Leadership

How Buyers Navigate A Trickier Homeowners Insurance Era

With affordability as a key driver – especially among entry-level, first-time buyers – a clear, cost-effective, and reliable insurance solution becomes its own force factor.

A moment of truth used to stand out.

It came so very rarely and commanded a lot of attention. That was because, typically, it meant that two or more big forces were converging or colliding in ways that would determine whole new outcomes, i.e. a newly peeled-back “truth.”

Not so much anymore. Moments of truth occur, it seems, every time you turn around. Nowhere is that the case so much as in the post-Covid, pandemic era market-rate single-family housing economy, a time period defined by galloping moments of truth.

This very stretch of weeks – bridging a “better than expected” first-half housing market with a “higher-for-longer” second half and beyond that may or may not continue the momentum – might qualify as a moment of truth for homebuilders and their partners. A near-future revelation – recovery or relapse – seems to be brewing.

The raw ingredients that make for one are clear and evident. One set of “big forces” applies to housing’s uber “affordability” challenge and to one of the key drivers of first- and second-quarter success for the builders, their ability to “price-in” first-time homebuyers.

- A key measure of home buyer demand – the National Association of Home Builders’ Housing Trends Report for Q2 2023 – shows softening, particularly among price-sensitive prospects who’d be buying their first home.

- According to that same Housing Trends Report, elevated home prices and mortgage rates disproportionately impact first-time buyers because, among other reasons, they lack equity savings from a previous home sale. In Qtr2’23, the share of all prospective buyers who are first-time buyers dropped to 61%, down from 71% a quarter earlier.

- After improving in the first quarter of 2023, buyers’ outlook for housing affordability soured in the second quarter, when 76% report being able to afford less than half the homes for-sale in their markets (up from 73% in Qtr1’23). This shows that recent upticks in home prices and mortgage rates (though modest) are filtering directly into buyers’ affordability expectations.

Colliding or – if you will – converging force factors are a source of turbulence, worry, and confusion in some of the U.S.’s most active residential new development and construction markets. Namely, natural disasters’ impact on homeowners insurers operating in some of these zones.

A Redfin analysis pulls together a couple of the converging, colliding forces into a single “moment of truth” thread here:

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, when 189,000 more people moved in than out. The same trend took hold in the places most vulnerable to wildfires and heat as the pandemic homebuying boom and a housing affordability crisis pushed Americans into disaster-prone areas.

“The counties with the highest wildfire risk saw 446,000 more people move in than out over the past two years, a 51% increase from 2019 and 2020. And the counties with the highest heat risk saw 629,000 more people move in than out, a 17% uptick.”

A second article, from the New York Times’ Peter Coy, slams home the crash of the two forces:

As different as California and Florida are, they share one big problem: Insurance companies are curtailing business in the two states. Some aren’t writing new policies. Others are going further and not renewing policies as they expire. I’m picturing vans pulling out of Sacramento or Tallahassee filled with sad-looking insurance mascots. Geico’s gecko. Jake from State Farm. The bandaged-up Mayhem from Allstate. The bald guy in the tweed jacket from Farmers saying ‘we’ve seen a thing or two.’

This shouldn’t be happening. It’s a sign of governmental dysfunction when insurance companies give up on what should be a mutually beneficial relationship: profitable for the companies and useful for the customers who need insurance. Californians and Floridians are scrambling to find replacements for the coverage they desperately need, particularly homeowners insurance.”

When the drive for homeownership affordability butts up against questions, confusion, and disruption in areas home-seekers gravitate to for a better shot at attainability, it triggers questions as to what the collision will determine. That’s critical, especially as buyer demand appears to have lost at least a bit of momentum.

We've seen over the last month or two significant activity in terms of carriers pulling back and deciding to limit new business, or exit states completely, and the good news is we find pathways through these issues in every market,” says Tom Kriby, Vice President, Client Development and Partnerships at Westwood Insurance Agency. “We have long-term historical relationships with national and regional carriers that understand what we're doing and the benefits of writing as many new home policies as possible, because new homes are the cream of the crop and built up to code. We’ve also worked with the builders, and have learned the ins and outs of the game. We understand the homes that they're going to be building. We essentially pre-underwrite that home, so that when a customer walks in, they have a rate and a policy that they can secure that day. That rate is going to be honored, whether closing is three weeks out or nine months out from that original date.”

