Leadership

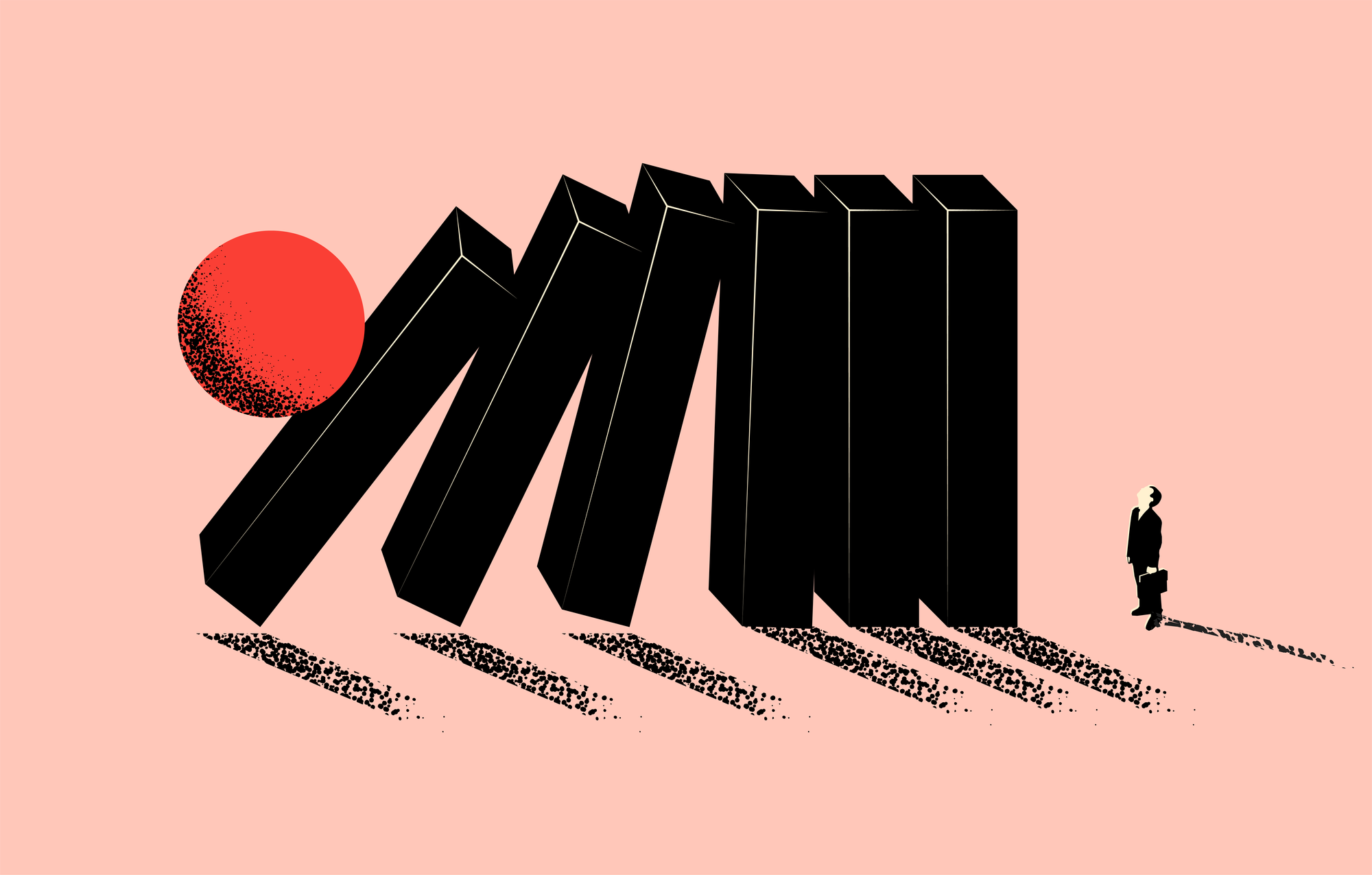

Here's Why Builders Don't Panic As Economic Storm Clouds Gather

Rather few strategists among higher-volume homebuilders believe the December 2022 to February 2023 lift will evolve into a sustainable reboot of exuberant demand. That doesn't faze them.

