Leadership

Jurney Mapping: Wade Jurney's Pursuit Of Affordability Continues

A go-big and go-bold homebuilding start-up strategy may sound counterintuitive in the throes of what looks to be a hard patch for housing. Wade Jurney and his to National Home Corp. co-founders, Michael Bergman, and Gregg Erickson, beg to differ.

Left to right: Michael Bergman, Co-Founder/Partner, Wade Jurney, CEO and Co-Founder, Gregg Erickson, Co-Founder/Partner, National Home Corp.

Newly built starter homes are a thing of the past, extinct. Affordably-priced, entry level and first-time buyer homeownership in a ground-up house is an endangered species. Market-rate, single-family homebuilders face too many intractable cost inputs to have much to offer an average working household.

Conventional and widely received wisdom, right?

Maybe. Except, Wade Jurney didn't get the memo.

Exactly 365 days ago October 11, Wade Jurney and two trusted co-founder partners officially hung up the shingle and started doing business for the newly christened National Home Corp out of an Atlanta headquarters. The firm's mission is to build new homes affordable on a sustainably profitable basis for households that mostly haven't attained professional class financial standing. Wade Jurney, Michael Bergman, and Gregg Erickson – NHC's co-founders – stood the new enterprise up in one helluva different economic backdrop and housing outlook.

Circumstances at the starting line for a "next act Jurney" were so starkly different a year ago than they are now, you might say just about everything's upside down from where it was. Per Redfin, monthly payments on the median asking price home this past August reached a record-high of $2,547, up 50% from $1,698 a year earlier, and that prices have now begun to waterfall, and that more and more buyers are either priced out or psyched out.

Now, demand, such that it is, is more talked about than activated in real life. Now, supply, which was woefully underbuilt 12 months ago, has emerged for many operators as a bloated albatross to try to get rid of. [This doesn't mean, of course, that homes of all sizes, types, price points, and land positions are available in sufficient quantity anywhere you look].

One constant and one only: Affordability – boom or bust – and its correlative, building affordably for profit, runs deep and wide as a common denominator for all housing cycles. Affordability, however you define it or spell it out, ranks as one of housing's challenges that morphs and expands no matter what anyone does or says about it. It's also one that neither daunts nor frustrates Wade Jurney, whether the broader housing market's chugging to meet demand like it was a year ago, or headed into a dark existential crisis, as it appears to be now.

It's my life, and our team's single strategic focus, and our reason for being," Wade Jurney told us in conversations this week. "Our goal – and we've done it before so we know we can and have to do it again – is to drive our own costs down. That's the essence of our business and operational culture. When we're fully up and running, we'll be looking to do homes something on the order of $150,000 to $250,000 in markets around the country that we serve."

If you didn't or don't know Wade Jurney, you might be a doubter.

For isn't this precisely the price-point range many of the most capable high volume production homebuilding enterprises regard as a fast-disappearing – perhaps forever – access point into an American Dream of homeownership? Even discounting for operational excellence and scale that could haul down vertical construction input expense, the land basis itself – laden with local, regional, and national regulatory costs, fees, time-in-motion expense, etc. – in most real-world cases, rules out serving a "classic starter home" market segment.

Those who've gotten to know Wade Jurney, do business with him, work on his team, and engage with his particular brand of entrepreneurial fire don't have a shred of doubt. Whether it's across the negotiating table or out in work boots on the jobsite, attention to fine details, and his unique determinism in finding a way to do what he's set about doing and stated he's going to do, those who know Wade Jurney don't tend to hesitate at taking him for his word.

