Land

Houston Rocket Fuel: Starwood Pairs Up With Land Tejas MPCs

As builders and their partners search and vie for visibility and predictability in early 2022, true north will point to fewer, larger mega platform master plans and land banks. Here's a case in point.

photo courtesy of Lago Mar

The "second-day lead"

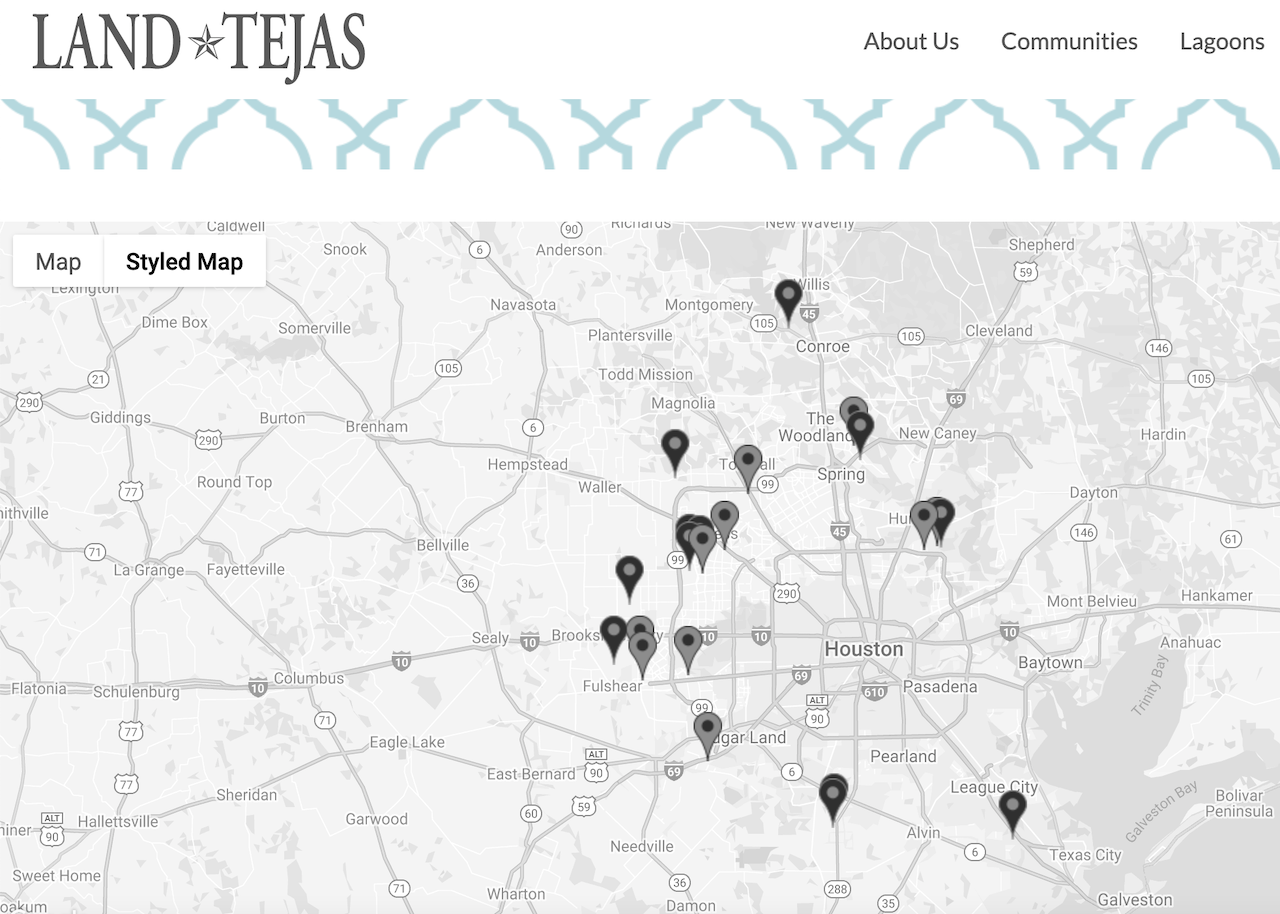

Starwood Capital last week announced its Starwood Land group has taken a majority interest in a premier-brand Houston-based masterplan community developer Land Tejas, comprising 10-actively selling communities – a pipeline of more than 16,000 lots and commercial assets – in the U.S.'s No. 2 hottest new-home marketplace.

The Builder's Daily characterizes this 2021-closing mergers and acquisitions event between Starwood Land and Land Tejas to be a lightning-rod event, significant both in its strategic and tactical value to the two principle entities, and as a bellwether indicator for land and real estate business and competitive dynamics across the sweep of 2022 and beyond into the mid-2020s.

Here we'll set the context from a high-level first and then focus on impacts and implications of the two main parties in this particular real estate deal.

