Capital

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.

The word resilience and its variations have already done yeoman's duty in the long wake of the pandemic.

Yet, given what many expect will continue to be a whiplash stretch of turbulence ahead, resilience's overuse and ultimate risk of being hurled onto a growing heap of terms emptied of meaning is almost an inevitable fate.

Still, it's the simplest word – with its full stack of implications and impacts – that makes the most sense to fasten on as a signal amidst all the noise.

In mid-March, homebuilding business leaders and investment strategists converge on one critical question: What’s next? The next 8 to 12 weeks, commonly called the Spring Selling Season, dictate the year's trajectory for U.S. homebuilders. It’s when a large majority of annual new-home sales occur, making it the most closely watched segment of the housing cycle.

This year, Builder Advisor Group CEO Tony Avila hosted his annual Forum for Housing Executives in San Francisco. The event brought together an elite group of homebuilders (representing more than half of all new single-family home deliveries in the United States), developers, and capital market players to assess economic conditions, capital flow, and market opportunities for 2025.

The event featured speakers from AllianceBernstein, Rockefeller Wealth, Fifth Third Bank, Zonda, Builders FirstSource, and executive strategists from public and private homebuilding firms.

What emerged from the discussions? A market at a crossroads, caught between rising affordability pressures, shifting buyer trends, and a potential Federal Reserve pivot. Here are six must-know insights from the 2025 Forum for Housing Executives that homebuilders and investors need to digest now.

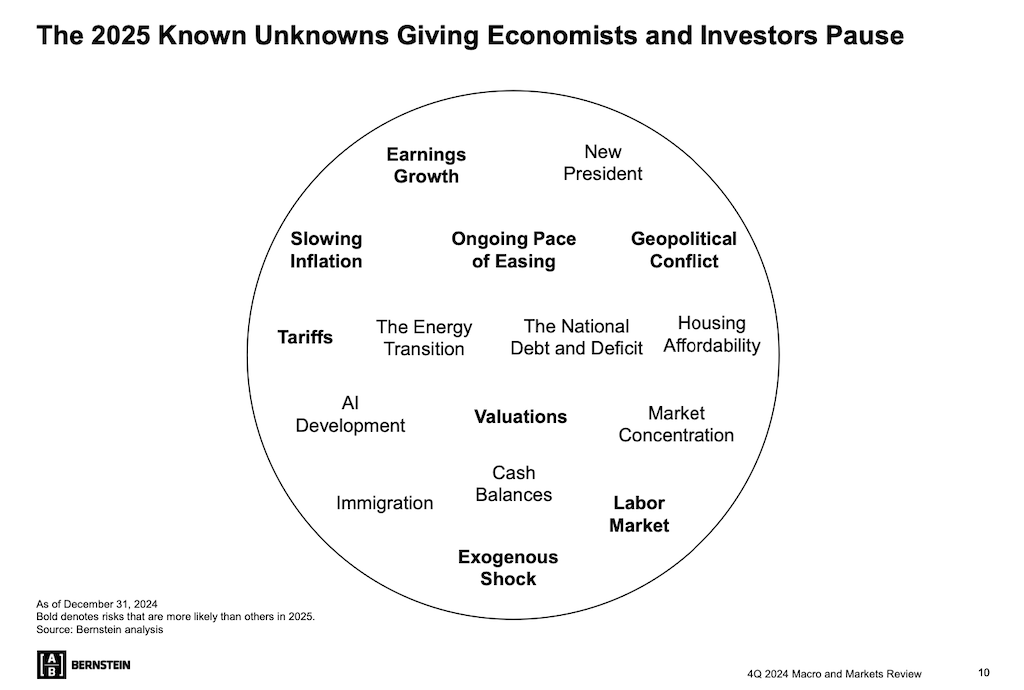

1. The Fed’s Next Move: Rate Cuts Are Coming, but Inflation Looms

The Federal Reserve’s policy stance remains a key market driver. The 100 basis-point rate cut in 2024 has brought the target range to 4.25% - 4.50%, and most Fed officials anticipate two additional 25 bps cuts in 2025.

While mortgage rates have eased slightly, inflation remains a wild card. Core Personal Consumption Expenditures (PCE) inflation, the Fed’s preferred gauge, has dropped from 6.6% in June 2022 to 2.6% in January 2025. Yet, geopolitical instability, tariff impacts on materials, and labor constraints could reintroduce inflationary pressures.

For homebuilders, the biggest takeaway? Rate cuts may improve affordability, but the timeline remains uncertain. Companies that prepare for prolonged higher-for-longer borrowing costs will be better positioned.

