Leadership

Homebuilders Face 2025's New Reality: Certainty Sells Homes

Rising home insurance costs are no longer just a buyer concern — they’re reshaping the homebuilding business. Builders who eliminate cost surprises, embed insurance into their process, and assess risk early will be the ones closing deals in today’s uncertain market.

It’s Spring Selling Season for homebuilders, and the American homebuyer is getting nervous.

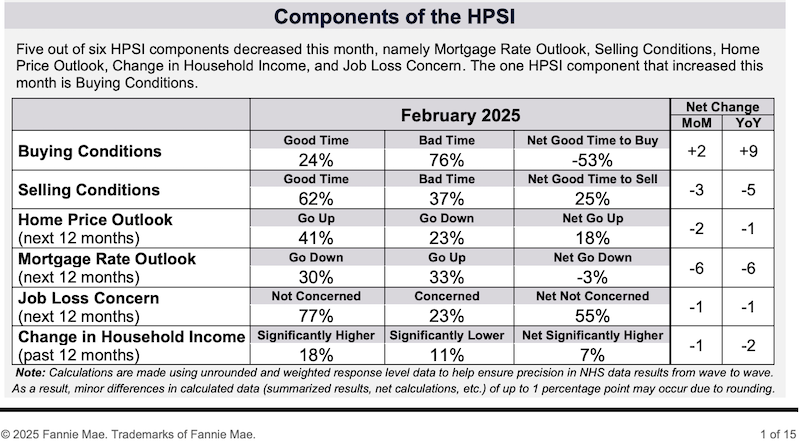

Mortgage rates remain high, insurance premiums are soaring, and uncertainty about the economy, interest rates, and even extreme weather events is rattling consumer confidence. February’s U.S. Consumer Confidence Index dropped 7 points — the largest monthly decline since August 2021. The data is clear: Buyers are questioning whether now is the right time to commit to the most expensive purchase of their lives. And that uncertainty is becoming an existential problem for homebuilders.

For homebuilders, the risk isn’t just in unsold inventory — it’s in deals that fall apart at the last minute. A buyer can get pre-approved for a mortgage, sign a contract, and still walk away if an unexpected insurance premium hike suddenly makes their monthly payment unaffordable. The hard truth: Uncertainty can kill deals.

That’s why predictability, trust, and risk management are no longer optional in homebuilding. Builders who eliminate surprises for their buyers—particularly around insurance—stand the best chance of closing sales in today’s volatile market.

Arvin Darilag, VP of Business Development at Westwood Insurance Agency and an expert in homebuilder insurance strategies, explains why homebuilders must rethink their approach:

There was a time when we had to convince homebuilders that insurance should be part of their sales process. Now, they’re the ones reaching out to us, asking for help. They’re seeing firsthand that securing insurance has become as critical as securing financing—it’s no longer an afterthought.”

The Insurance Shock Factor

Homebuyers today don’t just worry about mortgage rates. They worry about affordability in total—mortgage, taxes, insurance, maintenance. And insurance is the wild card.

Homebuilders used to think of affordability in terms of interest rates,” Darilag says. “Now, insurance payments are just as much a factor in whether a buyer can afford a home. When premiums unexpectedly jump from $1,500 to $5,000 a year, that’s enough to derail a sale—and builders are realizing they need to address this risk early.”

Insurers, facing mounting losses from climate-driven disasters, are exiting markets or dramatically increasing premiums. In California alone, major insurers like State Farm and Allstate have scaled back coverage. Florida, Texas, and Louisiana face similar challenges. That means more buyers are blindsided at closing when they see their final monthly payment calculation. Some walk away. Others try to renegotiate. Some just absorb the shock—until rising costs force them to sell.

Homebuilders need to account for this instability. They must provide buyers with insurance cost certainty as early as possible in the sales process. This is where pre-rating and pre-approval become game-changers.

Eliminating Last-Minute Surprises

Darilag points to an evolving strategy that reduces risk for both buyers and builders:

One of the biggest benefits of having Westwood integrated into a builder’s process is that we pre-rate and pre-approve homes and communities. That means when a buyer walks in, they know exactly what their insurance payment will be—just like they do with mortgage rates and property taxes. That clarity helps buyers make decisions with confidence and reduces the risk of cancellations down the line.”

