Marketing & Sales

Homebuilding's Top 10 Trends In '24: No. 9 Tons Of Grand Opens

'Coming soon' and 'Grand Opening' pins on homebuilding operators' local area "find your new home" neighborhoods scheduled to open in early 2024 are – quite literally – all over the map in the nation's hotbeds of new construction and real estate.

'Coming soon' and 'Grand Opening' pins on homebuilding operators' local area "find your new home" neighborhoods scheduled to open in early 2024 are – quite literally – all over the map in the nation's hotbeds of new construction and real estate.

A lot is riding on this pick-up in ribbon-cutting moments. Many of them involve new product offerings value-engineered to bend ASP-curves in a direction more households will find to be within reach of their wherewithal and compelling to boot. , getting granular with consumer insight and what's driving behavior set winners, also-rans, and losers apart in the year ahead.

"Metro markets in southern states will likely outperform others due to faster job increases, while markets in the Midwest will experience gains from being in the most affordable region." – Lawrence Yun, National Association of Realtors

A housing forecast released earlier this week by Jan Hatzius, chief economist at Goldman Sachs calls for an increase in new home sales volume of 43,000 houses from preliminary 2023 estimates of 680,000 to 723,000 in 2024.

Community count increases among both public and privately held operators will likely fuel a great deal of that 6% year-over-year increase, judging from commentary in this past cycle of quarterly earnings reports from public builder senior-level executives.

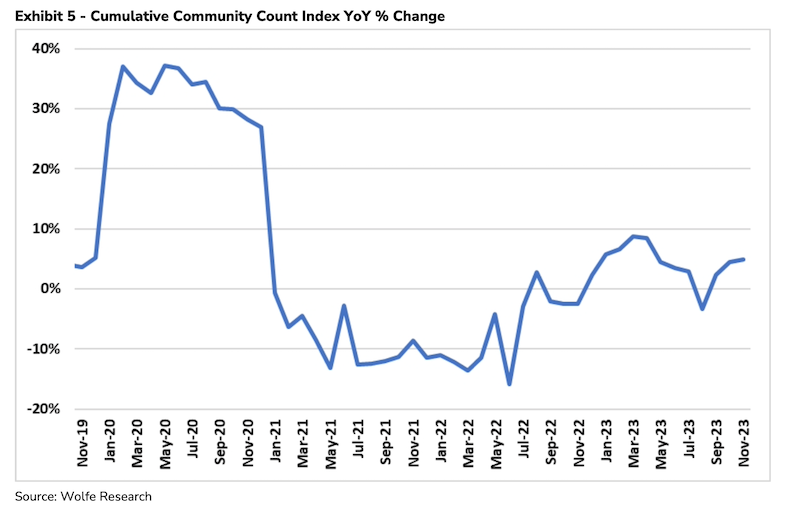

A November Private Homebuilder Survey by the team of analysts led by Truman Patterson at Wolfe Research leads with this insight:

For 2024, respondents expect 1) Orders will increase +10% on average, primarily driven by community count growth (assuming flattish absorptions)."

Adding commentary on new neighborhoods – current and calendared – "grand opening," Patterson's high-level take on the impact of community count-fueled new order estimates is as follows:

November Community Count increased +1% sequentially and increased +5% YoY. Private Builder community count has improved on a YoY basis for 17 consecutive months. We continue expecting our coverage universe’s net Community Count increases sequentially through year-end as the backlog of previously planned communities open. We forecast our Public HB Group’s 4Q23 Community Count increases +7% YoY."

Clearly, velocity and simplicity will work as hallmarks to operational excellence in the construction value cycle, as will a holistically-activated common thread of data from end-to-end pre-construction to closing lifecycle.

Still, creating a community-specific pull of demand for new neighborhood offerings stems from a root source understanding of consumer drivers that motivate what, when, and how much consumer households have underlying the pursuit of their next new home.

To that end, a new 2024 Housing Market forecast from Audience Town, the real estate industry’s first consumer intelligence platform that identifies when, where, and how people are moving, reveals their predictions on the housing market for the next year, along with insights on the trajectory of the real estate industry in 2024.

Among the top-line takeaways Audience Town spotlights:

- There are two distinct housing markets and types of home movers in 2024:

- Market Rate Renters and Buyers – for homes priced around the national average, sellers have a mortgage and their buyers need a mortgage. If these don’t match, they become renters or don’t move at all.

- Upscale Renters and Buyers – many of these movers, making up 42% of homeowners today, own their home already and don’t need financing to move.

- The number of predicted home movers will be down to 26 million. In 2021, 28 million people relocated, indicating a decrease in home movers in the coming year. Peak years have recorded 35 million or even 40 million movements, underscoring a historical trend of decline. However, people who move with all-cash are still on the move.

- The most affluent are predicted to move in 2024. 40% of this group are more likely to buy an additional home

- They are two times more likely to sell

- Their current home value is $1M+·

- The rest will compromise their quality of life in order to move, either by living far from their desired location, cutting back on their lifestyles, or having a long commute to an office 1-3 days per week.

Real estate marketing is transitioning to focus on people instead of place," says Ed Carey, CEO of Audience Town. "A transformation is taking place across the real estate culture that is all about delivering a remarkable, digitally enhanced experience to consumers. This involves leveraging data, video, live services, and on-site assistance to ensure that consumers enjoy an outstanding journey—from their initial visit to a property website to post-move-in, where they can access concierge services from the builder or owner/operator."

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.