Leadership

Homebuilding’s Top 10 Trends In 2024: No. 5 Visibility’s Value

While first-cost hurdles remain a mathematical challenge to price-in would-be buyers, total lifetime value and financial constants play a key role in persuading folks to buy now.

Homebuilding teams’ “not-so-bad,” better-than-expected 2023 owes itself in nearly equal measures to luck and skill.

Luck came mostly in two ways.

One was that rising interest rates stayed just barely low enough for most builders to adapt their pricing, incentives, and mortgage buydown tools in their toolboxes to sustain sales pace among lots of interest-rate and price-sensitive would-be buyers, bridging that mathematical gap to keep their production machines running. The other was that those very same interest rates stayed high enough to discourage most would-be sellers – many who’d locked in historically low 30-year mortgage rates prior to January 2022 – from listing their homes. This effectively seized up the existing home marketplace, beaming a bright light on newly constructed homes as homeownership’s “only game in town.”

Skills varied widely among operators. By and large, they started with solid pre-crisis planning and discipline, well in advance of adverse conditions, to rid balance sheets of debt, to pare back land exposure, and to drive gross margins to where they’d be able to absorb plenty of shocks. Then, after the Fed began applying a tourniquet-style monetary and fiscal policy approach to snuff inflation, operators pivoted into DEFCON mode, applying a full array of pricing and incentive tools precisely aimed by neighborhood, by project, by product spec, etc.

In 2024, however, better-than-expected performance will stem far more from homebuilding operators’ skills, and far less from the helping tailwinds of locked-in owners. Why is that?

An article from The Atlantic staff writer Annie Lowrey could hardly put the current situation in a better context:

At this time 15 years ago, real-estate agents had 2.2 million vacant housing units available to show prospective buyers. That number has dwindled and dwindled and now sits at just 732,000, despite the country having added 30 million people to its population. The Case-Shiller index of home prices sits near its highest-ever inflation-adjusted level; houses are unaffordable for middle-class families across the country. Rural areas are expensive. Suburbs are expensive. Cities are absurdly expensive. Nowhere is cheap. That’s in part thanks to mortgage rates. The monthly payment on a new home has increased by more than 50 percent in the past three years, as 30-year mortgage rates have climbed from less than 3 percent to nearly 8 percent.

It’s a terrible time to buy a house.”

Add to that macro take on the current sentiment among consumer households, compared with renting, buying a home is particularly challenging for would-be first-time homebuyers. Two Fortune magazine staffers, Alena Botros and Nick Lichtenberg, write:

BofA economists took a look at the rent versus buy conundrum, comparing rent and mortgage payments (they included property taxes in their calculation, but excluded home insurance, utilities and maintenance costs). Nonetheless, their analysis found that “rent was still cheaper than mortgages in all but two of 97 major Metro Areas,” as of October, despite the fact that both rents and mortgage payments have gotten more expensive, relative to median income, since the pandemic. It’s not hard to understand this, given that the whips and scorns of the pandemic let millions perchance dream of a different way of life—and a different housing situation, sending home prices up more than 40% nationwide and fueling a rent spike that has settled down faster than the buying market.”