To get into either story-track, it's critical to follow a simple logic here: There would be – and will be – no building materials and products supply chain critical path blockages to start-to-completion unless there's a supply of entitled, engineered, permitted, and shovel-ready building sites to take into vertical development.

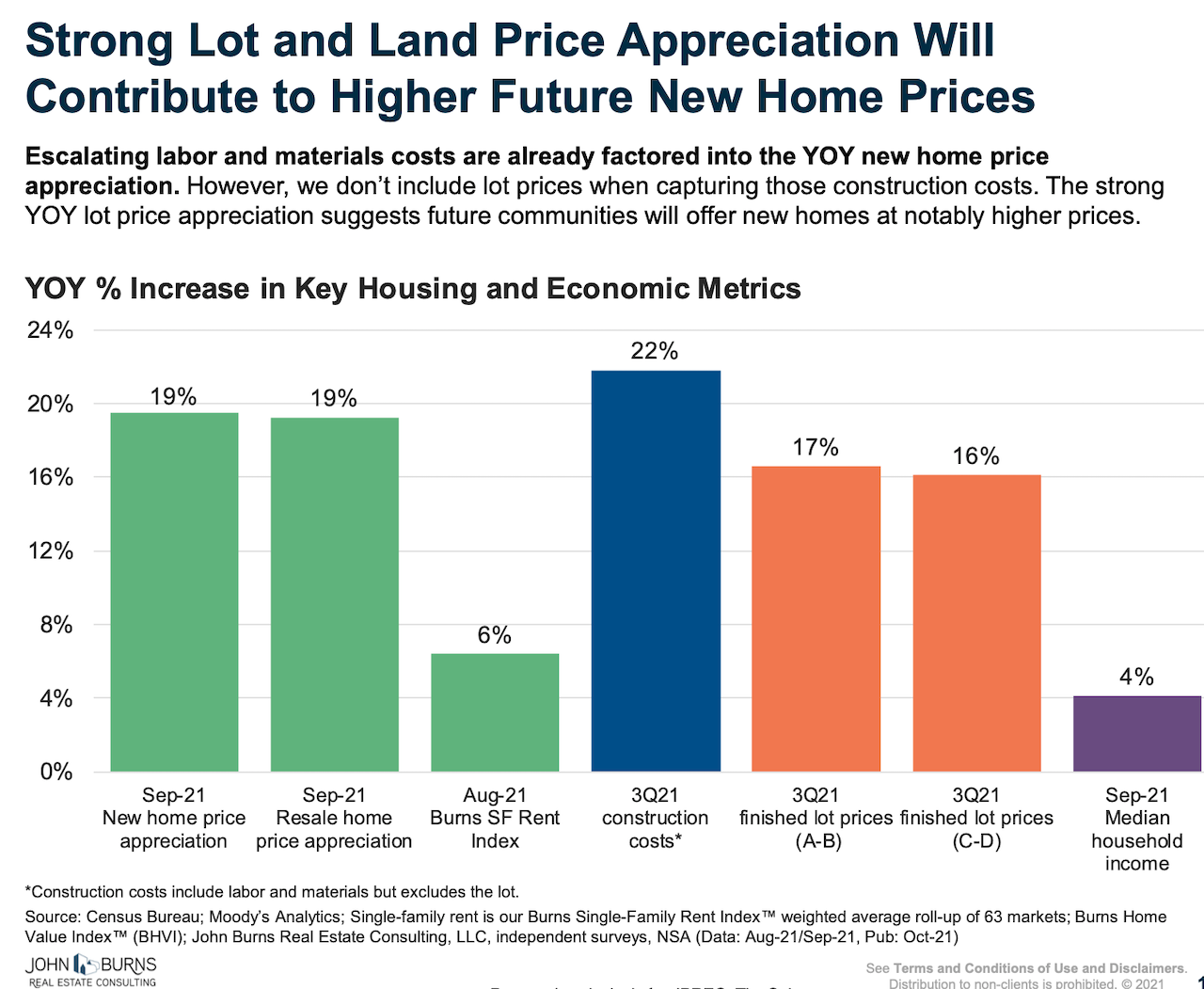

For 2022 and the 36 months forward, shortages of buildable land set the tone and conditions that supercede other constraints.

The Big Picture: Land Friction

The last time any of us looked, abundance of exactly three resources smoothe out what's otherwise a bumpy ride in cyclically-shifting residential real estate markets.

In the pandemic era, where the novel coronavirus continues to run true to its name with a slew of new cards up its sleeve, it's no different. If you have all three of the following – in amounts to spare, ideally – others' turbulence is your own flight through calm skies, from horizon to horizon.

They are:

- time

- money

- people

A backdrop of a 2022 residential real estate and construction experts conclude will either go great guns for a finite number of known reasons, or absolutely kerflooey for an indefinite number of unknowns, these three resources – and their specific value measures – chart the decade's atlas of capability and business resilience.