Predictability is a key selling point in today’s market. Buyers who feel financially confident in their decision are more likely to move forward. The best way to deliver that confidence is to give them full visibility into all homeownership costs long before they reach the closing table.

Why Embedded Insurance Is Becoming Essential

Embedded insurance — where homebuilders integrate insurance pricing and policies directly into the homebuying process — is becoming the industry standard for builders who want to reduce friction and uncertainty.

We’re in a market where homebuilders can’t afford uncertainty,” Darilag says. “Embedded insurance has become a must-have because it eliminates a major unknown from the buying process. Buyers get a clear, upfront quote, builders know their sales won’t fall apart over unexpected costs, and lenders have reliable numbers for debt-to-income calculations. Everyone benefits from that level of certainty.”

This is particularly critical for buyers in high-risk states where insurance carriers are tightening underwriting standards or exiting altogether. If a homebuyer finds out late in the process that their insurance options are limited—or their premium is much higher than expected—the sale is at risk.

Builders who integrate insurance into their sales model give buyers peace of mind and make their homes more financially predictable. It’s a competitive advantage in a market where confidence is fragile.

Proactive Risk Assessment at the Development Stage

Beyond individual home sales, insurance uncertainty is also reshaping how builders plan communities. Some areas that were insurable five years ago are now classified as high-risk zones, meaning coverage is harder to obtain or more expensive. Builders are adjusting.

Builders are now talking to us before they even break ground on a new community,” Darilag says. “They want to know—‘Can we get insurance here? What will it cost?’ We’re helping them assess insurability at the land acquisition stage, so they’re not blindsided later by high-risk zones or limited coverage options.”

Just as builders consider zoning, infrastructure, and market demand, they must now factor in insurance viability before acquiring land. A site that can’t secure insurance—or where premiums are so high they deter buyers—becomes a liability rather than an asset.

Buyer Education: Expectations Management

Insurance isn’t a back-end issue anymore—it’s a front-end discussion. Buyers expect transparency and education early in the process.

For too long, homebuilders treated insurance like homework — something to figure out at the last minute before closing,” Darilag says. “That’s changing. Buyers have more questions now, and they want answers early. By engaging them at the start of the process, we help them understand their options, reduce uncertainty, and prevent deal-breaking surprises.”

This shift aligns with broader trends in consumer behavior: Buyers are more risk-averse, more research-driven, and more hesitant to make big financial commitments without full visibility into costs. Builders who proactively provide that visibility will be in a stronger position to close deals.

Takeaways for Homebuilders

• Uncertainty kills deals. Buyers who feel unsure about long-term affordability are more likely to walk away.

• Insurance costs are as important as mortgage rates. Homebuilders must factor insurance into their pricing and sales strategies.

• Pre-rating and embedded insurance reduce last-minute fallout. Builders who provide upfront insurance estimates give buyers confidence and protect their sales pipeline.

• Risk assessment must happen at the land acquisition stage. Some areas are becoming uninsurable or prohibitively expensive, making insurance feasibility a critical planning factor.

• Educating buyers early prevents deal-breaking surprises. Homebuilders who address insurance concerns at the start of the process reduce friction and increase conversions.

Certainty Wins in a Market of Doubt

With consumer confidence slipping and affordability concerns mounting, homebuilders can no longer afford to treat insurance as an afterthought. Buyers want certainty—on costs, risks, and their ability to sustain homeownership long-term. Builders who provide that certainty will be the ones who continue selling homes in a market where doubt is the biggest obstacle to closing the deal.

MORE IN Leadership

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.

Build With Purpose: What Homebuilding Must Learn Now

Jamie Dimon’s 2025 letter isn’t about banking — it’s a challenge to business leaders in housing and beyond.

Wanda Headley Shows What Strength Looks Like Now

In a time of volatility and doubt, a retiring LP team member reminds us that character, commitment, and community are still the bedrock of resilience.