Capital

Is It Time To Go Public? Here's What Goes Into IPO Success

Four bedrock requirements for any homebuilding enterprise to pivot from private to public on a solid footing to build a high-performing business.

Is now time for a fast-growing private homebuilder with a strong customer segment value proposition and a solid, scale-able operations system to go public? Smith Douglas Homes filed Sept. 6 with the SEC its plans to offer shares of the company to investors at a moment when the IPO market seemed ripe for a run. Since then, however, investment capital markets have taken a turn.

Uncertainty has generally been climbing in the US stock market, at least as measured by a common fear gauge, the Cboe Volatility Index or VIX. With questions swirling about the market’s direction, Microsoft-backed cybersecurity software-as-a-service company Rubrik Inc. delayed filing for an IPO, originally slated for Tuesday, until further notice, people familiar with the situation said. It cited market conditions.

Issuers are being forced to think carefully about the risk of the government closing, said Kati Penney, a corporate transactions lead at CrossCountry Consulting. While companies face multiple risks, “more contingency planning is now coming into play with a potential government shutdown,” Penney said. – Amy Or and Bailey Lipschultz, Bloomberg

Whether Smith Douglas moves forward with its plans is subject to speculation, according to industry executives with knowledge of the initiative. What's more, every week of an evolving higher-for-longer cost-of-capital regime takes a greater toll on both the demand and supply sides of housing's business equilibrium.

Four paragraphs in a letter today from residential real estate, construction, and mortgage lending industry groups to Federal Reserve Chairman Jerome Powell spell out just how deeply worried they are about their immediate future. From the sounds of it, a not-so-bad, better-than-expected 2023 is at risk of unspooling into a disastrous year-end and a painful year ahead.

According to MBA’s latest Weekly Applications Survey data, mortgage rates have now reached a 23-year high, dragging application activity down to a low last seen in 1996. The speed and magnitude of these rate increases, and resulting dislocation in our industry, is painful and unprecedented in the absence of larger economic turmoil.

Today, the spread between 30-year mortgage rates and the 10-year Treasury yield is at historically high levels, signaling deep-seated uncertainty about where the Fed is headed.

The difference between the current spread and the long-run average indicates mortgage rates for homebuyers across the country that are at least 120 basis points higher than they otherwise would be. In other words, the uncertainty-induced mortgage-to-Treasury spread is costing today’s homebuyers an extra $245 in monthly payment on a standard $300,000 mortgage. Further rate increases and a persistently wide spread pose broader risks to economic growth, heightening the likelihood and magnitude of a recession.

Furthermore, a leading source of inflation in recent months has been increases in shelter costs. In the August CPI report, consumer prices were up 3.7%, while shelter costs were up 7.3%. In July, shelter inflation was responsible for 90% of the gain for consumer prices. The most effective approach to tame shelter costs, and assist on the broader inflation fight, is to facilitate the construction of attainable, affordable housing. Sustained wide spreads or further increases in interest rates make this economic goal more challenging by limiting lot development and home construction, exacerbating housing supply, and pricing out millions of households from the goal of homeownership. – MBA.org

Still, no matter how stressed and adverse conditions are for eight- or nine out of 10 homebuilding operators around the country, outliers inevitably strengthen and grow even as the others are back on their heels playing defense. We've written recently about a handful of such privately-held outliers, scaling up when others are battening down, and seemingly on a big, bold mission of market dominance and national enterprise impact.

At any given time over the past two years since the post-Covid juggernaut in homebuyer demand, eight to 10 privately-held homebuilding companies at least have contemplated going public according to Tony Avila, CEO and founder of Builder Advisor Group, a supporting partner of The Builder's Daily.

According to Avila, now may not be ideal for a builder to initiate a public offering, even if it can.

There was hope that we would see a reduction in long bonds and in the 30-year, mortgage rate in the beginning of September. In fact, what we saw was the Fed messaging to the market that we're going to be higher-for-longer and we may even have one more Fed funds target increase. Then there was the threat of the government shutdown. That caused a lot of concern about owning US Treasuries. Later, we saw the US Treasury curve right itself. We saw the long-dated end of the of the Treasury curve from five years to 30 years increase dramatically. We saw the 10 year at its highest point since 2000, and the 10-year Treasury Bond at its highest point, since 2007. As that all occurred, mortgage rates increased dramatically. As that happened, research analysts said, 'there's going to be price pressure. Maybe the pace slows a bit. Maybe house prices can't go up.'

What's more, gross margins may deteriorate because builders will have to offer larger concessions or rate buy-downs or other incentives to get consumers to buy the houses. So with higher mortgage rates and potential for gross margin deterioration, builder stocks traded off dramatically. As market expectations for builder earnings decline, stock prices decline, and that sort of closes an IPO window.

When you have expectations that builder stocks are going to go up; when you have mortgage rates maybe coming down; when you have margins increasing, ... this is a time for the IPO window to be open. When you have the prospect of mortgage rates going higher margins coming down, and potential builder earnings coming down. That will close the IPO window."

