Capital

Jobs And Homes: Amid Mixed Signals, Learning Beats Knowing

How to read the May jobs report in five easy pieces.

Bad news is the new good news on the jobs and housing front.

So, too, is the opposite. Good news is the new bad news.

That's because, while a rebounding employment report reflects an economy on sturdier ground, the devil in its details triangulates around three stress and strain points for residential construction investors, developers, builders, manufacturers, distributors, and their stack of partners.

- Wage inflation

- Working age male labor participation declines

- Greater unconstrained demand versus greater constrained supply

For May, nonfarm payrolls rose by 559,000, and unemployment dipped 0.3 percentage point to 5.8%, according to the Bureau of Labor Statistics. The headline number missed estimates of a consensus of economists (that consensus, a topic for another day). Still, as Wall Street Journal staffer Amara Omeokwe reports, the broad takeaway – especially in light of a generalized apocalyptic mood 12 or so months ago – is constructive.

The faster pace of hiring came as several factors are propelling a burst of economic activity. More Americans have become vaccinated against the coronavirus, and state and local governments have eased restrictions on businesses as Covid-19 cases have declined and as the federal government has relaxed its pandemic guidance. Those factors, along with federal pandemic aid, have prompted a pickup in spending, particularly at services businesses, which in turn is stoking labor demand.

The overall miss in the topline number is not a big whoop, however the worrisome notes in the BLS report concern a step down in labor participation, and an irky escalation in hourly wages – both factors boding who-can-say-what? But worrying.

Hey, it's June. It's hard to find and hire good people. It's hard to keep good people on the payroll. And it's hard to turn those multiple spinning plates of unpredictables into completed homes and happy customers.

When intuitive thinking leaves one short, and when down looks like up and it all looks upside down, counter-intuitive focus and a reframing of challenges in a longer-term light can help. Here's five take-aways from the Employment Report that, while they don't sugarcoat the intensity of difficulties and scope of underlying issues right now, may offer a path of agency and accountability for leaders and line managers in circumstances that may feel entirely out of control.

- Employment rebound and greater demand is the better challenge to face, versus signals of stagnation that could reverse the rate of job openings and pivot enterprise from expansion to contraction and cost cutting.

- Directionally, and compared with the April report, the headline data shows structural steps toward normalcy – with resumed livelihoods trumping the comfort of Uncle Sam-supported home-bound financial lifelines. In other words, work matters to people and it's starting to prove out.

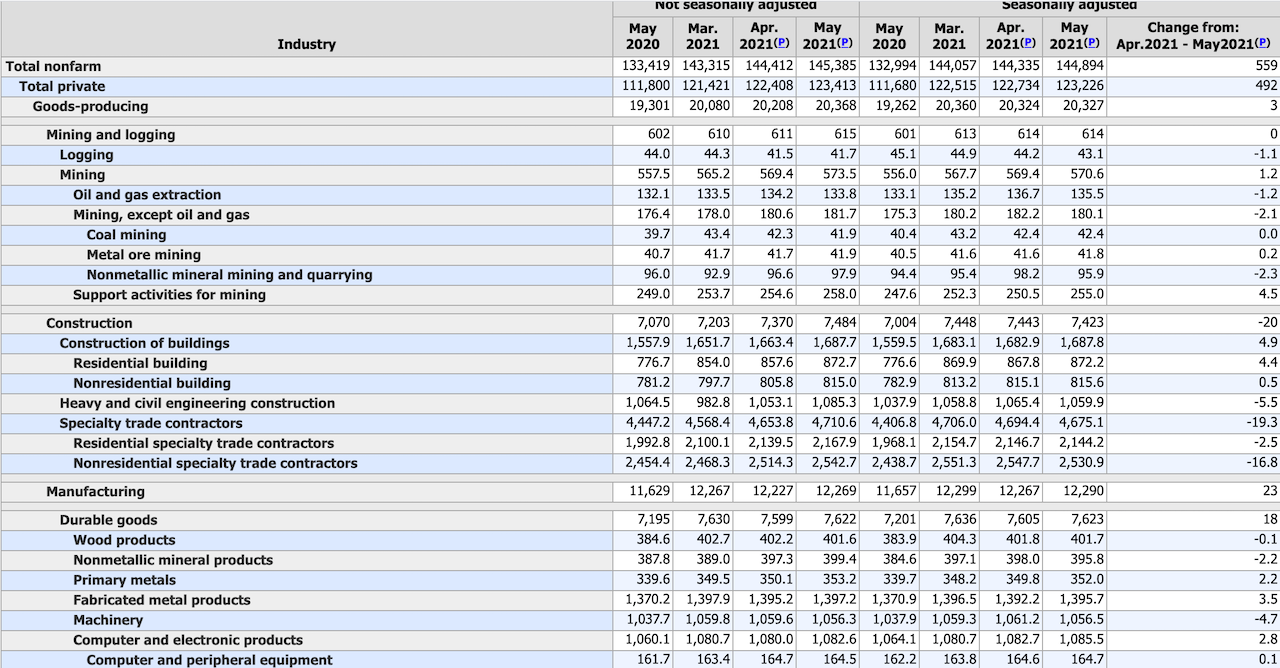

- Residential construction workers are coming back. BLS data shows an increase of 90,000 in residential construction employment year-over-year, since May 2020, a 4.4% increase. While this rate of improvement is far eclipsed in this report by hospitality, travel, leisure, and entertainment private sector employment increases, it shows that builders have made strides at pulling people out of unemployment insurance on to job sites.

