Capital

JP Morgan’s Latest Power Move: A Homebuilding Shake-Up in the SFR Market

JP Morgan’s new venture with Paran Homes signals a shift in housing’s power structure. Institutional capital isn’t just funding BTR communities—it’s now shaping how they’re built. This could be a flashpoint for private homebuilders and developers navigating the M&A landscape.

What This Means for Homebuilders, Investors, and the Future of Housing

The homebuilding M&A story continues to evolve with new twists and turns. The latest: JP Morgan Asset Management’s strategic partnership with Georgia-based Georgia Capital and its affiliated homebuilding operation, Paran Homes, to form Laseter Development Group, a vertically integrated build-to-rent (BTR) development company.

At first glance, it’s yet another example of institutional capital flowing into the SFR and BTR spaces. But a closer look reveals something more: a structural reset in the power dynamics of homebuilding, development, and investment. This isn’t just a deal; it’s a signal of a new balance of power in how capital, homebuilders, and land acquisition strategies intersect in today’s high-barrier housing market.

Why JP Morgan’s Bet on BTR Matters

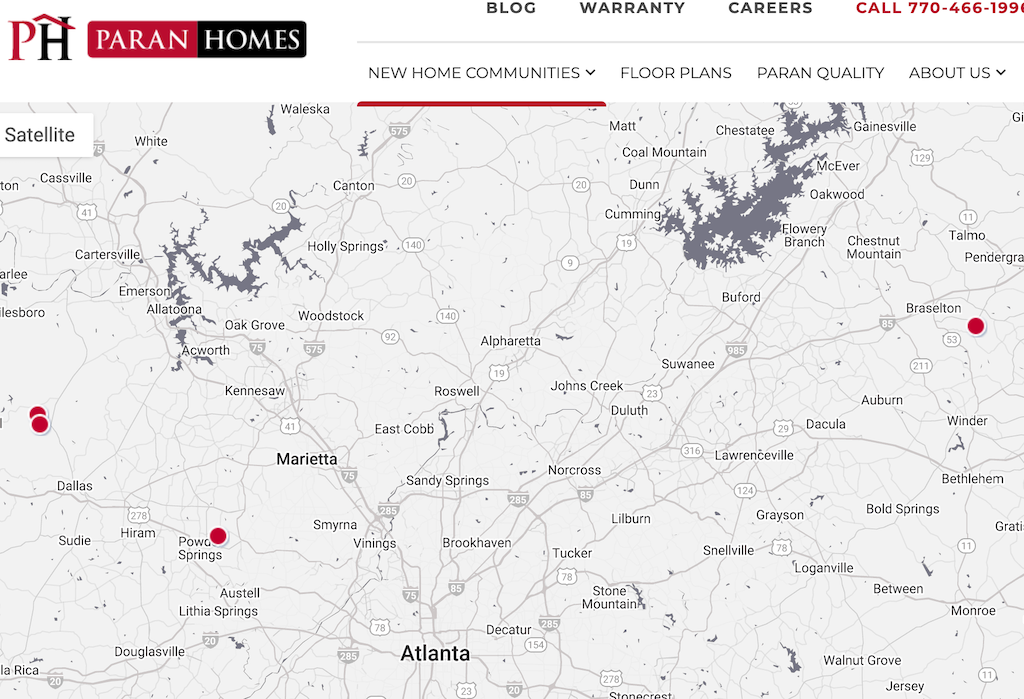

Laseter Development Group will focus on developing single-family rental communities in high-demand markets across the Sunbelt, with its first projects breaking ground in Atlanta and Nashville this year. JP Morgan’s 50/50 investment with Georgia Capital and Paran Homes gives it a dedicated BTR homebuilding capability—something that rivals like Blackstone, Invitation Homes, and TIAA have not yet fully integrated into their portfolios.

Tony McGill, Senior Managing Director at Zelman & Associates and financial advisor to JP Morgan Asset Management on the deal, explains:

“This isn’t just about another SFR investment. With this move, JP Morgan is now a built-for-rent production player — an institutional-scale homebuilding operator, not just a portfolio buyer. That’s a major differentiator from its competitors.”

