or Inflection Point?

The depth, geographic pervasiveness, and readiness among "haves" to become new-home buyers have created a Goldilocks era for homebuilders in 2023 and, so far, through mid-2024.

How deep, widely dispersed, and motivated are America's "haves" households?

This question arises as worries grow over consumers' sustaining positive sway over both the economy and new-home demand.

A "split-screen" view of consumers adds to those worries, especially as consumer debt rises.

This is 'an economy of the haves and have-nots,' Michael Reid, an economist for RBC Capital Markets, told DealBook. 'The haves just have so much more spending power.'

What’s making “the haves” so flush: They tend to have little to no mortgage debt or car or student loans, and their stock-market-tied retirement accounts have accumulated healthy gains to finance vacations or nights out.

But the less-affluent are feeling the pinch. They’ve blown through their pandemic savings, and they’re racking up credit card and other loan debt. One area to watch: A surge in “buy now, pay later” programs may be masking America’s “phantom” consumer debt problem. – New York Times [gift link]

The depth, geographic pervasiveness, and readiness among "haves" to become new-home buyers have created a Goldilocks era for homebuilders in 2023 and, so far, through mid-2024.

The have-nots haven't yet dented a widespread view of demand that will continue to eclipse new-home supply and weigh on pricing.

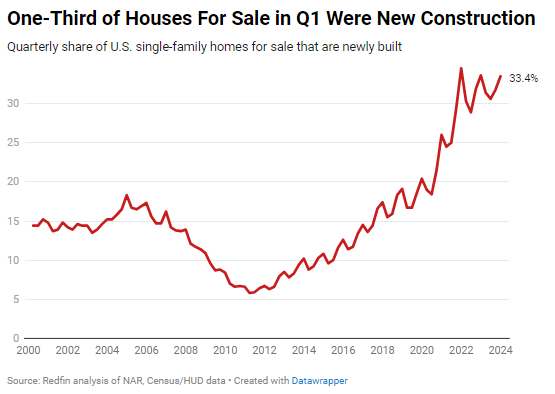

A new Redfin analysis notes:

One-third (33.4%) of single-family homes for sale in the U.S. in the first quarter were newly built, essentially unchanged from a year earlier but down from a record-high 34.5% two years earlier. The portion of housing supply that’s newly built is still roughly double pre-pandemic levels.

Newly built homes have taken up an outsized portion of inventory since the pandemic homebuying boom sent builders into overdrive. There are two main reasons for that:

- Homebuilding has shot up. Construction of U.S. homes soared at the start of the pandemic, with builders responding to sky-high homebuying demand brought on by remote work and rock-bottom mortgage rates, and single-family housing starts are still sitting at significantly higher levels than pre-2020.

- The supply of existing homes for sale has dropped. Homeowners are staying put because mortgage rates hit a two-decade high last year, and they’re still elevated far above pre-pandemic and pandemic levels. Many would-be sellers are opting to hang onto their low rate instead of moving and taking on a new one.

Still, last week, at least four sharp notes of caution drew attention to and question about the thickness and lasting nature of new-home demand.

Homebuilder Sentiment Sank

All three HMI component indices posted declines in May. The HMI index charting current sales conditions in May fell six points to 51, the component measuring sales expectations in the next six months fell nine points to 51 and the gauge charting traffic of prospective buyers declined four points to 30." – Eye On Housing

Single-Family Permits Fell

Single-family permits decreased 0.8% to a 976,000 unit rate; this is the lowest pace since August 2023." – Eye On Housing

Private Builder Orders Fell In April

Our Private Builder contacts’ April Orders declined -1.5% MoM, outperforming New Home Sales’ -4.8% average historical MoM performance. That said, we caveat that March was an easy comparison increasing +2.0% compared to the +9.8% historical average. Overall, we believe the Public Builders are fairing better in the higher rate environment as they continue gaining market share from smaller publics (Public Builder Market Share Gains Continue - 1Q 2024). Like March, higher mortgage rates are weighing on April homebuyer demand. On a YoY basis, survey results decelerated from +3.0% growth in March to +1.0% growth in April." – Wolfe Research

Sales And Traffic Declined In April Vs. March

Sales and traffic. April sales and traffic indicators softened slightly compared to March. 35% of respondents reported yr/yr increases in sales orders per community vs. 41% last month and 31% in April 2023. 24% saw a yr/yr decrease in orders vs. 22% last month and 34% for the same month in 2023. 38% of builders reported an increase in yr/yr traffic at communities and 25% saw a decline vs. 46% and 23%, respectively, last month and 34% and 27%, respectively, in April 2023." – BTIG Research

Strategic Takeaways for Industry Leaders

- Monitor Market Segments: Focus on the differentiation between the "haves" and "have-nots" within the consumer base. Understanding the financial health and behavior of these segments can help predict future demand trends.

- Adjusting Strategies: Consider adjusting sales and marketing strategies to cater to the changing dynamics. Emphasize targeting the "haves" while continuing to explore and develop ways to make new homes more accessible to the "have-nots."

- Evaluate Inventory and Spec Production: With indicators showing potential weakening demand, reassess inventory levels and future production plans to avoid overbuilding and align with market realities.

- Financial Implications: Keep a close eye on mortgage rates and their impact on buyer affordability and sentiment. Be prepared for potential shifts in financing options and consumer preferences.

By staying attuned to these early indicators, strategic homebuilding and residential real estate sector leaders can better navigate potential challenges and adjust their approaches to maintain stability and growth.

Just because most urban, suburban, and rural markets have been and will continue to be under-built doesn't mean that every new home that a builder produces will find an immediate pull of demand. That's where the hard work comes in in a housing cycle that someday may be regarded as constructive, but it sure doesn't feel that way as these bumps and bruises play out in real-time.

MORE IN Leadership

United Homes Group’s Board Crisis In Compliance Countdown

United Homes Group is running out of time to rebuild a functioning board and avoid a Nasdaq compliance breach. CEO Jack Micenko says day-to-day operations continue, but governance uncertainty and market headwinds now threaten the company’s stability.

Smith Douglas Homes Doubles Down On Pace And Growth

Smith Douglas Homes Corp. (SDHC) remains defiant amid a slowdown by prioritizing pace over price. The builder's rapid cycle time and focused expansion strategy could serve as a blueprint for competitors that serve the strained entry-level segment.

After An Involuntary Pause, Orders Matter Again For LGI

In a market where affordability is collapsing, LGI’s disciplined, spec-first model is proving its worth. A year after seizing ground from private builders, the company’s focus on land control, cost precision, and first-time buyers is paying off.