Leadership

In A Severely Volatile Near Future, CX Can Secure Builders' Lifeline

External forces may be out of homebuilding leaders' control in a bumpy operating environment with multiple crises. A still largely untapped internal resource might help right now: the impact of women across building's value stream.

If residential real estate and construction business, operational, and production fitness – come what may -- in today's highly volatile, heightened risk environment took the form of an equation, might it look something like this?

CX +TX + PX + SX = RP

That is, consumer experience, plus team-member experience, plus partner (vendors, distribution channels, municipalities), plus shareholders and lenders equal resilient profitability.

It's common in housing business cycles' more uncertain and challenging stretches for businesses to "go back to basics," as they simplify balance sheets and look to reduce their risk exposure. When they do so, they tend to mothball the new ideas and unproven investments, instead focusing all resources where immediate and tangible returns are most likely. In today's business environment, that could be a costly error and a missed opportunity to tap competence in the area of consumer experience as a way to improve your efforts to mitigate risk.

Permit a brief digression that supports this idea.

In JP Morgan Chase chairman and ceo Jamie Dimon's annual letter to shareholders – a cannily-crafted sweeping manifesto of American private sector leadership at moment of convergent urgencies – the word "unprecedented" crops up seven separate instances.

The focus point – for sheer potential and incalculable impact on what's to come – analysts' have picked up on is this bright line in Dimon's eight-part field-guide to being a leader in a nexus of history, economics, health, business, and culture:

I do not envy the Fed for what it must do next: The stronger the recovery, the higher the rates that follow (I believe that this could be significantly higher than the markets expect) and the stronger the quantitative tightening (QT). If the Fed gets it just right, we can have years of growth, and inflation will eventually start to recede. In any event, this process will cause lots of consternation and very volatile markets. The Fed should not worry about volatile markets unless they affect the actual economy. A strong economy trumps market volatility."

The observation predicts stormy weather ahead, one way or another – for businesses, for consumer households, and for policy makers. The observation also sets a baseline level of confidence in its assertions, with a strong caveat, "about volatile markets unless they affect the actual economy." Dimon allows for at least the possibility that he doesn't know definitively whether volatile markets may affect the actual economy.

There are plenty of gems, highlights, memorable and quotable turns of phrase and insights in the letter. The passages that follow struck me powerfully.

America’s moral, economic and military might all derive from our principles and are also predicated on the strength and competence of the American system. We must acknowledge that nurturing and maintaining our enormously prosperous economy provides the foundation of that system. Ultimately, that economy is what pays for the best military the world has ever seen.

Over the past 20 years, our economy has grown, on average, at only 2%. American ingenuity, work ethic, technology and business capability were able to overcome some — but not all — of our mismanagement. We should not accept mediocrity; we no longer imagine what should be: Over the past decade, we should have grown at 3.5%.

Freedom and its brother, free enterprise, properly regulated are the answer — not unconstrained capitalism nor crony capitalism, where business uses government and regulations to maintain its position or strengthen its hand. All interest groups, business groups included, should applaud good public policy and not resist it for self-serving reasons.

Free enterprise celebrates, and is inseparable from, human freedom and creativity, which ultimately are the sources of all human progress. The secret sauce of free enterprise is not only the free movement of capital but also, more importantly, the value of knowledge and free people exercising their rights.

The words "strength and competence" stand out here – for they embraces the helix of striving and the success that make up America's DNA, its character, and its enduring capability as a people, come what may.

As volatile as times ahead may be, America's private and public sector leaders can hope for the best, but need to prepare for worse than that. As Dimon notes:

[In each time of major turmoil, shock, and stress in the nation's history] America’s resiliency persevered and ultimately strengthened our position in the world. We hope this time is no different, but we should not be complacent as we do not have a divine right to success.

For residential real estate and construction business community leaders, strength and competence are both part of the natural received-wisdom tool set, and a constant challenge to reimagine, refresh, reinvent, and reapply as solutions capable of meshing with present and future challenges.