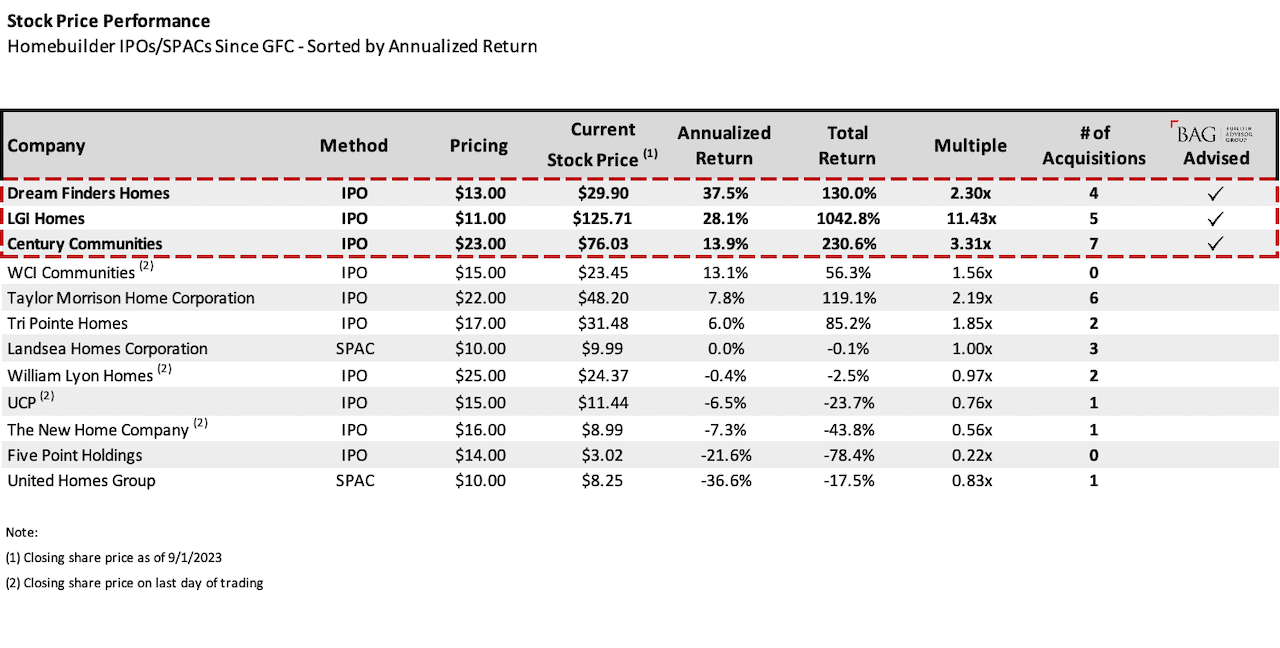

Tony Avila should know. He and his Builder Advisor Group were IPO advisors on three of the past decade-plus's best-performing companies since they offered shares to the public. Here's data that backs that up:

We advised all three in structuring their IPOs in a way that put shares in the hands of people that want to hold for the long term," says Avila. "That means you get a lot of friends and family that will hold shares for the long term you get the shares in the hands of board members and employees that are invested in the firm. And I think you'll see a lot of employees at a Dream Finders and LGI Homes and Century Communities who have significant holdings and stock. That's important."

We talked with Tony about the common strategic, management, and organizational ingredients that go into the IPO recipe for success, starting with size, scale, and a sharp growth trajectory. Those common ground ingredients include: 1) start with the right capital stack at IPO, 2) enhance it using the public markets, 3) retain the right people, 4) focus on growth in the right geographies, 5) be smart about utilizing acquisitions for growth.

Here are some excerpts from Avila's insights into what makes for a high-performing company from the time of a strategically-executed IPO:

On Size And Scale:

To have adequate size and scale, a company needs well in excess of $100-to-$150 million of equity in the company. The builder is probably making at least $40 million of pre-tax income – the tax effect takes that down to about $30 million net. And maybe they should be fairly geographically diversified; three, four, five, or six different markets at least. Another factor for a company is that it's growing quickly – growing margins and earnings. That's all table stakes.

On People

The builder's going to have to have a public company-quality CEO and CFO, and be prepared to have a strong board of directors with good corporate governance. The firm needs to establish an audit committee, a compensation committee, a Corporate Governance Committee, etc. Depending on which states they do business in, they may have to have diversity among their board of directors as well."

On Financials And The Capital Stack

There are requirements, including audited financials for the trailing three years that are PCAOBP (Public Company Accounting Oversight Board)-compliant. What's really important when you look to go public, is I've seen a lot of guys go about doing it without using the right advisor and setting up the company appropriately. The other thing you have to be prepared to do is have the right capital stack in place. What you want to do is make sure you've got a syndicate of commercial banks that are prepared to take the company to an unsecured syndicated borrowing position. Some builders go public with disparate borrowing and credit facilities, and they’re borrowing on a secured basis, which can be way more expensive.

Having the right capital stack, the right blend of that inequity is mission critical. So is having an independent advisor. With an independent advisor, it’s likelier you’ll wind up with the most favorable valuation and best execution of an IPO for your company. The idea is to place the shares of stock from the IPO in the hands of people who are going to hold it for the long term and to create scarcity when you do an IPO. This results in strong demand in the aftermarket so that the stock trades well.

On M&A

As a public company, you have greater access to capital. And certainly, as a public company, you get larger, you're saying you're going to be around for a long time. A lot of talented people are very interested in being with a company that's growing and going to be around for a long time and can offer up shares to employees. Having a strong acquisition strategy as a way to grow your business makes a lot of sense.

If you look at the top builder out there, D.R. Horton. The way they became the largest builder in America was 17 acquisitions from the mid-90s through 2002. And Lennar: they've been very prudent in doing transactions. In the early days of the 90s, it was US Home and subsequently a huge one that was CalAtlantic. And they've also done smaller transactions where we've been had the opportunity to work with Lennar as well. Pulte successfully acquired Del Webb in the 2000s, and came to be the 3rd largest by combining with Centex. So if we look at the top three builders in America, you're gonna see they've had a very successful history of strong acquisitions. And that's, that sort of gives you a good indicator or a strong indicator of how to be successful.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.