Leadership

Future-Proof The Home Purchase By Omitting Some ‘Moving Parts’

With prices, interest rates, bank credit, and local economies in flux, eliminating the random and adding certainty to homebuyers’ calculus makes first-time homeownership simpler.

Author and design expert John Maeda writes about the reason we try to make things simpler roughly this way:

Simplicity subtracts the obvious,” Maeda says. “It adds the meaningful.”

Boiling down the idea of simplicity’s power clarifies why we respond to it when – so rarely – we experience it and why we are so often acutely aware of and frustrated by its absence.

Take Millennial adults and homeownership, for instance. Millennials, like no adult generational cohort before them notoriously gravitate to simplicity, transparency, authenticity, speed, and convenience. Challenge, of course, is that the journey of buying a home – especially in today’s “moving-parts” market conditions – is typically none of the above.

These moving parts amount to a whirlwind for just about any would-be buyer in today’s weird and wacky housing marketplace. For first-timers, many of them millennials, the volatility and Whack-a-Mole of challenges makes an already-complex and precarious process outright dizzying.

- Prices continue to power upward due to scarce supply

- Interest rates are spooling up to generational high-water marks

- Bank lending and credit is under siege as ratings agencies red-flag risk

- Cost-of-living pressures continue as the Fed battles inflation’s “last – and hardest – mile”

- Non-stop natural hazards have added complexity to buying decisions

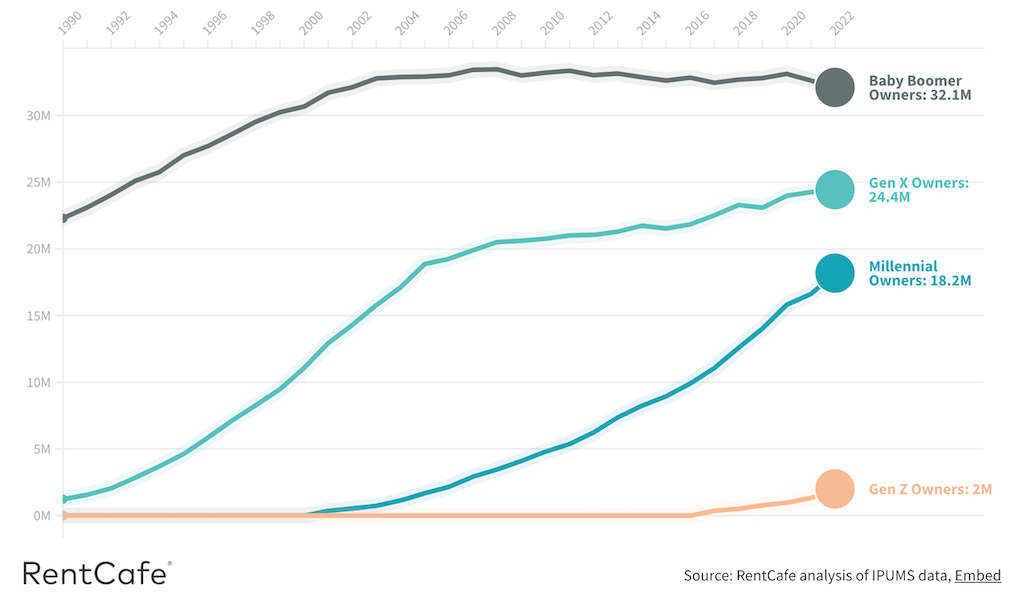

Still, millennials this year reached a homeownership tipping point: For the first time, and on a delayed schedule, a majority of them – 52% or so – have become homeowners. However, the millennial generation – 17.2 million of whom still make up the largest percentage of renters -- still have a lot of catching up to do to reach homeownership levels that even nearly compare with Generation X and Baby Boom homeownership rates.

Many millennials coming out of college faced poor job prospects and earnings after the global recession that began in 2007. Meanwhile income inequality worsened, and housing prices were rising faster than wages after 2010. “The economic hardships encountered at the start of their adulthood, coupled with student debt, resulted in millennials reaching homeownership later than other generations,” said Alexandra Both, a real estate writer and research analyst at the apartment list site RentCafe.

