Leadership

Green Brick Strategy, Focus On Execution, Bode Well In 2023

Being good, which is a prerequisite for being lucky, means "knowing how they make money," which is a blend of strategy and discipline – i.e. land and product – and operational excellence and execution, which redound to pricing. Put together, they make a homebuilder stand apart.

Real estate and proverbs go hand in glove. Often, it's said in false modesty, "You have to be lucky to be good" in the game of timing when to lean in and when to sit out and when to sell out.

What may be said less frequently but is equally true is the proverb's inverse: "You have to be good to be lucky."

Now, when it comes to being good in homebuilding in one of this generation's trickiest business environments, the words of Scott Cox, founding principal of SLC Advisors and a TBD contributor stand out. Scott writes of a common trait among homebuilding operators that can and will succeed in such times:

They do not try to be all things to all people. They really know how they make money. Just as important, they also know how they do not make money, and are willing to walk away from deals that someone else might make money from but they know does not fit their discipline."

Being good, which is a prerequisite for being lucky, means "knowing how they make money," which is a blend of strategy and discipline – i.e. land and product – and operational excellence and execution, which redound to pricing. Put together, they make a homebuilder stand apart.

Green Brick Partners, an operating homebuilding and development company whose portfolio of homebuilders serve homebuyers in Texas, Georgia, Florida and Colorado, reported Q4 and full-year 2022 earnings yesterday. Both the performance and the outlook stand as examples of a leadership and team who know how it is they make money, and how they don't.

Here's the top line on Green Brick's reported earnings for the two time periods, from a company statement:

Our team did a great job closing out the year. For the full year ended December 31, 2022, we delivered 2,916 homes — a record number — generating 25.3% year-over-year growth in total revenue to $1.76 billion. Diluted earnings per share for 2022 increased 61.8% year-over-year to $6.02, with an annual gross margin of 29.8% and return on equity of 31.4%,” said Jim Brickman, CEO and Co-Founder. “While producing these results, we lowered our debt-to-total-capital ratio to 25.7%. We believe that these numbers reflect our superior lot position and operational excellence, as well as validate our ROE-driven approach.”

“For the fourth quarter, we delivered 727 homes and achieved record home closing revenue for any fourth quarter of $429 million. Our total gross profit was $112 million, also highest for any fourth quarter. Diluted earnings per share was $1.18, down 4.8% year-over-year. Net new home orders decreased 11.1% to 423, the smallest decline amongst peers. Importantly, we started to regain sales momentum since November. December sales were up 43% over the average of the prior six months. Our cancellation rate also improved throughout the quarter and was down to 12% in December. We started off 2023 with increased sales momentum particularly with our finished or finishing spec homes. Several communities opened in January and sold particularly well. Our cancellation rate has further improved in 2023, dropping to single digits."

Going back to Scott Cox's observation on what makes for success, the Green Brick leadership and operational teams deliver, simply put, the right product, in the right location, and for the right price, which is the same as knowing how they make their money, and how they don't.

