Land

Insurance Tactics Builders Adopt As Volatility Casts Its Shadow

Big public builders have pivoted land strategies to allow them to weather a bumpier patch ahead and troll for opportunity. Smaller players have literally fewer options to de-risk.

De-risk.

It's one of those terms that word-police should never have been allowed into the English language.

Only its meaning now – at a juncture of furious price growth, inventory scarcity, and as-plain-as-day demand with known and unknown unknowns that can quickly turn expectations inside out – validates how and why it belongs. It lurks near the surface of so many conversations in residential real estate, explicitly or not.

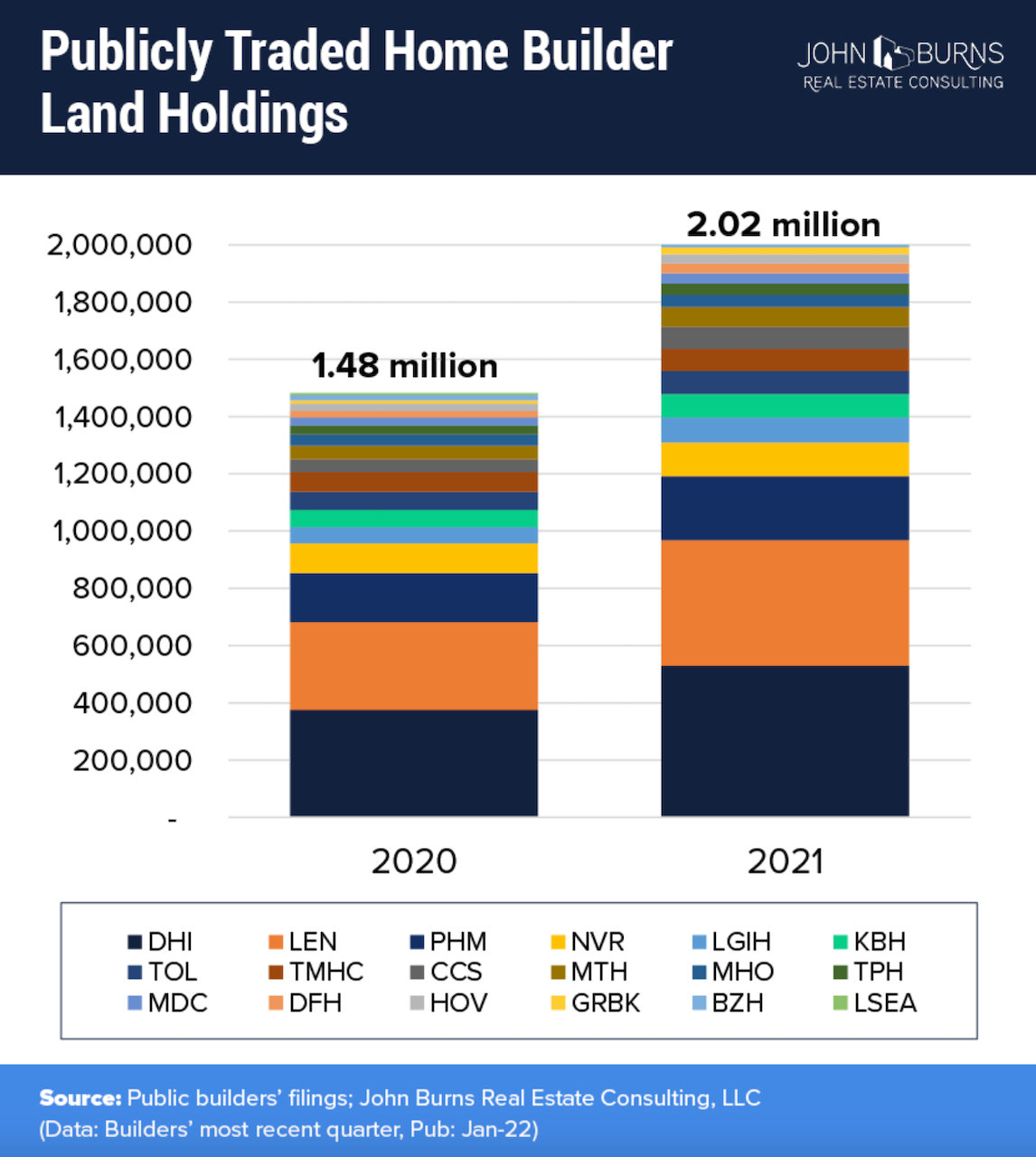

The John Burns Real Estate Consulting research team recaps a macro pivot to reduced land exposure in its analysis of 18 public homebuilders' owned- and controlled land inventory disclosures from 2021.

The high-level, JBREC ceo John Burns and senior manager of Research Danielle Nguyen note, involves a multi-billion-dollar rotation aimed at securing building lot futures that build in buffers for bumps, chops, spikes, and drops in exchange for a share of the largesse appreciating property values will throw off if volumes pick up and sustain at predicted levels.

Even as they've added assured access to more building lots, big public builders – using enormous access to institutional, low-cost debt – have deepened the inventory-turn capability of their empires while at the same time lightening their balance sheets of the full-weight of ownership.