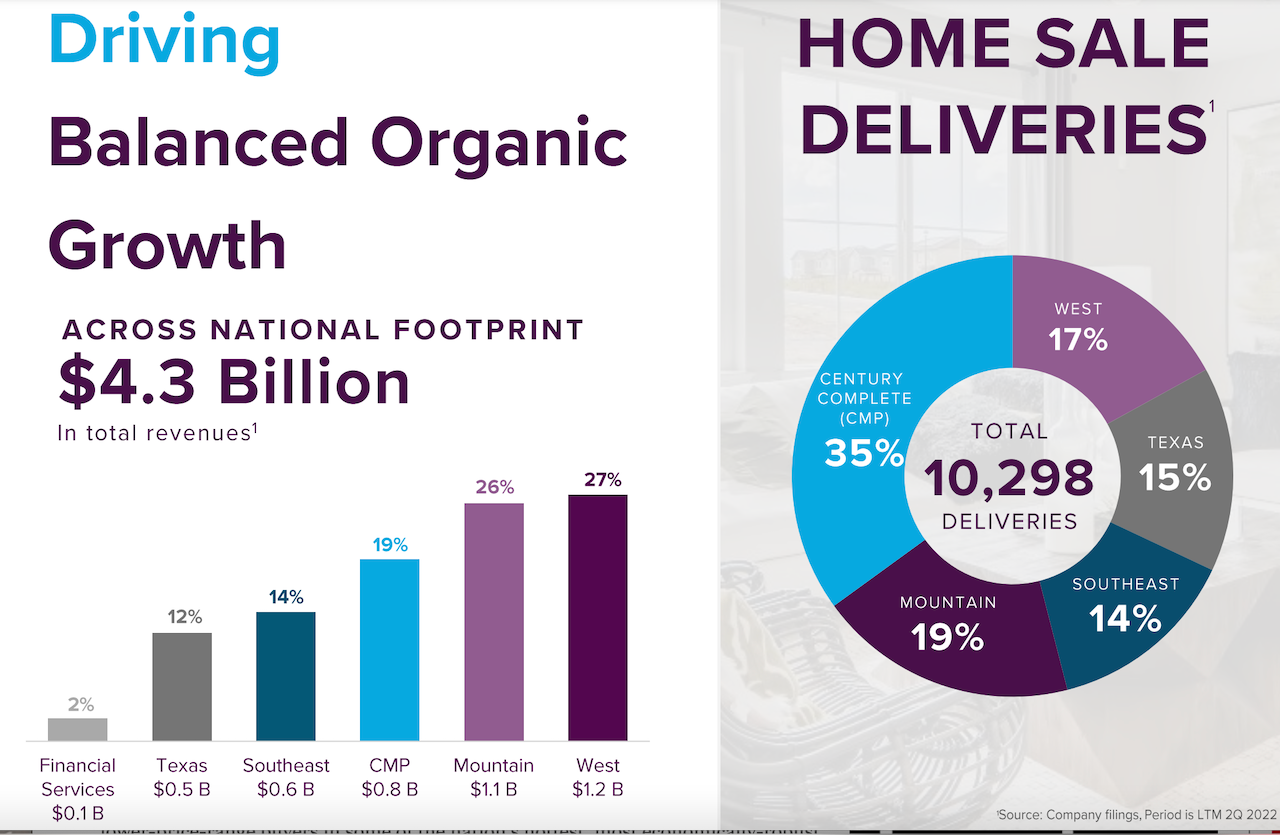

One reason for that is that is that he's already done it. As proof, a place to start might be here, where top 10 ranked homebuilder Century Communities – which purchased 50% equity in Wade Jurney Homes in 2016 for $18 million and completed its 100% acquisition of the company Jurney started in 2001 in 2018 – reports to analysts its Q2 results. The presentation notes that its Century Compete brand line of homes for entry level buyers 100% within FHA limits clocks in at 35% of Century's entire book of business, which tallied up at 10,300 homes, with revenues of $4.3 billion on an LTM basis for Q2 2022.

Century Complete, a platform within Century's portfolio that performs as a land-light, just-in-time inventory, finished-lot centered, 100% spec business and model that scales fast because it needs less capital investment and yields quicker asset turns, evolved directly out of the operational model and geographic footprint of Wade Jurney Homes.

