Policy

In Digital ID Era, Property And Privacy Enter Brave New World

The inevitability of an industry standard property identification record -- and its vast array of benefits and uses -- doesn't diminish the need for eyes-open recognition of the big risks.

People in the multi-trillion-dollar residential real estate complex in the U.S. draw on a kajillion data points.

Some capably harness – through canny intuition, the school of hard knocks, or deep disciplined data science – fast, deft, and value-producing capture-or-divest action plans out of data models that can, more-times-than-not, convert a real-world mess of property transaction and development into real estate's investment, community planning, and construction Fortune 100 empires, or mini-fiefdoms.

In fact, a superabundance of data, a tiny finite percentage of which is usable to some as opposed to all of the rest of us – the imbalance of the power of information and knowledge – makes and breaks. That asynchrony creates winners and losers, and defines the real estate property trade, the advantages of a first-mover, the reward of opportunity and the pain of risk, and the winnowing of the less smart from the ones who thrive in the game.

So, what if a data benchmark standardized, democratized, and leveled the knowledge playing field?

- Where would that level-set begin?

- How would it impact asynchronous advantages and disadvantages in real estate valuation and trade?

- Importantly, what occurs when – not if – malicious players engage in, steal, and/or potentially destroy livelihoods or lives with its misuse?

Two values – zero and one – hold a key to a simple, elegant, profound, and potentially unnerving brave new world for the residential property sector and its ecosystem of stakeholders, down to the mailbox and kitchen table level. It's binary code, zeros and ones, that stand as the structure of big data, a bridge between in-real-life and digital realities, constructs, values, costs, opportunity and threat.