What new construction homebuyers – particularly those highly-price sensitive new home prospects who are purchasing their first home – appreciate when they work with Westwood to navigate flooding issues in the Florida and Texas coastal areas, and wildfires in California and other western states is learning just as much as they need to know about the nuances of matters like insuring a home to its value, versus its full price.

Insuring your home to value is the most important,” says Westwood’s Tom Kriby. “Land prices are included in a sales prices, but many first-time buyers learn from us that you only need to insure the rebuild cost of the home. There's a lot of knowledge that an independent agent like ourselves can impart into a homebuyer and it's significantly different in Southern California, vs. the Gulf Coast of Texas, vs. Miami all the way up to the Carolinas. Risks vary widely. Many people don’t realize that flood damage isn't covered in a base insurance policy. Many don't have an understanding of how a deductible works, or perhaps ways to save money through discounts and a careful assessment of risks, and a sense of priorities around coverage.”

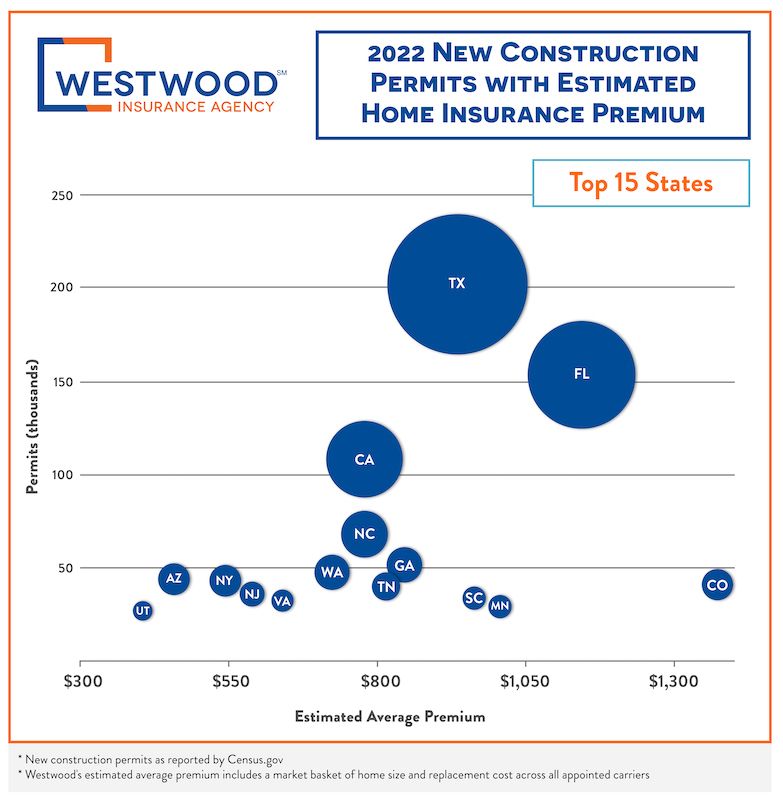

Discounts, notes Kriby, are a factor that separates Westwood from other carriers or other agents that specialize in new business. The average brand-new home insurance cost was about $1,100 per year. By comparison, annual premiums of homebuyers who went through Westwood for their coverage during the first six months of 2023 averaged just under $900 for the year, about a 19-20% benefit that comes from a hands-on, information-based process for a homebuyer to pick what’s going to work best for them.

That's a solid benefit for our customers,” says Kriby. “It’s $200 over the course of a year, but every dollar could help you qualify, or save on monthly expenses, or allow a few extra dollars for an upgrade on your house. That's a positive, and the builders appreciate that too.”

MORE IN Leadership

Homebuilding Strategists Talk Candidly About Getting To 2030

At Denver’s Focus on Excellence summit, five builder leaders strip away spin. They reveal real pressures—capital, costs, people—and how they’re fighting back.

D.R. Horton’s Greenville Play Signals Private Builder Squeeze

The nation’s largest builder isn’t slowing tuck-in acquisitions. SK Builders’ exit reveals why privates face thinner "lower-for-longer" margins — or, perhaps, the exit door.

Insurance Costs Now Define Housing’s Affordability Equation

Insurance premiums have soared nearly 70% in five years, now consuming almost one in ten housing dollars. Homebuilders who plan for insurability early protect both margins and buyer trust.