Leadership

Housing's What-Comes-Next Is Unknown: Is Your Team Ready?

What few housing leaders were predicting -- signs of softening demand -- have begun to crop up and weaken the outlook. How resilient have homebuilding organizations made themselves for what's ahead?

Ben Franklin said it.

By failing to prepare you are preparing to fail.'

Preparing for what may come next may include preparing for what you may not believe could happen.

We hear from builder execs, "We've got eyes, ears, [and a great deal of money] on the ground. We are prepared for what comes next."

Then, by all rights what should not have happened, happens, or shows signs it will happen. Such as, "there are more buyers than we can produce homes for" morphs into ...

John Burns Real Estate Consulting's June builder survey indicates that rising interest rates continue to eat away at demand for new homes. More and more markets are cooling from the red-hot growth of 2021 to more sustainable levels, though inventory remains low.

Or, perhaps, more of a red flag than that, from this monthly survey from BTIG/HomeSphere:

- Sales dropped significantly in May, with only 19% of respondents reporting YOY increases in sales v. 32% in April and 48% in May 2021.

- Positive traffic trends slowed considerably, as noted above. Additionally, 43% of builders saw a decline in YOY traffic compared to 27% in April.

- Sales and traffic relative to expectations fell sharply, and the better-minus-worse expectations ratio for both flipped negative this month. 15% of respondents saw sales better than expected vs. 20% last month, while 34% saw sales as worse than expected. Just 19% saw better traffic than expected vs. 28% in April 2022, while 28% of builders saw traffic as worse than expected (22% last month).

- 60% of builders raised some, most or all base prices in May, down from 76% last month and the peak of 100% in May 2021. Incentive use increased slightly; 16% of builders increased "most/all" or "some" incentives vs. 9% last month.

Builders – a generalized cohort of people in 30 or more occupational fields whose ages in homebuilding and partner companies range from their mid-60s to their mid-20s – are prepared for "normalizing" and perhaps "cooling" and maybe even slowing down after an unsustainable run-up of buyer-demand-going-to-any-length for the opportunity to purchase a new home.

Very likely, however, anyone under the age of 35 has not been around long enough to have experienced anything other than a market rebound starting in 2010 or so. BTIG equity research analyst Carl E. Reichardt, Jr. in commentary about the latest turn of trends in the BTIG/HomeSphere survey notes:

Demand trends slowed significantly in May. 19% of builders reported yr/yr increases in sales orders per community vs. 32% last month, and 53% of builders saw a yr/yr decline. Both are the poorest readings in the 56-month history of our survey.

That's almost five years of hardly ever anything but up.

Builders' observations a few months ago were that nothing was going to sway the single strongest dynamic impacting their business, which was that overwhelming demand of mostly Millennial buyers would continue to clamor – come what may – for too few new homes to meet that demand.

Here was a clear picture of the big-demand-meets-tiny-supply equation:

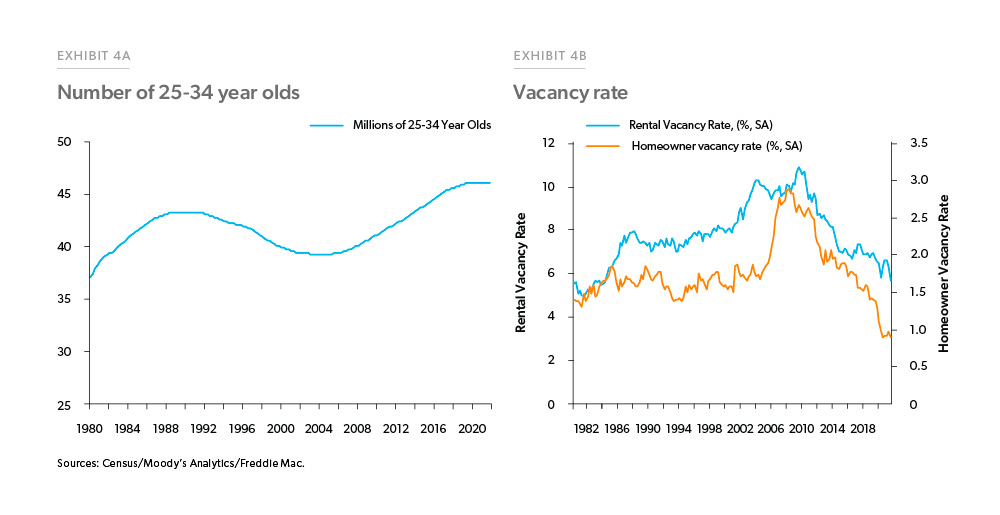

There is a record number of people in the typical age range for first-time homebuyers, as shown in Exhibit 4A, causing a strong increase in demand for both single and multifamily housing.

There are now 18% more people between the ages of 25 and 34 than in 2006. That is 6.6 million more potential first-time homebuyers, from 39.5 million in 2006 to 46.1 million today.

This demographic increase in potential homeowners was not met with enough new construction. Thus, vacancy rates dropped, pushing up rents and making renting less attractive. Exhibit 4B shows the downward trend in both homeowner and rental vacancy rates, which fell to 40-year lows.

This picture and the underlying data prove one thing. The fundamentals that support a business dynamic don't always reliably predict that business dynamic, which means that leaders of firms in the homebuilding ecosystem need to be prepared for a "what comes next" that they may not believe will ever happen.

For instance, looking back, leaders would have to go back as far as the early 1970s to see how at-odds their speculation based on strong demographic drivers would wind up being vs. the actual behavior of the marketplace.

Calculated Risk's host Bill McBride compares the current set of housing market headwinds to a time period more than 40 years ago a precious few were around to experience and apply learnings for today – the 1978 to 1982 cycle. During this four-year stretch, new home sales fell by half, months of supply jumped sharply, and housing starts collapsed.

Here's the basic framework for his comparison:

- Demographics were similar

- House prices had been increasing rapidly.

- Inflation picked up, partially as a result of a spike in oil prices.

- The Fed raised rates to bring down inflation.

- House payments increased sharply

Of course there are different factors between then and now.

What, however, does it mean for leaders to be prepared for today? In a sense, it means preparing for a scenario they don't believe is likely, allowing however, for its plausibility and future-proofing their organization as though it can occur.

We are concerned firms are saying "we are prepared" when what they mean is that they believe they know enough about "what comes next" to feel confident fundamental demand will win the day.

To that, we'd recommend listening to a man whose stock in trade is saying what means the most in as few words as possible, Seth Godin:

Our story about the future is in the now, regardless of how far away the future is.

All we can do with the future is experience our story about it right now.

All problems are short-term problems if we tell ourselves the right story. But we usually don’t, because we discount the future significantly. A grilled cheese sandwich today is more important than two grilled cheese sandwiches next week. Unless we tell ourselves a present and urgent story about what it feels like to ignore the future.

Because sooner or later, we live in the present. A present filled with stories and cultural pressure and the urgencies we invent for ourselves.

So, when it comes to "what comes next?" are you prepared? Or are you filling the present with a story whose urgency is of your own invention?

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.