Technology

If Not Now, When? Offsite's Role In Housing Gets A Roadmap

The Research Roadmap's intent, its authors say, is to clarify and depth-find the "knowledge gaps" that both heighten and thicken barriers to a future housing landscape of hub and spoke factories.

Which one doesn't belong and why? [with apologies to Imus In The Morning's 'Cardinal' Egan].

- (1) Public homebuilders (and most privates) recorded their most profitable year in their respective organizations' histories in 2022.

- (2) Housing affordability hit a low-point for the past 10 years in Q4 2022

- (3) Frontline worker labor constraint ranks as a top business risk for homebuilders

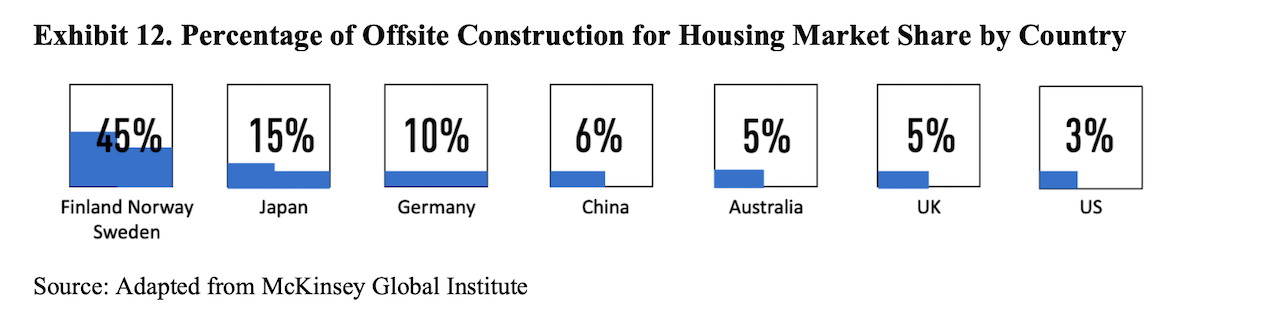

- (4) Offsite construction had less than 5% penetration as a share of total single- and multifamily completions in the U.S.

What's baffling, too, is how many people might look at the four bullet points above the image without experiencing massive cognitive dissonance.

Reconsider bullet-point (4) in light of the other three. The statistical market share value reflects one side of in-real-life actuality. On the other, a growing multi-regional knowledge base of ground-up data that supports this statement:

Offsite construction promises to control cost, reduce schedule, and mitigate worker safety liability; however, it continues to be perceived as a higher risk for developers and lending institutions than conventional construction." – Offsite Construction for Housing: Research Roadmap, HUD

Paired together, 3% market share for a construction technology/operational model that's proving out in the field as higher velocity, safer, more precise, less wasteful, more durable, is one of the early-2020's most glaring disconnects in ground-up residential construction – single-family or multifamily.

Now, recently unveiled, the U.S. Department of Housing and Urban Development, in partnership with the National Institute of Building Sciences and MOD X, has published the Offsite Construction for Housing: Research Roadmap.

Will offsite residential construction emerge as the nations', states', and communities' weapon to beat an escalating crisis in housing affordability? Not without jumping a load of fences and changing a lot of minds.

The Research Roadmap's intent, its authors say, is to clarify and depth-find the "knowledge gaps" that both heighten and thicken barriers to a future housing landscape of hub and spoke factories profitably producing urban, suburban, and rural housing accessible to more – if not all – Americans.

The report's authors note:

The roadmap provides a plan for HUD to align its programs and partnerships while concurrently offering a path for government, industry, academia, and related non-profit sectors to come together to advance offsite construction for affordable and sustainable housing.