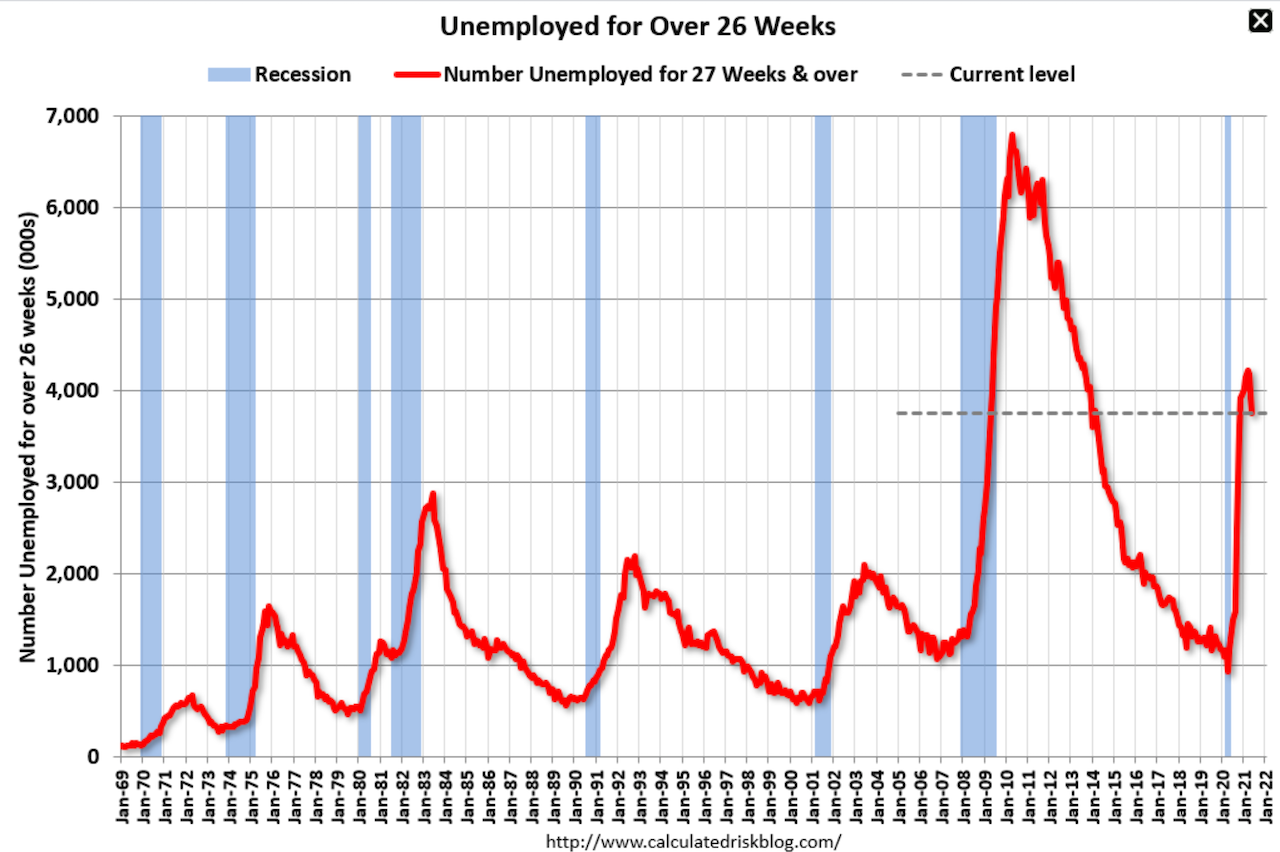

- The more important – less vaunted – data point – and where there's both a big, hard problem and enormous opportunity right now for those who are investing in, developing, designing, and building market-rate homes is the long-term unemployed number. That number represents either a stubborn, paralyzed expense to society, or – for builders keen to tap into a greater universe of motivated potential trainees and jobsite workers – a ready-and-willing pool of potential. Calculated Risk's Bill McBride notes:

According to the BLS, there are 3.752 million workers who have been unemployed for more than 26 weeks and still want a job, down from 4.183 million in April. This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

- The final piece here with respect to understanding what signal to detect when signals are mixed is this. Nobody has a corner on the market for learning and discovery. The facts are that the current situation – with its precedents and unprecedented dimensions – calls for business leaders to learn more right now than they know.

That's reality's way of saying the playing field is level for everyone with the humility to say he, she, and they have a lot to learn.

A parting thought about "knowing vs. learning" from Medium contributor Keara Mascareñaz:

Tom Chi, Founder of Prototype Thinking and former leader at Google X and The Factor. Tom has ... discovered an important insight. A brain in knowing mode is distinctly different from a brain in learning mode. As Tom has described, “When you’re in knowing mode, it shuts down the capability of your brain to form new learning memories. When you’re knowing you are trying to hold tight to your current sphere of knowledge. When you’re learning, you are seeking to expand your sphere with new data and possibilities.” As much as we like like to think we can both know and learn at the same time, we simply cannot. As Tom has explained, “It’s hard to do any two verbs at the same time [think playing the violin and riding a bicycle]. It’s even harder to be knowing and learning at the same time.” And yet, we very often conflate our experience of knowing and learning.