Leadership

Here's How Agility Can Work As Uncertainty Enfolds What's Next

"We're going to continue to be agile, collaborate, and move quicker and faster than we have before so that we can take advantage of whatever opportunities present themselves in this market. But we'll also properly manage the risks that are still evident as well." -- Meritage ceo Phillippe Lord

In housing – just like on Wall Street right now – there are bulls, bears, and the rest of us mortals.

Bulls seem over-confident that the worst damage of inflation and the heavy-handed Fed is done and past. Bears, on the other hand, seem to under-appreciate the resiliency of consumer households – especially Millennials forming families and Baby Boom retirees on GPS routes to their next adventure and forever homes – and their impact on the broader economy.

Snippets from this Wall Street Journal piece reported by Hannah Miao echo the vibe we've picked up among housing interests setting a narrative whose goal, first and foremost, would seem to be crushing headline risk. Miao's piece says:

'It feels like someone is trying to hold a basketball underwater,' said Jeff Kilburg, founder and chief executive of KKM Financial, of the burgeoning rally. Mr. Kilburg said that he believes stocks will keep climbing and that the market is entering a different environment from last year due to the possibility that interest rates will ease.

Stocks have rallied to start 2023 in large part because investors are wagering that moderating inflation could put the Federal Reserve on track to cut rates later this year. Central bank officials, however, have repeatedly said their work to cool the economy is far from over.

The flipside's pundits – in theme and variations – sound roughly this way:

The past four weeks saw $44.7 billion of inflows to global equity funds, a BofA team led by Michael Hartnett wrote in a note, citing EPFR Global data, according to the news service.

But there’s a risk that inflation will come back in the next few months and that the U.S. recession will deepen in the second half of the year, according to Hartnett, Bloomberg writes.

Hartnett's team’s note warned that the 'most painful trade' is always the 'apocalypse postponed,' according to the news service." – Financial Advisor IQ

So, if you're in a camp like me – where you'd ascribe to neither a fully bullish nor an extremely bearish conviction, given what we don't know now what we'll have to learn later – the only true answer to the question of how good or bad 2023 will be for homebuilders can only be a shrug, "who knows?"

This helpless conclusion runs against a bedrock assumption of my craft. That is that if you talk to and learn from enough of the right people, the sum of their prior experience and shrewd insight and your own instincts should add up to a conviction about how things will play out.

My first editorial for the now defunct Big Builder in Spring 2005 carried the headline, "Always A Greater Fool: Talking tulips—and reasons to manage for a downturn during good times."

A passage from that Spring 2005 story reads:

A home's intrinsic value to its owner—versus a tulip's or an Internet business—is a refrain you'll often hear when housing industry executives argue against applying the “bubble” word to the current home building environment. Are there people who still buy homes now because they think prices are going to soar further and stay up? Are there buyers who will buy irrespective of the price because they're willing to bet some “greater fool” will pay even more money later? Yes. Home buyer psyche is today's “X factor,” and while nobody is capable of predicting it, the leaders of the nation's biggest home building companies are doing a lot of gut-checking these days.

“Bring it on,” a senior level executive from a top-five home builder said to me of the possibility of a market correction in sales in the next 12 months. “If times get rough for the market as a whole, you're going to see the strongest companies get even stronger.”

For all the ways experts have hammered on how different this time's housing correction is – in 2022-23 – versus that time, what remains to be seen may turn out to be sharply different or the same in one very important respect. That is, how right a few people were ahead of the Great Financial Crisis, and how wrong so many more people were as they looked at the same evidence and reached the opposite conclusion.

Being right, one should recognize, is right smack in the middle of the zone Collaborative Fund sage Morgan Housel writes about in this recent essay, "Everything You Can't Have." Consider:

This all makes sense when you understand what your brain wants.

It doesn’t want nice cars or big homes.

It wants dopamine.

That’s it.

Your brain just wants dopamine. – Morgan Housel, Collaborative Fund

That "fix" of validation that comes from having called a macro trend correctly is hardly different than the internalized drives for any goal, especially for an industry commentator.

