Land

Great Southern Pivots Via SPAC Deal Into The Newest Public Power

The new Nasdaq-listed company, United Homes Group, will be led by Michael Nieri and real estate investment rock star David Hamamoto, and they plan to grow ... fast and far.

Left: Michael Nieri, Chairman, President & CEO of United Homes Group

Right: David Hamamoto, Chairman and Co-CEO of DiamondHead Partners

Clemson University undergrad Michael Nieri – the son of a civil engineer who liked his teenage kids doing their summer jobs in the 1970s on construction sites, painting, drywall, surveying, what-have-you – got a friendly jab one afternoon in the early 1980s from one of his teachers at the school's Construction Science and Management Department in the College of Architecture, Arts, and Humanities.

I remember my architecture professor ribbing me outside the classroom one day about my old, brown pickup truck in the parking lot," Nieri recalls. "I told him, some day, I'm going to build my own company, starting with this truck."

A decade or so later, after knocking around a bit in commercial, institutional, and light industrial construction, engineering, and planning, he built a house for his family in 1993. Fast-forward from the beat-up brown pickup truck in the early 1980s to that very first new home to today, where the company he started 18 years ago just crossed a milestone of 11,000 homes completed for families throughout South Carolina and into Georgia. Great Southern Homes, a top 50-homebuilder in the nation with 160-plus team-members, projected it would reach $630 million in 2023 revenues, with EBITDA estimated at $118.2 million.

- One is, by the way, that Clemson University school of Construction now bears the Nieri family name.

- The other is, the student who took grief from his architecture professor for the condition of his truck, yesterday celebrated by announcing a spac deal to go public, valuing the company at $572 million.

Beat-up pickup truck, eh?

As it looks right now, that young construction, planning, and architecture student – of hardscrabble means and sorry looking prospects if you were looking only at the vehicle he was driving at the time – could well be running a $2 billion-plus top 15 homebuilding enterprise in the next five years if the deal Michael Nieri's just pulled off pans out as planned.

Yesterday's announcement led off this way:

Great Southern Homes, Inc. announced today that it has entered into a definitive merger agreement with DiamondHead Holdings Corp. (NASDAQ: DHHC), a special purpose acquisition company. Upon closing of the transaction, GSH will become a publicly traded company, and DiamondHead Holdings Corp. will be renamed United Homes Group, Inc. DiamondHead is expected to remain listed on the Nasdaq Capital Market and is expected to trade under the new ticker symbol “UHG.”

GSH is currently one of the largest homebuilders in the Southeast. The Company builds homes in South Carolina and Georgia, focusing on the entry level and first time move up home buyer segments. GSH plans to employ a capital efficient “land-light” operating model that is expected to generate higher returns with lower cyclical risk compared to a traditional homebuilding operating model. Through organic growth, GSH has become the 25th ranked starter-home builder and the 41st ranked single-family detached home builder in the United States, respectively, based on 2021 home closings according to Pro Builder’s 2022 Housing Giants Report.

DiamondHead is a special purpose acquisition company led by Co-CEO and Chairman David Hamamoto, who has over 40 years of experience in real estate investing, as well as operating both private and publicly held real estate businesses. David Hamamoto was the founder and Chairman of the previously publicly-traded NorthStar real estate related companies: NorthStar Realty Finance Corp., NorthStar Asset Management Group, Inc. and NorthStar Realty Europe Corp. In addition, David Hamamoto was a former partner at Goldman, Sachs & Co. and the co-founder of its Real Estate Principal Investment Group and Whitehall funds.

DiamondHead is co-sponsored by Antara Capital, which is an event-driven hedge fund founded by Himanshu Gulati in 2018 that invests across a wide variety of financial instruments, including loans, bonds, convertible bonds, stressed/distressed credit and special situation equity investments.

Reasons for the timing of the bold eve-of-uncertainty de-SPAC transaction owe to an alignment of stars that starts with DiamondHead chairman David Hamamoto's interest in Michael Nieri himself, as well as an array of plusses around Nieri's land-light operational model, geography, market segment, price-point, mobility and migration economics, in a backdrop of fundamentally strong demand over the next decade. In both Hamamoto and Nieri's assessment – with the support of Antara Capital's Himanshu Gulati – Great Southern Homes is a mega-regional powerhouse waiting-to-happen, and now the wait is over.

