Leadership

Inside LP's Blueprint To Leverage Innovation, Partners For Solutions

A cultural pivot -- from building materials and products manufacturer to customer-focused technology-powered solutions platform -- points to a win-win transformation.

[Editor's note: The Builder's Daily stands for solutions-seeking through business and strategic partnership across the real estate and building lifecycle. After noting last week in our analysis of LP Building Solutions' executive changes and strategic investment and commitment to its advanced-framing capabilities at Entekra, we're energized to have Craig Miles, who heads up National Sales and Marketing for OSB/EWP, LP Building Solutions, with us today. Here Craig takes us inside LP's own adaptive transformation over the past few years, and unpacks two vital necessities to 2020s capability as we will know it: 1. customer-centric innovations and 2. partner-enabled solutions. We're grateful to add Craig's voice to a much-needed dialog and aligned effort among builders, manufacturers, distributors, developers, engineers, architects, and investors to solve for our raft of epic challenges. – John McManus]

Challenges our industry has faced in recent years are unmatched. We have been hit with a record number of destructive storms, a devastating health crisis, a labor shortage, a materials shortage ... the list goes on and on.

All this to say, these issues may divert focus away from a root issue and monumental threat: a lack of innovation. The construction industry is the largest in the world, yet has only seen a 1% annual growth in productivity over the past 20 years.

Our industry’s focus glues itself to cyclical issues. While yes, these are real and impactful issues that demand our attention, what if constantly tackling these boom and bust problems sways our attention away from larger issue of pushing progress in the building industry’s ideology and practices?

Our Industry Lags

The building industry is traditional; it's prone to avoiding change. Many homebuilders use the same thinking and building practices for generations. These practices have been handed down from older, and wiser, generations. However, as a result, the community struggles to keep pace with advances in technology, increased housing demand, affordability issues, volatile weather patterns and resiliency issues. While an older workforce has the benefit of sharp skills that can only be honed through years of practice, the industry would also benefit from diversity of thought. Sometimes disruptive thought is what helps drive us forward in terms of innovation and productivity.

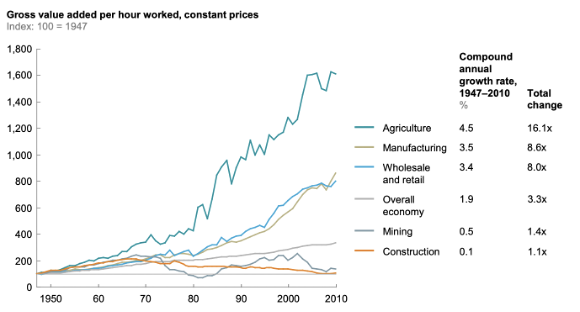

Let’s juxtapose our industry with a similarly traditional industry: agriculture. The agriculture industry embraced innovation through technological and scientific advancements, such as vertical farming, robotics, etc. As a result, agriculture saw meteoric growth. This comes through clearly in a 2017 study by the McKinsey Global Institute that outlines the productivity growth (as measured by gross-value added) of various industries from 1947 to 2010. The gross-value added in agriculture compared with construction in the figure below speaks for itself. If the agriculture industry can improve productivity through innovation, why not construction?

Why Now is the Best Time for Innovation

If there is ever a time to reimagine the way that we build homes, it is now. The moment, 2021 leading into 2022, offers a plethora of environmental and economic factors that require a new way of thinking to build more resilient, affordable homes.

- Storm Frequency: The number of storms in the U.S. has been increasing. NOAA reported 2020 as a record year in billion-dollar extreme weather events, and it is only expected to get worse.

- Sustainability: With average home sizes trending larger, and recent climate change concerns, sustainability has become a top-of-mind issue. Buildings use vast amounts of energy and are a primary source of emissions. There is a need for more efficient building practices, as well as more energy-efficient buildings, if we truly want to make a difference in the environment.

- Economic Factors: Finally, our industry is facing a labor shortage, affordability crisis and housing shortage. Demand is simply growing faster than supply.

Listen, Learn, Adapt

All this may sound like a bleak assessment of our industry and its outlook. My goal is not to discourage but to shed light on the opportunity and need for change. So where do we go from here? Innovation is far easier said than done. It will require unprecedented industry collaboration and cultural change.