Circling Back

A "strength and competence" measure for builders and their partners at a moment – perhaps a prolonged one – risk, volatility, uncertainty, and threat swirl around and hover over what should be a solid surge of economic activity and growth might fasten itself to a long-developing, and strengthening opportunity area in today's rapidly evolving macro economy.

Women and homebuilding in the writ-large sense of consumer experience, team-member experience, partner experience, and financial shareholder experience.

Competence and strength with respect to engaging, seizing on the power, and sustaining business prosperity through rough and tumble times ahead could focus particularly on the opportunity area of recognizing women as and integrated and essential dimension of each numerical part of the resilient profitability equation noted above.

Here's a few examples of why:

- Wage growth for American women is increasing at a faster rate than for men, a stark shift from earlier in the Covid-19 pandemic. Female wages were up 4.4% in February from a year earlier, compared with a 4.1% rise in male wages, according to the Atlanta Federal Reserve’s wage tracker. That marks the sixth straight month that women’s wage growth outpaced men’s. Female wage gains exceeded male gains by 0.5 percentage point in December, matching the widest margin for records tracing back to 1997 [Wall Street Journal].

- Married women 45 and younger are twice as likely as older married women to make the financial decisions in their families, according to a new report from Merrill Lynch Wealth Management. [CNBC]

- Women in the United States continue to earn less than men, on average. Among full-time, year-round workers in 2019, women’s median annual earnings were 82% those of men. The gender wage gap is narrower among younger workers nationally, and the gap varies across geographical areas. In fact, in 22 of 250 U.S. metropolitan areas, women under the age of 30 earn the same amount as or more than their male counterparts, according to a new Pew Research Center analysis of Census Bureau data. [Pew Research]

- There is a wide gap between what women say they want from employers and the benefits employers provide. The survey found that more than 75 percent of women rate paid leave, health insurance, or job security as “very important” or “important” when considering future jobs, but at least 1 in three women workers say they currently lack one or more of these critical benefits. [IWPR]

- "We need to create products with women in mind, and the best-equipped to do that are women. From venture capital dollars to female-founded companies to gender diversity in boardrooms and leadership -- this is how we create products and services that meet the needs of those actually clicking the purchase button. [Inc.]"