Housel writes:

Your brain doesn’t want stuff. It doesn’t even want new stuff. It wants to engage in the process and anticipation of getting new stuff."

This is so true when it comes to predicting how scarcely predictable countervailing business and consumer trends will play out. If all the evidence suggests one "can't have" knowledge of what will transpire in the housing market over the next 12 to 24 months, the natural urge is to want it more.

What this comes back around to is this cliche of a business principle, even as homebuying behavior has sparked up in markets around and about the national landscape, and pre-buying searches suggest that even nuclear winters can tend to thaw out on an accelerated schedule:

Hope for the best; plan for the worst."

This is to say that one of the biggest mistakes to make now – for homebuilding operator – would be to jump the gun by lifting expectations to a level of assuming that the worst of post-pandemic aftershocks have come and gone.

That may be true or it may not. Like as not, the only way out of this period of elevated risk is through it. The ways through it – for homebuilders – come in three varieties:

- Heft – deep pockets, a diverse portfolio – footprint and customer segments, and leverage in re-negotiating both costs and selling prices

- Agility – Operational nimbleness – cutting prices fast, getting the right product in the right place, realizing cost savings going forward, trimming margins, driving velocity, and capturing share.

- Hope – if inflation's been tamed, the Fed can relent on its reins on borrowing costs, and a new boom can kickstart into gear.

