Policy

Frank Anton: By-The-Numbers, The Measures Of Racial Equity

We introduce Dream Team member Frank Anton, an iconic voice in housing, with an analysis series, each of whose topics spring from a single, meaningful statistical measure.

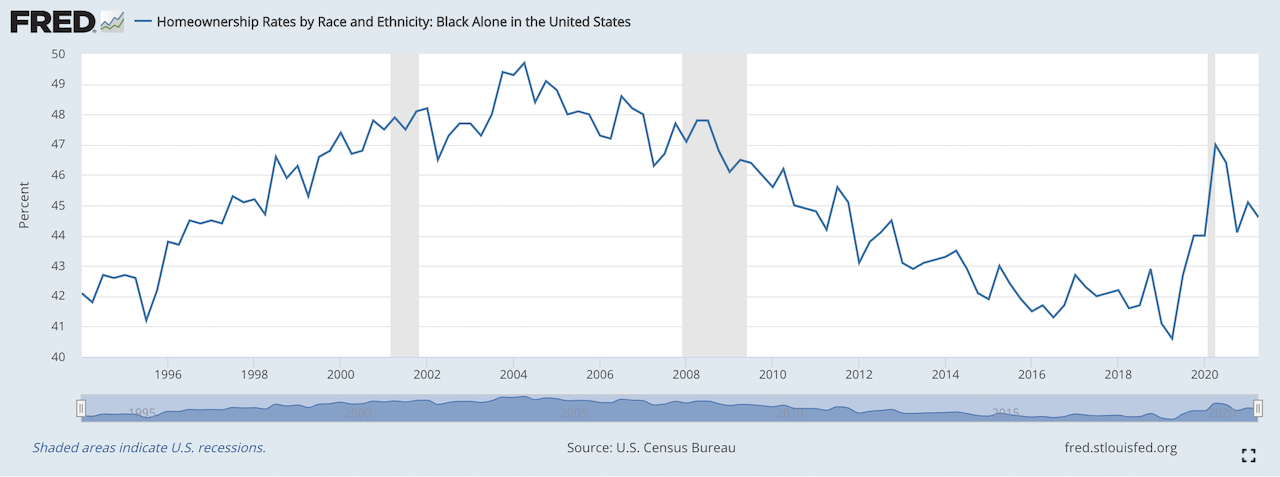

45%

That’s a number that brings shame to the nation and the housing industry. It’s the current homeownership rate for black households in the United States, and it’s moving in the wrong direction. It was 49% almost 20 years ago.

As a point of comparison the homeownership rate for white households is 74%. That means there’s a 25% gap in homeownership rates between white and black households, which is nothing new: the gap has been between 20% and 30% for the last 100 years.

Some of that dismal difference between homeownership rates can be explained by equally dismal differences in household income and net worth between black and white households. For example:

- Median income for white households is $98,000 versus $46,000 for black households; and

- Median net worth for white households is $171,000 versus, oh my, $17,000 for black households.

This helps explain, I think, why 33% of black households have very poor credit files versus 18% of white households, which in turn might explain in part why lenders deny mortgages to black applicants at a rate 82% higher than white applicants.

Discrimination is almost certainly another factor behind the dismal differences. While the Fair Housing Act of 1968 made it illegal to discriminate against anybody who wanted to rent or buy an apartment or a house, it did not completely stop redlining. Nor did it stop some unworthy sales agents from steering black buyers away from white communities. Nor did it stop some unworthy appraisers from consistently undervaluing homes in black neighborhoods. Nor did it stop some unworthy lenders from setting tougher financial requirements for black borrowers. Such practices are well-documented and persistent.

Then there’s this: the housing industry itself is almost lily white. Yes, for the last 50 years or so the President of the United States has often appointed a black woman or man as the HUD secretary, which is a small step in the right direction. And it’s not uncommon to see black workers on construction sites. (Counterpoint: black workers represent 12% of the total American workforce but only 6% of the construction workforce.)

Let me continue.

Go to the housing industry’s biggest melting pot event, the annual International Builder’s Show, and you’ll see very few black faces among the 40,000 or so attendees. Or go to the housing industry’s most exclusive event, the Policy Advisory Board meeting of Harvard University’s Center for Housing Studies. It usually brings together 50 or so top executives from the largest home building firms, building product manufacturers and distributors. I’ve gone to maybe 75 of these meetings over the last 30 years or so. I can’t recall seeing even 10 black attendees.

Or travel the country as I did for about 40 years, which I did during my career at Hanley Wood, the company that owned and published BUILDER magazine, and visit the headquarters of building manufacturers and the offices and sales centers for builders big and small, and guess what: black employees at any level were few and far between.

I wish I could say I’ve never been part of the problem, but I can’t. At one point, when I was CEO of Hanley Wood, the company employed almost 800 people. Far fewer than 5% were black. And the company was headquartered in Washington, DC, which until very recently was a majority black city.

So shame on me and shame and you for making it harder rather than easier for black American households to realize the American dream of homeownership. It’s time for all of us to try to make a difference.

Join the conversation

MORE IN Policy

Texas Treads A New Path Into Zoning To Battle Housing Crisis

Texas is one of the nation's most active homebuilding states, yet affordability slips out of reach for millions. Lawmakers now aim to rewire the state’s zoning laws to boost supply, speed up approvals, and limit local obstruction. We unpack three key bills and the stakes behind them.

Together On Fixing Housing: Solve Two, Start the Rest

NAHB Chief Economist Robert Dietz and Lennar Mortgage President Laura Escobar argue that the housing crisis won’t be solved by magic. It starts with a unified focus on two or three priorities—a rallying cry for builders, developers, lenders, and policy-makers.

Zone Offense: North Carolina Moves To Fast-Track By Right Housing

North Carolina legislators are pushing a bipartisan bill that could fast-track housing where people need it most: near jobs and transit. Richard Lawson breaks down what it means, how it compares to other states’ moves, and why developers are watching closely.