Explaining the recent 10-week lift across many U.S. markets for new home sales may sound like a set-up to a punchline.

How many new homebuyers, closed – not canceled – deals, walked-back incentives, fewer and lower price reductions, and consecutive weeks of positive, growing sales per community per week does it take to make a head-fake?

Clarity may be coming soon.

- We're on the eve of an employment report that will either result in a more hawkish Fed or a more challenged near-term economy.

- The mortgage interest rate Santa reprieve seems to have run out of juice, and this week, per Freddie Mac, 30-year, fixed rates hit 6.73%, their highest since last November. And they're on a five-week run up.

- Then, Tuesday, next week we get a CPI inflation reading leading into a moment-of-truth March 22 FOMC policy decision and Fed Funds rate projections.

At that point, clarity for investors, with direct impacts to consumer sentiment, wealth-effect turbulence, costs of money, and the sustainability of economic strength will finally begin to sharpen. A Wall Street Journal piece by Sam Goldfarb and Matt Grossman notes:

That makes the coming stretch pivotal, with the potential to either confirm suspicions that inflation remains on a path to the Fed’s 2% target, or force a more painful rethink of the kind that drove steep losses across markets last year.

In which case, the punchline to the original question about the head-fake will either amount to a recognizable quantity or a witty retort.

One way or other, rather few strategists among higher-volume homebuilders believe the December 2022 to February 2023 lift will evolve into a sustainable reboot of exuberant demand.

And the thing is, even if it's not an incipient rebound in the making, most homebuilders – although they know their profit margins are going to get some stress-testing – are not pessimistic. Rather, it's the opposite.

Their optimism in the face of threats of higher interest rates or – heaven forbid – a recession, traces to three key sources of experience-fueled confidence.

- They [i.e. many] have hardened their businesses – financially and operationally – to an array of economic, financial, logistical, and social challenges during the past eight to 10 years. Better balance sheets, less debt, less land risk, bigger margins to work with.

- The near-term is simply a duration, a span across which a homebuilding or development firm must endure to flourish again in a structurally undersupplied mid- to long-term future.

- The past few months – late-December through February – were a boon in that the psychological lift they got from an interest rate reprieve allowed them to sharpen and refine a range of mechanical solutions builders put to use to overcome buyer objections and put monthly payment packages in front of them that both priced them in and calmed them down.

Now, the price, product, location challenge feels different because they've experienced directly the cause-and-effect results of their incentive and financial support tactics, even as they've zeroed in on their own per square foot costs as opportunity areas rather than as runaway trains of expense.

One way or another, the next six to 30 months will likely sort out as a match game with new rules that involve tighter, more expensive borrowing for everybody. Builders learned good and necessary lessons about all the routes they can take to make a monthly principal and interest payment doable for a buyer. Meanwhile – for their business viability – they've also got a good jumpstart on learning all the ways they're going to need to pry away at each square foot of living space's cost stack, which helpfully, the National Association of Home Builders just released its latest data set as a benchmark of construction costs.

The NAHB recently published its latest Cost of Construction Survey. Results show that 60.8% of the average home sale price consisted of construction costs, essentially unchanged from the 61.1% posted in 2019. Since the inception of this series in 1998, this was the fourth time construction costs represent over 60% of the total price of the home (2013: 61.7%, 2015: 61.8%, and 2019: 61.1%).

The finished lot category was the second largest cost at 17.8% of the sales price, down from 18.5% in 2019. The average builder profit margin was 10.1% in 2022, compared to 9.1% in 2019.

At 5.1% in 2022, overhead and general expenses were also essentially unchanged when compared to 2019 (4.9%). The remainder of the average home sale price consisted of sales commission (3.6%), financing costs (1.9%), and marketing costs (0.7%). These percentages are also similar to their 2019 breakdowns. – Eye On Housing, NAHB

Now, the media and a certain number of experts would like to use the early-2023 "head-fake" narrative to support a view that market-rate housing only has optimists and pessimists, one group of which is right about what's next and the other wrong.

The fallacy of that view is that many of the business's optimists are not so because they believe or are confident that circumstances are likely to go their way.

They're optimistic – most of them – precisely because they're confident in their team's ability to detect or create pathways forward and successfully in spite of conditions and hard problems and circumstances that don't go their way.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.