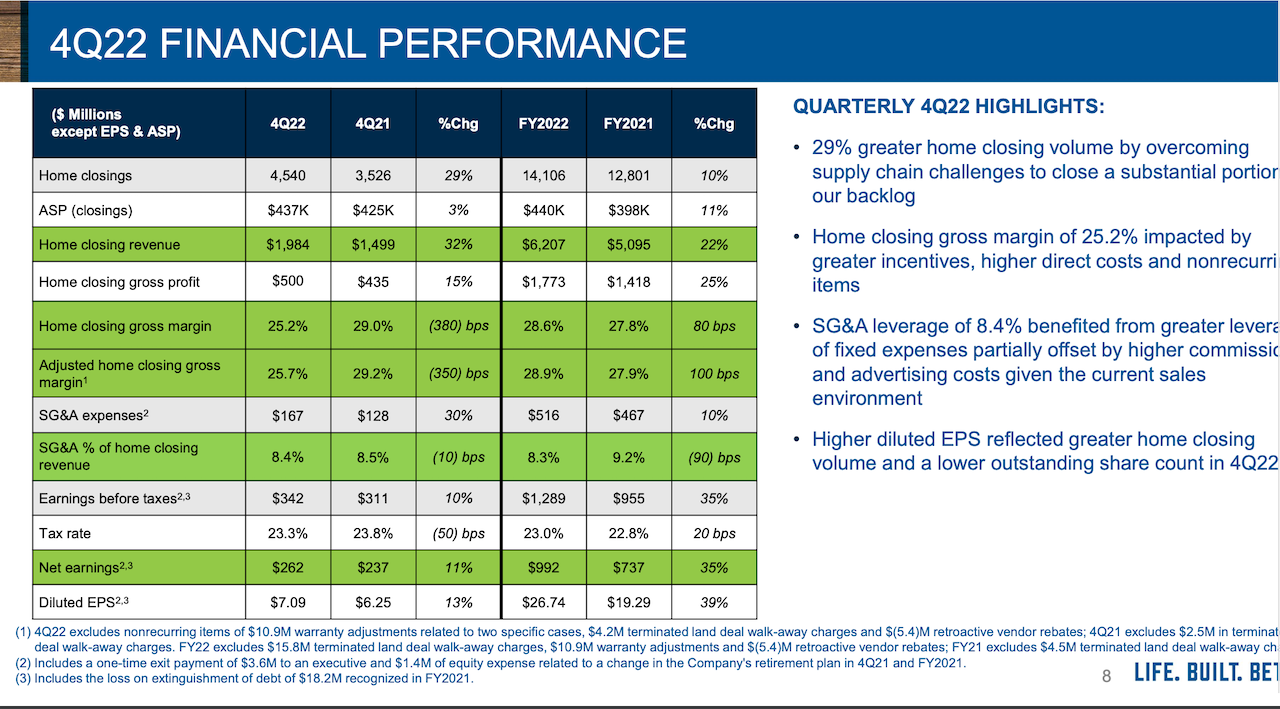

A few smart comments from Meritage Homes ceo Phillippe Lord – from last Thursday, Feb. 2nd's Q4 and full-year earnings call with investment analysts and researchers – spoke to the power of agility in an uncertain market. Variations on Meritage's aggressive price, velocity, ready-to-own inventory, and operational excellence focus could be a model for private homebuilders who can not tap option number 1 – Heft – as a strategic way forward, and would be loathe to rely on option number 3 – Hope – as a strategy either.

We'll extract out highlights of where Meritage's Phillippe Lord unpacked exactly the role agility and feed-back driven optionality play as strategic ways through uncertainty and heightened risk.

Agility: Strategy In Action

Phillippe Lord - Chief Executive Officer

To reiterate our strategies and the actions we have taken, we remain committed to prestarting 100% of our entry-level homes. This readily available home inventory puts us in a favorable position since buyers in the current market want homes are ready to close within 45 to 60 days. Eliminating uncertainty and reducing stress are a premium in today's murky economic environment. Further, line building allows us to complete homes on a shorter cycle time than a build-to-order model despite supply chain issues. Prestarting homes with a limited SKU library means we can also offer more affordable products as we pass on our savings to our customers. As an added benefit, when we have cancelled inventory, the lack of customization of our homes, stemming from our streamlined and -- specifications, results in limited discounting for the future resell of that home. Since we mainly build entry-level products, we expect a higher average absorption pace and prioritize pace over price."

We want to open up [new communities] with move-in ready inventory. Customers are willing to engage with something that moves in 30, 60, 90 days. They can lock their rate. And I think it minimizes your cancellation exposure. So we've got our cancellations down to where we want it now. And we're going to run our business to make sure we keep those cancellation rates low, assuming that interest rates will continue to remain volatile."

Hardening The Backlog

Phillippe Lord - Chief Executive Officer

We also aggressively validated every home that remain in our backlog as of year-end. Most confirmed their commitment to their homes. Some use incremental pricing or rate adjustments that we were able to offer. In other cases, though, we had to cancel the sales, it was clear the buyer is not going to purchase home with a reasonable incentive structure. By proactively showing our backlog, we likely identified some cancellations earlier in the cycle than normal but this gave us more confidence in our backlog at the end of 2022 and added available inventory for sales into January."

Resetting Go-Forward Costs

Phillippe Lord - Chief Executive Officer

Our purchasing team is actively rebidding our vertical costs to capture cost savings as incremental capacity is growing within our supply chain...We are pursuing cost savings across all cost categories in all of our markets this year. These intentional actions enable us to adjust pricing and can structure community by community so that we can take advantage of our supply of available inventory as we kick off 2023. We believe we have the right level of completed and near-completed [homes] which combined with a different mix of pricing actions, financing solutions and incentives allows us to offer a total package that is aligned with each local market environment."

Evenflow In Spec Starts

Phillippe Lord - Chief Executive Officer

Market demand dictates our target amount of available inventory in each of our communities. Our goal is to keep four to six months' supply of specs on the ground by managing our starts to match our sales pace and production capabilities -- although excess cancellations increased our specs slightly above our target rate in the quarter. To align with the additional supply of inventory on hand, we will flex and slow down our starts until we reach our optimal equal liver. But as noted, we have already worked through about 25% of these stacks in January. Similar to last year, 79% of our home holding this quarter came from previously started inventory."

Pricing To Monthly Payment Power

Hilla Sferruzza - Executive VP & Chief Financial Officer

We expect that price concessions elevated discounts and a continuation of financing incentives for rate locks and buydown will negatively impact gross margins in 2023. However, with our sales ASP down 10% to $389,000 this quarter when compared to last year, we've already taken material pricing action, demonstrating our commitment to elevating our sales pace. And although we're not projecting broad-based cost savings to offset the challenging market conditions today, we are starting to make some headway to reduce direct costs and improve cycle time.

