Land

Houston, We've Got Lift-Off! Smith Douglas Nets Devon Street Homes

The Builder's Daily talks with Smith Douglas Homes president and CEO Greg Bennett on what's driving the firm to expand into the competitive Houston market ... and why he thinks the SDH team's likely to win.

Tom Bradbury – 79-year-old founder and self-described "chief culture officer" of Atlanta-area Southeast regional homebuilding powerhouse Smith Douglas in the depths of The Great Recession in 2008 – declared an unapologetic goal for his team six years ago. It was to evolve into one of homebuilding's "enduring, closely-held" brands – along the lines of a David Weekley Homes, Highland Homes, Ashton Woods, Shea Homes – and to spool up, 10X, from about $108 million in revenues in 2016 to above $1 billion in 2024.

Just like them.

At the very same moment Bradbury put out that claim about his firm's accelerated growth trajectory – and mind you, that was just after his firm scraped through a "near-extinction moment" coming out of the GFC -- he unveiled one of his secret weapons for getting to the goal: His hiring of former protege-become-rock-star Greg Bennett to rejoin him as chief operating officer of an operation with rocket-fuel in its DNA.

We wrote here at the time:

Forward from that moment, in the same guy – Tom Bradbury – and a recombinant team of trusted Colony pros, with one important added ingredient of strategic gravitas in Charles Schetter, who’d climbed aboard a month earlier at Bradbury’s urging, emerges the Smith Douglas that could be.

Another way of looking at it is this. Check our Builder 100 rankings at the companies, say between 70 and 100, where the organizations deliver between 350 and 650 homes with annual revenues ranging from around $100 million to $200 million. That’s squarely what Smith Douglas was. Now, look up the list to the top 15-ranked builders, those delivering no less than 4,000 homes a year, and clearing revenue of over $1 billion in home building sales. That’s where Bradbury, Schetter, Bennett and team believe they’re going to be in seven years or less.

Now, fast-forward to a news announcement that came through yesterday, announcing Smith Douglas' purchase of the assets of Houston-based Devon Street Homes.

Combining Smith Douglas' reported $755 million in 2022 homebuilding revenues, and Devon Street Home's $107 million last year – totaling $862 million – would any knowledgable homebuilding observer doubt that Tom Bradbury's $1 billion revenue promise by 2024 is beyond reach?

Don't bet on it.

We want to unpack this acquisition for what principal and strategic stakeholders may want to understand about the dynamics and mechanics of the new residential real estate construction, development, and investment marketplace. Specifically, the ways these forces and conditions impact privately-held companies, whose capital access options require them to navigate some narrower and more costly pathways to business stabilization and sustainable growth.

Let's check first, details of the Smith Douglas Homes-Devon Street Homes combination released in a statement late yesterday:

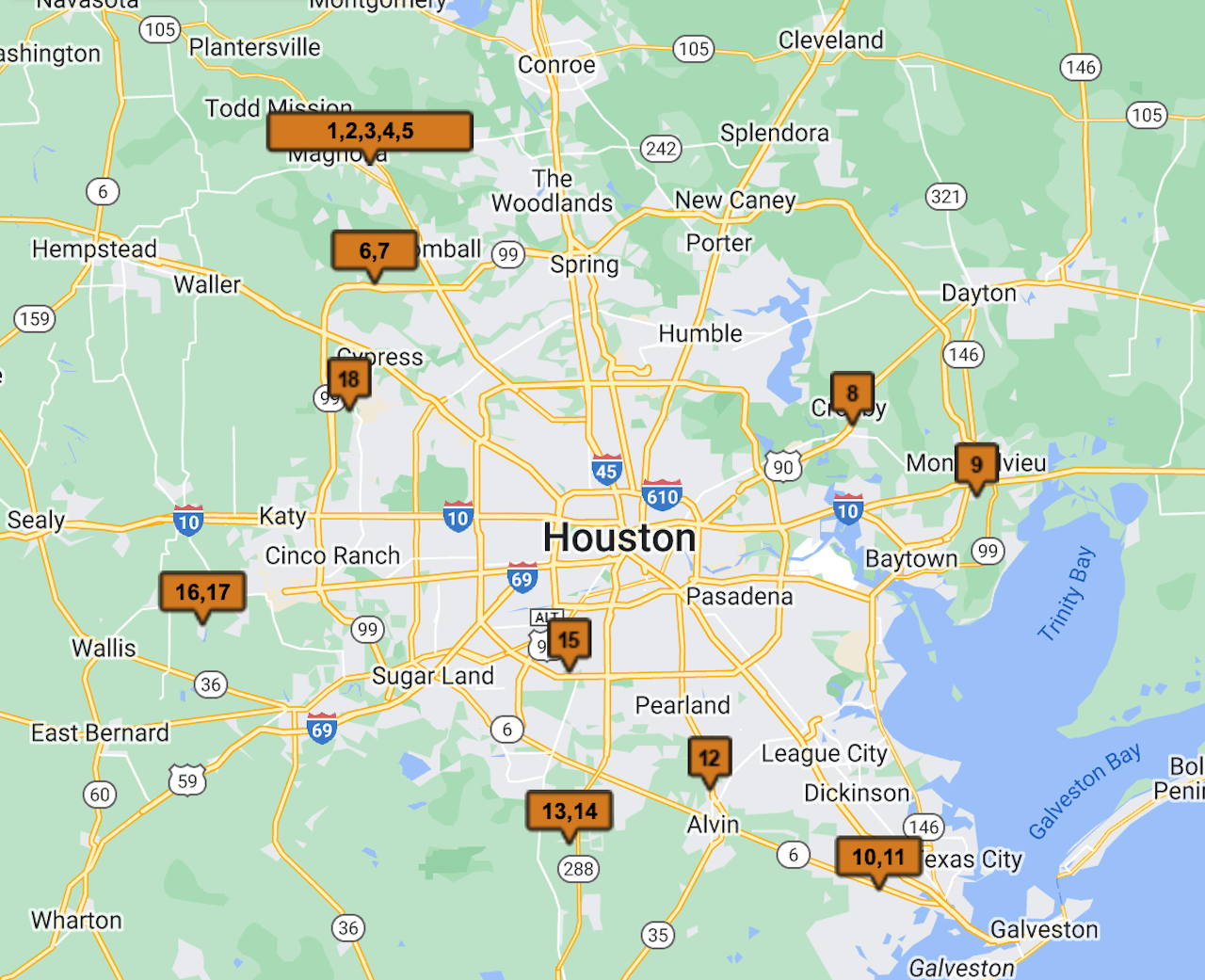

A top 30 builder in the local market and ranked the 150th largest builder in the country by Builder magazine, Devon Street Homes was founded in 2006 to provide Houston area families with quality homes at an affordable price. In 2022, Devon Street closed 324 homes across 15 communities with revenues in excess of $100 million and currently controls nearly 1,500 lots in the greater Houston area. 'After growing this company to its current size, I felt a like-minded, multi-market partner such as Smith Douglas Homes could carry on my mission by serving even more Houston families while providing the loyal team of Devon Street Homes associates with even greater future career opportunities,' said Stephen Ray, Founder and President of Devon Street. Mr. Ray will continue to lead the Houston division and all Devon Street associates have been offered positions with Smith Douglas.

'Devon Street Homes offers an ideal strategic and cultural fit within our existing platform, and we’re thrilled that Stephen was looking to partner with another builder at a time when we were looking to expand,' added Greg Bennett, President and CEO of Smith Douglas Homes. 'This acquisition provides us with a great foundation from which we’ll look opportunistically at other Texas markets.' New communities will be introduced under the Smith Douglas Homes brand while existing Devon Street Homes communities will be rebranded over time.