Century was so astute in its initial purchase of 50% equity in WJH in 2016," says Tony Avila, ceo of Builder Advisor Group, which served as advisor to Jurney in both transactions with Century Communities. "The capital Century invested in 2016 enabled Wade to triple WJH unit volume, revenue, and the entity's valuation within a three-year period."

When the acquisition came to light in 2018, we wrote:

In Wade Jurney, Century has acquired a Southeastern super-regional juggernaut, with nearly 6,000 owned and controlled lots to add to Century's 30,000 owned and controlled pipeline, with nearly 1,200 homes on order worth nearly $190 million, and a last-12-month pro forma volume of 1,937 home deliveries.

By completing that initial investment--the purchase of 50% equity in the WJH entity in November 2016 for $18 million--Century locks in four key near-term and longer-term strategic objectives.

- One, and perhaps most significant, is immediate, powerful exposure to entry-level, lower-price-range buyers in some of the nation's hottest, most economically-robust Southeastern marketplaces, stretching from Florida, north into the Carolinas and Tennessee. Wade Jurney average selling prices of $150,000 may even belie the operational and selling engine that enables this firm to deliver homes at this price profitably.

- Two, the Jurney acquisition is a text-book case in the profit-margin benefits of applying rigorous submarket operational excellence for "deep scale" advantages--start-to-completion build times of 120 days maximum, evenflow lot take-downs and starts timed to completions of work in process, cluster-based project supervision and community selling, reduced windshield times, greater visibility and forward-commitment to trade base, and strong local relationships with developers and other land sellers.

- Three, the acquisition is both real estate and a talent-operational model DNA that demonstrably works in a post-distressed asset land positioning environment. In other words, the Wade Jurney model of acquiring profitably-penciling lots as an asset-light entity among competing bidders, has proven itself out even as competition has stiffened.

- Four, the Wade Jurney operational model and disciplines, as well as product line, value-engineering, customer segmentation, and marketing and sales models are portable--at least in part--to Century's other markets, which are more land-constrained, higher-cost, and higher-risk geographical markets, Denver to the West Coast, on up to the Pacific Northwest.

Jurney's return on equity centric business, operational, financial, and customer driven focus position, vis a vis competitors, partners, stakeholders, municipal officials – you name it – may sound quixotic on the face of it. Affordability ranks high, whoever you talk to and whether they know what they're talking about or not, as one of housing's most vicious vicious-circle challenges.

Starting with the moment the hard-scrabble native-born Mt. Airy, North Carolinian – having grown up working for his dad's homebuilding company during his teenage and college years – came out of school with this business degree and started his own firm in Greensboro in 2001, Jurney's focus has been the entry level American Dream seeker buyer.

We realized that, being ROE driven rather than gross profit margin driven, and focusing on velocity, operational excellence, value engineering for price advantage, and fast inventory turns, we could pull profits out of volume, rather than carry a large balance sheet like a lot of the other players. By the time the housing crash and Great Recession wiped so many others out, our model took off like it had rocket fuel all because we were able to serve that entry level first time buyer."

But, since Jurney's non-compete ran out on the eve of the onset of the Covid-19 pandemic crisis, he's been champing at the bit to reboot a new venture that would pick up – at a boot-straps level but with a big bold takeover-the-world strategic ambition – where he'd left off working with Century.

I'm all about affordable, he says. "The reason I'm starting back up, and the reason we're going big with the venture is that when I'm gone, I want that push to go on. Century has taken the WJH model and made it their own and improved it, and in a sense is proving the enormity of the opportunity in their Century Complete strategy. I hope this NHC enterprise has the same fate."

Believers include a nationwide, deep local, regional, and national rolodex of business community partners, leaders and stakeholders whose trust, confidence, and excitement over the potential for the NHC venture are evident in their immediate embrace of Jurney's alignment with Michael Bergman and Gregg Erickson.