By age 30, just 42% of millennials owned homes, compared to 48% of Gen Xers and 51% of baby boomers, an analysis of government data by Apartment List found. This gap persists into their early 40s, with the oldest millennials still having a lower rate of ownership than previous generations when they were that age.” – The Guardian

Millennial Homeownership

Now one thing the housing market has not been in anyone’s recent memory is simple. From the full-on “sellers’ market” in the few months following the onset of Covid in 2020, through the turbulence of supply chain disruptions, to an elongated present moment of spiraling interest rates and steadily building price pressures, buyers – particularly first-time buyers, who make up 50% of all of today's buyers -- have found this stretch to be particularly trying.

That's dead opposite, in fact, from the kind of buying experience these would be buyers have come to want, expect, and in fact, demand. In response, homebuilders have taken strides – both technologically and in customer care – to simplify, personalize, and remove friction from the process. Relationships with mortgage lenders have gone far to bring a daunting financial challenge within many first-time buyers’ means as well as their appetite for stress. Similarly, homebuilding organizations are finding that taking confusion, stress, and unpredictability out of the homeowners’ insurance process

Our builder partners create great homes,” says Arvin Darilag, VP of Business Development at Westwood Insurance Agency. “Still, especially now that they're catering more to a younger buyer profile – millennials -- they're shifting focus to ‘how can we provide a better home-buying experience?’ So now, it's not so much just about the product, but the experience itself. Younger homebuyers expect things to be instantaneous and quickly customizable. Westwood has been able to provide those factors, and because of that capability, homebuilders have seen that their customer satisfaction survey scores run higher. The more turnkey services they're able to provide their homebuyer -- like their in-house lender -- helps create a one-stop-shop, everything-under-one-roof feel. Homebuyers like that; it’s simpler and leads to higher satisfaction scores. It’s a win-win.”

“Subtracting” complexity and confusion and adding a meaningful value carries through as a buyer experience on more than the process itself. In the actual transaction and the “priced-in” or “priced-out” calculus that goes on so often as homebuilders work individually with so many buyers to help them with a path to ownership, Westwood’s Darilag notes that both builders and their would-be buyer prospects benefit from having instant access to a precise figure to plug into monthly principle, interest, tax, and insurance calculations.

With the higher interest rates and the higher home prices that we're dealing with now, this kind of help figures into how homebuilders’ buyers get qualified,” says Darilag. “When homebuyers are touring the communities and the model, they're calculating payments in their head. 'We know what the sales price is, and we know where the interest rates are right now, etc.’ When homebuilders partner with Westwood, one of the key things that we're able to provide is insurance quotes. The moment a homebuyer steps foot on the community, we already know exactly how much the insurance will be for each home. And our rates apply to all homebuyers, which is unique. If a homebuyer is touring the models, calculating payments and ask the sales counselor, ‘what's the total payment for this?’ The homebuilder can provide that additional answer for their homebuyers. Homebuyers get to walk out with their monthly payments already figured out.”

This property-specific concrete clarity also subtracts time, friction, and emotional duress from buyer prospects’ efforts to nail down their financing and mortgage approvals both at the pre-qualification stage and final loan approvals, notes Darilag.

Instead of plugging in just some ball-park estimate insurance cost figure when they're doing their debt-to-income calculations, our builder partners’ lenders get access to our property-specific finalized rates,” says Darilag. “Often, because we’re able to get the most favorably competitive rate available, we’re able to make a difference in qualifying the buyer for their mortgage. Our tools and technology also speed up the paperwork and process.”

For all of the unknowns, uncertainty, and volatility that cloud the present and near-future of the housing market, what’s now come clear and predictable are both ongoing scarcity and constraint in homeownership options – meaning higher prices -- and higher-for-longer interest rates. Taking some of the capricious effects of those known conditions, and future-proofing a first-time buyer’s journey by subtracting the random and adding trustworthy certainty can give homebuyers that rarest of experiences: Of simplicity.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.