Leadership

Homebuilding Lightning In A Bottle For A Soaring 2nd Time Start-Up

Greenwood Homes – which cut its first new communities' ribbons in very late 2020 has catapulted to just shy of $200 million in expected 2023 revenues across its three mid-Atlantic operating nodes.

Among his peers, it won't take a lot of extra explaining to get three-plus decade veteran, divisional start-up pro, and serial entrepreneur Drew Holzwarth when he refers to homebuilding's calling as a "bug" he can't rid himself of just yet.

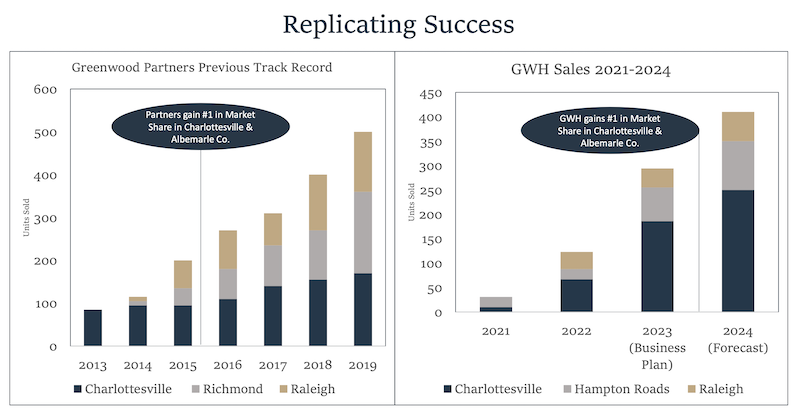

Case in point: After agreeing to merge a firm he'd started in 2009 – Charlottesville, VA-based Piedmont Realty & Construction – with Reston, VA-based Stanley Martin Homes in 2013, and leading the blended companies' turbocharged growth and expansion into Richmond and Raleigh, N.C., for five-and-a-half years, Holzwarth thought in 2019 it might be exactly the note to go out on, and call it a career.

He'd accomplished at least a career worth of professional and business goals, made money, and was looking at a comfortable retirement with time – at his relatively young age -- on his side to enjoy just as he wanted to.

The "bug" decided otherwise.

I was off on the sidelines for only about seven months, and I will tell you, it was nice, but you can only play so much tennis you can only play so much golf," Holzwarth says. "If you're wired like I am to get up and go, it just it wasn't that much fun. So, although Greenwood Homes certainly wasn't the plan, I'm glad we did. It's fun."

Greenwood Homes – which cut its first new communities ribbons in very late 2020, and has catapulted to over $200 million in expected 2023 revenues across its three mid-Atlantic operating nodes -- is the second de nova enterprise for Holzwarth, whose career in the field goes back to his first job in the RTC early 1990s, with NVR, fresh off an undergraduate double-degree in criminal justice and Spanish at Penn State.

That's when "the bug" got into him.

When I came out of Penn State, I expected to work for Ryan Homes for just a couple of years, and then I was going to go back to law school," Holzwarth says. Somehow, a "couple of years" time-warped into a decade-plus. "I was 27 when I became a Division President for Ryan Homes, running the Washington Metro Division. After growing the division from $4 million in pretax profit in 1999, to $56 million in pretax profit in 2004, I became a start-up leader for NVR – starting two new divisions – the second bringing me to Charlottesville VA."

Aiming for a C-Suite role at one of the big builders, Holzwarth finally did take a time-out from the industry, from 2007-2009, during which time he earned his MBA at UVA’s Darden School of Business. His "project" coming out of Darden was his first homebuilding start-up, Piedmont. In that venture, prior to its sale to Stanley Martin, what he'd learned in the past and where what he'd need to learn of the near- and long-term future seemed to fuse with Holzwarth's very DNA.

A colleague, friend, and homebuilding strategic leader Jamie Pirrello, wrote of Holzwarth's learnings and wisdom here in 2010:

Drew Holzwarth spent more than a decade with NVR. He was there as NVR successfully drove vendor prices down. Holzwarth knows it can be done, and NVR is one of the best at doing so. Today, Holzwarth is one of the principals of Piedmont Realty and Construction, a home building company based in Charlottesville, Va.

“One of the legends at NVR was our director of construction, Robert Burdette,” recalls Holzwarth. “Robert pounded into everyone he came in contact with that, ‘You cannot beat a man at his trade,' and that, ‘Our trade partners should play a key role in our cost-savings process, [because] they work with these products every day, and price cannot drive cost-saving decisions alone.' Somewhere along the way as these legends retired, they were replaced with procurement professionals, and trade partnerships were lost.

“As a private builder, I do pay a little bit more, but my standard equipment is a bit superior because I've had my partners help in the process. I've established true trade partnerships, and when I pick up the phone, my partners react. My partners are bringing in national suppliers who've been priced out of the national home building market—for instance, Kohler and Trane. In the end, I pay a bit more but I include brands that set us apart.”