In other words, JP Morgan has redefined its role in the SFR/BTR space. Rather than acquiring finished rental homes or relying on forward-purchase agreements, it’s now directly influencing development, construction, and land acquisition. That’s a fundamental shift from the traditional BTR investment model.

Connecting the Dots: JP Morgan’s Broader SFR Strategy

To understand the significance of this move, it’s essential to look at JP Morgan’s larger SFR playbook. The firm has steadily expanded its footprint in the space, including:

- A $1 billion joint venture with Haven Realty Capital in 2022 to acquire and develop BTR communities.

- A $2 billion SFR portfolio spanning 65 communities and 6,000+ homes.

- A 2017 $1 billion investment in American Homes 4 Rent to gain exposure to scattered-site SFR portfolios.

Now, with Laseter Development Group, JP Morgan isn’t just buying into the rental market—it’s building the future supply. That gives it direct control over costs, efficiencies, and community design, making its long-term investment play even more robust.

McGill adds:

“For institutional capital players like JP Morgan, being able to deliver housing at scale, in a managed environment, and control the cost basis—that’s a critical advantage over purely acquiring scattered-site rental homes.”

Why This Deal Is a Flashpoint in Homebuilding’s M&A Wave

The deal also highlights a bigger theme that has been driving homebuilding’s M&A surge since late 2023.

A thicker, more complex buyer pool for private homebuilders

M&A activity isn’t just about large public builders consolidating smaller firms anymore. Institutional capital, private equity, and global asset managers are now in the mix, adding new layers of competition—and value—into the equation for private builders weighing an exit.

A “now-or-never” moment for independent homebuilders

Many private builders face rising land costs, high borrowing rates, and aging leadership. Deals like this underscore how institutional players are aggressively expanding their footprint — leaving some independent operators wondering whether now is the best time to cash out.

The permanent rise of the BTR sector

JP Morgan’s latest move further solidifies what’s been happening under the radar: BTR is no longer a niche strategy—it’s a structural component of the housing market. The long-held assumption that homeownership preference will always dominate is fading as more households opt for high-quality single-family rentals as a lifestyle choice, rather than a stepping stone.

Strategic Takeaways for Homebuilders and Investors

BTR is becoming a power sector in homebuilding

JP Morgan’s move suggests BTR is no longer a secondary strategy — it’s a front-line investment thesis. Builders who haven’t factored BTR into their portfolio need to reassess where they fit in this evolving landscape—as potential sellers, partners, or direct competitors.

Private homebuilders have more exit options than ever

JP Morgan’s presence in BTR expands the buyer pool for private builders, offering more opportunities for acquisitions, partnerships, or joint ventures. Seller principals should consider how institutional capital could play into their own land and development strategies.

The homebuilding industry is seeing a new class of institutional builders

Traditional public homebuilders (Lennar, D.R. Horton, Pulte) aren’t the only big players in the space anymore. Financial giants like JP Morgan, Blackstone, and TIAA are now direct participants in homebuilding, land development, and community creation. This reshapes competition, particularly in high-growth Sunbelt markets.

A Tectonic Shift in Housing’s Power Dynamics

JP Morgan’s Laseter Development Group partnership with Paran Homes and Georgia Capital is more than just another investment—it’s a reset in the balance of power in homebuilding.

McGill sums it up:

“For years, BTR was something institutional investors wanted exposure to, but they lacked a way to control the process. Now, JP Morgan has changed that dynamic. They’re no longer just investing in single-family rentals — they’re producing them.”

That’s a tectonic shift — one that private homebuilders, institutional investors, and land developers cannot afford to ignore.

What’s Next?

This move positions JP Morgan at the center of a rapidly evolving BTR landscape, raising critical questions for builders, developers, and investors. Does this signal an institutional-scale shift in how new rental housing is produced? Will other institutional investors follow JP Morgan’s lead, or will they stick to acquisition-based models?

This isn’t just another market trend for homebuilding leaders — it’s a new reality, a smaller and smaller world dominated by fewer, larger and larger power-players. The capital, the players, and the business models are changing. The only question now is who adapts—and who gets left behind.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.