Leadership

Heading To 'Normal,' Some Builder Peers Take Bigger Hits Vs. Others

Homebuilder sentiment starts to show signs the market may take a rough, bumpy, costly route to finding its next new normal level. History both repeats and rhymes.

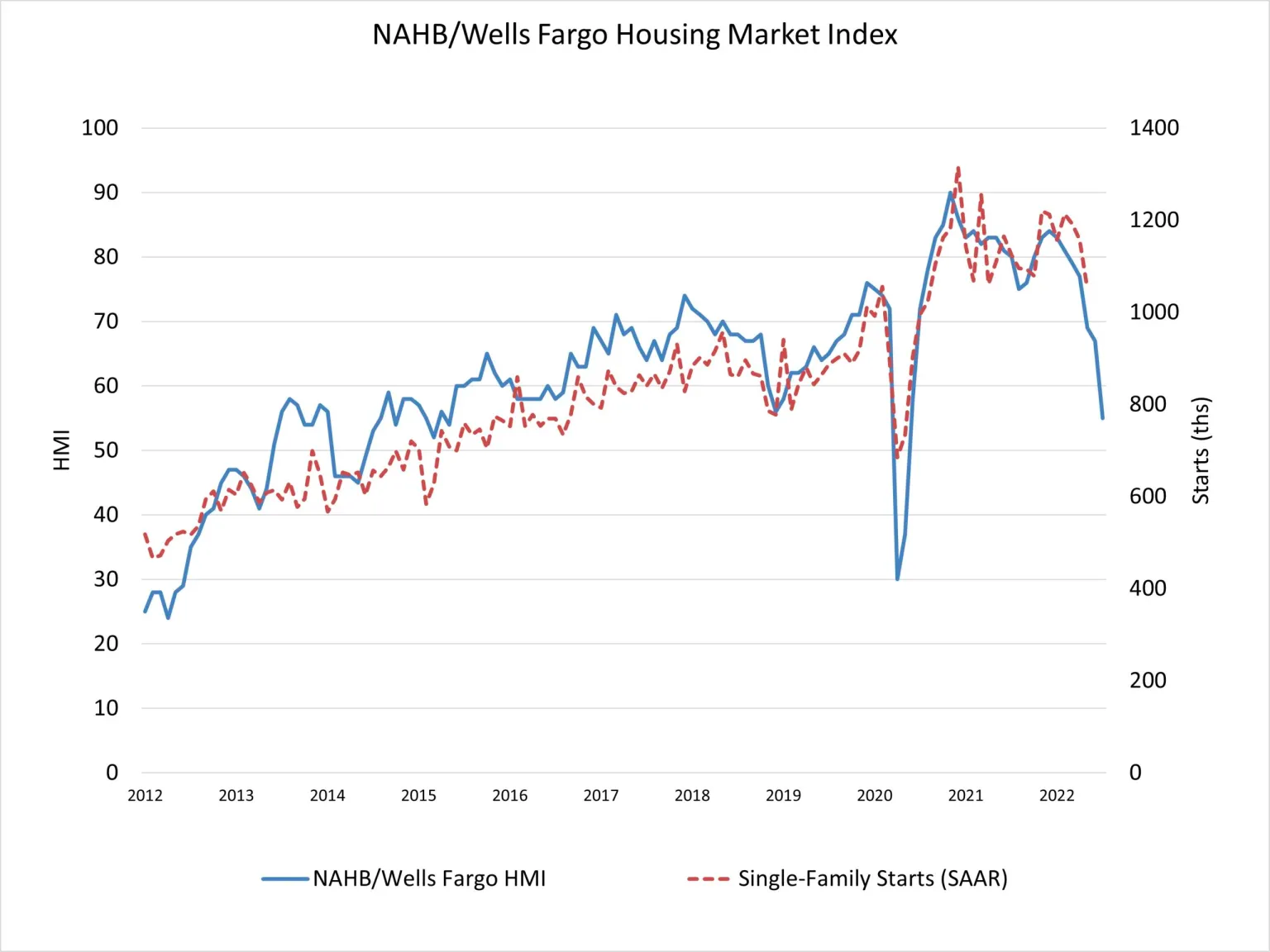

Homebuilder sentiment, a trusty pre-indicator of single-family housing permits and starts activity to come, took a headlong dive in the past four weeks, after months of telegraphing headwinds to business confidence.

