Land

Houston Rocket: Century Seizes Top-5 Lift-Off Via Anglia Homes Purchase

There's market share and there's Top 5 local market share. Any organization that can secure a wrung in that latter set – organically, through land development partners, or via M&A – is gunning for it as we speak.

The trajectory, uncertainty, and arc of inevitability in the mid-summer 2024 new home marketplace make one thing perfectly clear.

There's market share and there's Top 5 local market share. Any organization that can secure a wrung in that latter, upper-tier set – organically, through land development partners, or via M&A – is gunning for it as we speak.

That's clear from yesterday's revelation from Century Communities, the 10th largest homebuilding enterprise in the United States, that it has acquired "substantially all" the assets of Anglia Homes, a privately held homebuilder based in Houston, Texas.

Anglia Homes closed 410 homes in 2023, generating $138 million in revenue, per a press statement, which notes that Whelan Advisory served as the exclusive financial adviser for Anglia Homes.

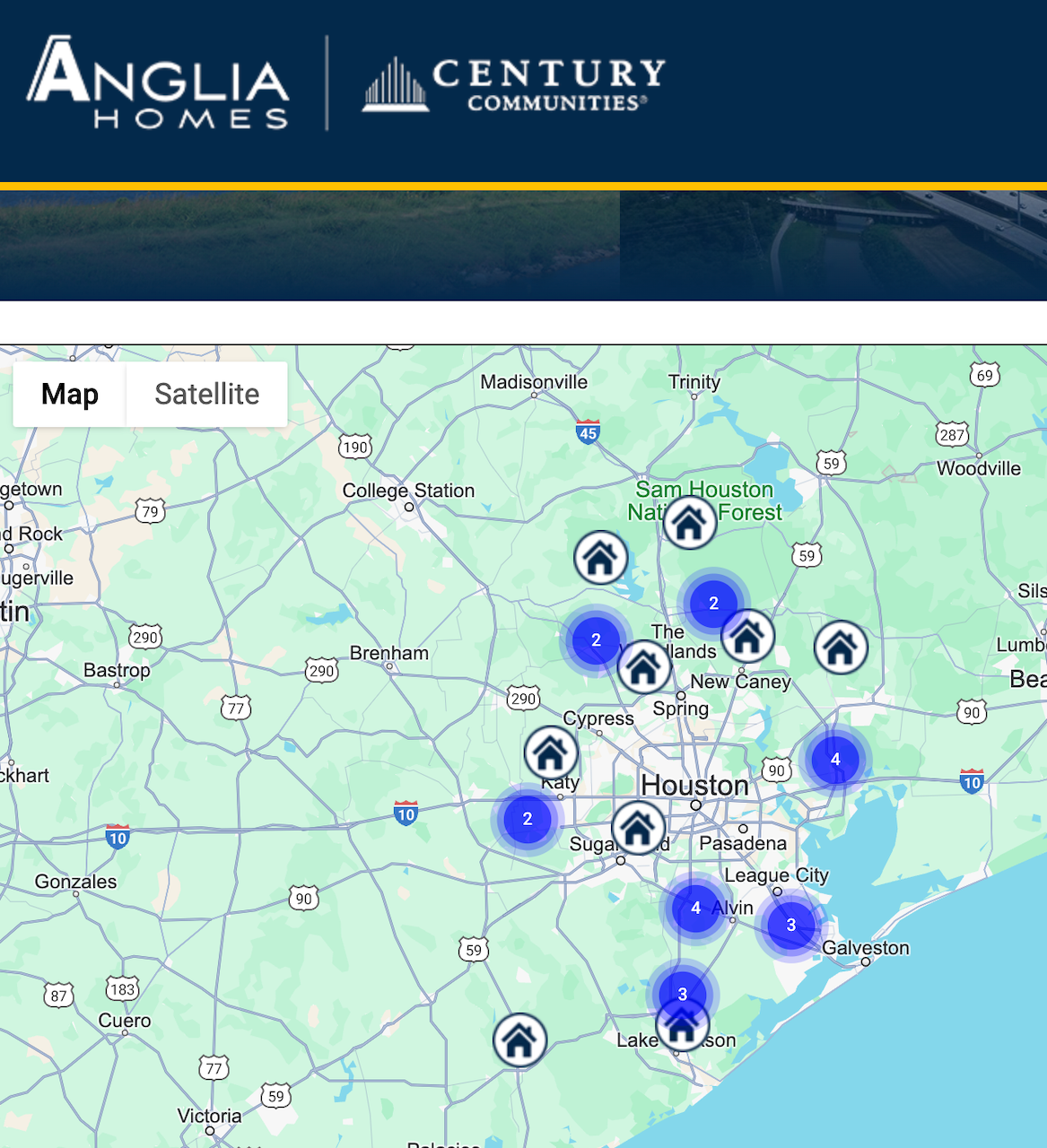

This acquisition is noteworthy not only because it doubles Century’s footprint in the Houston market but also because it propels the company into a Top 5 position in the Greater Houston area, which is the nation’s second most active new-home construction and real estate market.

Acquiring Anglia Homes increases our access to capital efficient finished lots," Century Communities Executive VP Jim Francescon tells The Builder's Daily. "Anglia only buys finished lots, and has a deep network of developer relationships in the market. And we're excited for that to be an increasing part of our land pipeline going forward in Houston."

Here, we'll explore what this deal means for the industry, Century's strategic approach, and its broader implications for the market.

Key Points for Industry Leaders

Strategic Market Expansion:

Our goal is to continue increasing our scale in each of our markets, becoming a top-five builder in each of our markets, continuing to gain that operational efficiency, and continue to grow the company forward," Jim Francescon tells us.

- The acquisition of Anglia Homes significantly enhances Century's market share in Houston, which is experiencing robust growth despite broader economic uncertainties.

- Century Communities more than doubles its community count in Greater Houston, adding over 25 communities, strengthening its competitive position, and increasing its presence in a vital market.

- Anglia Homes' operations and assets, which consist of one- and two-story single-family floor plans ranging from the mid-$200,000s to the high-$400,000s, will be transitioned to the Century Communities brand.