The Offsite Roadmap covers six (6) topical areas in need of coordinated research efforts with subtopics, related research questions, and key takeaways listed to help close identified knowledge gaps as follows:

(1) Regulatory and Policy Framework

(2) Standards and System Performance

(3) Capital, Finance, and Insurance

(4) Project Delivery and Contracts

(5) Labor and Workforce Training and Management

(6) Business Models and Economic Performance

Apropos of the 6th point, the following passage limns out a challenge that – if solved – would move the pivot point from a permanent place in some theoretical future to a step-by-step action plan that starts in the present.

For an industry to improve, it needs reliable data. There have been many claims about the economic performance of offsite construction—that it is faster, cheaper, safer, stronger, more productive, and sustainable—and although these claims are research-based on case studies, they are representative and not deterministic, meaning they are not definitive. Therefore, there is a critical need to develop a mechanism for the ongoing collection and analysis of offsite construction data. These data may come through existing data sources such as permits at AHJs, transportation permits, a national/state decal program from manufacturers, or perhaps from self- reporting of stakeholders (the latter is not as reliable and is most the difficult for convincing industry professionals to share business performance data). The ongoing need for data will serve to continuously improve the industry and demonstrate offsite construction value to all constituents, including housing developers.

We've heard -- lo, these many years – among the leaders of organizations and firms that currently develop and build nine out of 10 ground-up homes and communities in America, a refrain something like this: factories are the future of housing.

In their minds, and in the ways they run their businesses and operations, "the future" – when it comes to a pivot from "how we've always done it" to modern means of construction – is way, way off in some indefinite time dimension.

Those particular business leaders – but for a couple of noteworthy exceptions like PulteGroup and Clayton Homes – tend to regard offsite manufacturing capability more or less as a super-sub platform that puts some or all of the work of 25 to 30 subcontractors under one roof, literally.

For that reason, one of the sharpest insights in the report is here:

Offsite construction, as a product industry, is ideally centered on the customer. Customer-centric design, manufacture, and assembly are connected to the development of a product platform that, when deployed on projects, provides feedback data to continuously improve the products. Although there have been some nascent efforts from the housing industry to address the need to systematically develop a customer-focused enterprise (Holt, Benham, and Bigelow, 2015), this customer data loop found in other product industries and in the offsite construction industry internationally (e.g., Sweden, Japan, and Central Europe) has yet to mature in the United States."

The No. 1 customers – right now – for offsite, like it or not, are the nation's top 1,000 homebuilders and top multifamily developers.

Offsite may, in fact, be faster, cheaper, safer, stronger, more productive, and sustainable. The question related to whether these builder and developer customers buy in or not mostly has to do with two third-rail factors in how they run their businesses.

- One is a housing cycle that runs in steep upturn and downturn swings.

- Two, is that the business model that most successfully matches those sharp swings from boom to bust emphasizes keeping fixed expenses at a minimum and allowing variable costs to dial way up when things are hot, and way down when they're not.

The question then – for those builder and developer customers – in light of accepting, embracing, and activating offsite building solutions as the future of housing is in four parts:

- Do they have to?

- Do they want to?

- Are they willing to?

- Can they?

The answer to the fourth question is – no matter how severe and numerous the current barriers – yes. We may need to have a clear answer on the other three to better understand when the future of housing – offsite and industrial building solutions – enters the present.

MORE IN Technology

Lennar Taps Into Geothermal To Power New Colorado Homes

A major homebuilder's bet on geothermal heating and cooling for over 1,500 new Colorado homes could pave the way for mainstream adoption as buyers increasingly seek sustainable, energy-saving features.

AI Crushes Missing-Middle Time And Cost Curves Toward Affordability

Developing multifamily rental and for-sale properties takes time — sometimes years -- depending on a labyrinth of zoning rules and the whims of local jurisdictions.

Brandon Elliott’s Next Big Thing: An Uber-Style Building Trades Platform

After selling Elliott Homes to Meritage, the Gulfport, Miss.-based entrepreneur sets his sights on transforming trades with a logistics-tech startup that aims to make construction faster, smarter, and more affordable—starting with siding.