Hamamoto's prepared comment states:

We are impressed with the scale and operational performance of GSH, and we are excited to work with the GSH team in continuing their growth as a public homebuilder. We believe there continues to be a massive undersupply of single family homes in the U.S., especially in starter and first move up products which will result in significant demand for the foreseeable future. In addition, as Michael mentioned, we believe there are extremely compelling opportunities to generate accretive growth through M&A as well as a programmatic build-to-rent platform.”

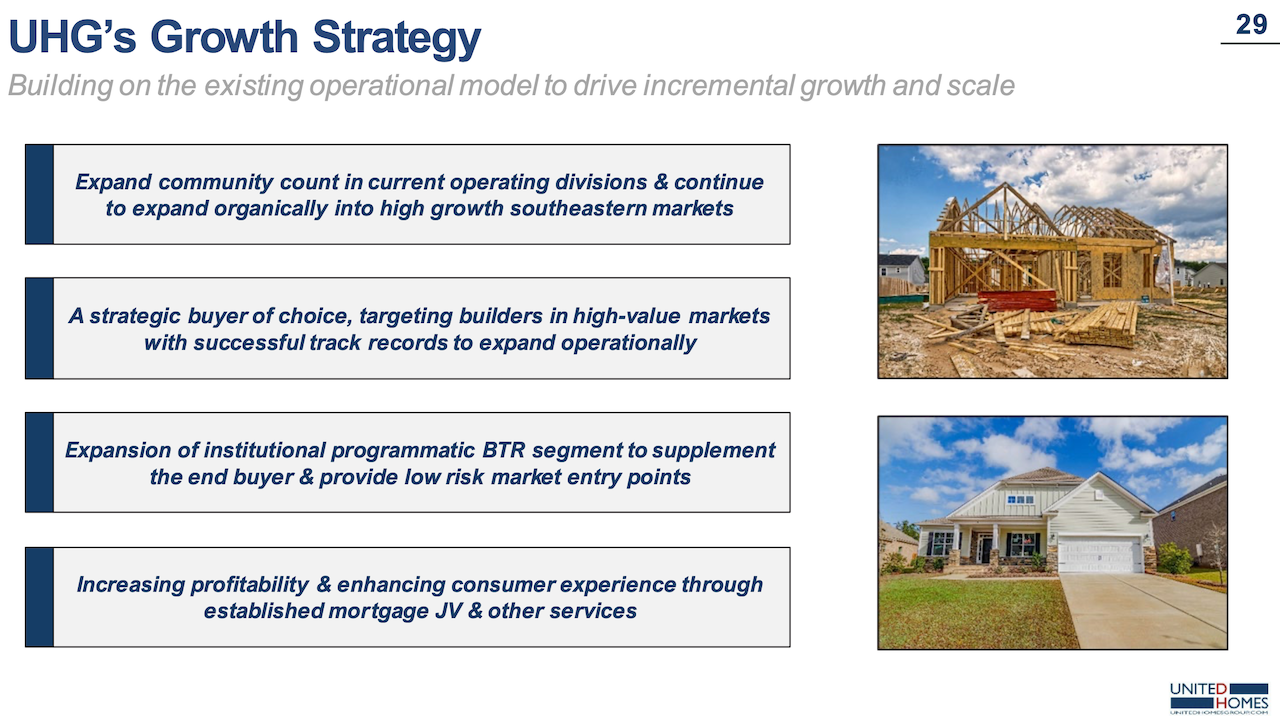

In that context, the event marks a capital access tipping point for the new company, and the inflection puts fast, material, aggressive growth into the cross-hairs with four key areas to ignite profitable growth just as the builders' near-to-mid-term outlook shows signs of strain that put them on the defensive.

Effectively, now committed capital from the sponsor group of DHP SPAC-II Sponsor LLC, David Hamamoto and Antara Capital amount to a war-chest GSH can draw on to augment organic growth by executing on its strategy of opportunistic M&A and the development of a programmatic institutionally focused build-to-rent platform.