In the mega-realm, where 18 enterprises account for more than one of every four new homes developed and built each year, here's a illustrative back-drop of de-risking in action.

As you can see from the year to year changes in the "stack" of lots owned and controlled by the 18 public builders, the total investment in secured access to land inventory swelled by 36%, with total lot-count increases reported by each of the 18 organizations.

The twist, Burns and Nguyen note, is that while their investment "paid reservations" to buy lots has swelled, they've also paid for insurance protections to their balance sheets should reality work differently than expected.

They elaborate here:

De-Risking of ownership

* 15 of the 18 builders own a smaller % of the lots than they owned one year ago.

* 3 of the 18 builders even own less than 25% of the lots they control, led by NVR which owns none of the lots.

Burns offers a framework for two key strategies larger homebuilding enterprises pursue to shield themselves from surprise negatives:

Options – effectively secured with monthly payments to landsellers to hold that property off the market during entitlements, permitting, and development and converting into an agreed-upon periodic take-down schedule – represent one preferred route for builders with deep, patient capital and development capability. This asset-lighter strategy is a price builders pay for the ability to walk-away from lot acquisition plans, an alternative they'd prefer to having to sell fully-owned land assets into a depreciating marketplace in the event conditions deteriorate.

Land banks, which require an upfront security deposit that protects the "bank" from walk-aways and serves as a land planning, entitlement, permitting, and development fund, give builders access to a take-down schedule. Again, this allows builders to count on access to a clear dashboard on a lot pipeline, but keeps the assets, their carry costs, and their ultimate exposure to depreciation in value off the builders' balance sheets. Burns and Nguyen write:

These agreements align the financial interests of all parties:

Home builder shareholders desire to maximize the return on their invested capital, while having certainty that they will have the land they need.

Long term land owners like farmers desire to maximize their net worth and are less interested in the time required to do so.

Land banking financial institutions are looking for a good risk-adjusted yield on their investment. In today’s low yield environment, money has been flowing into the land banking business.

Thing is, many, many builders are in a different boat when it comes to de-risking. That includes approximately the more than 4,000 other firms that build 10 or more homes a year, and account for 9 out of 10 new homes built, but don't have access to institutional capital to smooth out the bumps of a turbulent period ahead as the economy continues its effort to find solid footing in the wake of horrific shocks and stresses in late winter 2020 and the series of Federal rescue programs put in place to support life as we know it.

Now, risk, as we know it, first popped into English usage in the 1660s, taking its shape and meaning from the Italian word "riscare," to run into danger.

Risks to 2022 business plans run across the spectrum for builders of all sizes, their manufacturer and trade partners, their capital and land investment and master plan development ecosystem, and municipal jurisdictions counting on the bounty of fees, taxes, and and ancillary business revenue.

- A chronic skilled labor crisis now amped up exponentially in pandemic era wage inflation, job quits, early retirements, and declining interest in construction fields among younger people

- Supply chokeholds – a blend of raw materials, people, and timing – that are expected to bedevil completion schedules, revenue recognition, and cost management for the foreseeable future, casting uncertainty and doubt as to what builders and their partners agree to sell without assurance they're able to produce the deliverables

- Runaway input cost increases, an inflationary spiral that can only be relieved by greater production capability across a broader set of competitors, can continue to pressure builders to embed price escalators into their purchase contracts, which could strain relationships with buyers and trigger higher cancelation rates.

- Add to these known risk zones, unknown ones – impacts to consumer sentiment, big layoffs due to lowered business and operational guidance, global political turmoil, new variants of COVID-19, etc. – that may not only deflate demand, but begin a surge of distressed and zombie property conditions as the economy digests structural shifts in livelihoods and wherewithal.

Nobody really expects a scenario like that – especially in light of current and prospective population and age demographic patterns. In crude raw terms, more young adults making a living and forming their families are due to serve as an sturdy engine of economic and housing growth.

But everybody with a bank loan, payrolls to make, materials bills to pay, and homes to deliver to cover for all of that knows there's a real gap between what happens in crude raw terms and their business's liabilities and opportunity.

That's why the distasteful and inelegant word "de-risk" comes so easily to the tip of many tongues as operators plan for the worst and hope for the best for what's ahead.

Join the conversation

MORE IN Land

Millrose Q3 Outperforms On Tech, Discipline & Land‑Light Strategy

As many builders pull back, Millrose Properties leverages data‑driven underwriting and select partnerships to bank growth despite a softening market.

Jody Kahn: What Builders Say Now About New Home Demand

Amid slumping buyer urgency and looming policy uncertainty, John Burns Research & Consulting research guru Kahn summarizes builder sentiment trends and pain points from fresh field data.

Texas Land, Texas Spirit: A Wake-up Call For Better Neighborhoods

Scott Finfer calls for a reinvention of how communities are built—away from formulaic lot counts and toward ecosystems rooted in landscape, design, and daily experience. His essay challenges developers to deliver neighborhoods that endure and reflect the best of the Texas spirit.