The National Association of Home Builders' (NAHB)/Wells Fargo Housing Market Index (HMI) suddenly reflects a clear divide separating three distinct time periods: 1. a past exuberance plateauing to a 2. 50-50 sense that if things stayed as they are today it would be okay, deteriorating to a 3. rather troubling binoculars view of what's in store.

All three HMI components posted declines in July: Current sales conditions dropped 12 points to 64, sales expectations in the next six months declined 11 points to 50 and traffic of prospective buyers fell 11 points to 37.

All in, the NAHB HMI earned a "never before, except once" distinction that chaulks up as yet another this-time's-different reading, per NAHB chief economist Rob Dietz.

This marks the lowest HMI reading since June 2020 and the largest single-month drop in the history of the HMI, except for the 42-point drop in April 2020.

A consensus of empaneled economists and analysts forecast a higher overall reading. One expert who didn't is BTIG analyst Carl Reichardt, whose own HomeSphere/BTIG builder survey data foreshadowed a sharper negative shift in business conditions and a rapidly more challenging horizon.

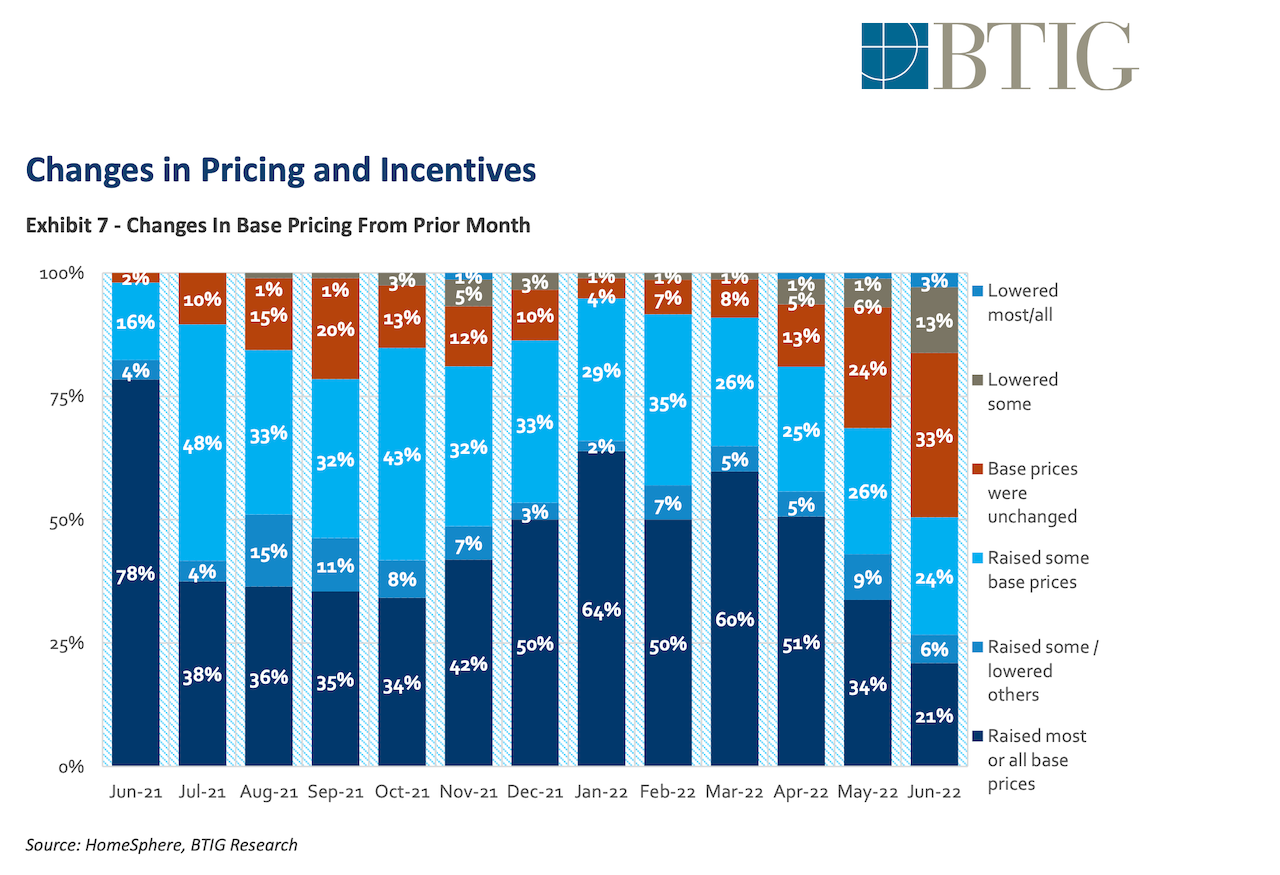

Reichardt's BTIG readings now reflect a majority of homebuilder respondents (51%) report year-on-year unit sales declines vs. the same period in 2021, and have begun to trot out a full array of pricing and incentives tools to move home sales at an acceptable absorption pace:

- Although the number of builders reporting higher YOY sales increased slightly to 27% in June (vs. 19% last month) readings remain at low levels.