When it comes to putting that war-chest to work, the Hamamoto-Nieri power axis have been tapping into the deep network of private and publicly-held homebuilders and time-tested track record of Builder Advisor Group's Tony Avila as a natural match-maker to bring to bear on the growth push.

We served successfully with the Landsea Homes de-SPAC in their win-win acquisitions with Florida-market Vintage Estates and Hanover Family Builders, and our relationships in the Southeast, from Florida up on through Virginia are unrivaled," says Tony Avila, ceo of Builder Advisor Group. "BAG will work with United Homes Group on acquisition opportunities throughout their target markets. We have builder targets for them in NC, SC, Florida and Georgia."

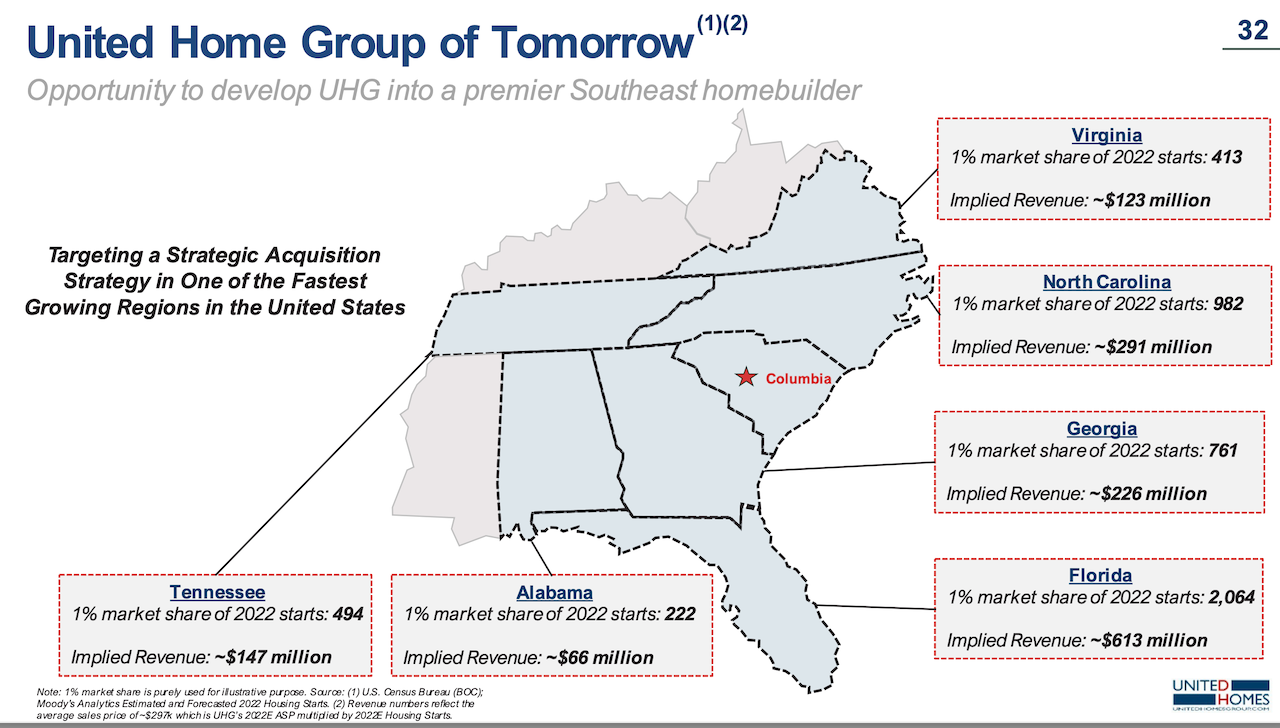

Imagining the potential scale UHG could achieve in an economically accelerating Southeastern macro-market conjures an NVR-like power-player burgeoning practically out of the blue.

Here's what that looks like.

Of growing interest is the hybrid-by-design business and operational model incorporating both single-family for-sale and build-to-rent capability, which given the economics of affordability barriers and rent-by-choice households, appears to be a business-model pivot for the foreseeable future.

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.