Wade is the most entrepreneurial homebuilder I've ever known in the business," says Avila. "His systems and practices are unmatched, and his operations generate the fastest return on equity in the business, and is the lowest cost operator. What's more, he's a gentleman with the highest integrity you can find in this business.

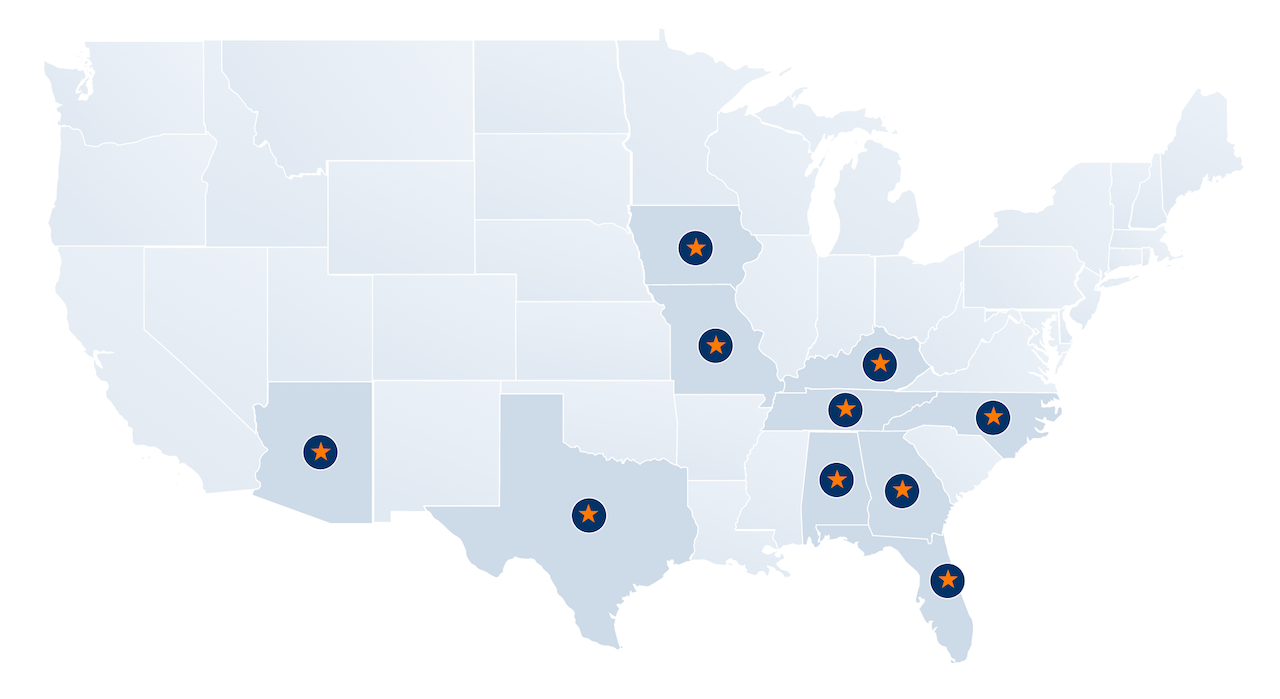

In kick-starting operations out of the gate, Jurney and team registered as licensed builders in 13 states including Florida, Alabama, Georgia, the Carolinas, Virginia, Tennessee, Kentucky, Missouri, Iowa, Texas, and Arizona, with capability in retail owner-occupier, fee-build, and building as a service operations for the burgeoning build-for-rent juggernaut.

What I might not have been aware of when we started, but am all-in on right now is the role and importance of the build-to-rent segment, as both a business model capability and an affordability platform for households who may not quite be ready for homeownership, but still want that single-family neighborhood feel," Jurney says. "Fee building at a larger scale gives us rampway to nurture our retail business even as the economy shows a lot of uncertainty."

Lenders – Wells Fargo, Regents, Fifth Third, and Flagstar – have all dialed in with capital financing to fund operations and smooth the gears as Jurney, Bergman, and Erickson set up systems, establish beachheads in their 11 state, 26 market operating areas, and get things off the ground.