2. Housing Market Outlook: A Gradual Recovery with Supply Constraints

The new-home market is recovering but unevenly. Builders project a 2.5% increase in single-family starts for 2025, supported by a steady stream of buyers who remain active despite affordability challenges.

Key data points from the forum indicate:

- Demand for vacant developed lots (VDLs) remains high due to a nationwide housing shortage of 1.5 million homes.

- Mortgage rates are expected to trend toward 6% by the end of 2025, which may help buyers regain confidence.

- Inventory levels are rising, with resale, new-home, and Build-to-Rent (BTR) supply all increasing.

3. Buyer Behavior: Repeat Buyers Dominate, Entry-Level Struggles Continue

Builders cannot rely on first-time buyers to drive volume in 2025. With affordability stretched, demand has shifted toward repeat buyers leveraging home equity to move up or downsize.

The market is bifurcated,” Avila noted. “Entry-level is facing the toughest road, but move-up, active adult, and discretionary buyers are still transacting.”

Some key trends:

- 34% of markets are overperforming, 34% are average, and 32% are underperforming.

- Builder concessions are averaging 4% of home prices, as incentives remain a necessary tool.

- Entry-level sales remain below pre-pandemic levels, though affordability adjustments could revive demand later in 2025.

4. M&A Activity: Public and Private Builders Accelerate Deals

Consolidation remains a dominant force in housing. Mergers and acquisitions (M&A) are accelerating, with public builders using excess capital to expand their land pipelines and enter new markets.

Recent examples include:

- Meritage Homes making its first acquisition in over a decade to expand into the Gulf Coast.

- Drees Homes moving into San Antonio, adding its fourth Texas market.

Successful transactions are commanding 8x EBITDA multiples and 2x book value, reflecting strong valuations. Expect more deals ahead, particularly involving Japanese capital — Sumitomo and Daiwa have tripled their after-tax margins since entering the U.S. market, making them eager acquirers.

5. Banking & Real Estate: The Liquidity Crunch Is Real

The forum discussions underscored the ongoing credit tightening that continues to affect homebuilders and developers. With regional banks pulling back from acquisition, development, and construction (AD&C) lending, private capital is stepping in to fill the gap.

Key factors:

- $1.2 trillion in commercial real estate debt is set to mature over the next two years.

- Private credit funds and non-bank lenders are playing an increasing role in financing homebuilding operations.

- Builder capital structures are evolving, with a greater reliance on land banking and joint ventures to offset debt constraints.

6. Policy Uncertainty: Tariffs, Immigration, and Federal Spending Cuts

Federal policies are creating turbulence across the industry:

- Tariffs on Canadian lumber and Mexican materials could add $7,500 to $10,000 to the cost of a typical new home.

- Immigration policy shifts could reduce labor supply and impact rental housing demand more than single-family construction.

- Federal contractor layoffs could ripple through the economy, affecting consumer sentiment and employment stability.

There’s no question we’re seeing a slowdown in discretionary spending,” Avila noted. “Soft indicators like Broadway ticket sales and tourism bookings are down, which points to a broader deceleration.”

Final Thoughts: Preparing for 2025’s Challenges

The 2025 Forum for Housing Executives revealed a market facing uncertainty, volatility, and high-stakes strategic decisions. Builders, developers, and investors must navigate shifting economic conditions, evolving buyer behaviors, and policy turbulence.

Actionable takeaways:

- Don’t assume interest rate relief is imminent — plan for higher capital costs.

- Prioritize buyer segmentation strategies — entry-level demand remains weak, but move-up and active adult remain stable.

- Expect more M&A deals — public builders and foreign capital are actively seeking expansion opportunities.

- Adapt to policy shifts — tariffs and immigration rules could disrupt cost structures and supply chains.

As Avila summed up:

The stakes have never been higher. The right capital structure, land strategy, and buyer focus will determine who thrives in 2025.”

For homebuilders and investors, positioning for resilience is the key to success in the months ahead.

MORE IN Capital

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Private Capital Strikes Again: Oak Knoll’s $130M Kickstart

A historic Bay Area naval site is being transformed into a master-planned community amid the toughest credit market in years. With banks pumping the brakes, private capital is fueling a critical project in San Francisco's housing crisis.

JP Morgan’s Latest Power Move: A Homebuilding Shake-Up in the SFR Market

JP Morgan’s new venture with Paran Homes signals a shift in housing’s power structure. Institutional capital isn’t just funding BTR communities—it’s now shaping how they’re built. This could be a flashpoint for private homebuilders and developers navigating the M&A landscape.