"There are full company initiatives to drive substantial cost reductions with success stories of $15,000 per home in savings just since already emerging in some divisions, particularly in our slower markets where trades have excess capacity. However, we likely won't benefit from the full impact of these savings until the tail end of 2023 and into 2024 as they will be captured in our home starts until mid to late this year. We still believe that long term, our normalized gross margin will benefit from better operating leverage from our increased volume and our streamlined operations and will end up at or above 200 bps from our historical average of 20%, although the next several quarters are likely to be bumpy."

Phillippe Lord - Chief Executive Officer

We're an affordable spec builder. So we're going to price ourselves in the bottom two piles of our competitor set, community-by-community, which is what we've done. This is why our price, our ASPs, are down now into the 300s from $480k at the peak. So, we feel like we've made some really significant adjustments to be affordable and to find the pace that we need. We feel like we're well positioned for the long term. But it's hard to tell what our competitors are going to do. Some builders still have quite a bit of backlog that they're going to close out and I don't think they've adjusted pricing yet. So we'll have to wait and see how that plays out. We certainly don't know what interest rates are going to do. We're happy to see them stabilize where they are and feel optimistic about that but those two factors are really driving our inability to predict pricing at this point."

Claiming Market Share

Phillippe Lord - Chief Executive Officer

From our perspective, it's about having move-in ready inventory which we have. That's what consumers want. And that's why we feel like we saw the January result. In a number of communities where we made adjustments, we did see very strong elasticity in demand when we lowered prices and we were able to achieve even above our 4 net sales. So in those communities, we're pulling back on incentives where we think that's sustainable. And we'll back off on rate buydowns. We don't have to use rate buydowns nearly as much as we did now that we're selling all specs. People can move in relatively quickly and we can drive those costs down. So it's community by community. But it's one month and we're going to go take market share right now. We're going to be aggressive. If we can do more than 4 months at today's margins, we'll probably take more than 4 months at today's margins. It's spring selling season and we want to go get this market share while other builders don't have the spec homes to go get it."

Agility As A Core Competency

Phillippe Lord - Chief Executive Officer

We're always learning. I think that we've demonstrated over the last 5 years that we're probably one of the -- we're an extremely agile and proactive organization. We've been ahead of a lot of the trends. We came out of COVID more aggressively than anybody, grabbed market share. We pivoted our strategy. I think we're playing in the -- with the right side in the right part of the market. We have specs. So we're going to continue to be agile. We do this job 24/7. We're paying attention to everything. We have a very aligned, engaged team out there. We talk all the time. We listen to one another and we're going to continue to collaborate as a team and move quicker and faster than we have before so that we can take advantage of whatever opportunities represented in this market but also properly manage the risks that are still evident as well.

So it's about being agile. It's about being willing to change and innovate constantly and we have a real strong capability here and we'll continue to invest in that. And that's what we've learned, right? Don't continue to think that everything that was is going to be and just be willing to evolve and adapt.

Bull, bear, or indifferent, agility can go far to sparing a person, a team, and an organization from the lash of the perpetual chase for that next hit of dopamine. You don't need to be right if you're agile.

MORE IN Leadership

United Homes Group’s Board Crisis In Compliance Countdown

United Homes Group is running out of time to rebuild a functioning board and avoid a Nasdaq compliance breach. CEO Jack Micenko says day-to-day operations continue, but governance uncertainty and market headwinds now threaten the company’s stability.

Smith Douglas Homes Doubles Down On Pace And Growth

Smith Douglas Homes Corp. (SDHC) remains defiant amid a slowdown by prioritizing pace over price. The builder's rapid cycle time and focused expansion strategy could serve as a blueprint for competitors that serve the strained entry-level segment.

After An Involuntary Pause, Orders Matter Again For LGI

In a market where affordability is collapsing, LGI’s disciplined, spec-first model is proving its worth. A year after seizing ground from private builders, the company’s focus on land control, cost precision, and first-time buyers is paying off.