Leadership

Future-Proof The Build-To-Rent Pro Forma: De-Risk Your NOI

A multi-layered holistic solution can insure owner-investors at the community and portfolio level, and provide households their renter’s insurance as well.

Single-family build-to-rent’s future is clearly brighter-than-bright. Still, there’s a tough-sledding present builders, developers, property-managers – and renters – need to weather to make it through to that shiny future when build-to-rent becomes a pervasive part of the solution to America’s crisis of housing undersupply.

On the one hand – even in a topsy-turvy economic backdrop – one of BTR living’s upper hand is in the evidence: There’s “never been a worse time to buy instead of rent” than now. Here’s a brief explanation of why.

The average monthly new mortgage payment is 52% higher than the average apartment rent, according to CBRE analysis. The last time the measure looked out of whack was before the 2008 housing crash. Even then, the premium peaked at 33% in the second quarter of 2006.” – Wall Street Journal

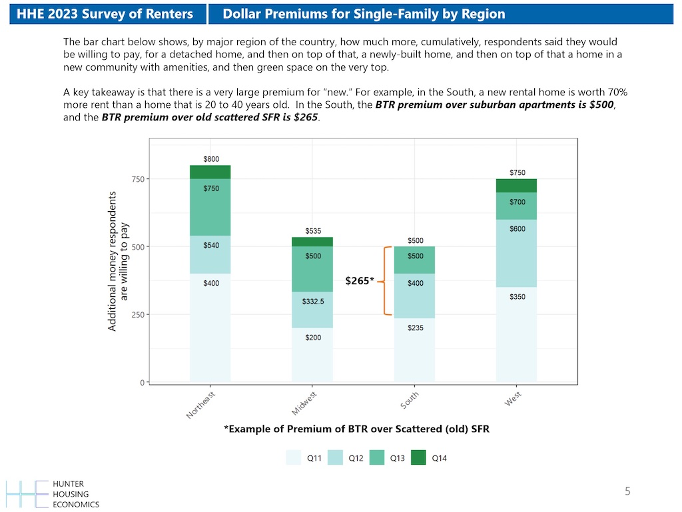

What’s more, people who are either priced-out of homeownership or renters-by-choice show a strong preference for new single-family built-for-rent living. Recent data from Hunter Housing Economics, surveying 1,000 current multifamily apartment renters from around the nation, explored renters’ willingness to pay more for single-family rental alternatives. Here’s how respondents broke out in terms of their preferences:

But strong and growing demand for built-to-rent homes and communities doesn’t mean challenge, volatility, and uncertainty aren’t strong headwinds right now. Getting new BTR projects to pencil – from their pre-construction through lease-up and cash-flow model value cycle – faces stiff forces of resistance due both to higher-for-longer costs of capital and an ongoing cost-of-living crisis impacting households’ monthly wherewithal to pay higher and higher rents.

Hunter Housing Economics president Brad Hunter captures both the bright BTR future and the impediments currently blocking the way there.

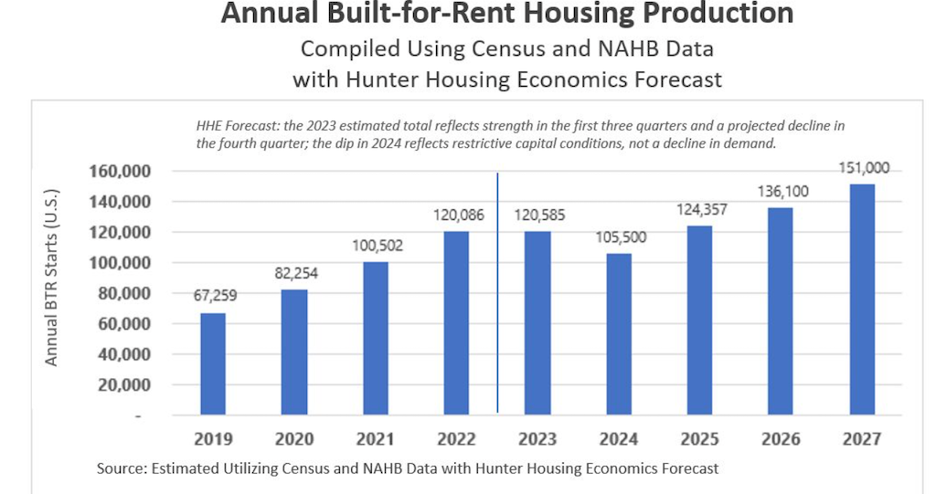

Hunter notes (accompanied by this chart):

Capital partners are reluctant to finance BTR projects unless they can be made to feel reasonably sure that the pro-forma performance of the project will be realized. This skepticism has killed a lot of BTR projects this year, and that will result in a decline of BTR construction "starts" next year (a measure of the new supply being built). The important take-away, though, is : the long-term fundamentals driving demand for this type of housing are strong, and developers who adequately address the capital's questions will have an opportunity to open to strong demand in 2025/2026/2027.