Integration and Synergies:

- Century’s ability to integrate Anglia Homes' operations will be critical in realizing the full potential of this acquisition.

- The combined entity is expected to benefit from enhanced operational efficiencies, shared resources, and expanded product offerings.

- The acquisition supports Century's strategy of increasing depth within existing markets in a land-light manner, providing access to capital-efficient finished lots.

Local Market Expertise:

- Anglia Homes brings deep local market knowledge and established relationships with subcontractors, suppliers, and landowners, which can be leveraged to optimize Century's operations.

- Anglia Homes focuses on quality, location, affordability, and design and has built a reputation for providing excellent homebuying experiences, which aligns well with Century's values and mission.

Century Communities: An M&A Powerhouse

Over the past decade, Century Communities has established itself as a formidable player in the M&A space. This latest acquisition of Anglia Homes follows a series of strategic purchases aimed at expanding the company’s geographic footprint and market share. Notable among these is the acquisition of Landmark Homes of Tennessee earlier this year, which bolstered Century's presence in the rapidly growing Greater Nashville market.

Jim Francescon, Executive VP at Century Communities, tells The Builder's Daily,

A key focus of ours is to continue growing scale efficiencies within our existing markets, and both Landmark and Anglia fit solidly into that strategy. The Houston market has been one of the strongest-performing metro areas in the last 10 years, and we think it has a lot of positive tailwinds going forward."

Implications for the Broader Market

The acquisition of Anglia Homes by Century Communities is emblematic of broader trends in the homebuilding industry, particularly in a period marked by economic uncertainty and fluctuating housing demand. Here are some key implications:

Market Consolidation:

- The deal highlights a continuing trend of market consolidation, as larger public builders seek to increase their market share and achieve economies of scale.

- This consolidation is driven by the need to secure land assets and manage costs more effectively in a challenging economic environment.

Economic and Housing Market Context:

- The acquisition occurs amid a period of intense economic and housing supply and demand uncertainty. Rising borrowing costs and higher operating expenses are putting pressure on private homebuilders, making them attractive targets for acquisition by larger, better-capitalized firms.