To start, suppliers must work harder to uncover pain points that homebuilders may not know they have. Discovery of these pain points requires that business community leaders take special care to listen to and get to know their audience. We need to be much more intentional about having problem-discovery conversations and asking questions that will extend past surface-level problems. This will drive true partnerships between builders and building companies, creating value for both parties.

Innovation demands an individualistic approach that both builders and building companies evolve. Not all builders should be building the same structures and systems. That's because each climate, homebuyer, and homebuilder is different. In other words, we must also tackle mass customization. How can suppliers better scale solutions that meet the unique demands of individual builders, their geographies, and their homeowners?

In this way, innovation hinges on a customer-centric approach.

- Climatology: Climatology will be a central issue around which suppliers and builders must innovate. Climates are variable and weather events are becoming more frequent and more extreme. As a result, the methods and materials used to build homes must adapt. A home in Maine should not be built the same way that a home in Florida is built. Each should be built to help defend against the specific weather and resiliency concerns of its specific geography.

- Homebuyers: The term “homebuyer” captures a diverse range of people, all of whom want different things from their home. An empty-nester Baby Boomer will probably want something different from a Millennial wanting to start a family. But they all want it to be more efficient and cheaper ... yesterday. As an industry, we know homebuilding must change. However, addressing homebuyer bias and the prevailing psychology of first-cost, homebuyers demand quality without an understanding of the required investment and eventual ROI. This leaves builders and suppliers feeling intense pressure.

- Homebuilders: Finally, each homebuilder has a different approach to their business, as well as a vision of what kind of legacy they want to leave. Some builders want to be known for building the greenest homes. Some are focused on luxury. Others need to build quickly and affordably. It requires a certain amount of internal searching and honesty, but once a builder knows where they want to go they should seek industry partners and true collaboration with those partners to support their vision.

LP’s R&D Transformation

In 2017, LP undertook a transformation. We evolved a products company into what we are now, a technology-driven solutions company. We changed our name from LP Building Products to LP Building Solutions and began a journey that underscored the centrality of innovation. It's become clear that innovation has to be our future. There is real business value in driving innovation. Enduring innovation insulates LP from being whipsawed by the market, creating more stability and driving greater value for our customers.

With this in mind, a key aspect of our transformation then became R&D. Specifically, a more customer-centric approach to R&D. Rather than just create some “widget” to present to the market, we aim to take a problem-solving approach by listening to customer needs to engineer solutions that address that pain point. Our Structural Solutions portfolio is, in some ways, a manifestation of our new R&D philosophy.

Our development process for this portfolio hinges on the biggest industry issues and resiliency threats: thermal, moisture and strength. We took a step back to consider more than just how to address these issues, but why these are problems. Looking at homebuilders’ pain points in a broader context allowed us to see the inefficiencies. For example, if moisture management is an issue, what are some of the roots of this problem? Many builders leverage housewrap to keep out moisture during construction. However, workability issues and human error are prevalent with typical housewrap. It also requires builders to sheath and then wrap a home — a two-step system. Based on insights like these, LP developed an integrated weather barrier system.

On the siding piece of our business, while we know how important aesthetics are to homebuilders and homeowners, workability is critical. LP realized that forming siding corners could be time consuming for builders and recently introduced outside corners, j-blocks and mini-splits to help builders achieve velocity, and right-the-first-time reliability.

Before our transformation, we'd engineer a product then find a way to market. Post-transformation, we seek what the market truly needs and innovate to develop that. That may seem like a subtlety; it's actually profound. It requires a shift in R&D processes, but even more a cultural pivot within our organization. LP employs many brilliant engineers. However, now the R&D team is focused on not only attracting brilliant engineers, but also deep thinkers, inherent problem solvers and collaborators. The R&D team also prioritizes building partnerships with homebuilders, so we can dig deeper into problems and collaborate on better processes and products.

Bottom Line

Ultimately, innovation is all about collaboration and customer-centricity. Once we have buy-in and collaboration from all the players in the game, we can open the possibility of taking on the industry’s deep and unknown problems. Uncovering needs and finding solutions happens when partners can align their customers’ hearts and business goals. Suppliers must help their homebuilders be the professionals builders they want to be; homebuilders must create spaces where their homeowners can thrive.

This work requires deep investment in understanding and partnership. The ability to actively listen and deeply understand a problem will ultimately drive more substantial and progressive change than trying to address surface-level issues.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.