Rare enterprises with troves of – or secured antifragile access to – all three critical vectors of resource stand to function as "banks" from which all others buy or borrow these capital lifelines of real estate value generation. The ebb and flow of under- and over-supply of each of these forms of capital in, say, the 50 most-active new home construction markets in the U.S. – time, money, and people – each a helix of capital that either eliminates and smoothes or becomes a fasten-your-seatbelts risk-prone business condition, determine outcomes.

What's more the depth and geographical breadth of stacks of this capital serve both as value generators in their own right and, importantly in real estate, as competitive moats that put rivals and less advantaged players at greater risk.

At a macro level, there's been a substantial run-up in some of the other hot U.S. markets, like Phoenix, for example, you've seen new home prices nearly double," Mike Moser, ceo of Starwood Land, tells TBD. "Houston, comparatively, has been barely impacted vis a vis the payment power of the market, so we see a lot of opportunity ahead with the sophisticated Land Tejas team and their remarkable communities, and the deep stable builders they're dealing with there. We want to put lots on the ground for the best builders in the country and this gives us that opportunity and Land Tejas gets deeper capital to grow. Right now, master plans are where the value is to builders."

As Moser's words make clear, 2022 begins amidst acceleration – prices, transactions, intensifying balance-sheet management risk and reward. In that business environment, mega-capability masterplanned community and land portfolio national and regional platforms like those of Starwood Capital, D.R.Horton/Forestar, Brookfield/Newland, Lennar-Five Point, Hughes Corp., Sumitomo-Crescent Communities, The Irvine Company, Tavistock Development, Hillwood Communities, Hunt Communities, Johnson Development, etc. become, for all intents and purposes, "the bank."

For builders – now, not just single-family for-sale, but single-family built for rent, and vertical mid- and high-rise rentals, as well – these mega platforms serve as a "single-source-of-truth" visibility and predictability dashboard at a time of escalating uncertainty on the economic and regulatory fronts.

Since each of those mega platforms possess deep, geographically-hedged, and option-rich reserves of time, money, and people, their moment – with a view across the 2020s decade where as many as 300 million current adults will pivot in their household preference – is now.

Their value in removing entitlement risk, marketing destinations people are attracted to in the pandemic era's early innings, and setting predictable take-down terms and schedules – for builders and B2R-focused firms – far outweighs the lot price premiums they're getting. Predictable capability versus the need to scramble and scrum for the ability to access, produce, and sell on a hand-to-mouth basis will set apart those who're likely to thrive from those who're struggling to survive.

What's more, the local scale efficiencies and premiums builders get on the demand side of the coin can work on the supply capacity front as well. Submarket locations that have smoothed – evenflow – and higher volume construction footprints can expect to merit prioritized distribution and delivery through the building materials and products channel, by virtue of consistent order volumes and throughput.

Starting with the launch of Starwood Land Ventures in 2008, and through the present, Starwood Capital has positioned its $105 billion portfolio to avail of opportunity to generate value across every asset class of real estate and finance. With a 2020s rampway that will make winners of those who "smoothe" out near-term spikes with a longer-term approach to time, money, and people, Starwood becomes a go-to resource others bank on to survive.

The Land Tejas Step-Change

At the same time, Starwood's investment in the winning value-creation formula Land Tejas has developed in what's going on 25 years, attests to the rich skillset that make it, as Starwood's Moser notes, "one of the best operators in the industry."

Moser adds:

Land Tejas is a seasoned operator, with a bevy of the best builders in the country, and they know how to stand out on the entitlement, engineering, amenities, entry-scape, hardscape, and the placemaking. The entire Land Tejas team will stay on and they'll keep an ownership interest in these communities."

With the Starwood infusion, Land Tejas effectively clears itself of leverage in the $100s of millions, and can now tap equity to supercharge its growth strategy, and if it later wants to, can re-tap the institutional debt markets from a more powerful enterprise level capital position. The Starwood-Land Tejas combination evolved out of an introduction Margaret Whelan, founder and ceo of boutique investment bank Whelan Advisory Capital Markets, made three years ago.

As the press statement notes:

We are excited to partner with Starwood Capital to simplify our balance sheet and expand our growth potential with such a large investment firm specialized in real estate," said Al Brende, Owner & Co-Founder of Land Tejas.

Moser makes note of the fact that Starwood's entering a Land Tejas business arc that is in a "mature" zone of current community development cycles.

The engineering, development of the lots are all on the ground, and 6,000 of these lots are under contract to builders right now," says Moser. "We want to help them get across the finish line with these communities at a moment Houston stands out as both affordable and desirable, and with the new resources, we can add landscape, hardscape, and embellish some of the amenities to help generate the highest value possible."

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.