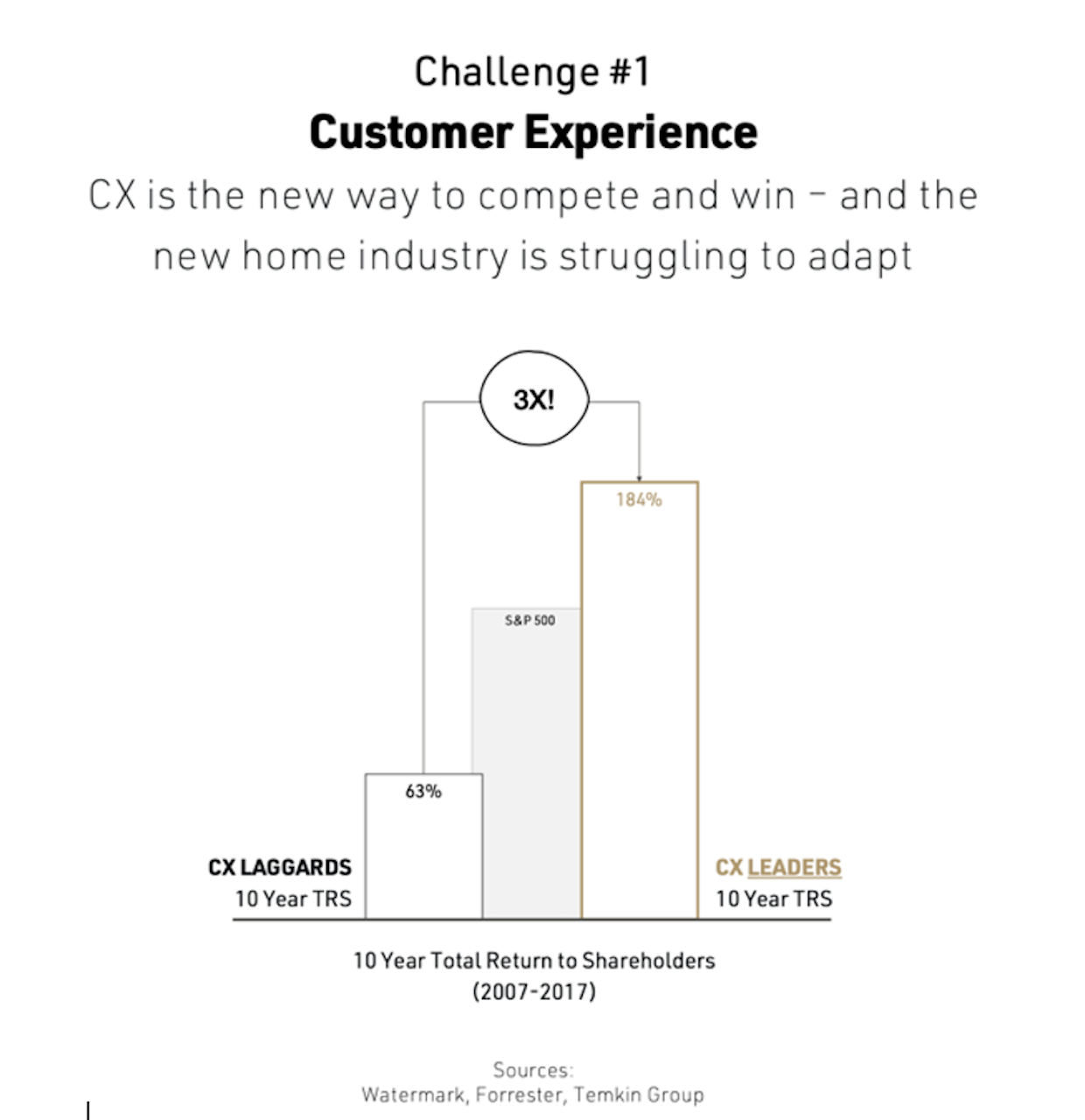

If we look, for starters, at the very first addend of the "Resilient Profitability" equation, CX, we get an insight from Cecilian Partners co-founder and ceo John Cecilian that weaves the "strength and competence" capability across each of the other equation's pieces and parts.

For Cecilian, every aspect of an organization's ability to thrive goes hand-in-hand, from customer experience, to operational experience, on across each part of the equation. He notes:

In the spring of 2019, Sheryl Palmer announced at the Housing Innovation Alliance Summit in Phoenix Arizona the power of CX, and the importance on focusing on the customer! This was a first by someone of her stature to lead with CX in a focal way. Was there a correlation between her being a woman and knowing the importance of purchase power that are led by the average American consumer, a woman?

The vision of connecting with the female consumer starts with leadership.

According to Nielsen, by '2028, women will own 75% of the discretionary spend, making them the world’s greatest influencers. Yet, around the world, women are shouldering more of the household burdens, feeling less financially secure and still are facing serious barriers when it comes to equality. Our recent research looks at how companies can rethink their approach marketing, innovation and designing services for women. The data shows that just paying lip service is detracting women, encouraging disloyalty, and causing fatigue.'"

As JP Morgan's Dimon suggests, externalities that business leaders do not control weigh heavily right now, laden with risk, volatility, and threat. Dimon's letter to shareholders states:

We normally don’t worry about — or even try to predict — normal fluctuations of the economy. In all times, we are prepared for difficult markets and severe recessions, as well as for unpredictable events, not only so we will survive them but also so we can be there for our clients when they need us the most. However, sometimes there are powerful underlying structural trends that we must try to understand since their impact can be so large, with widespread impact on many parts of human existence.

One such powerful "underlying structural trend" for every business leader in homebuilding, development, investment, and manufacturing to try to understand better is not an externality at all. It's a matter of recognizing what may be hidden in plain sight, the impact and power and potential of women in every dimension of building's value chain.

Join the conversation

Community development simplified. We transform the home buying experience with game-changing proptech for builders and developers.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.