- For Century, expanding in a high-demand market like Houston helps mitigate some of these economic pressures by leveraging local market efficiencies and enhancing profitability.

Strategic Importance of Local Scale:

- Local scale has become a critical component of strategy for public homebuilding enterprises. Larger market share within specific regions allows builders to negotiate better terms with suppliers and subcontractors, enhance brand recognition, and optimize logistics and distribution.

Why Century’s Acquisition of Anglia Homes Matters

The acquisition of Anglia Homes is significant not only for Century Communities but also for the broader homebuilding industry. Here’s why this deal matters:

- Seizure of Market Share:

- By acquiring Anglia Homes, Century has rapidly escalated its market position in Houston, known for its vigorous homebuilding activity.

- This aggressive expansion underscores the importance of market share as a strategic asset in the homebuilding industry.

- Public vs. Private Dynamics:

- The deal illustrates the widening gap between public and private homebuilders. Public builders like Century have greater access to capital, allowing them to pursue acquisitions and expand their market presence even during economic downturns.

- Private builders, on the other hand, face increased financial pressures and may struggle to compete, making them more likely targets for acquisition.

- Future M&A Activity:

- The acquisition signals a potentially active final five months of 2024 for M&A in the homebuilding sector. As economic pressures mount, more private builders may seek to be acquired by larger public companies.

- Industry leaders should be prepared for an uptick in deal flow as builders navigate the complex economic landscape and seek strategic advantages through acquisitions.

Jim Francescon’s Insights

Jim Francescon provided valuable insights into the strategic importance of this acquisition during our conversation.

Securing land and increasing market share and volume are critical functions that drive our opportunity to improve scale efficiencies," he emphasized. "Anglia’s deep network of developer relationships in the Houston market, which focuses solely on purchasing finished lots, will be an increasing part of our land pipeline going forward."

Francescon also noted the relationship with Anglia Homes' sellers, who may continue to work as eyes, ears, and trusted relationships on the ground in the Houston marketplace's fiercely fought land acquisition and development front.

Mike, James, and Thomas have built a great business and have been fantastic to work with throughout this transaction. They will transition into personal interests but maintain a close relationship with us. If there are future land opportunities, we see that potentially being a fit."

Century’s acquisition strategy also focuses on sustainable growth by maintaining relationships with former owners. Gary and Nick Wisniewski of Landmark Homes, for instance, continue to source and develop land for Century. This approach ensures a steady pipeline of lots and preserves the local expertise that is vital for success in specific markets.

Industry Background and M&A Dynamics

Drawing from the January acquisition of Landmark Homes of Tennessee, it's clear that Century Communities has a calculated approach to market expansion. The Nashville deal showcased Century’s commitment to securing heft and deepening scale in key markets. Dale Francescon, Chairman and Co-CEO of Century Communities, emphasized the importance of targeting affordable areas with high in-migration.

We've done eight [now nine] M&A deals over the years and have looked at many more. It has to be a fit with people as well."

The strategy behind these acquisitions is not merely about adding numbers but about enhancing operational efficiency and market influence. As Century integrates these new entities, it gains significant leverage over suppliers and subcontractors, enabling better cost management and competitive pricing. This tactic is particularly crucial in today's volatile economic environment where execution and operational excellence are paramount.

Reflecting on Century's broader M&A strategy, Jim Francescon remarked,

M&A has always been a part of our story. This is our second acquisition this year and the ninth in Century's history. We think we're good at it, and our extensive experience resonates with a lot of sellers, making us a preferred partner in these transactions."

The Takeaway

Century Communities' acquisition of Anglia Homes is a strategic move that significantly enhances its market position in Houston and exemplifies its M&A-driven growth strategy. The deal underscores the importance of market share, local scale efficiencies, and the ability to navigate economic uncertainties through strategic acquisitions.

As the homebuilding industry continues to evolve, the dynamics between public and private builders will shape the competitive landscape, with M&A activity likely playing a pivotal role in defining market leaders.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.