Leadership

Why Young 1st-Time Buyers Are Driving Spring '23 Demand

Buyers – especially the aspiring first-time and entry level prospects – pushed through a narrower mathematical pathway to achieve their goal. Here's what coaxes many of them along.

Two distinct would-be homebuyers stream – or trickle -- into new home demand pools in every geographic market, more or less always.

What sets them apart is important. One group of prospects clearly can act relatively immediately on a desire to own a new home. The other includes those who would, act on that aspiration if they can pull it off financially by navigating a narrower path to their end goal.

As 2022 came to an end, gravity pulling down home values played “buyer’s regret” mind games with the first group. Spooling interest rates wreaked arithmetic havoc on the second, pricing out prospects by the hundreds of thousands. Selling and closing homes was practically an act of psychotherapy for group Number 1, and a battery of heavy-duty personal financial acrobatics for more price- and mortgage rate-sensitive new home seekers.

A quarter into 2023, those new home market assumptions are history. “Better than expected” results overtook a guarded outlook on the year’s talk-track. Sequentially improving backlog closings, new orders, and even some perceptible stabilizing in new home pricing speak to a real household level of “buyers out there,” motivated and undeterred.

2023's Big Surprise: First-Time Buyer Power

Further, the first quarter just ended delivered perhaps its biggest surprise: Exactly which buyers out there have been most resilient at a time macro volatility, uncertainty, and complexity hung over the Spring selling marketplace. You’d think it was discretionary buyers, overcoming psychological hesitation, and moving ahead with their purchase – and many did. Still, it was buyer group Number 2 that kicked into action and reset expectations for 2023 as a whole. The moment interest rates moved downward off their peaks of over 7% late last Fall seemed to be the moment buyers – especially the aspiring first-time and entry level prospects – pushed through their narrower mathematical pathway to achieve their goal.

Relatively lower interest rates in the first quarter of 2023 also pushed more 1st-time home buyers to enter the market: 71% of all prospective buyers (a series-high) reported this would be their first time buying a home, up from 61% in the final quarter of 2022.” – NAHB Eye On Housing, Rose Quint, Assistant Vice President for Survey Research

In fact, lock-in effects have tended to moor current homeowners to stay put in their homes, where they’re paying historically low – below 3% -- mortgage rates, a phenomenon that has boosted the role and importance in the 2023 marketplace of Millennial and even Generation Z-aged first-time homebuyers.

Axios correspondent Matt Phillips says it succinctly:

Between the lines: At the risk of stating the obvious, first-time buyers don't already own a home — so they're not stuck in place by a sweet, low-rate mortgage.

- And with fewer than usual existing homes on the market for these entry-level buyers, builders see an opportunity.

- "It's a renewed focus, given the lack of inventory," Robert Dietz, chief economist at the National Association of Home Builders, tells Axios. "First-time buyers are going to play a key role in the order expansion for home builders going forward.

Further, data from national residential real estate broker Redfin reveals:

Gen Zers are tracking ahead of their parents’ homeownership rate: 30% of 25-year olds owned their home in 2022, higher than the 27% rate for Gen Xers when they were the same age." – Redfin

A Core Logic analysis notes:

First-time homebuyers (FTHBs) represent a growing share of the population, a trend that accelerated in 2020. The average age of FTHBs is 34, and most of them can be classified as Millennials or Generation Z.