- Traffic continues to decrease. While 24% reported an increase in YOY traffic at communities, 50% saw a decline. This compares to 20% and 43%, respectively, last month.

- Sales and traffic relative to expectations continued to fall, with two survey record lows indicated. A survey record low 11% of respondents saw sales better than expected vs. 15% last month, while 37% saw sales as worse than expected. A survey record low 14% saw better traffic than expected vs. 19% in May, while 27% of builders saw traffic as worse than expected (28% last month).

- As noted above, builders are adjusting prices and incentives. 45% of builders raised some, most or all base prices in June, down from 60% last month and 94% in June 2021. Incentive use increased slightly; 19% of builders increased "most/ all" or "some" incentives vs. 16% last month and 10% last year. *see graph

- Builders have yet to see a significant increase in cancellations. 67% of builders reported cancellation rates remained constant, approximately the same as May. Only 3% reported seeing “significantly higher” cancellation rates.

Bloomberg staffer Olivia Rockeman reports:

Homebuilder confidence is slipping as mortgage rates hover near the highest since 2008 and homes become less affordable. At the same time, production bottlenecks and higher costs are causing some builders to halt construction.

“Affordability is the greatest challenge facing the housing market,” Robert Dietz, chief economist at the NAHB, said in a statement. “Policymakers must address supply-side issues to help builders produce more affordable housing.”

Coming as it does on the eve of another monthly housing release, the Census' Housing Starts and permits release for June, a homebuilder confidence step-change to the south very likely signals at least a downshift in pulling new permits.

To date, unready to openly concede to a possibility that Millennial generational demand and up-to-now strong jobs tailwinds could ever succumb to headwinds of raging inflation and lost payment power, most homebuilding executives speak of a market moving from insanely hyperactive to a safer "normal" level.

There, they assert, people are historically accustomed to 6% mortgage interest rates, and maybe even 5% or 6% unemployment rates, and because their housing preferences are being driven by lifestage – i.e. family formation – their choices and priorities will stabilize around demand for that exclusive value a new home can offer.

That's the scenario and that's the talk-track up to now. Again, when we hear executives from D.R. Horton and Tri Pointe Homes give color commentary to their latest earnings performance later this week, answering equity research analysts' questions on week-to-week and market-to-market trends in cancellations, incentives, price concessions, new absorption rates, etc., the wished-for normal and the actual may start to reveal a divergence.

One of our trusted executive strategists on the residential development front has this observation, pointing up how fragmented, insulated, and differentiated homebuilding firms are despite outsiders' tendency to look at them of a piece.

If something has not happened to you personally, it's an unlikely theory. If it has happened to you personally, it's a clear and present danger.

So few people at this point personally experienced raging inflation and high interest rates, they treat it as the former.

Think about how many prominent economists you actually heard last year say, 'people worried about inflation are living in the past and it hasn't happened for 40 years.'"

What the homebuilding and residential development and investment business ecosystem proves out again and again is that it is expansive, unconsolidated, and specified enough to nest within it many of each of the two perspectives – ones who've experienced a phenomenon personally and those who have not, either because of their age, or geography, or business type.

So, there's historical interest rate tolerance, and historical income-to-new-home price ratio elasticity, and historical job-formations-to-new-home demand, all on top of historical cancellation rates, discounts and incentives percentages, and absorption rates per month per community.

And, then again, there's a historical boom-and-bust cyclical propensity among homebuilding firms and their capital and land and manufacturing partners to overextend themselves financially by miscalculating how many new homes they can sell and close in a given period, for how much money, and at what cost.

As well, there are historically an ample number exceptions to the rules that every homebuilding firm and every partner must look oblivion in the face when those miscalculations come home to roost.

Right now, most firms' leaders believe his, her, or their organization is one of those exceptions. Unfortunately, historically, they are just that, exceptions. So, not everybody who believes that description fits their firm right now will live to tell the tale.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.