As Hunter emphasizes, proving out the pro forma vs. a BTR project’s real world performance amounts to a higher barrier to clear among warier capital investors, not just in the costs of development and construction but in delivering promised NOIs for the full term of the investment or loan in a tougher cap rates environment. What adds complexity, of course, is the confluence of myriad business models into BTR, including homebuilders who may – in this day and age – either be sellers, buyers, owners, and/or managers of batches of single-family built-to-rent portfolios and communities at any given time.

Part of the pro forma challenge means protecting both property owners and renters from financial losses at both the property level and the renter’s household, with robust insurance programs that cover both landlords and renters. As higher-volume production homebuilding operators explore hybrid for-sale and for-rent business models, the option of having a go-to single-source solution offering for homeowners insurance for the for-sale operations, and for both renters’ HO-4 and investor-owner property insurance programs simplifies and removes friction and pro forma pain-points from both the for-sale and for-rent models.

Brian Schultz is Managing Partner of Millennial Specialty Insurance (MSI) which offers a suite of insurance products both to renters and to owners and investors at the rental community level. MSI and Westwood Insurance Agency work together closely on holistic insurance solutions for developer-builders, investors, and property managers – and their rental residents – in America’s hottest new residential asset class, build-to-rent.

“We've seen significant growth in the demand for insurance for investors who are in this single-family rental space,” says Schultz. “Whereas a large portion of single-family rentals used to be controlled by the individual investor who owned two or three properties, larger entities have really become active in this space in the last five years. Whether it’s builders or private equity, there's quite an entry into owning portfolios of single-family rental homes. Once the builder either turns over the property to the investor, or shifts into lease-up as their own community – just like a normal home closing –the investor is going to want to have insurance in place.

The first big advantage we have is capacity in all 50 states to write insurance for those types of portfolios. Secondly, we have the ability to write those portfolios on a single policy. This way, they can be managed in one place for the large investor. That's really valuable. They don't have to go to multiple carriers with multiple payment schedules. We can give them a dashboard where they can interact digitally, and get a real-time view of their exposures.”

At the community – or portfolio of BTR communities – level, MSI covers for potential financial losses across multiple layers of protection, including laying over individual renters’ policies in the event they cancel or let payments lapse. Brian Schultz’s colleague, Adam Falkauff, President of Multifamily Group at MSI, notes:

It's a very different risk portfolio than for vertical apartment properties, but it's a similar concept to the insurance a multifamily owner has on their property,” says Falkauff. “Tenants insurance or renters insurance, in some cases, can provide a first layer of protection before that owner needs to go to their insurance. As an example, a common type of loss for a renter – where they're responsible, and it's accidental – is a fire. They might be cooking and this fire is accidentally caused by the resident. It could impact not just the residents’ belongings, but the owner’s property. The standard in the renter's space is that at least $100,000 in liability coverage is required as a condition of the lease to live in this rental unit. That could be a single-family home or a 500 square-foot studio apartment.

We do a few different things. We are able to sell that renters insurance policy to a resident who is moving into an apartment or a single-family rental. We're also able to provide coverage to the investor– we call it master tenant legal liability coverage – for the unit that's occupied, but the tenant has failed to secure insurance.”

Falkauff also points out that an additional feature of the MSI technology platform is that it can serve as “eyes and ears” for investors and/or builder BTR community owners to flag cases where residents may have let their own renters insurance lapse.

If that 100 unit build-to-rent community has this master tenant legal liability program in place, what could happen is this,” says Falkauff. “The investor has a requirement in their lease that if the tenant is not insured, they will be charged a lease non-compliance fee of $15 a month until you get insured. A tracking software will help investors manage who's in what bucket and who needs to be charged.”

Circling back to that non-negotiable need for BTR projects to pencil – a protected pro forma and future-proofed NOI on their BTR portfolios – MSI’s Schultz connects the dots this way:

Builders who work with Westwood have a holistic solution,” says Schultz. “Westwood obviously can help an individual buyer get insurance. If it's an investor, MSI has the investor product. If the investor decides, ‘I want to make sure that all my tenants have renters insurance,’ we have a renters insurance product we can offer their tenants. If the investor further decides, ‘I want to make sure they don't cancel that renters insurance a day after they move in,’ we have a tracking solution where we can track to make sure that the renters maintain compliant insurance. We also can offer a solution to the investor, to protect them if the renter does not comply with their lease and obtain a renters policy. So it's an end to end solution for the investor to protect their investment.”

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.