We've started construction on about 300 homes, so far, and by year-end, we'll probably be around 500 starts, with about 100 or 150 completions," says Jurney. "Our matrix is to achieve a two-turn inventory turn model, triangulating around 500 homes the first 12 months, hitting 1,000 homes by 2023. Now, when we're operationally at full steam, 100% of those homes will price in below $300,000; 80% will list for less than $250,000; and 50% will come in under $200k."

Many economists and homebuilding industry pundits note that entry level, low price tier buyers tend to be far more vulnerable to being priced out these days as mortgage rates continue to rise, eliminating some on loan qualifications and others on the monthly payment power front. What some of those folks may forget is that each spike in interest rates has effect not just at the lowest level of the market, but at higher and higher ASP ranges as well, creating, as Jurney describes it, a "sliding down the pyramid" effect.

NHC co-founder Gregg Erickson, who's worked with Jurney – both at Wade Jurney Homes and at Century Communities during the 2016 to 2019 transition stage – actually sees an advantage in being the very lowest-priced product offering.

People may fall out of our price range due to rate increases as the Fed makes its moves over the next several months," Erickson says. "But when you think about the actual demand curve, what happens it that more buyers will fall down into our price range from higher price segments, than will fall out all together. It's the beautiful thing about being at the bottom. It's not an easy market to serve, but we've got it down. The margins are not that great, but in our business and the purpose fueling it, it's not dependent on the margins so much as it is the velocity. Not everybody can do that well, but Wade has become a master."

Erickson, who noted that from the moment the lights went on for NHC last October to the point where the firm could fully operate – including accounting systems, purchasing, project management, local trades, and operations – in four months.

While we are a new company, we've had relationships in all of these operating arenas for 20 plus years," says Erickson. "It's been nice given our history of good deeds with many of these partners, to have some chits to call in, and we've definitely called in some of those favors to get going on the scale we're at."

An unexpected, but crucial part of the co-founder team composition, Michael Bergman – whose career prior to the NHC venture focused mostly on infill construction and development projects as a third-generation landlord in multifamily residential rental projects – came through a chance connection. Bergman, who like Jurney, grew up in Durham, and did a lot of business in the North Carolina Triangle area, had – after spending part time in Florida for a decade or so -- moved to Naples, Fla. a year or two ahead of when Jurney and his family migrated there prior to Covid.

Until the last couple of years, since Covid really, we didn't know each other. We began to get friendly because we wound up in the same condo neighborhood in Naples, and you know, everybody knows each other in settings like that," says Jurney. "We started spending time together at the beach club with our wives, and got to talking about things. You feel it when you click with someone, and that's what happened with him. Mike really knows the ins and outs of how folks work in the rental development space and that's really interesting right now in the BFR space, where he's been critical as a source of insight and information and a presence in meetings with attorneys. He's been with me ever since then, flying three days a week almost every week, every step of the way.

And that's the thing with Gregg and Mike, they're both driven, and genuinely passionate about this affordability focus, which you have to be to make it work. I like to align myself with people who're driven by the same goals, and they show it day in and day out. It's really inside them each."

Bergman was quick to become a believer in the big, bold play Jurney mapped out, partly because he was there to witness how instantaneously all the doors began opening from the moment Jurney started sharing his vision during the summer of 2021.

It's enough to share that vision around a business that addresses the affordability crisis," says Bergman. "But when you work side-by-side with Wade and you see the impact of the trust and credibility and goodwill he's banked, with so much respect and confidence in his business and particular set of practices it's truly swayed me to want to join the team. People pick up his phone call. People want to come back and work with him. It's that character component that struck me as compelling."

NHC has put its name on the map in short order. Clearly however, this new Jurney is just beginning.

Residential construction made easy. As a tech-enabled general contractor for the residential development industry, Mosaic focuses on production-scale projects of all types, from single-family homes to horizontal apartments to other build-to-rent product types.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.