Holzwarth argues that he can't “out-Ryan Ryan Homes.” Instead, he focuses on differentiating his offering, stepping out of the commodity pricing arena. “The heads of procurement for the national home builders hold a lot of power,” Holzwarth says. “Procurement teams have dialed down the quality of the nationals' product and are now in conflict with profit center managers.” Everything is a trade-off.

Greenwood germinated from a "what if" to a "go time" launch during another time-warp spell, the months immediately following Covid-19's arrival.

Two of my close leaders separated from Stanley Martin in 2020, and we wrote the business plan for Greenwood Homes and launched late that year," says Holzwarth. The firm recorded better than $75 million in 2022 revenues across 15 neighborhoods in the Charlottesville, Hampton Roads, and Raleigh, N.C. markets, and soared to a No. 1 marketshare position in that two-year time period in Charlottesville. "While the explosive growth and success of Greenwood Homes are surprising for most, it is the result of a highly skilled team that have done this for four homebuilding companies across almost 30 years," he adds.

Further, the mid-Atlantic and Southeast market footprints that Greenwood Homes stood itself up and plans to grow in have meshed like stars aligned with three macro domestic migration, mobility and community development trends the Covid pandemic juiced – but didn't start – at exactly the moment Holzwarth and his partners launched in 2020-21.

- The evolving emergence and sustainability of hybrid remote- and office workplaces, powered primarily by high-speed network technologies

- The revision of post-career adult life, community, and family-connection preferences, that map 55-plus in closer geographical proximity to children and grandchildren

- The growing allure of "affordability" and "quality of life" geographic magnets as greater influencers for both young adults and retiring adult households.

Homebuilding and development companies whose land, construction trade labor, distribution, and financial relationships forged their product, location, and pricing expertise in markets – secondary and tertiary metro areas with natural amenity and connectedness to transportation, health, education, and cultural hubs – have kicked it up several notches in value. That value gain applies both to homebuyer prospects and potential investment and acquisition interests during the pandemic era.

When Holzwarth points to the three decades of market cycle and local experience his strategic and operational team bring to bear on growth, he's also downplaying how it's exactly that experience – and the "bug" -- that guided him to double-down on spec construction and development at exactly the moment many homebuilders were slowing their spec starts in fear of a dreaded overhang of finished inventory that sat unwanted on the market.

In the mid-Atlantic and in the northeast where zoning is difficult, our inventory homes and resale inventory continued to draw," says Holzwarth. "I looked at it and saw resale inventory at the lowest levels in history. Consumer confidence was okay. So, we made a bet in the 4th quarter of last year – where builders were pulling back in a big way -- we added inventory on the street, and as we entered the Spring market, we had speculative inventory. As= you know, eventually the market got comfortable with 6.5% interest rates. And as they the market got more comfortable with those interest rates, our new inventory fed into the really low MLS resale numbers and we've benefited from it."

With a weather eye on domestic migration, mobility, and local economic trends in the operating areas, Holzwarth remains cautious about continuing to gun the growth engine before evidence stabilizes during seasonal softness and a higher-for-longer rate as to the ongoing strength of demand.

We've pulled our foot off of the accelerator a little bit," Holzwarth says. "As we work into the 4th quarter, we'll see what happens with the Fed. Everyone has shared that the quarter-point interest rate is baked into the market. That's when we'll see if they'll start taking their foot off the gas in terms of raising interest rates. So I think you know, we're going to be cautious you can't be you can't get over your ski tips. There's no reason to at this point. Once we get into the 4th quarter and look at what what the forecast is for the Spring market in 2024, we'll make a solid decision in terms of how we position ourselves."

All things being equal, Holzwarth and the team see further expansion – possibly into Charlotte, N.C.'s torrid market – on the roadmap. Irrespective of market conditions, volatility, headwinds, what have you, Holzwarth's deepest sense of confidence, and his recognition that this "bug" is going to keep him at it for another decade or so building value as a builder comes from his team.

One of the things I consider most important is on the construction and production side of the business, all of our leaders in that area are builders," Holzwarth says. "They've been builders for a long time and they love building a tight quality product. And the partners are not focused only on 'can I save a day or two or days under construction?' Now, that means a lot right now as we grow. But, their focus is more on, 'we will never deliver a home until it's ready.' Our production leaders tell us when it's ready. They're the tip of the spear in the company. We're all excited about selling a home. Nothing happens until we sell a home. But once that home goes into production, we schedule our deliveries when our production team tells us the homes are ready, and that's been a dramatic nuance with our customers. And so what happens is our salespeople have confidence in that production team. And that production team has confidence that the partners are going to support them and we're going to deliver our home when it's ready, and it's going to be tight. It's going to be a 100% home. And so we've been able to attract people that want to build great homes that want to sell great homes. And that's really helped us build upon the culture of getting things done at the company. And as a result, we're having more fun, you know, we want to laugh together. We want to win together. But the reality is, we want to build great homes."

That's the "bug" talking.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.