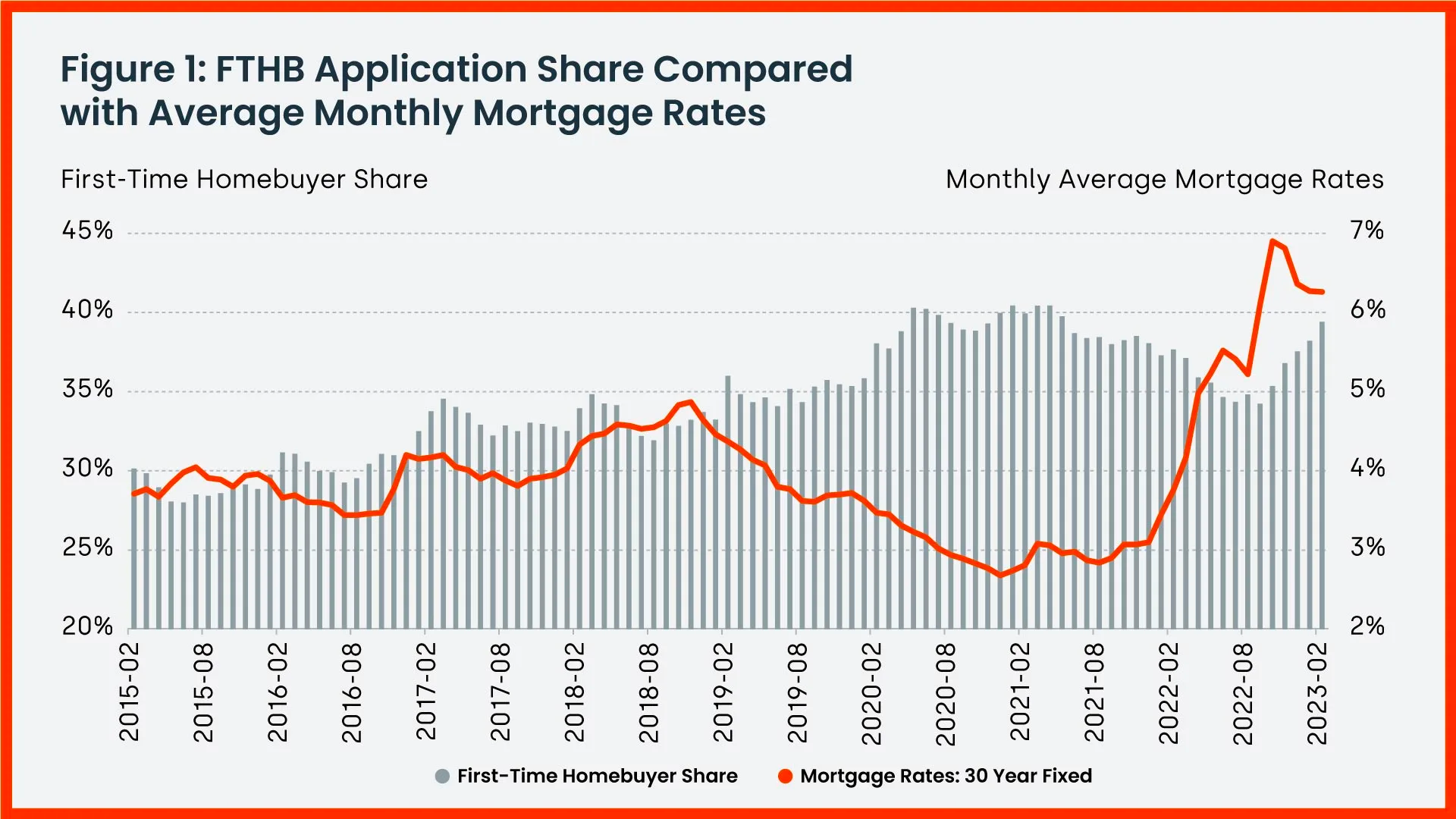

According to CoreLogic Fraud Consortium Loan Application data[1], the share of FTHB applications increased to 39% in 2020, up from about 29% in 2015 (Figure 1). However, the share dropped to a three-year low of 34% during the third quarter of 2022, as mortgage rates surged to the highest level since early 2000.” – Archana Pradhan, Principal, Office of the Chief Economist, Core Logic

The big take-away: Undeterred, undaunted, life-stage-driven young adult, first-time buyers have galvanized an X-factor upside to Spring Selling many builders discovered to their pleasant surprise. Through the first three months of 2023, homebuilders’ canny skills at working the switches and levers of rates, buydowns, locks, and other monthly payment reducing mechanisms have made the difference for so many first-time buyers in their pursuit of their dream of owning a new home. What’s more, builders and many of their preferred lenders, get granular when it comes to working with would-be buyers’ to get all the monthly numbers to mesh with their household income and wherewithal.

With the younger buyers, typically it may be their first home purchase,” Kimberlee Furcht, VP-Executive Account Manager at Westwood Insurance Agency, says. “They are not familiar, per se with how the process works. That's where builders who partner with Westwood really have a leg up because we are contacting the buyers early in the process. There are no surprises at the end. They know what their insurance is going to be. We are able to hold their hand through the process and because we're so familiar with the process on the builder side, you know, we can help them really feel at ease, save them some money, right? Because, everybody wants to save money, but typically, those first-time home buyers might be a little bit more price sensitive.”

Clarity Equates To Confidence

Furcht has observed that the current young adult household cohorts – Millennial and GenZ – of predominantly first-time homebuyers differ from earlier generations, not only in their information networks, but in how they tend and choose to navigate learning what they need to learn in what is the most significant financial commitment of their lifetimes.

They don't typically understand what's covered in homeowner’s insurance,” Furcht says. “They tend to find out from the lender and the home builder that they need to have insurance for their closing. They have the ability to complete their insurance application online. Millennials are used to doing stuff online. They might not like talking to people on the phone. We do offer them the option to do everything online and secure their insurance that way, if that's their preference. We give them options to communicate the way that they want to communicate with us.”

Westwooo Insurance Agency’s Kimberlee Furcht notes that while mortgage rate locks and buydowns have worked wonders to “price in” more group Number 2 buyers aspiring to the American Dream, an under-appreciated factor in their ability and resolve to push across the goal line comes down to their confidence and trust in who and what they’re dealing with along the journey.

That's where we can really help make them feel comfortable,” Furcht observes. “We understand that we have a couple customers. One of them is the builder. And one of them is the home buyer. We try to help both sides so we can get this buyer to closing at a competitive rate with a policy they understand. That’s in our interest as well.”

As Millennial, and increasingly, Generation Z young-adult households continue to play an outsized role in the strength and resiliency of the new-home market, both their pocketbook and their sense of trust and confidence in the process will serve as drivers of their demand.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.