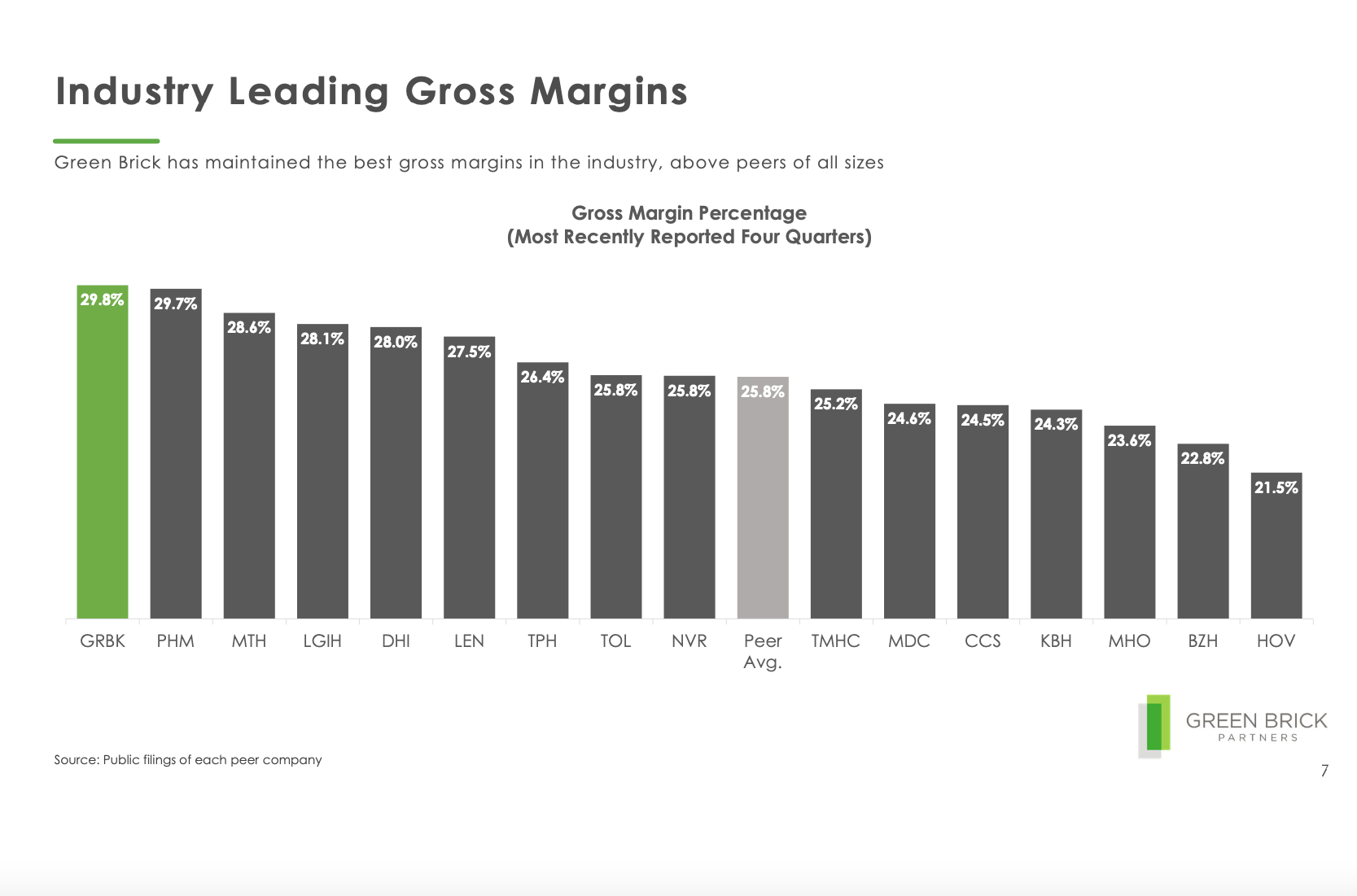

Here from a transcript of presentation and Q&A quotations from yesterday's earnings call, we'll focus on those three pillar areas that draw on both smart strategy and strong execution in the field, which tied together with discipline, account for "the highest gross margin among our peers for the trailing 12 months."

Strategy: On Operating Footprint

Jim Brickman, CEO and Co-Founder

Job growth in our markets is the best in the nation. Dallas added 235,000 jobs in 2022, Atlanta added 126,000 jobs. As shown on Slide 5, an estimated 3 million additional millennials and Gen Z will age into the prime home buying age in the next decade. We believe this will indicate there are significant spend pent-up demand from ready buyers who will purchase as mortgage rates stabilize. Green Brick is well-positioned for a market rebound with a high-quality land pipeline. We expect to have approximately 6,000 finished lots at the end of 2023, with 75% of these slots located and into locations."

Strategy: Product And Submarkets

Jim Brickman, CEO and Co-Founder

Green Brick is well-positioned for a market rebound with a high-quality land pipeline. We expect to have approximately 6,000 finished lots at the end of 2023, with 75% of these lots located and infill locations.

We believe these advantages are: first, a significant footprint in infill locations in markets with some of the strongest job growth and demographic fundamentals. A superior and disciplined land and lot pipeline to support long-term growth. A broad spectrum of product types and price points that capture entry level, move up, move down, and luxury home buyers."

Execution: Pricing and Pace

Jed Dolson - Chief Operating Officer

Trophy Signature Homes, in particular, fared better in terms of sales during the fourth quarter. Shares of total Green Brick net sales from Trophy increased to 49% by volume in the fourth quarter from 39% at the end of the second quarter when mortgage rates started to take off. We believe this is ascribed to three reasons.

First, Trophy's business is designed to be efficient and spec heavy and many homebuyers today favor move-in ready homes with a streamlined home-buying process. Second, Trophy offers more affordable products that cater to entry-level on first-time move-up buyers. We believe these homebuyers represent a deeper pool of potential customers.

Third, Trophy's homes come with design features that are appealing to the younger generation at affordable prices. For example, all of Trophy's homes include spray foam insulation, which produces an air pipe envelope that insulates homes better. This encapsulation brings greener and more efficient homes to homeowners at a low cost that will continue to generate energy savings for years to come.

We believe that through this product desirability, operational efficiency and scalability, Trophy will continue to capture unmet demand from entry-level and first-time move-up homebuyers and fuel Green Brick's growth strategy.

Are they good because they're lucky, or lucky because they're good?

The answer's yes.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.