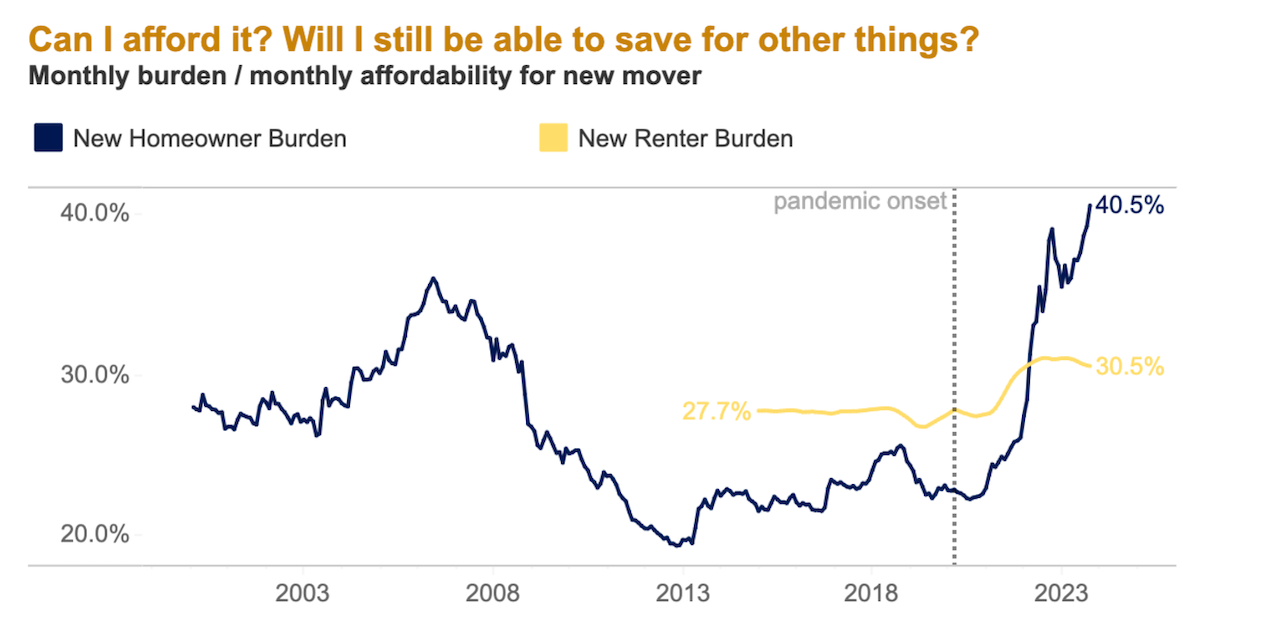

Beyond the headlines, Zillow researchers help to quantify that wider gap between new homeowners and renters from a monthly payments standpoint, with Zillow Home Value Index estimates including the new mortgage, plus property taxes (1% of home value annually), plus homeowners insurance (0.5% of home value annually) “for the typical U.S. housing unit.”

Here’s what that widening gap looks like for a middle-tier buyer vs. a middle tier new renter:

All this is to say that homebuilding operators’ teams have their work cut out for them in 2024. Those skills will play two critical roles: They not only need to continue to work their mathematical magic to keep pricing-in would-be buyers on the bubble of either interest rate or home-price elimination. But they also have to do the same on the psychology front, to keep persuading buyers that now’s the right time to make the big move, rather than to wait until a less uncertain time.

While volatility and uncertainty run riot, and while consumers’ own experience of their kitchen table cost-of-living challenges continues to weigh heavily on their monthly wherewithal, best-of-breed homebuilding operator teams have begun to flex persuasive skills around both the financial and intangible peace of mind benefits buyers can tap into with a new home purchase.

Owning a home gives many new buyers a great feeling of stability and permanence,” says Chris Geeslin, VP and Executive Account Manager at Westwood Insurance Agency, a The Builder’s Daily sponsoring partner. “Especially today with the high cost of renting, many buyers appreciate the fact that they’re building equity in their home and that they have control over where they live, what it looks like, and what the comforts are going forward.”

During a period of time where macroeconomic flux and a cost-of-living squeeze may go on for a foreseeable near- and mid-term future, new-home buyers can feel more confident in their purchase by considering both financial and intangible “lifetime value” from homeownership as a way to get over the hump of a high first-cost barrier to entry.

Among the more obvious financial analyses buyers will need to look at include:

Purchase Price:

- Analyze the initial cost of buying the new home.

- Consider any additional costs such as closing costs, real estate agent fees, and other transaction expenses.

Appreciation:

- Investigate the historical appreciation rates in the housing market.

- Estimate the potential future appreciation of the property.

Equity Buildup:

- Explore how mortgage payments contribute to building equity over time.

- Compare the equity buildup in the early years versus later years of homeownership.

Tax Benefits:

- Potential tax advantages associated with homeownership, such as mortgage interest deductions and property tax deductions.

Then, to begin to factor in ongoing expenses in comparison with other choices, i.e. renting an apartment or a single-family home, households can calculate operating costs:

Maintenance and Repairs:

- Ongoing costs of maintaining a new home.

- Regular maintenance on the property's value.

Utilities and Insurance:

- Costs of utilities and insurance over the homeownership period.

- Factor in the efficiency and sustainability features of the new construction.

Then comes the consideration of emotional and psychological factors in the new homeownership experience:

By having a mortgage, buyers know exactly what their payment will be every month, which is especially important today with the high cost of just about everything,” says Westwood’s Chris Geeslin. “Knowing that constant monthly amount for your biggest asset gives a sense of stability and security. It’s one less thing for first-time home buyers to worry about.”

Intangible Value

Quality of Life:

- How the new home contributes to the homeowner's overall quality of life.

- Factors like location, neighborhood amenities, and the layout of the home.

Emotional Satisfaction:

- Well-being derived from living in a newly-constructed home.

- Pride of ownership, personalization opportunities, and the joy of a modern living space.

Community and Social Aspects:

- The impact of the community and social environment on the homeowner's experience.

- Community events, neighbors, and the overall sense of belonging.

Of course, for a full lifetime value analysis, taking stock of future considerations and even an exit from the home at some later date is an essential part of the calculus.

Resale Value:

- Potential resale value of a newly-constructed home.

- The initial purchase decisions and subsequent maintenance can influence resale value.

Adaptability to Future Needs:

- Factor in how the home meets the homeowner's evolving needs over time.

- Recognize features that enhance the property's adaptability and long-term value.

Market Trends and Economic Factors:

- Broader economic trends and market conditions impact the value of homeownership.

Whatever the life-stage of new-home ownership, consumer households have begun to lean in to greater visibility and predictability as a “safe haven” from external volatility and uncertainty. Homebuilding operator teams that integrate those facets of visibility, stability, and predictability into their offerings will stand out and thrive in a 2024 market where skills will make an important difference in business expectations.

One of the great benefits that Westwood offers our clients is that we’re able to provide their home buyers with the insurance cost upfront,” says Geeslin. “There’s that visibility, and there are no surprises when everybody gets to the closing table. They know what their annual premium is and what they're responsible for. That’s important to a sense of security, and immediately makes that home a place where a buyer feels they belong.”

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.