Leadership

Fret Less, Focus More On Buyers Market Volatility Won't Deter

Cost shocks have upended both consumer households and business operations. The level-set ahead will no doubt trace to a timeless well-spring: Value.

It's Thursday, May 19, 2022, and here are 10 things we know among countless dozens of things we don't but wish we did:

- America is not building enough homes

- Not enough people choose homebuilding livelihoods

- In our minds, inflation is our No. 1 "we" challenge

- Jobs and unemployment data may begin to reflect layoffs.

- Financial markets are under stress

- Zoning and land-use rules are housing's 'forever' challenge

- Employee leverage may be debatable

- Water, water [is not] everywhere

- Each homebuilding firm's delta function between permits and completions contains intelligence as to that business' health and viability

- Mortgage rate increases mostly impact first-time, price-sensitive buyers; inflation rates impact at least some discretionary buyers, convincing them, "now may not be the time to buy."

Builders – with a go-to-any-length blitz on completions -- have been tending to concede to chokehold-transitory rush-charge premiums, plus on top of that, an X-factor core-inflation to secure their build cycle inputs.

Basically, builders have been in the same boat their homebuyer customers have been, swarming scarce inventory, and driving direct costs upward with little visibility into healthy restoration of supply chains.

The disconnect – a collective conscious ceiling on payment power vs. price and ownership costs for homes – has come. Many homebuilders, their data analytics partners, their investors, and their manufacturer and distributor partners fell prey to a data gap. That gap – today's actual data belying tomorrow's data – created a business visibility wedge between not-enough and too many, and an equally harmful wedge between what they have to pay to produce and what they have to charge to make money.

The business has its truism – the models work when the market's rising, but after it peaks, not so much. That truism is playing out.

Time to call it a buyers' market?

Not so fast.

In a buyers' market, buyers sense they're in the driver's seat. They well with confidence they've seized an upper hand, and can get more bang for their buck.

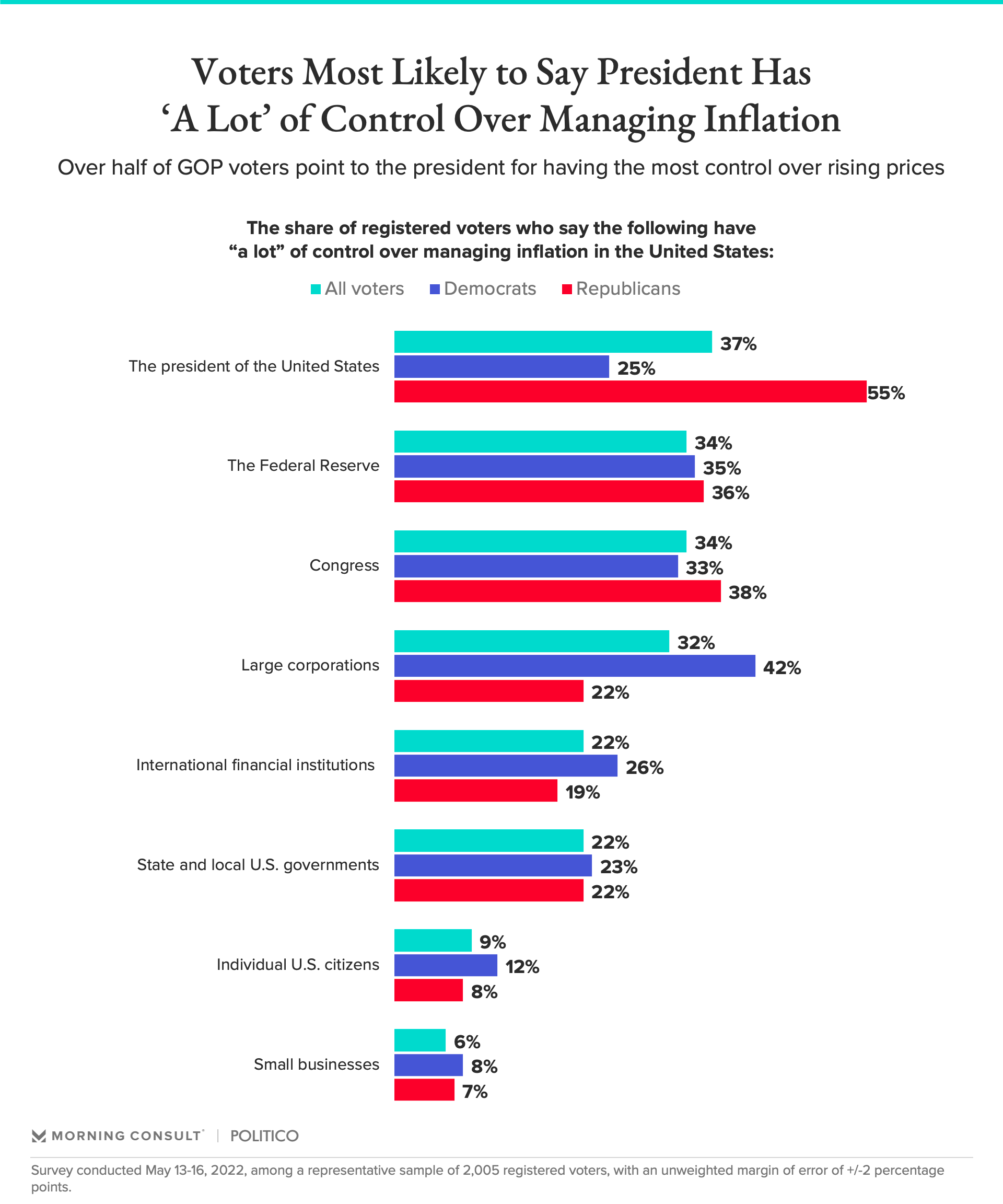

Here's a telling piece of data on what Americans – voters, consumers, business people, leaders, community officials, politicians, etc. – believe about who can do something about the shockingly high, and increasing, prices of essentials right now.

What this data tells us is that it's way too early to declare late-Spring 2022 as a tipping point into a buyers' market – where conditions, options, locations, price-points, negotiating leverage, etc. pivots profoundly in favor of buyers.

Right now, the buyers for whom the market has decidedly shifted are discretionary buyers – the ones with time, money, security, optionality all on their side.

They are the value buyers. They're the ones who'll re-set the floor of demand, and work with you as you work out of the vicious-circle of paying sky-high prices for directs, and can more easily tolerate 60 or 90 days added to the build-cycle for a home they regard as their dream home.

Despite the severity of convulsions over the past 24-plus months, "these are the good days" for tens of millions of Americans. They're value-driven, not price sensitive.

So, to get on the beam of the things we know, and fret less about what we don't, focus on what you can do to cause your value buyer to experience a simpler, clearer, more valued path to your doorway.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.