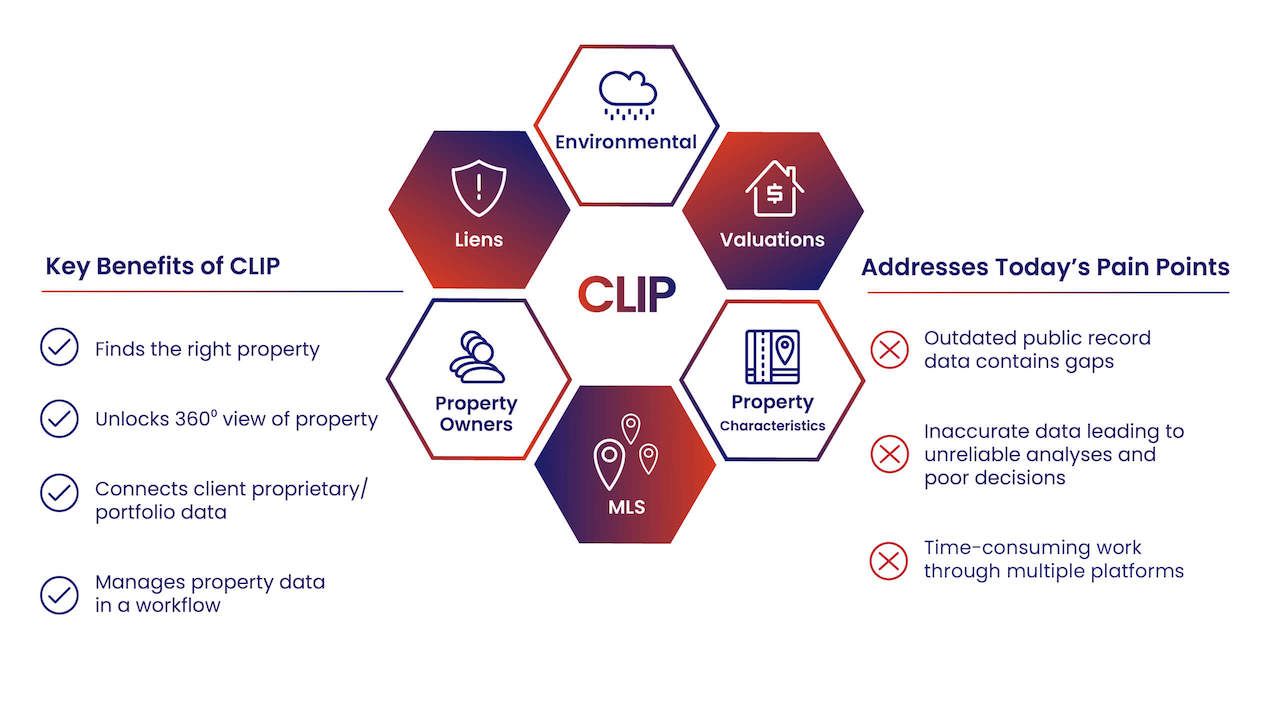

CoreLogic this week unveils what it evangelizes as a digital identification standard for residential properties called CLIP – CoreLogic Integrated Property Number – a "master key that unlocks and connects any property database."

The property equivalent of a social security number, a vehicle information number, or a Data Universal Numbering System (DUNS#) designation, which would catapult CoreLogic into a data and knowledge-base business dimension not dissimilar to Dun & Bradstreet, S&P, or Nielsen industry standard.

Like a QR or barcode, a CLIP label for a property would contain a property genome the power of which is a marvel to imagine. As CoreLogic senior leader for product, Matt Karli notes:

With CLIP, clients can gain detailed clarity on individual properties and take portfolio analysis to new levels by integrating multiple, previously disconnected data sets. Mortgage lenders, for example, can get a more comprehensive view of a property by integrating crime data, natural hazard risk and in-depth property histories before underwriting a loan. Marketers can target prospect lists with new levels of precision by adding data layers from multiple sources to go beyond traditional list generation. Portfolio managers can sort and analyze risk and opportunity by expanding property data to include microeconomic trends, hazard risk and other data sets.

These relational data fields, paired with machine learning that can leverage algorithms to stitch in other "hyperlocal" and block-level granular variables such as nearby business Yelp reviews, energy performance comparables, etc. – it dazzles the mind to imagine where that can lead.

A standard label for a property that digitally packs in that property's traits, neighborhood characteristics, financial information, repair history, performance KPI, exposures to risk, health pluses and minuses etc. brings real estate data and analytics to a new turning point in terms of what households want to have others know and what they regard as essential to the sanctuary a home represents in their minds.

As CoreLogic's Karli notes:

By solving the property identification problem, CLIP has opened the door to opportunities our clients are just beginning to discover.

The CLIP system, or some other organization's way of establishing an industry standard residential property reference, labeling, and record-keeping knowledge base, may be inevitable, and it may usher in a raft of enormous benefits and values among stakeholders who thirst for data signals amidst the oceans of statistical noise.

But, just the same, such an advance and its possibilities comes with flipside risks and threats that make a moment like this one, just before a technology and data product like CLIP becomes a household name, feel like it's opening Pandora's Box.

It goes with housing's turf. Solving some of the business's biggest challenges means having, next, to solve the challenges those solutions create.

Join the conversation

MORE IN Policy

Texas Treads A New Path Into Zoning To Battle Housing Crisis

Texas is one of the nation's most active homebuilding states, yet affordability slips out of reach for millions. Lawmakers now aim to rewire the state’s zoning laws to boost supply, speed up approvals, and limit local obstruction. We unpack three key bills and the stakes behind them.

Together On Fixing Housing: Solve Two, Start the Rest

NAHB Chief Economist Robert Dietz and Lennar Mortgage President Laura Escobar argue that the housing crisis won’t be solved by magic. It starts with a unified focus on two or three priorities—a rallying cry for builders, developers, lenders, and policy-makers.

Zone Offense: North Carolina Moves To Fast-Track By Right Housing

North Carolina legislators are pushing a bipartisan bill that could fast-track housing where people need it most: near jobs and transit. Richard Lawson breaks down what it means, how it compares to other states’ moves, and why developers are watching closely.