Whelan Advisory acted as the exclusive financial advisor to Devon Street Homes. – Press Release

One of the first contextual observations here: A private-to-private acquisition propelling a Southeast-based regional player into Texas is somewhat of an M&A market expansion rarity. In most cases in recent homebuilding M&A deal-flow, it is a Texas-based operator acquiring a Southeast-market springboard for expansion.

Across Tom Bradbury's almost 50 years of experience in homebuilding, his company's purchase of a Texas-based, operationally excellent, entry-level and first-time-buyer oriented firm such as Devon Street has a "full-circle" sense to it. As we wrote here in 2017:

What San Antonio legend and innovator Ray Ellison figured out in the 1950s and made a discipline of, that many other home builders never seem to solve, was how to get 100% of a day's work done--or close to it--on his home sites. Ellison sold his company, Rayco, to Kaufman and Broad Home Corp. (KB Home) in 1996, and the Rayco model was the industry standard at the time for how to give customers both a modicum of choice about what was in their home and a price tag they could manage within their means.

... One thing Tom Bradbury did early on was to go to school on what Ray Ellison was doing down in San Antonio, and then he worked with pioneer data-operations information technology geeks Mike Goldsberry, Mike Johnson, and Kenny Norton to commit their thinking, visualizations, construction, engineering, product spec, and work-streams to code, so that every task, process, product SKU, and system was mapped into an integrated workflow tool.

At that time, the late 1990s, an endeavor like that was practically insane, but what it allowed Tom Bradbury and his team--including a young, up-and-coming operations superstar named Greg Bennett--to do was to build houses virtually before they built them on site.

Imagine, taking a Rayco-like construction management discipline and then connecting the entire ecosystem of construction--manufacturers, materials suppliers, trades--to a single operations plan, one playbook. This is what evolved into the SMART system Smith Douglas uses today, and it allows teams in their respective communities in their six markets to execute on a true evenflow building model--one start, one completion, one sale per community per day--and average 3-and-a-half to four asset turns per year, a best of breed productivity measure.

It's this operational point of distinction that supports a critical, essentially revenue-funded business that regional land banks, developers, and other capital providers find to be particularly attractive.

A lot of things that work to our benefit include that we’ve aligned with a number of land bank and capital providers, and we do all of our land financing off-balance sheet, and that's made for some really good partnerships," Smith Douglas president and CEO Greg Bennett tells The Builder's Daily on the heels of the deal. "Our cycle times, make us very attractive to those folks on our terms. Prior to this acquisition, we were zero net debt. We've been very profitable and that's no surprise. Everybody's done well through the post-COVID stretch. everybody has homebuilding if you've not you're just not from the operator he should be so you know where you got Yeah, we've been very fortunate. We've got a line that we we do only our housing on, but we do very little drawing off of that these days. So, our lack of leverage made this a perfect opportunity for us as well."

Alignment with hungry-for-growth, Houston entry-level-oriented boot-strapper Stephen Ray and his team felt like just the fit as a Smith Douglas Manifest Destiny, says Bennett.

Steven and his team know the area deeply, and they have a great network reputation and relationships. They just seemed like the perfect fit to partner and launch our platform into an existing lot pipeline," says Bennett. "Mostly, though, the people at Devon Street were a big part of what excites us. Plus, Houston, just seems logical. The price points that they operate in are right in our sweet spot. The market is affordable. Land is affordable and somewhat available. To do our model of off-balance sheet, take-down structures, options, that's something that's available here. So everything aligns. What's more, it’s a big market. We think we're gonna get to where we are in Atlanta here in Houston, and then leverage off of our team here in Houston."

As Bennett looks ahead at additional opportunities to bring the Smith Douglas SMART system into Houston and beyond, the business culture, capital optionality, and operational focus of the organization draw constantly from the seemingly ever-flowing spring of founder Tom Bradbury.

Tom's mantra is, 'it's not who's right, but what's right,' and with that almost 50 years in the business, he's still as passionate as ever about the business," Greg Bennett tells us. "He's created a culture here where people want to come and work for us, and they stay, so we're happy to have the Devon Street Homes team join the family."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.